Animal Feed Additives Market Research, 2032

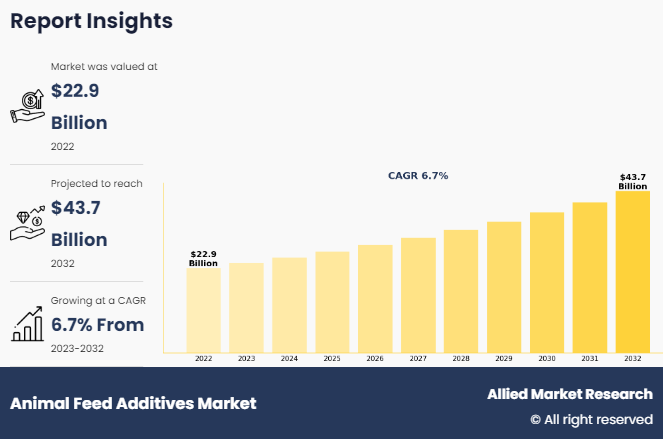

The global animal feed additives market size was valued at $22.9 billion in 2022, and is projected to reach $43.7 billion by 2032, growing at a CAGR of 6.7% from 2023 to 2032.

Animal feed additives are substances added to animal food to improve its nutritional value, promote growth, or enhance overall health. These additives can include vitamins, minerals, amino acids, enzymes, and probiotics. They help ensure that animals receive all the necessary nutrients for proper growth and development. Some additives also aid in digestion, strengthen immune systems, or increase feed efficiency, which can lead to better animal health and productivity. However, it's important to use these additives responsibly, following regulations and guidelines to ensure animal welfare and food safety. Overall, animal feed additives play a crucial role in supporting the health and well-being of livestock and other animals raised for various purposes.

Key Takeaways of Animal Feed Additives Market Report

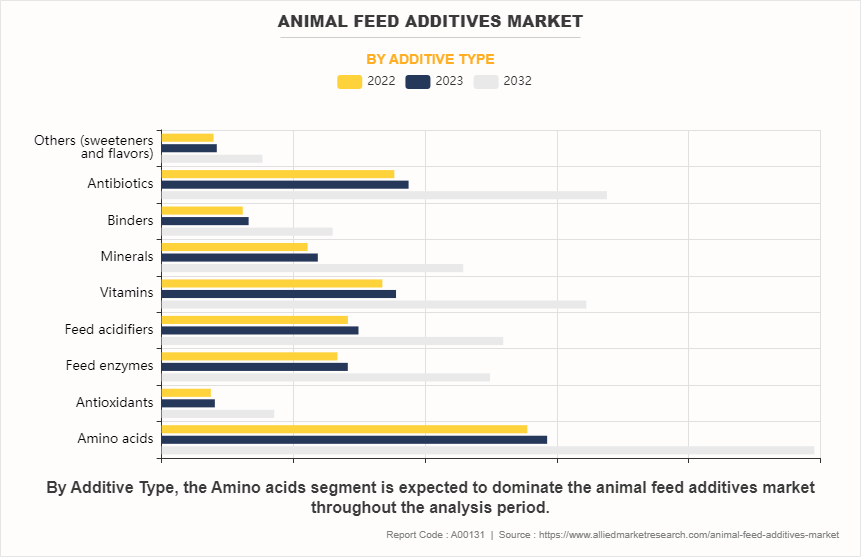

- By AdditiveType, the Amino acids segment was the highest revenue contributor to the market in 2022, and is expected to grow at a significant CAGR during the forecast period.

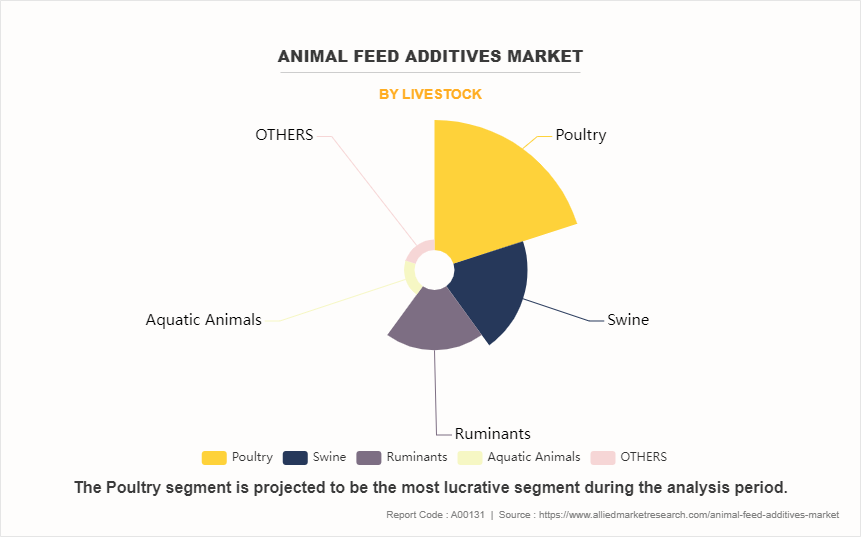

- By Livestock, the Poultry segment was the highest revenue contributor to the market in 2022, and is expected to grow at a significant CAGR during the forecast period.

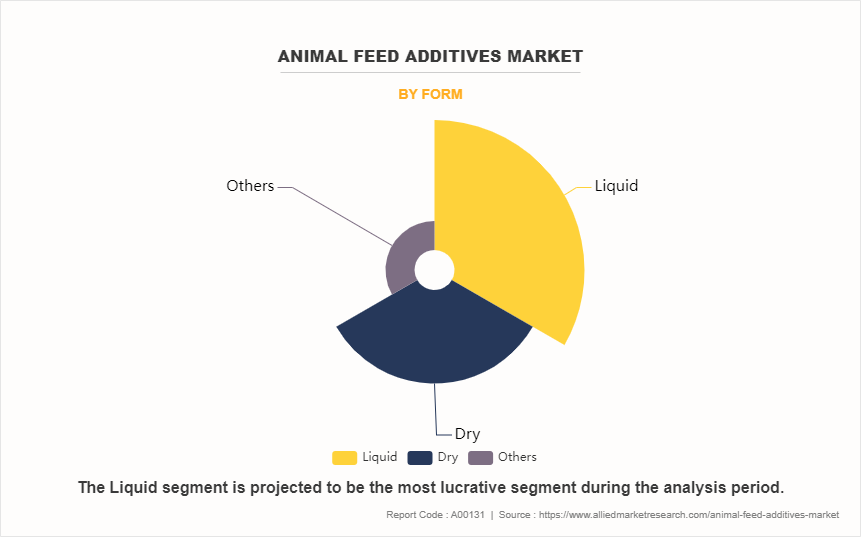

- By Form, the Liquid segment was the highest revenue contributor to the market in 2022, and is expected to grow at a significant CAGR during the forecast period.

- By Function, the Multifunction segment was the highest revenue contributor to the market in 2022, and is expected to grow at a significant CAGR during the forecast period.

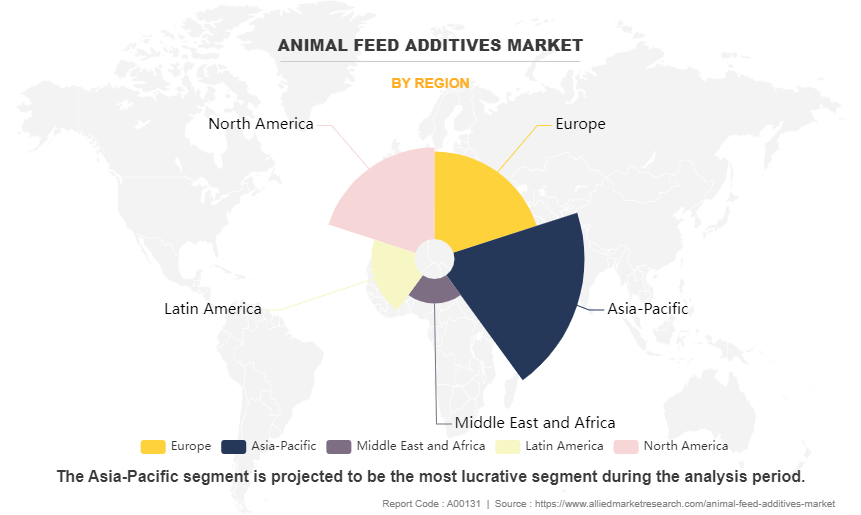

- By Region, the Asia-Pacific region was the highest revenue contributor to the market in 2022, and is expected to grow at a significant CAGR during the forecast period.

Market Dynamics

The increasing demand for meat and dairy products directly fuels the growth of the animal feed additives market. As the global population continues to grow, particularly in developing countries, there is a rising demand for protein-rich foods like meat and dairy. This surge in demand puts pressure on livestock producers to enhance the efficiency and productivity of their operations. Animal feed additives play a crucial role in meeting this demand by optimizing the nutrition and health of livestock, thereby improving growth rates, reproductive performance, and overall animal well-being. To meet the growing demand for meat and dairy products sustainably, producers rely on feed additives to maximize feed efficiency, promote faster growth, and ensure the health of their animals. Additives such as growth promoters, probiotics, enzymes, and vitamins are used to enhance feed quality and nutrient uptake, ultimately translating into higher yields of meat and dairy products. Thus, as the demand for animal protein continues to rise, so does the need for innovative and effective feed additives to support the global livestock industry.

Moreover, the growing focus on animal health and welfare has become a significant driver for the surge in demand within the animal feed additives market. With consumers becoming increasingly concerned about the well-being of animals raised for food production, there is a heightened emphasis on ensuring that livestock receive optimal nutrition and care. This emphasis translates into a greater demand for feed additives that promote immunity, enhance digestive health, and support overall animal well-being. Additionally, producers recognize the economic benefits of maintaining healthy and content animals. Healthy livestock are more resistant to diseases, have better growth rates, and produce higher-quality products. Consequently, there is a growing willingness among producers to invest in feed additives that can improve the health and welfare of their animals. As a result, manufacturers of animal feed additives are witnessing an uptick in demand for products that address specific health concerns and contribute to the overall welfare of livestock, thereby driving animal feed additives market demand.

Furthermore, Government regulations play a crucial role in shaping the demand for animal feed additives. Regulations regarding food safety, antibiotic use, and environmental sustainability can significantly impact the types of additives used in animal feed formulations. For instance, stringent regulations limiting the use of antibiotics in animal feed to prevent antimicrobial resistance have led to increased demand for alternative additives such as probiotics, prebiotics, and organic acids that promote animal health and growth without relying on antibiotics. Moreover, regulations promoting sustainable agriculture and environmental protection drive the demand for feed additives that reduce environmental impact, such as enzymes that improve feed efficiency, thereby decreasing the amount of feed required per animal and minimizing waste production. Compliance with these regulations is essential for producers to ensure the safety and quality of animal products while meeting consumer expectations for ethical and environmentally responsible practices, ultimately fueling the growth of the animal feed additives market.

The rising prevalence of livestock diseases acts as a significant driver for the animal feed additives market. Diseases such as avian flu, foot-and-mouth disease, and swine fever can devastate livestock populations, leading to economic losses for farmers and threatening food security. In response, there is an increased demand for feed additives that bolster animal immune systems and improve disease resistance. Probiotics, prebiotics, and immune-stimulating additives are gaining traction as they enhance the overall health of animals, reducing the likelihood of disease outbreaks and improving survival rates. Additionally, there is a growing need for feed additives that contain antimicrobial properties to mitigate the spread of infectious diseases within livestock populations. These additives help maintain a healthy microbial balance in the animal's gut, reducing the risk of pathogen colonization. As livestock producers seek to safeguard their animals from disease risks, the demand for effective and safe feed additives continues to surge, driving growth in the animal feed additives industry.

Segmental Overview

The global animal feed additives market forecast is segmented based on additive type, livestock, form, function, and region. Based on additive type, the market is categorized into amino acids, antioxidants, feed enzymes, feed acidifiers, vitamins, minerals, binders, antibiotics, and others. As per livestock, the market is categorized into swine, ruminants, poultry, aquatic animals, and others (equine, pets, and birds). Based on form, it is classified into dry, liquid, and others. Depending on function, it is fragmented into single function and multifunction. Region wise, it is analyzed across North America, Europe, Asia-Pacific, LA, and MEA.

By Additive Type

Based on additive type, the market is categorized into amino acids, antioxidants, feed enzymes, feed acidifiers, vitamins, minerals, binders, antibiotics, and others. The amino acids segment accounted for a major animal feed additives market share in 2022 and is expected to grow at a significant CAGR during the forecast period. The demand for amino acids in the animal feed additives market is rising due to their crucial role in supporting animal growth, health, and overall performance. Amino acids are the building blocks of protein, essential for muscle development, tissue repair, and various physiological functions. As livestock production intensifies and consumers demand higher-quality meat, the need for precise amino acid supplementation becomes paramount. Moreover, amino acids can replace traditional protein sources, reducing feed costs and environmental impact. Hence, the amino acids segment is experiencing significant growth in response to these multifaceted benefits.

By Livestock

Based on livestock, the market is categorized into swine, ruminants, poultry, aquatic animals, and others (equine, pets, and birds). The poultry segment accounted for a major market share in 2022 and is expected to grow at a significant CAGR during the forecast period. The demand for poultry feed additives is rising due to several factors. Firstly, poultry production has been increasing globally to meet the growing demand for poultry meat and eggs, particularly in emerging markets. Secondly, poultry are susceptible to various diseases, such as avian flu and coccidiosis, which can significantly impact production efficiency and profitability. As a result, there is a heightened need for feed additives that enhance poultry health, immunity, and overall performance. Additionally, consumer preferences for antibiotic-free poultry products are driving the adoption of alternative feed additives to maintain flock health and welfare.

By Form

Based on form, it is classified into dry, liquid, and others. The liquid segment accounted for a major market share in 2022 and is expected to grow at a significant CAGR during the forecast period. The demand for the liquid segment in the animal feed additives market is rising due to several factors. Liquid additives offer ease of handling and application, making them convenient for incorporation into feed formulations. Additionally, liquid additives provide better homogeneity in feed mixing, ensuring uniform distribution of nutrients throughout the feed. Liquid formulations also enable precise dosing, allowing for more accurate control over nutrient supplementation. Furthermore, liquid additives often exhibit improved palatability, enhancing acceptance by animals. These advantages drive the increasing preference for liquid feed additives among livestock producers seeking efficient and effective solutions for animal nutrition.

By Function

Based on function, it is fragmented into single function and multifunction. The multifunction segment accounted for a major market share in 2022 and is expected to grow at a significant CAGR during the forecast period. The demand for multifunctional feed additives is rising due to their ability to address multiple needs within animal nutrition effectively. These additives offer a convenient solution for farmers by combining various functionalities such as growth promotion, disease prevention, gut health enhancement, and feed efficiency improvement into one product. With multifunctional additives, farmers can streamline their feeding regimens, reduce costs, and simplify management practices. Additionally, as consumers increasingly prioritize sustainable and natural solutions, multifunctional additives that offer comprehensive benefits while minimizing environmental impact are becoming increasingly desirable in the animal feed additives market.

By Region

Based on region, the market is analyzed across North America, Europe, Asia-Pacific, LA, and MEA. The Asia-Pacific region held the major market share in 2022, and is expected to grow at a significant CAGR during the forecast period.The demand for animal feed additives is rising in the Asia-Pacific region due to several factors. Firstly, rapid population growth and urbanization have increased the demand for meat, dairy, and poultry products, driving the need for enhanced livestock productivity. Secondly, growing disposable incomes have led to dietary shifts towards protein-rich diets, further stimulating demand for animal products. Additionally, the region's expanding aquaculture industry requires specialized feed additives to support the health and growth of aquatic species. Moreover, increasing awareness of animal health and welfare among consumers and producers is fueling the adoption of feed additives to improve livestock well-being.

Competitive Analysis

The major players operating in the market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have been also focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the global animal feed additives industry include BASF SE, Cargill, Inc., Archer Daniels Midland Company, Evonik Industries AG, Nutreco N.V., Addcon Group, Aliphos Belgium S.A., Kemin Industries Inc., Koninklijke DSM N.V., and Phibro Animal Health Corporation.

Recent Developments in the Animal Feed Additives Market

- In 2023, Agromex Importaciones, S.A. de C.V. was acquired by Amlan International, the animal nutrition and health division of Oil-Dri Corporation of America.

- In 2023, a biotech company called Agrivida was acquired by Novus International.

- Evonik introduced Biolys, its latest generation product in 2023, offering animal feeds with a concentrated dosage of L-lysine.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the animal feed additives market analysis from 2022 to 2032 to identify the prevailing animal feed additives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the animal feed additives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global animal feed additives market trends, key players, market segments, application areas, and animal feed additives market growth strategies.

Animal Feed Additives Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 43.7 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 453 |

| By Additive Type |

|

| By Livestock |

|

| By Form |

|

| By Function |

|

| By Region |

|

| Key Market Players | ADDCON GROUP GMBH, SHV Holdings N.V., PHIBRO ANIMAL HEALTH CORPORATION, BASF SE, KEMIN INDUSTRIES INC, Koninklijke DSM N.V., Archer-Daniels-Midland Company, ALIPHOS BELGIUM SA, Cargill Incorporated, Evonik Industries AG |

Analyst Review

According to the insights of the CXOs, the global animal feed additives market is expected to witness robust growth during the forecast period. This is attributed to the shift towards natural and organic additives. The shift towards natural and organic additives has significantly surged the demand in the animal feed additives market due to evolving consumer preferences and increasing awareness of health and sustainability. Consumers are increasingly seeking products that are free from synthetic chemicals and additives, opting instead for natural alternatives that align with their values and promote animal welfare. This growing demand has prompted feed manufacturers to reformulate their products with natural ingredients such as herbs, botanicals, essential oils, and plant extracts.

CXOs further added that animal feed safety concerns serve as a significant driver for the surge in demand within the animal feed additives market. Incidents of contamination and food safety scares, such as outbreaks of diseases like salmonella or aflatoxin contamination, highlight the need for additives that enhance feed quality and safety standards. Consumers, regulatory bodies, and industry stakeholders prioritize the implementation of measures to ensure the safety of animal feed, thereby boosting the demand for additives that mitigate contamination risks and improve overall feed integrity.

Natural and Sustainable Solutions: Increasing consumer demand for natural and sustainable products is driving the adoption of feed additives derived from organic and plant-based sources, as well as alternatives to antibiotics. Precision Nutrition: Precision livestock farming techniques, including personalized nutrition strategies tailored to individual animal needs, are gaining traction to optimize feed efficiency and enhance animal health and performance. Microbial and Enzyme Innovations: Growing research and development efforts are focused on harnessing the potential of microbial-based additives, such as probiotics and enzymes, to improve nutrient utilization, gut health, and overall animal well-being.

Nutritional Supplements: Adding essential nutrients such as vitamins, minerals, amino acids, and fatty acids to animal feed to ensure balanced nutrition and promote optimal growth and development. Gut Health and Digestive Aids: Including probiotics, prebiotics, enzymes, and organic acids in feed formulations to support digestive health, improve nutrient absorption, and enhance feed efficiency. Health and Immune Function: Incorporating additives with immune-boosting properties, such as immunomodulators, antioxidants, and antimicrobial agents, to strengthen the immune system and reduce the risk of disease outbreaks. Performance Enhancement: Using growth promoters, hormones, and metabolic modifiers to enhance feed conversion efficiency, increase lean muscle mass, and improve weight gain in livestock, resulting in higher productivity and profitability. Mycotoxin Management: Including mycotoxin binders, adsorbents, and detoxifiers in feed to mitigate the harmful effects of fungal toxins on animal health and performance. Antibiotic Alternatives: Seeking natural and alternative additives, such as phytogenics, botanicals, and essential oils, to reduce reliance on antibiotics for disease prevention and growth promotion, in line with regulatory trends promoting antimicrobial stewardship. Feed Preservation and Palatability: Adding preservatives, mold inhibitors, and flavor enhancers to improve feed quality, extend shelf life, and enhance palatability, ensuring consistent intake and nutrient delivery to animals. Environmental Sustainability: Incorporating feed additives with environmental benefits, such as methane inhibitors and nitrogen utilization enhancers, to reduce greenhouse gas emissions, improve nutrient utilization efficiency, and minimize environmental impact of livestock production. Specialty Applications: Targeting specific nutritional needs or health concerns of different animal species, such as aquafeed additives for fish and shrimp, pet food additives for companion animals, and specialty additives for niche markets like organic and free-range production systems. Regulatory Compliance: Ensuring compliance with regulatory requirements and quality standards governing the use of feed additives, including safety assessments, labeling requirements, and maximum residue limits, to uphold animal welfare, food safety, and consumer confidence.

Asia-Pacific

The global animal feed additives market was valued at $22,914.3 million in 2022, and is projected to reach $43,697.5 million by 2032, registering a CAGR of 6.7% from 2023 to 2032.

The major players operating in the market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have been also focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the global animal feed additives industry include BASF SE, Cargill, Inc., Archer Daniels Midland Company, Evonik Industries AG, Nutreco N.V., Addcon Group, Aliphos Belgium S.A., Kemin Industries Inc., Koninklijke DSM N.V., and Phibro Animal Health Corporation.

Loading Table Of Content...

Loading Research Methodology...