Biomarkers Market Research, 2033

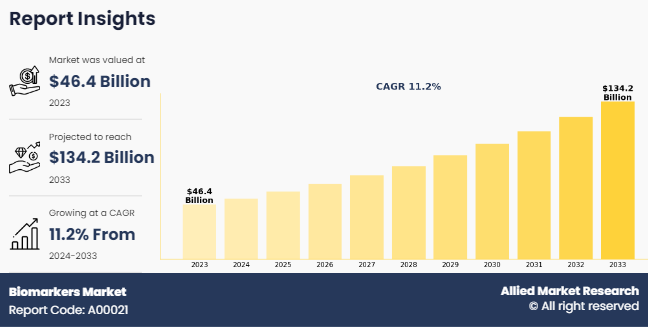

The global biomarkers market size was valued at $46.4 billion in 2023, and is projected to reach $134.2 billion by 2033, growing at a CAGR of 11.2% from 2024 to 2033. The growth of the biomarkers market size is driven by an increase in adoption of biomarkers for drug discovery and development. For instance, according to a 2020 report by the National Library of Medicine, it was reported that in the U.S., biomarkers are qualified using the Center for Drug Evaluation and Research (CDER) Biomarker Qualification Program (BQP) that is described within the ˜Drug Development Tools (DDTs) Program.

In addition, the rise in prevalence of chronic diseases is expected to contribute significantly to the growth of the biomarkers industry. According to a 2023 report by the National Library of Medicine, it was reported that biomarkers exploration is essential in detecting diseases as it helps predict, diagnose, identify, treat diseases, and understand disease processes.

Biomarkers are measurable indicators that signal the presence or progression of a biological process, disease, or pharmacological effect of a drug. Biomarkers serve as valuable tools in medical research, diagnostics, and personalized medicine, providing insights into an individual's health status, response to treatment, or disease risk. Biomarkers play a crucial role in early detection and diagnosis, enabling healthcare professionals to identify diseases at their onset when treatments are often most effective. In addition, biomarkers aid in monitoring disease progression, assessing the effectiveness of therapies, and predicting patient outcomes.

Key Takeaways

By type, the sample preparation segment held the largest share in the biomarkers market in 2022. However, the efficacy biomarkers segment is expected to register the highest growth during the forecast period.

By application, the drug discovery and development segment held the largest biomarkers market share in 2022. However, the disease diagnosis segment is expected to register the highest growth during the forecast period.

By service, sample preparation segment held the largest share in the biomarkers market analysis in 2022. However, the assay development segment is expected to register the highest growth during the forecast period.

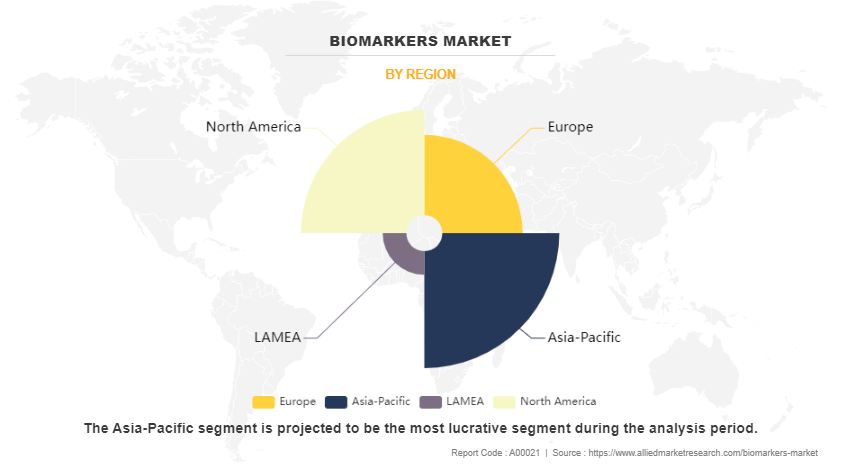

Region-wise, North America held the largest market share in 2022. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Market Dynamics

High adoption of biomarkers for drug development procedures, rise in prevalence of chronic diseases and increased adoption of biomarkers in cancer, cardiac diseases, & neurological diseases, and collaborative efforts of major key players to develop biomarkers technology are the key factors that drive the growth of the biomarkers market.

The high adoption of biomarkers for drug development procedures stands as a significant driver that propels biomarkers market growth. Biomarkers, which are measurable indicators of biological processes or responses to therapeutic interventions, have gained substantial traction within the pharmaceutical industry due to their multifaceted utility. One of the primary reasons behind their widespread adoption is their ability to streamline and expedite drug development processes. By offering insights into drug efficacy, safety, and mechanisms of action, biomarkers allow more informed decision-making at various stages of drug development, from preclinical research to clinical trials. According to a 2020 report by the National Library of Medicine, it was reported that immunosuppressants, immunostimulants, drugs used in diabetes, antithrombotic drugs, antineoplastic agents, and antivirals are some of the pharmacotherapeutic class of drugs which majorly include biomarkers study in drug development process. Moreover, biomarkers play a crucial role in personalized medicine, facilitating the identification of patient subpopulations most likely to benefit from specific treatments. This targeted approach enhances patient outcomes and contributes to the optimization of healthcare resources. Thus, the high adoption of the biomarkers in drug development procedures is expected to contribute significantly to the growth of the biomarker industry.

In addition, according to biomarkers market trends analysis, the rise in prevalence of chronic diseases, such as cancer, cardiac diseases, and neurological diseases, is expected to drive the growth of the market. According to a 2023 report by the National Library of Medicine, it was reported that neurological disorders are the leading cause of physical and cognitive disability across the globe, currently affecting approximately 15% of the worldwide population. As these diseases often require long-term management and care, there is a surge in need for effective diagnostic and prognostic tools to facilitate early detection, monitoring, and personalized treatment approaches. Biomarkers, which are measurable indicators of biological processes or responses to therapies, play a crucial role in disease diagnosis. Biomarkers offer valuable insights into disease progression, therapeutic efficacy, and patient stratification, thereby enabling healthcare professionals to make informed clinical decisions. According to a 2020 report by the National Library of Medicine, it was reported that Apolipoprotein E (APOE) gene variations are used as susceptibility/risk biomarkers to identify individuals with a predisposition to develop Alzheimer‐™s disease. Thus, a rise in the prevalence of chronic diseases is expected to drive the growth of the market.

Furthermore, according to the biomarkers market forecast analysis, the collaborative efforts by the major players and other government and private organization for advancement of biomarkers technology has significantly contributed in the growth of the market. Pharmaceutical companies, research institutions, and biotechnology firms have increasingly recognized the potential of biomarkers in revolutionizing diagnostics, drug development, and personalized medicine. Collaborations between these entities have led to the pooling of resources, expertise, and data to accelerate the discovery and validation of novel biomarkers. For instance, in January 2024, Quibim, the global company transforming imaging data into actionable predictions of cancer progression and treatment response, announced that it has entered into a collaboration with leading science and technology company Merck KGaA. The two companies explore how to harness the potential of biomarkers and radiomics to predict a cancer patients response to immunotherapy and anticipate cancer patient outcomes. Through collaborative initiatives, major players implement technological advancements in biomarker discovery platforms and establish standards for biomarker validation and regulatory approval. Such concerted efforts are essential for overcoming the complex challenges associated with biomarker development, including variability in sample collection, assay standardization, and data interpretation. Thus, the collaborative efforts by the major players and other government & private organizations for advancement of biomarkers technology is expected to drive the growth of the market.

However, the high development cost of biomarkers stands as a significant restraint for the growth of the biomarkers market. The process of identifying, validating, and commercializing biomarkers is inherently complex and resource intensive. Researchers often encounter substantial challenges in discovering reliable biomarkers due to the intricacies of biological systems and the need for rigorous validation studies to ensure accuracy & reproducibility. In addition, regulatory requirements for biomarker validation and approval further escalate expenses, as extensive clinical trials are typically required to demonstrate their clinical utility and safety. Thus, the high development cost of biomarkers might restrain the growth of the market.

Segments Overview

The biomarkers market growth is segmented on the basis of type, application, service, and region. By type, the market is divided into efficacy biomarkers, safety biomarkers, and validation biomarkers. By application, the market is classified into risk assessment, development of molecular diagnostic, disease diagnosis, drug discovery & development, drug formulation, forensic application, and others. By service, it is categorized into pharmaceutical & sample preparation, assay development, biomarker validation & testing, and other services. Region-wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (France, Germany, Italy, Spain, UK, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, rest of LAMEA).

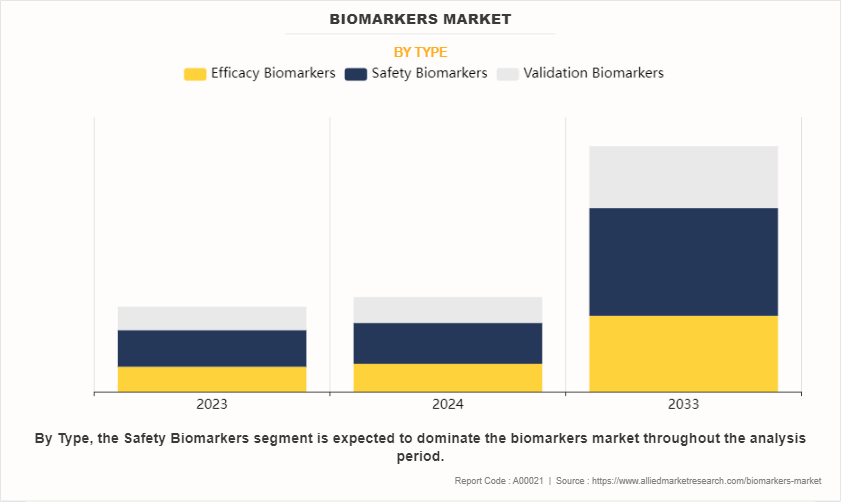

By Type

On the basis of type, the biomarkers market share is categorized into efficacy biomarkers, safety biomarkers, and validation biomarkers. The safety biomarkers segment dominated the global market in 2023 owing to high adoption of safety biomarkers for evaluation of safety of the drug candidate during the drug discovery and development process.

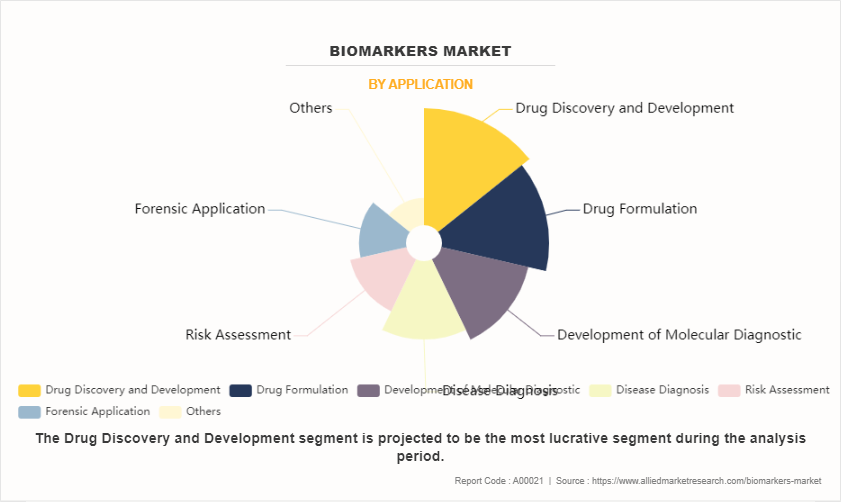

By Application

On the basis of application, the market is categorized into risk assessment, development of molecular diagnostic, disease diagnosis, drug discovery & development, drug formulation, forensic application, and others. The drug discovery and development segment dominated the global market in 2023. This is attributed to the fact that the biomarkers are used for the safety and efficiency evaluation of the drug candidate during the clinical trials. However, the disease diagnosis segment is expected to register highest growth during the forecast period, owing to high use of the biomarkers in cancer and lung cancer biomarkers.

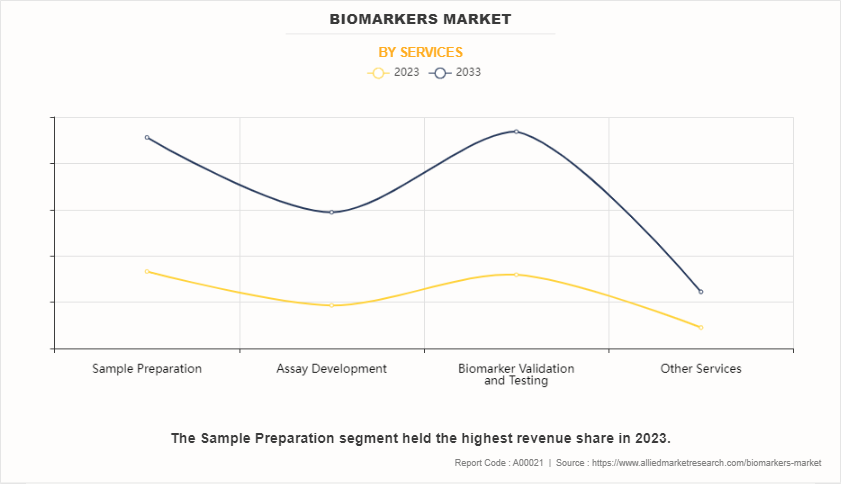

By Service

On the basis of service, the market is categorized into sample preparation, assay development, biomarker validation & biomarker testing, and other services. The sample preparation segment dominated the market in 2023. This is attributed to the fact that sample preparation encompasses a series of techniques aimed at extracting, isolating, and purifying biomolecules from complex biological matrices such as blood, urine, or tissue samples. These preparatory steps are crucial for enhancing the sensitivity, specificity, and reproducibility of biomarker assays, improving diagnostic accuracy and clinical utility. However, the assay development segment is expected to register the highest CAGR as assay development plays a pivotal role in the biomarker discovery process, serving as the foundation for accurately measuring and quantifying specific biomolecules indicative of various biological processes or disease states.

By Region

The biomarkers market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market share in terms of revenue in 2023. The growth in this region is mainly attributed to the strong presence of key players and higher adoption of biomarkers for new drug development processes.

Asia-Pacific is expected to grow at the highest rate during the forecast period. This is attributed to the rise in prevalence of chronic diseases and high adoption of biomarkers for disease diagnosis such as in lung cancer biomarkers. Furthermore, the biomarkers market in Asia-Pacific is cost effective as compared to North America and some parts of Europe.

Competitive Analysis

Competitive analysis and profiles of the major players in the biomarkers market, such as GE Healthcare, Abbott Laboratories, Inc., Bio-Rad Laboratories, Epistem Ltd., Eisai Co. Ltd., Roche Diagnostics Limited, Thermo Fisher Scientific Inc., Agilent Technologies Inc., Aushon Biosystem, and Siemens AG are provided in the report. Major players have adopted product launch, strategic alliance, partnership, new product development, and collaboration as key developmental strategies to improve the product portfolio and gain a strong foothold in the biomarkers market.

Recent Developments in Biomarkers Industry

In February 2024, Abbott Laboratories and Fujirebio announced a partnership to develop a research use only (RUO) neurofilament-light chain (Nf-L) neurology biomarker assay for use on Abbott's Alinity i.

In January 2024, Merck KGaA announced that it entered into a collaboration with Quibim, the global company transforming imaging data into actionable predictions of cancer progression and treatment response. The two companies explore how to harness the potential of biomarkers and radiomics to predict a cancer patient's response to immunotherapy and predict cancer patient outcomes.

In December 2023, GE HealthCare announced it has the lead industrial role in the European consortium project Predictom, a pioneer venture to use real-world data (RWD) coupled with artificial intelligence (AI) screening to advance identification of those with early signs of Alzheimer's disease. The predictom project aims to develop a digital platform that is expected to aggregate participant RWD in different screening stages, including imaging, blood, cerebrospinal fluid, electrophysiological, and digital biomarkers.

In August 2022, Thermo Fisher Scientific launches CE-IVD (IVDD) next-generation sequencing test and analysis software to expand access to precision oncology biomarker testing.

In April 2021, Siemens AG announced a strategic agreement with Biognosys. The agreement leverages Biognosys' expertise in unbiased biomarker discovery technologies and solutions with Siemens Healthineers' biomarker assay development, lab testing, and commercialization capabilities.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biomarkers market analysis from 2023 to 2033 to identify the prevailing biomarkers market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biomarkers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biomarkers market trends, key players, market segments, application areas, and market growth strategies.

Biomarkers Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 134.2 billion |

| Growth Rate | CAGR of 11.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 347 |

| By Type |

|

| By Application |

|

| By Services |

|

| By Region |

|

| Key Market Players | F. Hoffmann-La Roche AG, Siemens AG, Merck KGaA, Bio-Rad Laboratories, Inc. , Agilent Technologies Inc., Revvity, Inc., Thermo Fisher Scientific, Abbott Laboratories, Qiagen N.V, GE Healthcare |

Analyst Review

The biomarkers market has witnessed remarkable growth and transformative potential in recent years, propelled by advancements in personalized medicine, diagnostic technologies, and a deeper understanding of molecular biology. Biomarkers play a pivotal role in revolutionizing patient care by offering precise and early indicators of disease onset, progression, and treatment response. The integration of innovative technologies such as genomics, proteomics, and metabolomics has expanded the scope and utility of biomarkers across various therapeutic areas, ranging from oncology to neurology.

Furthermore, the emergence of non-invasive biomarkers and point-of-care testing solutions has revolutionized patient care by enabling early detection, monitoring disease progression, and guiding therapeutic decisions. However, challenges persist, including the validation and standardization of biomarker assays, regulatory complexities, and reimbursement issues. Despite these challenges, the biomarkers market is expected to register significant growth during the forecast period owing to high adoption of biomarkers for disease diagnosis and for drug development process.

High development cost of biomarkers stands as a significant restraint for the growth of the biomarkers market.

Yes, competitive landscape included in the report

The primary trends driving the biomarkers market include heightened adoption of biomarkers in liquid biopsies, significant advancements in proteomics, and the emergence of digital biomarkers as key players in healthcare monitoring and diagnostics.

The biomarkers market was valued at $46,401.30 million in 2023 and is estimated to reach $134,181.30 million by 2033, exhibiting a CAGR of 11.2% from 2024 to 2033.

The drug discovery and development segment dominated the global market in 2023.

North America is the largest regional market

Abbott Laboratories, Inc., Bio-Rad Laboratories, Ge Healthcare, Roche Diagnostics Limited, Siemens AG, and Thermo Fisher Scientific Inc. are key companies to hold major share in the biomarkers market

High adoption of biomarkers for drug development procedures stands as a significant driver that propels biomarkers market growth.

Loading Table Of Content...

Loading Research Methodology...