Enteric Disease Testing Market Research, 2032

The global enteric disease testing market size was valued at $3,870.60 million in 2022 and is projected to reach $5,323.60 million by 2032, growing at a CAGR of 3.3% from 2023 to 2032. Enteric diseases are infections that affect the gastrointestinal tract, which includes the stomach, small intestine, and large intestine. These diseases can be caused by various microorganisms such as bacteria, viruses, or parasites. Some common examples of enteric diseases include Clostridium difficile (C. difficile), campylobacteriosis, cholera, Escherichia coli (E. coli), Helicobacter pylori (H. pylori), salmonellosis, shigellosis, norovirus, rotavirus, amebiasis, cryptosporidiosis, and giardiasis. Various laboratory tests are used to diagnose enteric diseases and identify the specific pathogen causing an enteric disease. These tests typically involve analyzing samples of stool, blood, or other bodily fluids for the presence of enteric pathogens, such as bacteria, viruses, and parasites.

Market Dynamics

The enteric disease testing market share has witnessed growth owing to a rise in prevalence of enteric diseases. For instance, according to the World Health Organization (WHO) report published in May 2020, foodborne diseases can be severe, especially for young children. According to the same source, diarrheal diseases are the most common illnesses resulting from unsafe food, with 550 million people falling ill yearly, of which 220 million are children under the age of 5 years. Campylobacter is 1 of the 4 key global causes of diarrheal diseases.

In addition, the surge in incidence rate of shigellosis, clostridium difficile (C. difficile), campylobacteriosis, cholera, Escherichia coli (E. coli), salmonellosis, and cholera, which may further cause severe diarrhea or death, drive the growth of the enteric disease testing market size. For instance, according to research article “The burden of diarrhea, etiologies, and risk factors in India from 1990 to 2019: evidence from the global burden of disease study” published in 2022, in India, the total number of deaths of all ages was 632,344 in 2019 and the mortality rate is 45 per 100,000 population.

Furthermore, the untapped enteric disease testing market in developing countries presents a considerable opportunity for healthcare companies to develop innovative and cost-effective testing solutions to address the unmet needs of the population. Moreover, rise in trend of enteric disease testing, increase in awareness regarding diagnosis of enteric disease testing in developing countries such as China and India, surge in disposable income, increase in funding, and rise in discovery & development of effective enteric disease testing product drive the growth of the enteric disease testing industry.

In addition, rise in adoption of key strategies including product launch, collaboration, merger, funding, acquisition, agreement, adopted by key players, drive the growth of the enteric disease testing market during the forecast period. For instance, in August 2021, Meridian Bioscience Inc., announced that it closed the previously announced acquisition of the North American BreathTek business from Otsuka America Pharmaceutical, Inc. effective July 31, 2021. With this acquisition, Meridian will assume the customer relationships in North America to supply BreathTek, a urea breath test for the detection of Helicobacter pylori.

Segmental Overview

The enteric disease testing market is segmented into product type, technique, disease type, end user, and region. On the basis of product type, the market is classified into reagents and consumables, and equipment. On the basis of technique, the market is bifurcated into molecular diagnostics, and immunodiagnostics. On the basis of disease type, the market is divided into bacterial enteric disease, viral enteric disease, and parasitic enteric disease. On the basis of end user, it is segregated into hospital laboratories, pharmaceutical and biotechnology companies, academic and research institutes. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

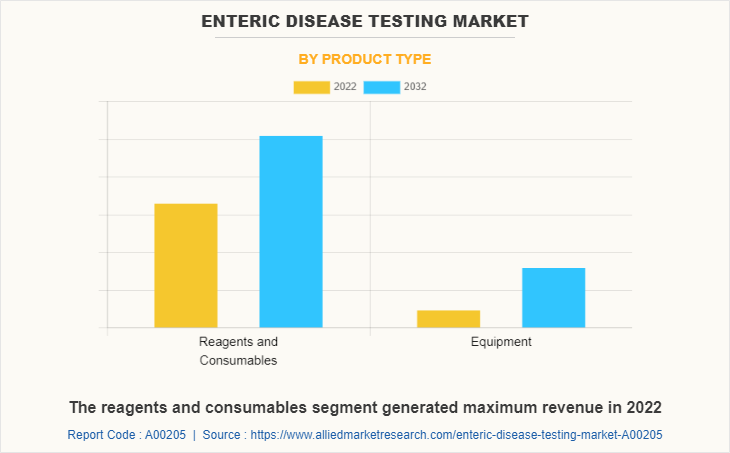

By Product Type

The enteric disease testing market is segmented into reagents and consumables, and equipment. The reagents and consumables segment generated maximum enteric disease testing market share in 2022, owing to high adoption of reagents and consumables, higher number of availability of reagents and consumables, and companies witnessed high sales of reagents and consumables. The equipment segment is expected to witness the highest CAGR during the forecast period, owing to the short time of testing, multiple samples can run together, higher accuracy, and high demand of automation for testing of enteric disease.

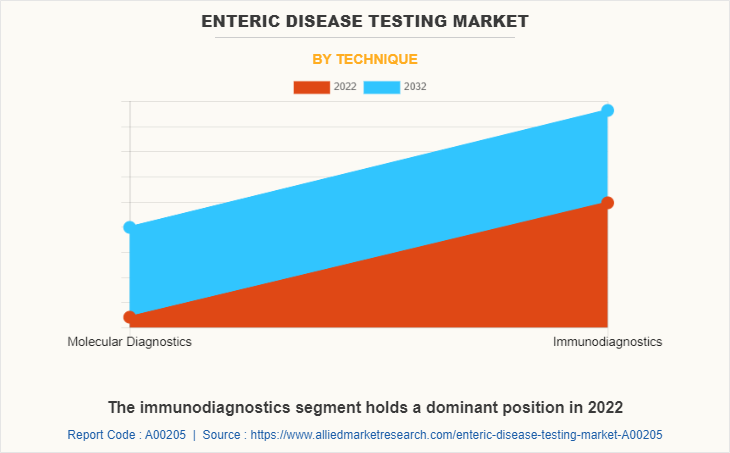

By Technique

The enteric disease testing market is segmented into molecular diagnostics, and immunodiagnostics. The immunodiagnostics segment generated maximum revenue in 2022, owing to increased adoption of immunodiagnostics technique and advancement in immunodiagnostic technique. The molecular diagnostics segment is expected to witness highest CAGR during the forecast period, owing to an increased demand of molecular diagnostics product, increase use of molecular diagnostics technique in research and increase in availability of molecular diagnostic technique equipment.

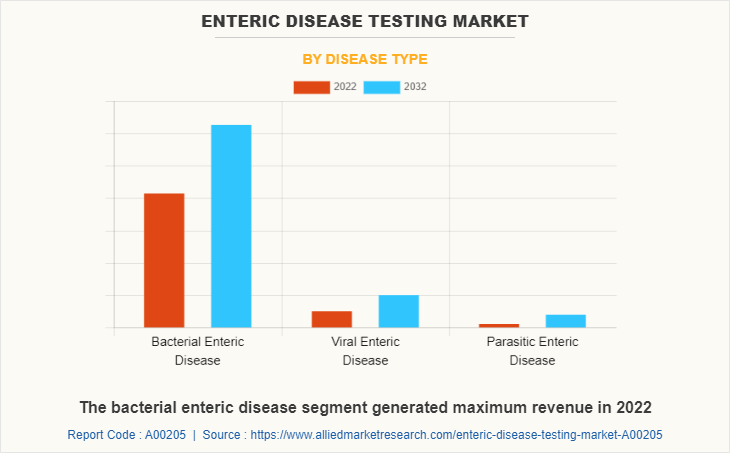

By Disease Type

The enteric disease testing market is segregated into bacterial enteric disease, viral enteric disease, and parasitic enteric disease. The bacterial enteric disease segment held maximum share in 2022, owing to high number of people suffering from clostridium difficile (C. difficile), campylobacteriosis, cholera, Escherichia coli (E. coli), helicobacter pylori (H. pylori), salmonellosis, and high use of enteric disease testing product for diagnosis of bacterial enteric diseases. The same segment is expected to witness the highest CAGR during the forecast period, owing to a rise in awareness regarding diagnosis of bacterial enteric diseases and rise in prevalence of bacterial enteric diseases globally.

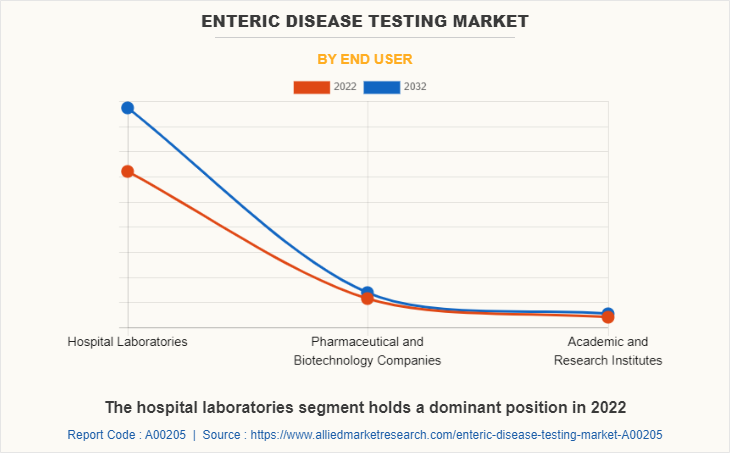

By End User

The enteric disease testing market is segregated into hospital laboratories, pharmaceutical and biotechnology companies, academic and research institutes. The hospital laboratories segment generated maximum revenue in 2022, owing to increase in health coverage for hospital-based treatment, increase in hospital admission, and higher preference for hospital laboratories. The same segment is expected to witness the highest CAGR during the forecast period, owing to rise in diagnosis of enteric diseases in hospital laboratories and rise in awareness regarding routine body checkup in hospital laboratories.

By Region

The enteric disease testing market is studied across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the enteric disease testing market in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Abbott Laboratories, Becton Dickinson & Company, Biomerica, Inc., Bio-Rad Laboratories, Inc., Meridian Bioscience, Inc, and Quest Diagnostics and advancement in manufacturing technology of enteric disease testing product in the region drive the growth of the market. This is majorly attributed to rise in number of patients suffering from enteric diseases, rise in funding from government for research regarding diagnosis of enteric diseases and significant rise in capital income in developed countries.

Furthermore, the existence of sophisticated reimbursement structure that aims to reduce expenditure levels drives the growth of the market. Hence, such factors propel market growth. In addition, the U.S. is anticipated to contribute to a major share of the regional market and is expected to drive the growth of the enteric disease testing market throughout the forecast period. The presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of enteric disease testing are expected to drive the market growth.

Asia-Pacific is expected to grow at the highest rate during the enteric disease testing market forecast period. The enteric disease testing market growth in this region is attributable to rise in prevalence of infectious enteric diseases such as E. coli, salmonellosis, cholera and H. pylori in this region as well as growth in the purchasing power of populated countries, such as China and India. The countries in Asia-Pacific possess a huge population base, with China being the first having 1,397,715 population in 2020 and India is the second most populated countries having 1,366,417.75 population in 2020.

Competition Analysis

Competitive analysis and profiles of the major players in the enteric disease testing industry, such as Abbott Laboratories, Becton Dickinson & Company, Biomerica, Inc., Biomerieux SA, Bio-Rad Laboratories, Inc., Coris Bioconcept, Diasorin, Meridian Bioscience, Inc, Quest Diagnostics, and Trinity Biotech are provided in the report. There are some important players in the market such as Biomerieux SA, Diasorin, Trinity Biotech, and Meridian Bioscience Inc. that have adopted product approval, acquisition and partnership as key developmental strategies to improve the product portfolio of the enteric disease testing market.

Recent Product Approval in the Enteric Disease Testing Market

- In January 2022, Meridian Bioscience Inc. announced that the Curian Campy assay has received U.S. Food and Drug Administration (FDA) clearance. The Curian Campy assay is a rapid, qualitative fluorescent immunoassay for the detection of a Campylobacter-specific antigen including C. jejuni, C. coli, C. upsaliensis, and C. lari in human fecal specimens. The assay was developed to be utilized on the Curian immunofluorescent testing platform.

- In January 2020, Biomerieux SA announced that BioFire Diagnostics, its molecular biology affiliate, has submitted to the Food and Drug Administration for 510(k) clearance of the BIOFIRE Blood Culture Identification 2 (BCID2) Panel. The BIOFIRE BCID2 Panel includes several additional pathogens, an expanded list of antimicrobial resistance genes, and many revised targets compared to the existing BIOFIRE BCID Panel.

Recent Acquisition in the Enteric Disease Testing Market

- In May 2022, Meridian Bioscience Inc. announced that it has acquired, through its subsidiary Meridian Life Science, Inc., substantially all of the assets of EUPROTEIN Inc. offers custom development and production of high-quality bioresearch reagents, with a particular focus on human and other mammalian proteins and recombinant monoclonal antibodies. This acquisition will help Meridian accelerate its pipeline of new immunological reagents while expanding recombinant capabilities.

- In August 2021, Meridian Bioscience Inc. announced that it closed the previously announced acquisition of the North American BreathTek business from Otsuka America Pharmaceutical, Inc. effective July 31, 2021. With this acquisition, Meridian will assume the customer relationships in North America to supply BreathTek, a urea breath test for the detection of Helicobacter pylori.

Recent Partnership in Enteric Disease Testing Market

- In January 2023, Trinity Biotech announced a strategic partnership with imaware Inc. that combines their built-to-partner digital health platform with Trinity Biotech's advanced reference laboratory facilities to power the Digital Health Industry with at-home and remote testing programs.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the enteric disease testing market analysis from 2022 to 2032 to identify the prevailing enteric disease testing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the enteric disease testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global enteric disease testing market trends, key players, market segments, application areas, and market growth strategies.

Enteric Disease Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.3 billion |

| Growth Rate | CAGR of 3.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 474 |

| By Product Type |

|

| By Technique |

|

| By Disease Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Biomerica, Inc., Meridian Bioscience Inc., Quest Diagnostics Inc., Bio-Rad Laboratories, Inc. , Trinity Biotech, Coris BioConcept, Becton Dickinson & Company, Diasorin S.p.A., Abbott Laboratories, Biomerieux SA |

Analyst Review

The enteric disease testing market has witnessed growth, owing to a rise in prevalence of enteric diseases such as cholera, E. Coli, H. pylori, and salmonellosis across the world and availability of various enteric disease testing products.

According to the perspectives of CXOs, the global enteric disease testing market is expected to witness growth in the future. The rise in initiatives taken by government to raise awareness regarding diagnosis of enteric disease and surge in geriatric population that is susceptible to bacterial enteric diseases due to lower immunity drives the growth of the enteric disease testing market. In addition, increase in preference of healthcare professionals for enteric disease testing and rise in demand of equipment for enteric disease testing, drives the growth of the enteric disease testing market. Enteric disease testing is expected to help improve the patient survival rate and reduce the burden of infectious enteric disease in the world.

North America is expected to witness the highest growth, in terms of revenue, owing to a robust healthcare infrastructure, presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth, owing to an increase in awareness related to use of enteric disease testing products, unmet medical demands, high population base, and increase in public–private investments in the healthcare sector.

The rise in technological advancement in testing reagents and equipment of enteric disease, increase in initiative taken by government in developing countries to reduce the burden of infectious enteric diseases, and surge in prevalence of enteric diseases such as E. coli infection, peptic ulcer, amoebiasis are a few key trends in enteric disease testing market.

The base year is 2022 in enteric disease testing market.

The enteric disease testing market was valued at $3,870.60 million in 2022 and is estimated to reach $5,323.60 million by 2032, exhibiting a CAGR of 3.3% from 2023 to 2032.

The immunodiagnostics technique segment generated maximum revenue in 2022, owing to increased adoption of immunodiagnostics technique and advancement in immunodiagnostic technique.

North America dominated the enteric disease testing market.

The high cost of equipment and high cost associated with molecular diagnostic assay are expected to hamper the enteric disease testing market growth.

The top companies to hold the market share in enteric disease testing market are Becton Dickinson & Company Biomerica, Inc., Biomerieux, Abbott Laboratories, Meridian Bioscience, Inc, and QUIDEL CORPORATION.

Yes, competitive analysis is included in enteric disease testing market.

Loading Table Of Content...

Loading Research Methodology...