Flow Cytometry Market Research, 2032

The global flow cytometry market size was valued at $6.2 billion in 2022, and is projected to reach $16.6 billion by 2032, growing at a CAGR of 10.3% from 2023 to 2032. The rise in technological advancement and the expanding application of flow cytometry in various fields such as immunology, hematology, oncology and stem cell research are the major factors that contribute to the growth of the market. In addition, the surge in demand for flow cytometry in clinical diagnostics and drug discovery and development propels the growth of the market. Furthermore, the increase in demand for personalized medicine and easy availability of automated and high throughput flow cytometry system for the handling of large-scale experiments efficiently are the major factors that boost the market growth.

Key Takeaways:

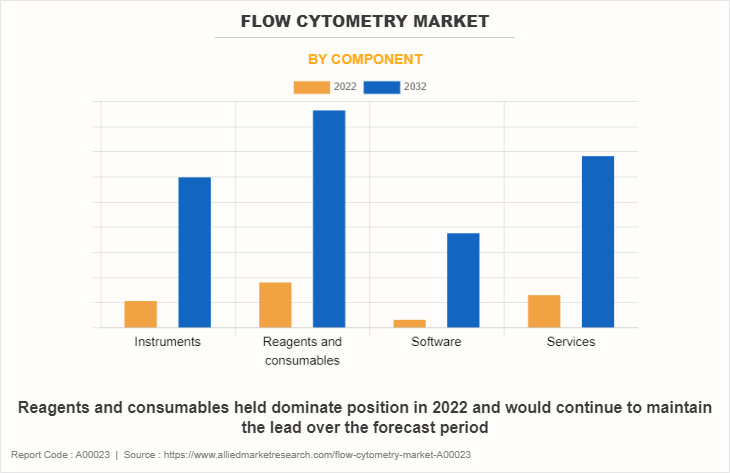

• By component, the reagents and consumables segment dominated the market in 2022.

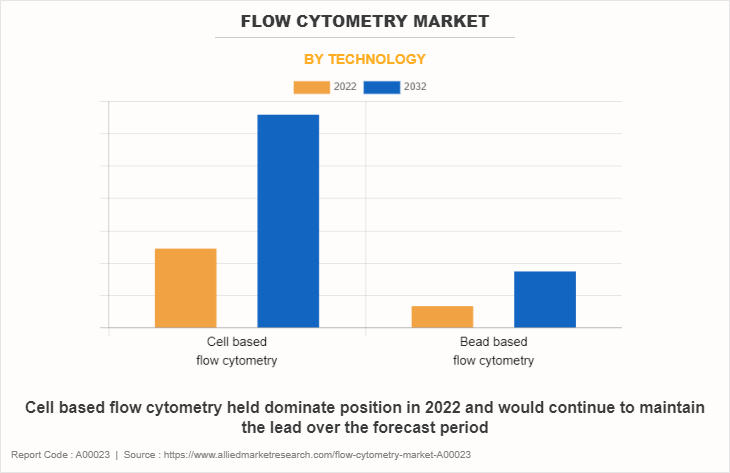

• By technology, the cell-based flow cytometry segment dominated the market in 2022.

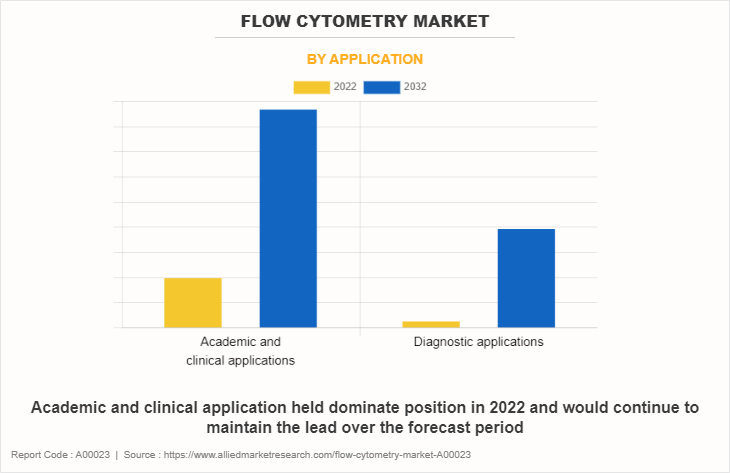

• By application, the academic and clinical applications segment dominated the market in 2022.

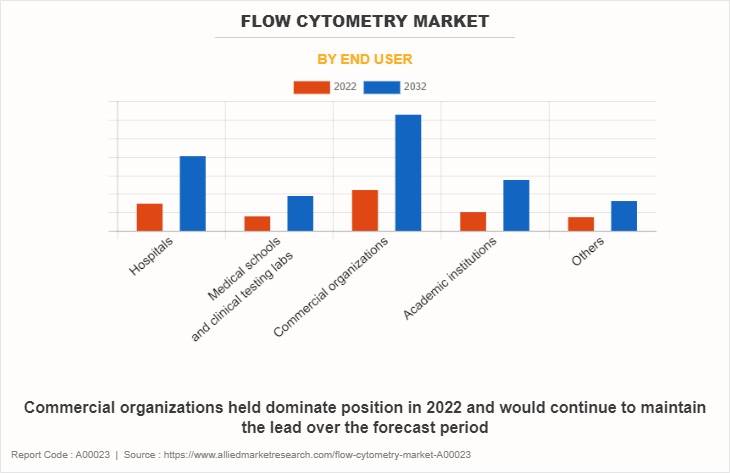

• By end user, the commercial organizations segment dominated the market in 2022.

• By region, North America dominated the market in 2022 and is expected to grow during the forecast period.

Flow cytometry is a powerful analytical technique used in biology and medicine to assess and quantify various cellular characteristics. Flow cytometry is invaluable in fields like immunology, hematology, and cancer research, as it enables researchers and clinicians to analyze complex cell populations, sort cells for further studies, and diagnose various diseases based on the distinct cell characteristics they exhibit.

Market Dynamics

The flow cytometry market share is expected to grow significantly, owing to high adoption of flow cytometry in the drug discovery and development, technological advancement and application of flow cytometry in disease diagnosis. The high adoption of flow cytometry for drug discovery and development has emerged as a major driver for the flow cytometry market.

Moreover, it plays a crucial role in toxicology studies, helping researchers assess the impact of drug candidates on different cell types, making it essential for safety evaluations. Furthermore, flow cytometry enables the monitoring of the effects of drug compounds on cellular responses, such as cell cycle progression and apoptosis, thereby facilitating the study of the underlying mechanisms of action.

Its ability to analyze a wide range of cell-based assays efficiently and with high precision has led to its widespread integration into pharmaceutical research. For instance, Litron Laboratories used a MACSQuant Analyzer to apply flow cytometric in place of microscopic analysis in an in Vitro micronucleus test. This test is widely used in drug development settings to assess cytogenetic damage in mammalian cells upon trigger. Traditionally employed microscopic analyses lack high-throughput capabilities as a screening tool. On the other hand, vitroMicroFlow Kit in combination with the MACSQuant Analyzer 10 provided a fast, standardized, and automated flow cytometry–based workflow that easily overcame those limitations, providing high-content information that was both reproducible and reliable.

Technological advancements in flow cytometry have emerged as a major factor driving the flow cytometry market growth. These advancements are primarily characterized by innovations in instrumentation, data analysis, and application diversity. The development of high-resolution, multi-parameter flow cytometers has allowed researchers to simultaneously measure and analyze an expanding array of cellular characteristics, from surface markers to intracellular proteins and even genomics.

Moreover, the integration of cutting-edge technologies such as microfluidics, nanotechnology, and spectral flow cytometry has significantly improved the sensitivity, speed, and accuracy of flow cytometry. Microfluidic systems have made it possible to analyze rare cell populations and even single cells, making it invaluable in fields like cancer research, where the detection of minimal residual disease is critical. For instance, Advanced Microfluidics provides BactoSense, a fully automated flow cytometer at microfluidic scale. Thus, the advancement in technology in the flow cytometry technology is expected to drive the growth of the market.

However, the high cost of flow cytometry instruments might restrain the growth of the market. Moreover, the integration of artificial intelligence in the flow cytometry instruments and software is expected to present significant growth opportunities.

Segmental Overview

The flow cytometry market size is segmented on the basis of component, technology, application, end user, and region. By component, the flow cytometry market is segmented into instruments, reagents & consumables, software, and services. On the basis of technology, the market is segmented into cell-based flow cytometry and bead-based flow cytometry. As per application, it is segmented into academic & clinical applications and diagnostic applications. On the basis of end user, the market is categorized into hospitals, medical schools & clinical testing labs, commercial organizations, academic institutions, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, and rest of LAMEA).

By Component

The flow cytometry market is categorized into instruments, reagents & consumables, software, and services. The reagents and consumables segment dominated the global market in 2022 and is anticipated to continue this trend during the forecast period. This is attributed to the use of reagents in every process of flow cytometry.

By Technology

The flow cytometry market share is categorized into flow cytometry and bead-based flow cytometry. The cell-based flow cytometry segment dominated the global market in 2022 and is anticipated to continue this trend during the forecast period due owing to high adoption of flow cytometry for cell analysis for drug development and disease diagnosis applications.

By Application

The market is categorized into academic and clinical applications and diagnostic applications. The academic and clinical applications segment dominated the market in 2022, owing to high usage of flow cytometry in research application.

By End user

On the basis of end user, the market is categorized into hospitals, medical schools & clinical testing labs, commercial organizations, academic institutions, and others. The commercial organizations segment dominated the market in 2022, owing to high usage of flow cytometry in drug discovery and development.

By Region

On the basis of region, the Flow Cytometry Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. On the basis of region, North America had the highest market share in 2022, owing to presence of major key players, and rise in prevalence of cancer. However, Asia-Pacific is expected to exhibit the fastest growth during the flow cytometry market forecast, owing to a rise in geriatric population, an increase in demand for minimally invasive treatment, and rise in number of hospitals & clinics.

Competition Analysis

Competitive analysis and profiles of the major players in the flow cytometry industry, such as Agilent Technologies, Inc., Becton Dickinson and Company, bioMérieux SA, Bio-Rad Laboratories, Inc., Danaher Corporation, DiaSorin S.p.A. (Luminex Corporation), Miltenyi Biotec, Inc., Sartorius AG, Sysmex Corporation, and Thermo Fisher Scientific Inc. Major players in the flow cytometry industry have adopted product approval, acquisition, and product launch and collaboration as key developmental strategies to improve the product portfolio and gain strong foothold in the flow cytometry market.

Recent Product Approval in the Flow Cytometry Market

In January 2022, Beckman Coulter Life Sciences, a subsidiary of Danaher Corporation, announced that it has received an EU Quality Management System Certificate under the new In Vitro Diagnostic Medical Devices Regulation (IVDR) for more than 200 flow cytometry reagents developed and manufactured at their Marseille, France facility.

Recent Acquisition in the Flow Cytometry Market

In December 2022, Thermo Fisher Scientific Inc. announced it has completed the acquisition of Phitonex, Inc., a Durham, North Carolina-based company that has pioneered a spectral dye platform for high-resolution biology applications designed to accelerate research and development in cell therapy, immuno-oncology, and immunology research. Phitonex's product offering will enable Thermo Fisher to offer greater flow cytometry and imaging multiplexing capabilities to meet evolving customer needs in protein and cell analysis research.

Recent Product Launch in the Flow Cytometry Market

In June 2021, Thermo Fisher Scientific Inc. announced the launch of Invitrogen Attune CytPix Flow Cytometer, an imaging-enhanced flow cytometer that combines acoustic focusing flow cytometry technology with a high-speed camera. The Attune CytPix allows users to collect high-performance fluorescent flow cytometry data from cells while simultaneously capturing high resolution brightfield images, allowing users to match images with their flow cytometry data to better understand the morphology and quality of the cells.

Recent Collaboration in the Flow Cytometry Market

In August 2022, Becton, Dickinson, and Company announced a collaboration agreement with Labcorp. The collaboration aimed to create a framework to develop, manufacture, market and commercialize flow cytometry-based companion diagnostics (CDx) intended to match patients with life-changing treatments for cancer and other diseases.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the flow cytometry market analysis from 2022 to 2032 to identify the prevailing flow cytometry market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the flow cytometry market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global flow cytometry market trends, key players, market segments, application areas, and market growth strategies.

Flow Cytometry Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 16.6 billion |

| Growth Rate | CAGR of 10.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 360 |

| By Component |

|

| By Technology |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Danaher Corporation, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc. , Thermo Fisher Scientific Inc. , Sysmex Corporation, Sartorius AG, BioMerieux SA, Becton, Dickinson and Company, Miltenyi Biotec GmbH., Cytek Biosciences |

Analyst Review

Flow cytometry has been an indispensable tool for researchers, clinicians, and pharmaceutical companies for several decades, and its importance continues to grow. The market has witnessed remarkable advancements in technology, particularly with the development of high-throughput and multi-parameter flow cytometry systems, enabling researchers to analyze complex biological samples with unprecedented precision.

Key driver behind the growth of the flow cytometry market is the increasing demand for personalized medicine and diagnostics. Flow cytometry plays a pivotal role in identifying and characterizing specific biomarkers, aiding in the diagnosis and treatment of various diseases, including cancer and autoimmune disorders. Additionally, the integration of artificial intelligence and machine learning into flow cytometry data analysis has opened up new avenues for data interpretation and automation, further enhancing its utility in clinical and research settings.

Flow cytometry is a powerful analytical technique used in biology and medicine to assess and quantify various cellular characteristics. Flow cytometry is invaluable in fields like immunology, hematology, and cancer research, as it enables researchers and clinicians to analyze complex cell populations, sort cells for further studies, and diagnose various diseases based on the distinct cell characteristics they exhibit.

Technological advancement, high adoption of flow cytometry technique in disease diagnosis and surge in adoption of flow cytometry technique in drug discovery and development

The total market value of the flow cytometry is $6216.42 million in 2022.

The forecast period for flow cytometry market is 2023 to 2032

Top companies such as Agilent Technologies, Inc., Becton Dickinson and Company, bioMérieux SA, Bio-Rad Laboratories, Inc., Danaher Corporation, DiaSorin S.p.A. (Luminex Corporation), Miltenyi Biotec, Inc., Sartorius AG, Sysmex Corporation, and Thermo Fisher Scientific Inc held a high market position in 2022.

Cell-based flow cytometry segment dominated the global market in 2022 and expected to continue this trend throughout the forecast period.

Integration of AI in flow cytometry is the major factors that are expected to create lucrative opportunities for the growth of the market.

Yes, the competitive landscape is included in the flow cytometry market.

Loading Table Of Content...

Loading Research Methodology...