Transparent Conductive Films Market Outlook – 2030

The transparent conductive films market size was valued at $4.9 billion in 2020, and is projected to reach $12.9 billion by 2030, registering a CAGR of 10.8% from 2021 to 2030. TCFs (transparent conducting films) are electrically conductive and optically transparent thin films. They are used in a variety of electronic devices, such as liquid crystal displays, OLED displays, photovoltaic, and touchscreens.

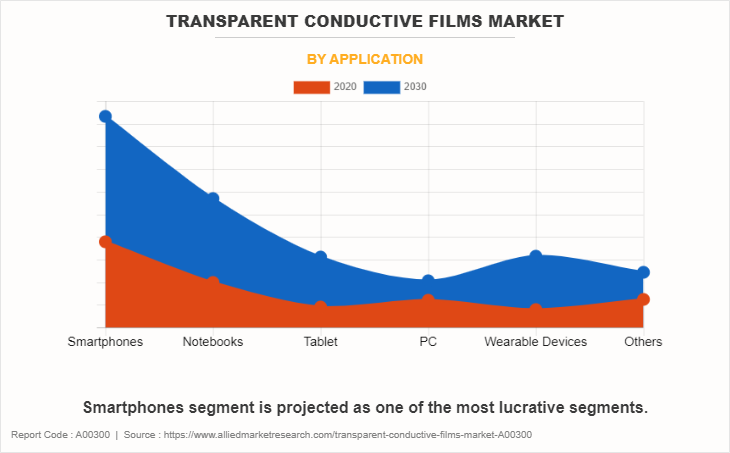

Growth of the global transparent conductive films industry is anticipated to be driven by factors such as rising adoption of touch UI interface devices, and declining cost of smartphones. In addition, features such as low power consumption, minimal reflection, thinness, and flexibility & robustness of transparent conductive films boost the market growth. However, high operating cost of transparent conductive films products acts as a major restraint for the market. On the contrary, rising demand for tablet PCs and notebooks is expected to fuel the transparent conductive films industry growth during the forecast period.

The transparent conductive films market is segmented into Material and Application.

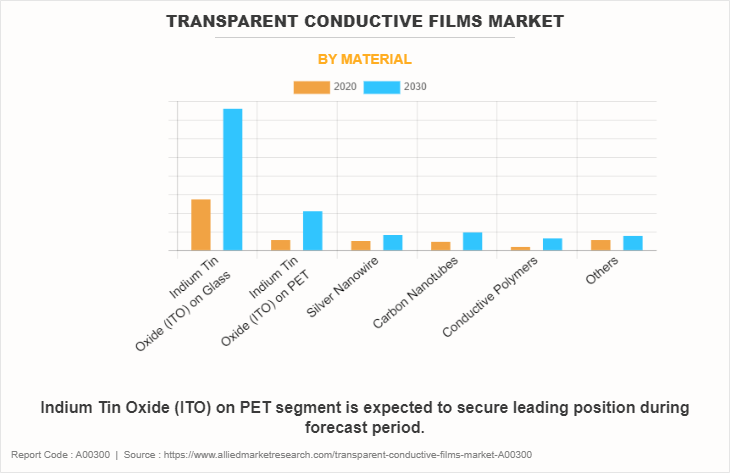

By material, the market is classified into Indium Tin Oxide (ITO) on Glass, Indium Tin Oxide (ITO) on PET, silver nanowire, carbon nanotubes, conductive polymers, and others.

On the basis of application, the market is divided into smartphones, notebooks, tablet, PC, wearable devices, and others.

Leading transparent conductive films market manufacturers such as 3M, Nitto Denko Corporation, Dupont Teijin Films, and Eastman Kodak Company are focusing on their investments on technologically advanced, cost-effective, and more secure products and solutions for various applications.

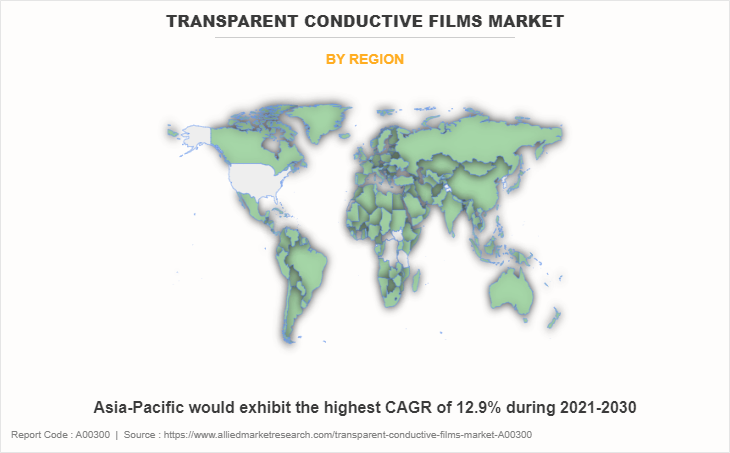

Region wise, the transparent conductive films market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, South Korea, India, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific dominated the transparent conductive films market in 2020, and is projected to register significant growth rate during the forecast period, owing to growth in the automotive segment. Also, Asia-Pacific is expected to witness significant growth by the end of the forecast period, followed by LAMEA.

TOP IMPACTING FACTORS

The prominent factors that impact the transparent conductive films market growth include growing penetration of smartphones, tablets and other electronic gadgets. In addition, rising application of transparent conductive films owing to their mechanical properties, electrical conductivity and optical transparency fuel the market growth. However, less availability and supply of indium tin oxide due to high pricing restricts the market growth. On the contrary, potential demand for photovoltaic application and displays is expected to create lucrative opportunities for the market.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major transparent conductive films market players such as 3M, Cambrios Technologies Corporation, Canatu Oy, Dontech Inc., Dupont Teijin Films, Eastman Kodak Company, Fujifilm Holdings Corporation, Nitto Denko Corporation, TDK Corporation, and Toyobo Corporation have been covered in the report.

COVID-19 IMPACT ANALYSIS

The outbreak of COVID-19 has significantly affected the electronics and semiconductor sector. Business and manufacturing units across various countries were closed in 2021, owing to increase in number of COVID-19 cases, and are expected to remain closed in the second quarter of 2022. Furthermore, partial or complete lockdown has disrupted global supply chain posing challenges for manufactures to reach customers.

The COVID-19 pandemic is impacting the society and overall economy across the globe. The impact of this outbreak is growing day-by-day as well as affecting the overall business globally. The crisis is creating uncertainty in the stock market and is resulting in falling business confidence, massive slowing of supply chain, and increasing panic among customers.

Asian and European countries under lockdowns have suffered major loss of business and revenue, owing to shutdown of manufacturing units. Operations of the production and manufacturing industries have been heavily impacted by the outbreak of the COVID-19 disease, which further impacted growth of the transparent conductive films market outlook.

In addition, the COVID-19 pandemic has impacted the electronics sector as production facilities have been stalled. Its major impact includes a large manufacturing interruption across Europe and interruption in Chinese parts exports, which hinder the transparent conductive films market opportunity. It is expected that the demand for new and innovative products could surge once the economy begins to recover. Companies are looking forward to invest in next-generation products using new technologies, as it is expected to boost its goodwill, once customer demand surges.

Key Benefits for Stakeholders

This study comprises analytical depiction of the global transparent conductive films market size along with current trends and future estimations to depict imminent investment pockets.

The overall transparent conductive films market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and transparent conductive films market opportunity with a detailed impact analysis.

- The current transparent conductive films market forecast is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and the transparent conductive films market share of key vendors.

- The report includes the transparent conductive films industry trends and the market share of key vendors.

Transparent Conductive Films Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 12.9 billion |

| Growth Rate | CAGR of 10.8% |

| Forecast period | 2020 - 2030 |

| Report Pages | 235 |

| By Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | TDK Corporation, Oike & Co., Ltd., Fujifilm Holdings Corporation, TOYOBO Co., Ltd., Eastman Kodak Company, Dupont Teijin Films, Cambrios Technologies Corporation, DONTECH Inc., Nitto Denko Corporation, Canatu Oy, 3M |

Analyst Review

The global transparent conductive films market is flourishing at a rapid pace. However, less availability and supply of indium tin oxide due to high pricing is still a concern for new entrants. Market players are generously investing in R&D activities to develop improved solutions to reduce the overall cost of transparent conductive films products. In addition, according to industry experts, it is essential to optimize affordable prices for transparent conductive films products for long-term growth.

In June 2021, Canatu Oy signed a joint development agreement with DENSO, a leading mobility supplier, to develop high-performance reactors used in the production of carbon nanotube films. The collaboration aims to triple the productivity of Canatu CNT film manufacturing.

Key players of the market focus on introducing technologically advanced products to remain competitive in the market. Partnership, acquisition, and product launches are expected to be the prominent strategies adopted by the market players. Asia-Pacific accounted for a major share of the market in 2020, owing to presence of major players in the region; Also, Asia-Pacific is expected to grow at the highest CAGR, owing to rise in adoption of transparent conductive films in a variety of fields.

The global transparent conductive films market size was valued at $4.94 billion in 2020

Asia-Pacific dominated the transparent conductive films market in 2020

3M, Nitto Denko Corporation, Dupont Teijin Films, and Eastman Kodak Company

Use of transparent conductive films in solar panels is in the latest trend.

It is widely used in solar panels, electrochromic glass, and LCD & OLED displays.

Loading Table Of Content...

Loading Research Methodology...