Advanced Wound Care and Closure Market Research, 2032

The global advanced wound care and closure market size was valued at $19.5 billion in 2022, and is projected to reach $32.9 billion by 2032, growing at a CAGR of 5.4% from 2023 to 2032. Advanced wound care and closures are designed to manage and treat chronic and acute wound. Sutures, staples, adhesive tapes, tissue adhesives, and sealants are examples of wound closures products used to close the wound. Further, hydrocolloids, alginates, and foam dressings are examples of advanced wound care products that keep the wound moist to accelerate the healing process.

Market Dynamics

The advanced wound care and closures market growth is driven by increase in prevalence of chronic and acute wounds and rise in awareness about the importance of wound management. Diabetes is a long-term condition, which can lead to diabetic foot ulcer. Diabetic foot ulcer is a type of open sore that occurs on the feet. Rise in prevalence of diabetic and diabetic foot ulcers drives the demand for advanced wound care and closures. For instance, according to IDF Diabetes Atlas report on diabetes foot-related complications 2022, the prevalence of diabetic foot ulcers (DFU) in African countries is between 10.0% and 30.0%. In addition, as per the same source, the prevalence of diabetic foot ulcer in Brazil was 21.0%. This has increased the demand for advanced wound care and closures which, in turn, boosts the market growth.

Advanced wound care and closures are employed for the wound management in hospitals, specialty clinics, as well as in homecare setting. In addition, rise in government initiatives and healthcare spending further contribute towards the market growth. For instance, National Wound Care Strategy Programme (NWCPS) is arranged to improve care for people with wounds. In addition, advancement in the wound care technology is the key factor drives the market growth. For instance, development of bioengineered cellular therapies, xenograft cellular matrices, and growth factors is expected to create lucrative opportunity for the advanced wound care market growth during the forecast period.

In addition, increase in product approvals by regulatory authorities also drives the growth of the advanced wound care and closures market. Approved products are marketed and sold to healthcare providers, which expand their accessibility to patients. This market expansion leads to increase in revenue generation, which, in turn, supports the growth of the advanced wound care and closures market.

Moreover, rise in ageing population and increase in incidence & prevalence of chronic wounds are expected to fuel the demand for advanced wound care and closures globally. However, high cost of advanced wound care and closures, limited access in low income countries, and reliance on traditional wound care products restrain the growth of the advanced wound care and closures market. High cost of advanced wound closures may restrict their adoption in smaller healthcare facilities and impacts the advanced wound closure market growth. Thus, limited access to costly advanced wound care and closures hampers the market growth.

What is the Impact of Recession 2023 on Advanced Wound Care and Closure Market

The performance of the medical technology companies is impacted by the economies of the countries and operational marketplaces. Due to the global financial crisis, manufacturing and operational costs have increased. Further, there is a shortage of raw materials and transportation costs have fluctuated and moved negatively, which is projected to continue in 2023. In addition, the advanced wound care and closure market size faces challenges from inflation as a result of the companies in this sector receiving a significant portion of their revenues from reimbursed categories, which restricts their capacity to pass along the inflationary pressure.

Segmental Overview

The advance wound care and closures market is segmented on the basis of type, application, end user, and region. On the basis of type, the market is bifurcated into advanced wound closures and advanced wound care. The advanced wound closures segment is further classified into hemostatic and sealing agent, topical tissue adhesive, and wound closure devices. The advanced wound care segment is further classified into moist wound dressings, active wound care, and therapy devices. By application, the market is classified into burns, ulcers, and others. The ulcers segment is further divided into pressure ulcers, diabetic ulcers, and venous ulcers. Depending on end user, the market is classified into hospitals, clinics and nursing homes, and others.

Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

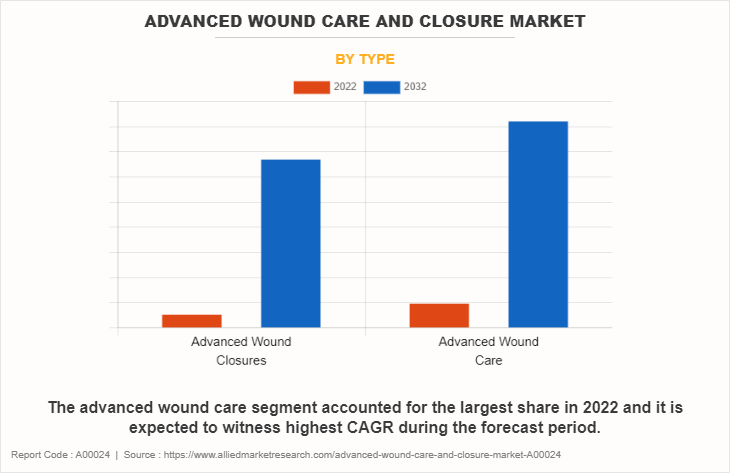

By Type

The advanced wound care and closures market is segmented into advanced wound closures and advanced wound care. The advance wound care segment dominated the global market in 2022, and it is expected to be the fastest growing segment during the forecast period. This is attributed to advancements in biomedical engineering such as development of advanced anti-microbial dressings, foam dressings, and others. Further, surge in minimally invasive surgeries also boost the demand for advanced wound care products and drives the market growth of advanced wound care market.

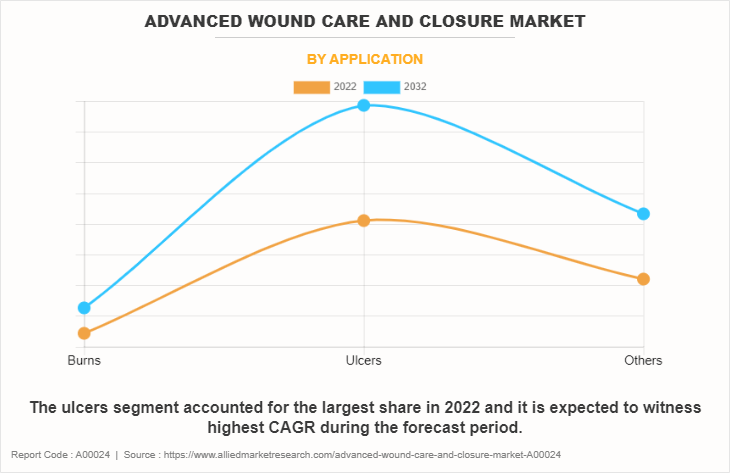

By Application

The advanced wound care and closures market is segregated burns, ulcers, and others. The ulcers segment accounted for the largest advanced wound care and closure market share in 2022, and it is expected to be the fastest growing segment during the forecast period. This is attributed to rise in incidences of chronic conditions such as diabetic foot ulcers and pressure ulcers. As the prevalence of chronic conditions rises, there is a greater need for advanced wound closures, which further drives the advanced wound closure market growth.

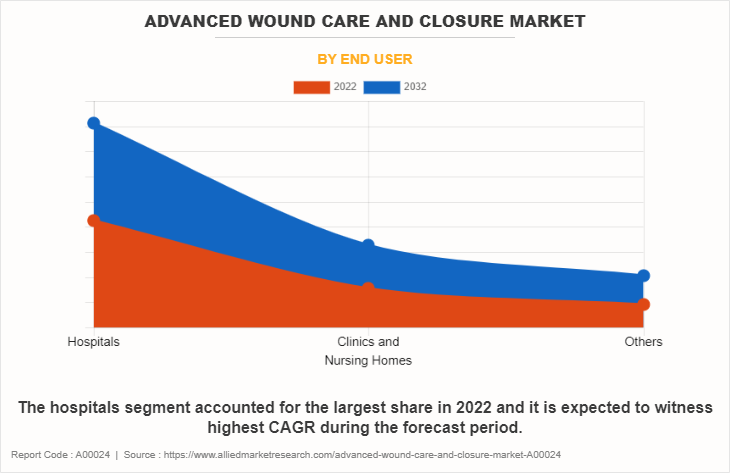

By End User

The advanced wound care and closures market is segmented into hospitals, clinics and nursing homes and others. The hospitals accounted for the largest advanced wound care and closure market share in 2022, and it is projected to register highest CAGR during advanced wound care and closure market forecast period. This is attributed increase in hospitalization for chronic wound treatments and surge in incidences of burns and diabetic foot ulcers.

By Region

The advanced wound care and closures market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the advanced wound care and closures market in 2022 and is expected to maintain its dominance during the forecast period.

The presence of several major players, such as Baxter International Inc., Convatec Group plc, and Johnson & Johnson and rise in prevalence of various chronic diseases in the region drive the growth of advanced wound care and closure industry. For instance, according to National Diabetes Statistics Report 2020 provided by Centers for Disease Control and Prevention (CDC), estimated that about 34.2 million people (10.5%) U.S. population have diabetes. Increase in prevalence of diabetes leads to surge in incidences of diabetic foot ulcers. This further leads to greater demand for advanced wound care and closures, which drives the market growth. In addition, availability of technologically advanced products further boosts the advanced wound care and closure market growth.

However, Asia-Pacific is expected to grow at the highest rate during the forecast period, owing to increase in demand for advanced wound care and closures. The Asia-Pacific region has a large population, and there has been an observed increase in the prevalence of chronic diseases in recent years due to ageing population, lifestyle changes, and environmental factors. This has led to an increase in the number of patients suffering from chronic and acute wounds, which in turn increases the demand for advanced wound care and closures. In addition, growing adoption of advanced wound care and closures further propels the growth of advanced wound care and closure industry. Asia-Pacific offers profitable advanced wound care and closure market opportunity for key players operating in the market, thereby registering the fastest growth rate during the forecast period, owing to rise in increase in healthcare expenditure and development of medical technology industry.

Competition Analysis

Competitive analysis and profiles of the major players in the advanced wound care and closures market are, 3M Company, B. Braun SE, Baxter International Inc., Coloplast, Convatec Group plc, Essity Aktiebolag AB, Integra LifeSciences Holdings Corporation, Johnson & Johnson, Medtronic plc, and Smith and Nephew plc. Other key players in the market include, Derma Sciences, BSN Medical, Kinetic Concepts, and others. Major players have adopted acquisition, product launch, and agreement as key developmental strategy to improve the product portfolio and gain strong foothold in the advanced wound care and closures market.

Recent Acquisition in the Advanced Wound Care and Closures Market

In March 2022, Convatec Group Plc, a global medical solutions company acquired Triad Life Sciences Inc., a U.S.-based medical device company that develops biologically-derived innovative products to address unmet clinical needs in surgical wounds, chronic wounds and burns. This acquisition is expected to help expand the product portfolio of Convatec.

Recent Product Launch in the Advanced Wound Care and Closures Market

In Jan 2023, Convatec Group plc launched its ConvaFoam, a family of advanced foam dressings designed to address the needs of healthcare providers and their patients in the U.S. ConvaFoam is used on a spectrum of wound types at any stage of the wound journey, making it the simple dressing choice for wound management and skin protection.

In January 2020, Convatec Group plc, a leading medical technology company, launched ConvaMax, the new super absorber dressing. Such product launches help the company to gain strong foothold in advanced wound care and closures market.

Recent Product Approval in the Advanced Wound Care and Closures Market

In July 2020, Baxter International Inc. a global leader in advancing surgical innovation, received the U.S. Food and Drug Administration (FDA) clearance of Altapore Shape Bioactive Bone Graft.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the advanced wound care and closure market analysis from 2022 to 2032 to identify the prevailing advanced wound care and closure market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the advanced wound care and closure market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global advanced wound care and closure market trends, key players, market segments, application areas, and market growth strategies.

Advanced Wound Care and Closure Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 32.9 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 275 |

| By Application |

|

| By End User |

|

| By Type |

|

| By Region |

|

| Key Market Players | Johnson & Johnson, B. Braun SE, Essity Aktiebolag AB, 3M Company, Coloplast, Integra LifeSciences Holdings Corporation, Baxter International Inc., Convatec Group plc, Medtronic plc, Smith and Nephew plc. |

Analyst Review

Advanced wound care and closures refer to modern medical solutions designed to treat more complex wounds, promote faster healing, and reduce the risk of infection. Advanced wound care products include hydrogels, hydrocolloids, alginate dressings, foam dressings, growth factors, and others. Closures include sutures, staples, wound closure strips, and adhesive compounds that are used to close or seal a wound after an injury or surgery.

Furthermore, increase in new product launches and acquisition strategies adopted by the key market players is expected to create opportunities for the market growth. For instance, in January 2022, Convatec Group Plc, a global medical solutions company entered into a definitive agreement to acquire Triad Life Sciences Inc., a U.S.-based medical device company that develops biologically derived innovative products to address unmet clinical needs in surgical wounds, chronic wounds and burns. In addition, Convatec launched its ConvaFoam, a family of advanced foam dressings designed to address the needs of healthcare providers and its patients in the U.S. in January 2023. Thus, such product launches and strategies adopted by key players boost the growth of the advanced wound care and closures market.

Advanced wound care and closures are the medical products designed to manage and treat chronic and acute wound.

The major factor that fuels the growth of the advanced wound care and closures market are surge in incidences of chronic wounds, technological advancement in the wound care, and increase in surgical procedures.

Advanced wound care is the most influencing segment in advanced wound care and closures market which is attributed to technological advancement in the active wound care products and surge in use of silver dressings and foam dressings.

Top companies such as, 3M Company, B. Braun SE, Baxter International Inc., Coloplast, Convatec Group plc, Essity Aktiebolag AB, Integra LifeSciences Holdings Corporation, Johnson & Johnson, Medtronic plc held a high market position in 2022. These key players held a high market position owing to the strong geographical foothold in different regions.

The total market value of advanced wound care and closures market is $19,455.44 million in 2022.

The market value of advanced wound care and closures market in 2032 is $32,859.43 million.

The forecast period for advanced wound care and closures market is 2023 to 2032.

The base year is 2022 in advanced wound care and closures market.

The advanced wound care and closures are used to treat various types of chronic and acute wounds such as pressure ulcer, diabetic foot ulcer, burns, and surgical wounds.

Loading Table Of Content...

Loading Research Methodology...