The global milk powder market size was valued at $29.6 billion in 2021, and is projected to reach $50.7 billion by 2031, growing at a CAGR of 4.8% from 2022 to 2031.

Milk powder, a dairy product, is produced by sprinkling liquid milk into a heated chamber and allowing the moisture to evaporate quickly. The remaining solids are then collected, and powdered into fine particles. When milk powder is reconstituted, water is added to the powder, transforming it back into a liquid. In locations where fresh milk is hard to procure due to a lack of proper transportation and storage facilities, the availability of milk powder, makes it a practical substitute for liquid milk. Milk powder is a common ingredient in baked goods, baby formula, and confectionery products. Yogurt, cheese, and other dairy products are also produced using milk powder.

Market Dynamics

The milk powder industry is experiencing demand in the consumption of quick-service restaurant goods, such as cakes, pastries, savories, shakes, and ice cream (QSRs). Furthermore, the extended shelf life of milk powder, the increase in the disposable income of people, and the increase in demand for protein-rich food products contribute toward market expansion. However, the rise in obesity rates, increased health consciousness among adults as well as hazardous chemicals and components in processed dairy products, limit market development. There has been a significant increase in the working population over the last decade. This has resulted in, tight schedules, higher workloads, and arduous commutes.

Customers are looking for quick and packaged food & beverages to satisfy their hunger while saving time because of the rise in work pressure. Packaged food & beverages expose consumers to major health risks such as gut inflammation, cancer, cardiovascular disease, obesity, and others. Furthermore, obesity is the most frequent problem encountered by worldwide consumers. According to an ourworldindata.org study in 2021, a total of 39 million children under the age of 5 were obese and overweight. There is an increase in awareness among people about the benefits of eating healthier. Customers have shifted toward functional food made from fortified milk powder which fuels the sales and the growth of the milk powder market.

The COVID-19 pandemic impacted farmers and company employees since carrying out operational activities was difficult owing to the government's severe lockdown requirements. The pandemic exacerbated uncertainty and volatility for dairy producers by disrupting output owing to a shortage of resources for manufacturing milk powder variants. Prices fluctuated, due to the limited supply of milk in the market, which affected the overall price of the final product making it more expensive than the average market price. While farmers attempted to raise output volume to fulfill demand from dairy corporations which resulted in the deterioration of the quality of the final product. The increase in transportation costs has caused regular disruptions in product distribution around the globe.

Along with this, the government laws and regulations regarding milk powder in every country is expected to restrain the growth of the milk powder market. For instance, according to the Ministry of Health and Family Welfare India, the fat and/or protein content of the powder may be adjusted by the addition and/or withdrawal of milk constituents in such a way as not to alter the whey protein to casein ratio of the milk being adjusted. It shall be of uniform color and shall have a pleasant taste and flavor free from off-flavor and rancidity. It shall also be free from vegetable oil/ fat, mineral oil, added flavor, and any substance foreign to milk. Thus, the implementation of stringent regulations hampers the milk powder market growth.

Innovation, processing, and packaging are the main areas of market that is providing milk powder market opportunity for growth. Factors, such as health awareness & consciousness among customers and varying consumer eating habits & tastes, are projected to drive innovation. Manufacturers increase their product range by including functional ingredients, vitamins, minerals, and added nutrients in product formulations to meet changing consumers’ demands. Innovative packaging strategies such as attractive jars, large packages, resealable packaging, and big tubs also contribute to higher sales of products. For instance, Tetra Pak is well-known for its handling of powder materials. While conducting pilot testing in a real factory, the business employs computational fluid dynamics (CFD) tools to model trials. CFD also assists them in developing the best line design for each dairy, ensuring that energy and other utilities are used as efficiently as possible. The company offers solutions that are designed in a way that reduces food wastage and protects the milk powder from contaminating with foreign particles.

The confectionery segment is the largest segment in which the application of milk powder is the highest. The growth of the confectionery market is restricted, owing to the escalation in prices of raw materials required for the production of the product. The primary raw materials utilized in confectionery production are milk, milk powder, cocoa, and sugar. Milk powder prices are volatile and can be influenced by a series of factors, including the production of milk, quality of the milk, processing condition, drying method, and storage condition. In addition, increase in the supply-demand gap in fresh milk has accelerated the prices of milk powder. The rise in prices and unavailability of raw materials hinders the growth and development of the global confectionery industry.

According to Food and Agricultural Organization (FAO), around 950 million tonnes of milk is produced in 2022 and the production is increased by 0.6% from 2021, owing to the surge in requirement for milk in emerging economies such as India, China, and Brazil. Furthermore, global whole milk powder exports were estimated to be 2.6 million tons, a 6.4% decrease from 2021, with a steep drop in imports into China, as well as significant drops in Sri Lanka, Nigeria, and Egypt, partially offset by possible increases in Algeria, Indonesia, Brazil, Thailand, and Saudi Arabia. The decrease in milk powder exports and imports creates a supply-demand imbalance, which increases price volatility.

Segmental Overview

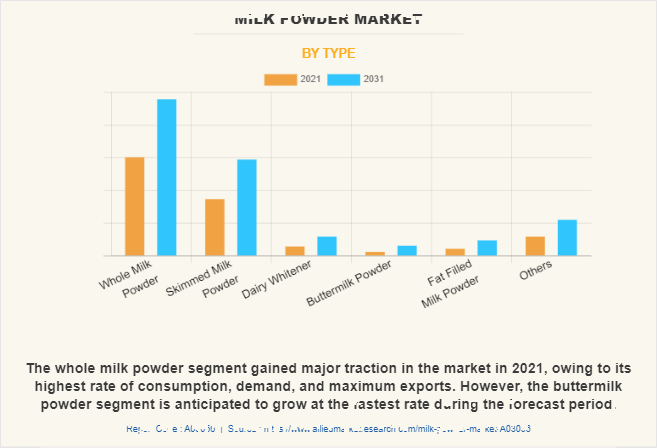

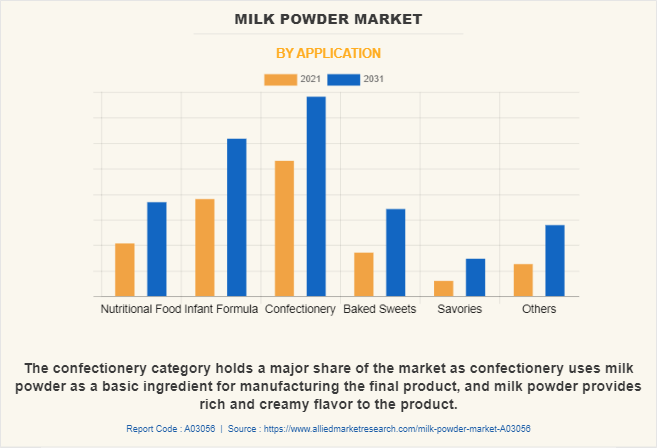

The milk powder market is segmented into type, application, and region. By type, the market is classified into whole milk powder, skimmed milk powder, dairy whitener, buttermilk powder, fat filled milk powder, and others. By application, the market is divided into nutritional food, infant formula, confectionery, baked sweets, savories, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Spain, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and the rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Type

According to the milk powder market demand analysis, on the basis of type, the whole milk segment gained a major share of the global milk powder market in 2021, and is expected to sustain its market share during the forecast period. A substantial majority of customers worldwide believe that whole milk is the most natural type of milk. Developing countries with increasing populations and disposable incomes are propelling the growth of whole milk powder. This is due to the convenience, shelf life, and nutritional benefit of whole milk powder over fresh milk. Moreover, emerging regions including those in Asia-Pacific, Latin America, and Africa present the whole milk powder market with tremendous development prospects. This is spurred by the rise in demand for dairy products in these areas and a shift in customer preferences in favor of convenience and health advantages.

By Application

According to the milk powder market revenue analysis, on the basis of application, the confectionery segment dominated the milk powder market in 2021, and is expected to sustain its market share during the milk powder market forecast period. Confectionery requires milk products such as whole milk powder, fat-filled milk powder, and others as a basic ingredient for manufacturing the final product. Milk powder provides confectionary items with a rich and creamy flavor, making them more attractive to customers. Milk powder is a useful component for confectionery makers since it is easy to store and transport and is able to be reconstituted with water as required. In addition, milk powder does not degrade as rapidly as fresh milk and confectionery items employing milk powder have a longer lifespan than those manufactured with fresh milk.

By Region

According to region, Asia-Pacific dominated the global milk powder industry in 2021 and is expected to be dominant during the forecast period. The Asia-Pacific milk powder market is propelled by changing lifestyles caused by globalization and a rise in the working-age population. The rise in the region's affluent population, as well as the increased penetration of the internet and social media, pushes the usage of processed and packaged food, paving the way for packaged products. China, Japan, and India are the biggest contributors to the region's growth.

Competition Analysis

Players operating in the global milk powder market have adopted various developmental strategies to expand their milk powder market share, increase profitability, and remain competitive in the market. Key players profiled in this report include Arla Foods amba, Fonterra Co-operative Group Limited, Nestle S.A., Saputo Inc., Schreiber Foods Inc., The Kraft Heinz Company, Groupe Lactalis, Dairy Farmers of America, Inc., Danone S.A, and Royal FrieslandCampina N.V.

Some Examples of Product Launch and Divestment in The Market

- In July 2022, Danone S.A. has launched the new Dairy & Plants Blend baby formula to meet parents’ desire for feeding options suitable for vegetarian, flexitarian and plant-based diets, while still meeting their baby’s specific nutritional requirements.

- In October 2021, Royal FrieslandCampina N.V. divested the sale of its milk powder towers in Aalter, Belgium, to Royal A-ware.

Some Examples of Partnerships and Acquisitions in The Market

- In March 2023, Dairy Farmers of America announced partnership with Good Culture in order to expand its probiotic milk products portfolio.

- In January 2023, Dairy Farmers of America (DFA) announced the acquisition of two extended shelf-life (ESL) processing facilities from SmithFoods.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the milk powder market analysis from 2021 to 2031 to identify the prevailing milk powder market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the milk powder market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global milk powder market trends, key players, market segments, application areas, and market growth strategies.

Milk Powder Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 50.7 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 320 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Arla Foods amba, Dairy Farmers of America, Inc., Danone S.A, Schreiber Foods Inc., Saputo Inc., Nestle S.A., The Kraft Heinz Company, Fonterra Co-operative Group Limited, Royal FrieslandCampina N.V., Groupe Lactalis |

Analyst Review

Various CXOs from leading companies perceive that the Asia-Pacific region has the most lucrative growth opportunities. Lactose intolerance is a serious issue in the Asia-Pacific region as the rate of lactose intolerance in consumers is 2.5 times higher than that of consumers living in the European region. Moreover, lactose intolerance is not the sole reason for lactose-free milk powder to flourish in the Asia-Pacific region. The rise in health consciousness among Asia-Pacific customers during the post-COVID is depicting the adoption of milk powder products. The growing knowledge about the importance of milk powder is also anticipated to contribute toward market growth. In addition, the manufacturing companies are looking forward to manufacturing products with vitamin and mineral fortification to elevate the taste of the product and provide a valuable experience for the customers.

CXOs further added that according to National Geographic, 18 billion pounds of plastic flows into the ocean every year, and only 9% of the total plastic produced has been recycled. Also, 79% of it is currently dumped into landfills or discarded in the natural environment. Therefore, there is a need for sustainable packaging of milk powder variants, which in consequence has led many key players to step toward eco-friendly and sustainable packaging options.

The global milk powder market size was valued at $ 29,553.8 million in 2021, and is estimated to reach $ 50,697.5 million by 2031, registering a CAGR of 4.8% from 2022 to 2031.

The global milk powder market registered a CAGR of 4.8% from 2022 to 2031.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the milk powder market report is from 2022 to 2031.

The top companies that hold the market share in the milk powder market include Arla Foods amba, Fonterra Co-operative Group Limited, Nestle S.A., Saputo Inc., and others.

The milk powder market report has 2 segments. The segments are type, and application.

The emerging countries in the milk powder market are likely to grow at a CAGR of more than 8.0% from 2022 to 2031.

Post-COVID-19, the increasing introduction of hotels, cafes, and restaurants in the post-COVID era has increased the demand for milk powder and is expected to rise during the forecast period as milk powder is a essential food ingredient in the food service industry.

Asia-Pacific will dominate the milk powder market by the end of 2031.

Loading Table Of Content...

Loading Research Methodology...