Non-alcoholic Spirits Market Research, 2031

The global non-alcoholic spirits market size was valued at $281.1 million in 2021, and is projected to reach $642.4 million by 2031, growing at a CAGR of 8.7% from 2022 to 2031.

Alcohol free-spirits made from a mixture of spices, herbs, and fruits. They are sweeter, fruitier, and balanced with strong and bitter flavors. The herbal aroma provides a lasting aftertaste. They are a perfect solution for those who wants a mixed drink minus the side effects of alcohol. Alcohol free-spirits contains active ingredients that are designed to mimic the positive effects of alcohol.

Get more information on this report

The population of middle-income groups has witnessed an upsurge, owing to economic growth as a result of increase in disposable incomes and decline in poverty levels. In 2020, the middle-income group consisted about 5.8 billion population. Developing economies with a large populace, such as, China, India, and Indonesia in Asia-Pacific, as well as in Africa, the Middle East, and Latin America, are expected to witness a surge in middle-income groups. The middle-class population in developed economies, such as U.S., Japan, and European countries, is expected to grow at an annual growth rate of 0.5%, as compared to the developing economies such as China and India, which is projected to grow at 6.0% or more per annum. As the income of middle-class population increased above basic needs, consumers can have discretionary funds to spend on the health alternatives to food & beverages which can improve their lives. Thus, growth in middle-class population is projected to lead to expansion of consumer base of the non-alcoholic spirits industry.

Non-alcoholic spirits are produced with plant-based sources such as flowers, spices, roots, berries, extracts, among other ingredients. Also, non-alcoholic spirits are vegan, gluten-free, calorie-free, and allergen-free. Owing to this it can be a healthy substitute for alcoholic spirits. The growing consumer preference for healthy food and beverage products is expected to drive the market for non-alcoholic spirits during the forecast period. Furthermore, the health-conscious population seeks to reduce or eliminate alcohol from their diet in order to lose weight and improve sleep. They are an excellent alternative for those who crave alcohol but do not want its negative side effects. Aside from that, non-alcoholic spirits are appropriate for those dealing with religious issues, pregnancy, dietary restrictions, and workplace appropriateness. Thus, the health benefits associated with the consumption will foster the non-alcoholic spirits market demand during the estimated period.

Non-alcoholic spirits are more expensive than alcoholic spirits and soft drinks. The product's high cost reflects the complex manufacturing process of non-alcoholic spirits. The distillation process required cutting-edge distillery machinery, which is more expensive to purchase and maintain. The dealcoholization process wastes gallons of alcohol and other liquid bases, making the finished product more expensive than alcoholic spirits. The high prices also indicated the product has been manufactured with high quality ingredients and almost care. For instance, Pernod Ricard’s non-alcoholic brand Ceder offers its 500ml bottle at $20 whereas, Beefeater gin costs $17 for 750 ml. Moreover, Coca-Cola 2 lit bottle will cost between $2-3. Thus, the high product prices associated with the product is likely to hamper the non-alcoholic spirits market growth in the long run.

Beverages are full of sugar and sweeteners. The availability of low-sugar and sugar-free products from various manufacturers has increased the demand for these products from consumers. The increased risk of diabetes associated with the consumption of sugary foods and drinks has prompted people to consume less sugar. According to the International Diabetes Federation, in 2015 he estimated that more than 400 million people had diabetes. I was sick. The World Health Organization (WHO) estimates that 90% of people with diabetes worldwide have type 2. Rising diabetic population is driving demand for low-sugar and sugar-free beverages, which is expected to create opportunities in the non-alcoholic spirits market. This product also contains little to no sugar, making it a great choice for the health conscious. For example, Seedlip gin contains about 4g of sugar per 100ml, while an alcoholic gin contains more than twice as much sugar per 100ml. and is expected to create lucrative opportunities in the non-alcoholic spirits market.

Alcohol consumption is decreasing, with millennials drinking 20% less than their parents at the same age, and consumers are making healthier choices in a variety of indulgent food and beverage categories without sacrificing taste or social experiences. Also, alcohol consumption can cause obesity, cardiovascular diseases, addiction, high blood pressure, and other health problems. Owing to these health risks the total per capital consumption of alcohol is seen to be declining among many countries. Thus, the factors such as decline in alcohol consumption due to the health risks associated with it can create an opportunity for non-alcoholic spirits market.

The non-alcoholic spirits market is segmented into Product Type, Category and Distribution Channel.

Product type includes the study whiskey, rum, vodka, tequila, and others. On the basis of category, the market is bifurcated into conventional and organic. By distribution channel, the market has been divided into food service and food retail. The food retail sub segment has been further divided as store-based and non-store-based. On the basis of region, the market is categorized into North America, Europe, Asia-Pacific and LAMEA.

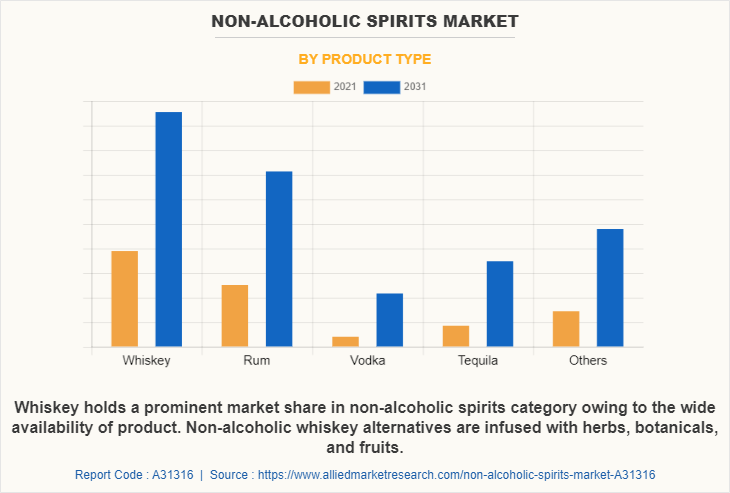

On the basis of product type, whisky segment garners a largest non-alcoholic spirits market share in 2021. However, tequila segment is projected to grow at a fastest CAGR during the projected period. Whiskey alternatives are becoming more popular due to the growing demand for healthy drink alternatives and non-alcoholic beverages. The adverse effects associated with the alcohol content of whiskey is one of the main reasons for the growth of the alcohol-free whiskey market as it does not contain alcohol. Apart from that, it has fewer calories than traditional drinks, which will further increase the market demand.

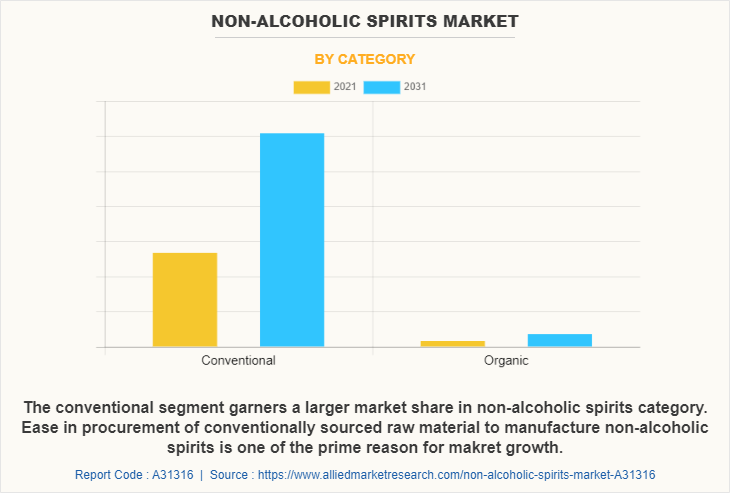

On the basis of category, conventional segment dominated the global market in 2021. Non-alcoholic spirits made with conventional ingredients are less expensive than organic spirits. Conventional ingredients are readily available. Therefore, the conventional segment is expected to receive the largest share of non-alcoholic spirits due to low prices and ready availability of ingredients.

On the basis of distribution channel, food retail segment garners a largest market share in 2021. Food retail segment is further bifurcated into store-based and non-store-based. Availability and visibility of in-stock products for consumers drives market demand for store-based channels. A store base that offers a variety of products that can be selected from a single type. Consumers can also compare prices, ingredients and amounts of different products to choose the product that best suits their needs. Therefore, easy access to products from various manufacturers will increase the demand for non-alcoholic spirits.

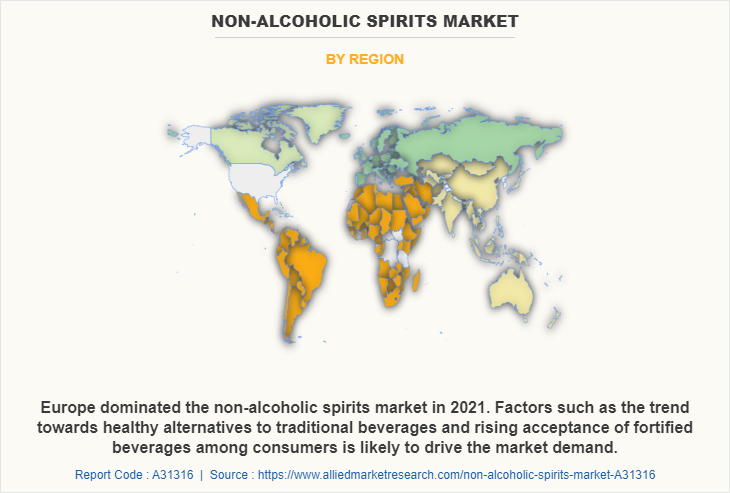

Region wise, Europe was a highest revenue contributor and is estimated to reach $ 303.63 million in non-alcoholic spirits market forecast period 2031. However, Asia-Pacific is expected to grow at a highest CAGR of 9.83% during the estimated period. Economic stability and high consumer purchasing power are some of the main reasons for the growth of the European non-alcoholic spirits market. Apart from that, consumer trends toward fortified beverages are likely to drive market demand. For example, The Free Spirits Company offers spirits alternatives fortified with vitamins B3 and B6, as well as naturally uplifting amino acids like taurine. Additionally, product launches in the non-alcoholic spirits category by various manufacturers are expected to create opportunities in the non-alcoholic spirits market due to the growing consumer preference for dry January. For example, in December 2020, renowned signature gin brand Gordon's announced the launch of a non-alcoholic version of their signature gin under Gordon's 0.0. With this launch, the company aims to allow consumers to enjoy the taste of Gordon's even if they choose non-alcoholic beverages. These initiatives, coupled with broad product availability in the market, are expected to drive demand for non-alcoholic spirits in Europe.

The key players operated in the global non-alcoholic spirits market includes Diageo, Pernod Ricard, Salcombe Distilling Co, Bacardi, La Martiniquaise, Lyre's Spirit Co, Spiritless Inc., Everleaf Drinks, ArKay Beverages LTD., Caleño, Spirits of Virtue, Aplós, fritz-kulturgüter GmbH, Escape Mocktails, Celtic Soul, Ritual Zero Proof, PROTEAU, Drink Monday, Strykk, and FLUÈRE.

Key players are investing in R&D to expand its product offering and launch innovative products to stay ahead in the competition. For instance, in January 2022, Bacardi launched Palette, a non-alcoholic spirit brand with an aim to expand its low and no alcohol product range. The product has been created in collaboration with Amsterdam-based bartenders. Alessandro Garneri, botanicals of Palette brand, and team used cutting-edge technology and three different methods to extract intense and all natural flavors from botanicals such as ginger, nutmeg, cinnamon, gentian root, juniper berries, and American oakwood.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the non-alcoholic spirits market analysis from 2021 to 2031 to identify the prevailing non-alcoholic spirits market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the non-alcoholic spirits market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global non-alcoholic spirits market trends, key players, market segments, application areas, and market growth strategies.

Non-alcoholic Spirits Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 642.4 million |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 259 |

| By Distribution Channel |

|

| By Product Type |

|

| By Category |

|

| By Region |

|

| Key Market Players | Ecology & Co., Elegantly Spirited LTD., Escape Mocktails, Diageo plc., FLUÈRE, Everleaf Drinks, Salcombe Distilling Co, Spirits of Virtue, ALTD SPIRITS, Spiritless Inc., Ritual Zero Proof, Pernod Ricard, Aplós, Lyre's Spirit Co, Bacardi Limited, Drink Monday, la martiniquaise, ArKay Beverages LTD., Caleño, Rheinland Distillers GmbH |

Analyst Review

According to the insights of CXOs of leading companies, non-alcoholic spirits market holds a substantial scope for growth; however, its contribution to the world market would increase significantly within the next six years. Owing to the increasing interest in wellness and mounting selection of no-ABV beverages, 58% of consumers in the U.S. are drinking more alcohol-free beverages compared to last year while 61% of consumers wants to have better quality products with wide availability when it comes to alcohol free drinks. Therefore, owing to this, manufacturers are also looking to expand their product offerings with innovative flavors in non-alcoholic category. In January 2021, 12 new non-alcoholic spirits brands were launched in the U.S., while 11 new brands launched in the UK market. That makes a total of 29 and 42 brands in each market, respectively.

Moreover, investors are showing interest to invest in non-alcoholic spirits brands. CleanCo, a manufacturer of non-alcoholic rum, gin & tequila alternative secured $ 12 million funding. Also, Diageo recently acquired a minority stake in Ritual Zero Proof. Apart from this, e-commerce (i.e., online) distribution channels such as Amazon, brand shopping sites, and grocery outlets are contributing to the growth of the market.

Moreover, according to the Alcohol change UK, over 6.5 million people took part in Dry January 2021, increase from 3.9 million in 2020. The numbers are steadily increasing considering that when the Dry January movement was launched in 2012, only four thousand population signed up to abstain. Such an impressive increase in number along with the increasing popularity and availability of booze free options is expected to create an opportunistic demand for market growth.

However, on-premise or food service channel is a critical tool for brand discovery, with bartenders acting as gatekeepers for the category. Also, preparing delicious and impressive cocktail experience through zero alcohol content is challenging as well as costly.

The global non-alcoholic spirits market was valued at $281.12 million in 2021.

Europe was a highest revenue contributor in non-alcoholic spirits market.

Health benefits associated with the consumption of non-alcoholic spirits along with the increase in popularity of no and low alcoholic beverages is likely to drive the demand for non-alcoholic spirits market.

Whiskey segment garners a largest market share in 2021.

La Martiniquaise, Lyre's Spirit Co, Diageo, Bacardi, and rKay Beverages LTD. are the top players that are operating in Non-alcoholic Spirits market

The forecast period for Non-alcoholic Spirits market will be 2022 to 2031

Non-alcoholic Spirits market is expected to register a CAGR of 8.73% over the forecast period

During COVID-19 pandemic, sales of low-and no-alcohol alternatives soared. Non-alcoholic spirits showed considerable growth in 2020. For instance, sales of low and no alcoholic beverages increased by 30% during lockdown in the UK. Also, in the U.S., the sales went up 44% for non-alcoholic beer in May 2020 as compared to last year.

Loading Table Of Content...