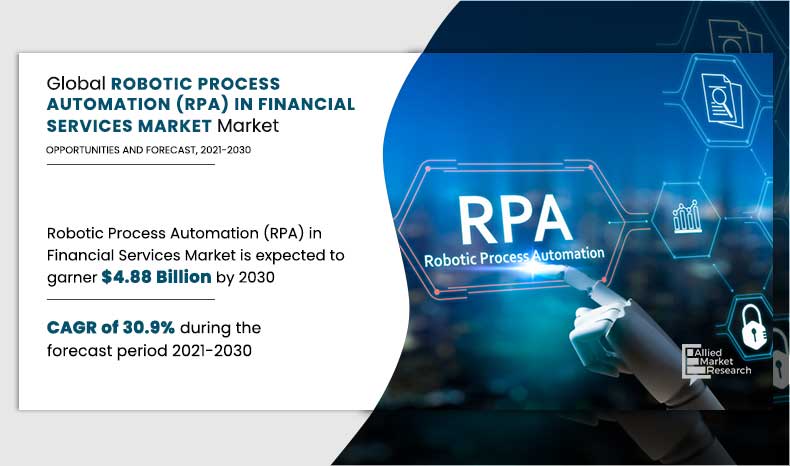

The global robotic process automation (RPA) in financial services market size was valued at $340.95 million in 2020, and is projected to reach $4,883.41 million by 2030, growing at a CAGR of 30.9% from 2021 to 2030.

The primary aim of robotic process automation (RPA) in financial services industry is to assist in processing the banking work that is repetitive in nature. Robotic process automation (RPA) helps banks & financial institutions increase their productivity by engaging customers in real-time and leveraging the immense benefits of robots. RPA is an extensive process, requiring robust employee training, structured inputs, and governance. However, once set up and implemented correctly, these RPA-based banking robots can take complete control of the system actions, including clicking & opening applications, sending emails, and copy-pasting information from one banking system to another.

RPA allows easy automation of various tasks crucial to the mortgage lending process, including loan initiation, document processing, financial comparisons, and quality control. As a result, the loans can be approved much faster, leading to enhanced customer satisfaction. Another benefit of RPA in financial services deals with unburdening the employees from doing manual tasks so that they can focus on more high-value tasks for better productivity. Therefore, these are some of the major factors that propel the robotic process automation (RPA) in financial services market growth. However, resistance to adoption of RPA by financial services is one of the major factor stopping them from embracing robotic process automation (RPA) in financial services industry. The automation strategy cannot be properly and effectively executed without implementing organizational change management as part of the holistic approach toward technology acceptance. Therefore, this is a major factors that limit the market growth. Contrarily, adopting RPA brings invaluable benefits and competitive advantages for the banks operating in the digital economy. RPA has the potential to accelerate and streamline business processes and scale up the organization business output with RPA implementation. Thus, adoption of RPA in financial services is expected to grow tremendously in the coming years.

The report focuses on growth prospects, restraints, and trends of the Robotic Process Automation (RPA) in financial services market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the RPA in financial services market.

Segment review

The RPA in financial services market share is segmented on the basis of component, deployment mode, enterprise size, application, end user, and region. By component, it is segmented into solution and service. On the basis of deployment mode, it is bifurcated into on-premise and cloud. Depending on enterprise size, it is segregated into large enterprises and small and medium enterprise. As per application, it is divided into customer account management, fraud prevention, reporting & invoice automation, account opening & KYC, and others. By end user, the market is divided into banks, insurance companies, credit unions, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Component

Solution segment accounted for the highest market share in 2020.

The report analyzes the profiles of key players operating in the robotic process automation (RPA) in financial services market such as Antworks, Automation Anywhere Inc., Atos SE, Blue Prism Limited, IBM, Kofax Inc., NICE SYSTEMS, Protiviti Inc., UiPath, and WorkFusion, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the robotic process automation (RPA) in financial services market forecast.

COVID-19 Impact Analysis

COVID-19 has increased the demand for the RPA in financial services as the pandemic forced the global human workforce remote working under lockdown, RPA allowed financial companies to remain operational. One of the key challenges that financial firms face during COVID-19 is the extreme shift in workload pressures on certain processes such as accounts receivables and the delays caused by remote working. Therefore, financial firms increasingly invested in RPA, which allows companies to overcome the burden of manual processes, shift their workforce to more value-added tasks, and be ready to rebound fast. Therefore, COVID-19 positively impacted the RPA in financial services market growth.

By Application

Customer Account Management segment accounted for the highest market share in 2020.

Top impacting factors

Adoption of RPA by banks for various financial processes

Financial institutions all around the globe are seeking to increase efficiency, cut costs, and raise production as technology continues to evolve at a rapid rate. Automation has played a significant role in this transformation, with RPA to play a key role in job execution in financial institutions in recent years. Moreover, various processes such as automatic report generation, know your customer (KYC), anti-money laundering, mortgage lending, and credit card processing are automated by RPA in present banking scenario. In addition, RPA is a cost-effective system, which helps banks to increase efficiency and save time by providing a convenient performance. It further helps in the elimination of human errors due to which banks can have more precise and accurate data. RPA can keep a track of legislative changes & upgrades and promptly incorporate the findings into financial organizations' anti-money laundering strategies. In addition, the continual process of gathering and processing data from both external and internal sources aids the relationship manager in staying on top of their client portfolio while being compliant. Hence, banks have adopted the RPA systems to boost their efficiency by automating the work. Thus, the adoption of RPA by banks for various financial processes is fueling the RPA in financial services market growth.

Technological advancements in automation processes

Advancements in RPA system are expected to drive the growth of the market in the upcoming years. The advancements in artificial intelligence (AI) and machine learning (ML) is anticipated to make the systems more efficient and enhance the performance. Moreover, increased use of AI chatbots for customer services is expected to enhance the customer experience and conveniently solve their problems. In addition, surge in adoption of AI in various financial processes for the automation of operations is expected to fuel the growth of the market in the coming years. For instance, by deploying RPA, the global insurer, Zurich was able to release up to 40% of their commercial underwriting process. As a result, it has been able to concentrate on high-value-added jobs and dedicate more time to difficult policy. Thus, technological advancement in automation processes are anticipated to provide lucrative opportunities for the RPA in financial services market growth in the future.

By Region

Asia-Pacific would exhibit the highest CAGR of 34.6% during 2021-2030

Key Benefits for Stakeholders

- The study provides in-depth analysis of the global robotic process automation (RPA) in financial services market share along with current & future trends to illustrate the imminent investment pockets.

- Information about key drivers, restrains, & opportunities and their impact analysis on the global robotic process automation (RPA) in financial services market size are provided in the report.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the market.

- An extensive analysis of the key segments of the industry helps to understand the global robotic process automation (RPA) in financial services market trends.

- The quantitative analysis of the market size from 2021 to 2030 is provided to determine the market potential and several robotic process automation in financial services case study.

Robotic Process Automation (RPA) in Financial Services Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Application |

|

| By End User |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

The volume of everyday customer queries in banks ranging from balance query to general account information is enormous, making it difficult for the staff to respond to them with low turnaround time. RPA tools allow banks to automate such mundane, rule-based processes to effectively respond to queries in real-time, thereby reducing the turnaround time substantially. Moreover, the fact that robots are highly scalable allows to manage high volumes during peak business hours by adding more robots and responding to any situation in record time. In addition, RPA implementation allows banks to put more focus on innovative strategies to grow their business by freeing employees from doing mundane tasks.

One of the benefits of RPA in financial services is that it does not require any significant changes in infrastructure, due to its user interface (UI) automation capabilities. The hardware and maintenance cost further reduce in the case of cloud-based RPA. In addition, with RPA implementation, banks and financial services industry are using legacy as well as new data to bridge the gap that exists between processes. This kind of initiation and availability of essential data in one system allows banks to create faster and better reports for business growth.

Some of the key players profiled in the report include Antworks, Automation Anywhere Inc., Atos SE, Blue Prism Limited, IBM, Kofax Inc., NICE SYSTEMS, Protiviti Inc., UiPath, and WorkFusion, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...