Smart Finance Hardware Market Research, 2031

The global smart finance hardware market was valued at $16 million in 2021, and is projected to reach $30 million by 2031, growing at a CAGR of 6.8% from 2022 to 2031.

IoT applications in ATMs are among the smart finance hardware technologies. ATMs include platforms, services, and connectivity as IoT components. The installation of IoT-based ATMs in smart cities is one of the main factors fueling smart finance hardware market growth during the forecast period. IoT-based ATMs are being placed at bank locations quickly to offer customers more convenient financial services.

Key Developments / Strategies

- In May 2021, Diebold Nixdorf entered into a partnership with Abu Dhabi Islamic Bank (ADIB), an Islamic bank based in Abu Dhabi city, in the United Arab Emirates. Under the partnership, Diebold Nixdorf would install integrated technology (Smart Tellers) that provides the services of a mini-branch in a supplementary self-service channel for Abu Dhabi Islamic Bank.

- In June 2019, Virtusa formed a partnership with Hitachi, a Japanese multinational conglomerate. Under the partnership, both companies aimed to capitalize on the quickly rising acceptance of AI in financial services. Consequently, both companies developed new AI-based solutions that integrated Hitachi’s advanced digital technology and leading R&D capabilities with Virtusa’s deep financial services industry expertise and digital engineering knowledge.

Smart ATMs are frequently being installed in bank locations to provide convenience of cash withdrawals, deposits, and transfers. In addition, the increase in level of technical advancement in IoT technologies, such as incorporation of data analysis tools drives the growth of the smart finance hardware market. However, the market expansion is likely to be hampered by the increase in data breaches and rise in concerns regarding data security. On the contrary, the surge in integration of next-generation smart ATMs that can be remotely maintained further encourages the demand for smart devices among end-users, which is anticipated to contribute toward the growth of the smart finance hardware market.

The report focuses on growth prospects, restraints, and trends of the smart finance hardware market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the smart finance hardware market outlook.

The smart finance hardware market is segmented into Type and End User.

Segment Review

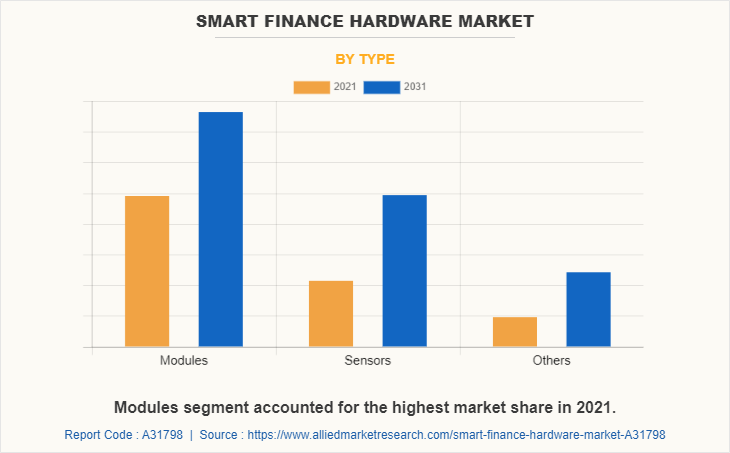

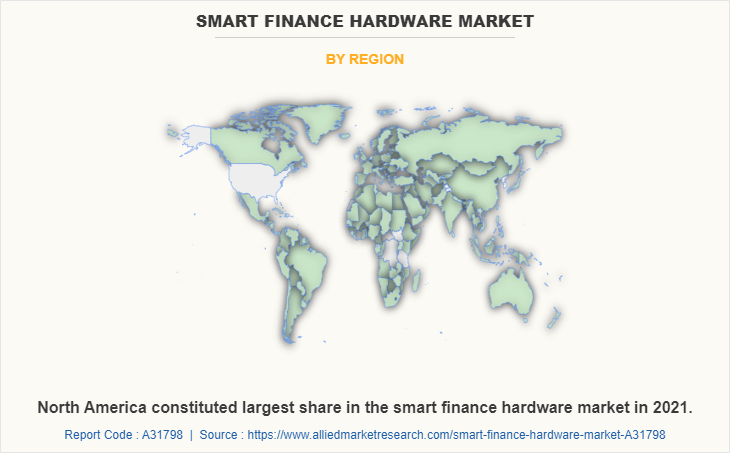

The smart finance hardware market is segmented into type, end user, and region. By type, the market is differentiated into modules, sensors and others. By end user, the market is segmented into bank & financial institutions and independent ATM deployer. Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the modules segment has acquired the highest size of smart finance hardware market size in 2021. This is attributed to the fact that the protection of physical access, safe ATM key management, secure ATM key generation, and secure execution environment are the major advantages of hardware modules. Further, a number of security features are provided by smart finance hardware modules to thwart external attacks and any physical manipulation.

Region wise, North America dominated the smart finance hardware market share in 2021. This is attributed to the region’s developed IT infrastructure as it makes easier to implement IoT-based devices in the BFSI sector, such as smart ATMs, contributing to the region’s considerable share in the smart finance hardware market.

The key players operating in the global smart finance hardware market include Intel Corporation, NCR Corporation, Diebold Nixdorf, Incorporated, Fujitsu, IMS Evolve, InHand Networks, Miles Technologies, Digi International Inc., Microchip Technology Inc., and OptConnect.com. These players have adopted various strategies to increase their market penetration and strengthen their position in the smart finance hardware industry.

Market Landscape & Trends

Industry 4.0 machines, technology, and equipment are transforming the manufacturing industry by digitalizing production processes, quality control, maintenance, and many other parts of the manufacturing ecosystem. However, there are adoption obstacles that can be resolved with financing. Further, vendor finance offers an alternative to outright purchase during the initial scoping and needs analysis phase, which can assist OEMs, systems integrators, and other technology vendors in improving their value proposition and fending off competition challenges. Vendor financing, which can include entire financial solutions, maintenance, servicing, hardware, and software, can play a significant, supplementary role in supporting the sale of digital technology and machines. Affordable payment methods might also encourage the OEM's client to think about a more specialized technical specification and comprehensive solution to meet the client's evolving needs.

Further, various key players are increasingly adopting various strategies to offer innovative solution in smart finance hardware market. For instance, in July 2022, Huawei Cloud launched its Cloud Native Core Banking solution – the foundation for agile innovation of traditional banks and new digital banks.

Furthermore, various companies across U.S. are collaborating to boost prosperity in smart finance hardware market. For instance, in June 2021, NEXGO and GUOXIN MICRO started a corporation and signed the strategic cooperation agreement. Two enterprises would build up a partnership in mobile communication, FinTech, digital currency, IoT, smart life, etc., for business transformation and upgrade, boost the intelligence industry.

The COVID-19 outbreak had a negative effect on the market for smart finance hardware market industry because many bank ATMs were shut down during the lockdown. The governments of every country in the world took this action to prevent new ATM installations. As individuals opted for UPI and other cellular transactions during the pandemic, which had an impact on the market's growth, the restriction of the pandemic further reduced ATM transactions.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smart finance hardware market forecast from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities of smart finance hardware market overview.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the smart finance hardware market segmentation assists to determine the prevailing smart finance hardware market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global smart finance hardware market trends, key players, market segments, application areas, and market growth strategies.

Smart Finance Hardware Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 30 million |

| Growth Rate | CAGR of 6.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 150 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | IMS Evolve, Fujitsu, Intel Corporation, Miles Technologies, InHand Networks, Digi International Inc., OptConnect.com, NCR Corporation, Microchip Technology Inc., Diebold Nixdorf, Incorporated |

Analyst Review

Banks and financial institutions of all sizes benefit from smart finance hardware systems, which accelerate innovation and development with smart finance solutions based on equipment and technology from third parties. Further, the solutions combine technology and equipment with innovative financing so that businesses of any size can access advanced technology and equipment to support digital development.

The COVID-19 outbreak has a significant impact on the smart finance hardware market and has accelerated the adoption of the smart technology in BFSI industry. Moreover, the adoption of smart finance hardware technology increased among medium and small-sized banks, during this global health crisis. This, as a result promoted the demand for smart finance hardware components, thereby accelerating the revenue growth.

The smart finance hardware market is fragmented with the presence of regional vendors such as Intel Corporation, NCR Corporation, Diebold Nixdorf, Incorporated, Fujitsu, IMS Evolve, InHand Networks, Miles Technologies, Digi International Inc., Microchip Technology Inc., and OptConnect.com. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for smart finance hardware across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The smart finance hardware market is estimated to grow at a CAGR of 6.8% from 2022 to 2031.

The smart finance hardware market is projected to reach $0.02 billion by 2031.

The growing use of smart ATMs, rising trend towards online banking services and rising smart city projects across the globe majorly contribute toward the growth of the market.

The key players profiled in the report include Intel Corporation, NCR Corporation, Diebold Nixdorf, Incorporated, Fujitsu, IMS Evolve, InHand Networks, Miles Technologies, Digi International Inc., Microchip Technology Inc., and OptConnect.com.

The key growth strategies of smart finance hardware market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...