At-Home Fitness Equipment Market Research, 2035

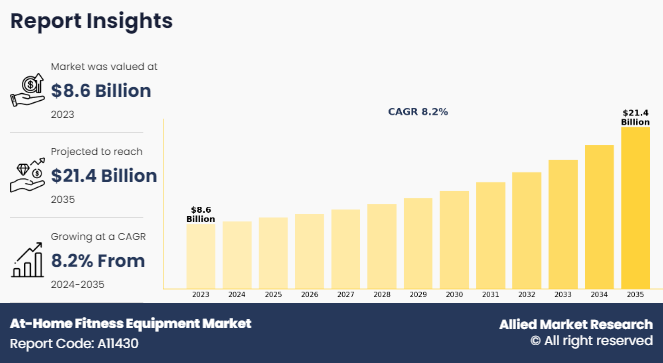

The global at-home fitness equipment market size was valued at $8.6 billion in 2023, and is projected to reach $21.4 billion by 2035, growing at a CAGR of 8.2% from 2024 to 2035.

At-home fitness equipment are the devices or machines used for physical exercise by the consumer in the comfort of their home in order to develop muscular strength, improve stamina, and manage body weight. An alarming rise in global obesity, especially in urban areas, supplements the growth of the market. According to WHO, 2.5 billion adults (18 years and older) were overweight. Of these, 890 million were living with obesity. In 2022, 43% of adults aged 18 years and over were overweight and 16% were living with obesity. In 2022, 37 million children under the age of 5 were overweight. Obesity is associated with a number of health issues or disorders such as sudden cardiac arrest, hypertension, hypotension, and diabetes. Therefore, to lose weight, reduce stress, and improve blood circulation, obese people tend to use more fitness equipment, thereby increasing the sales of these products.

The commonly used at-home fitness equipment are treadmills, stationary cycles, stair climbers, rowing machines, ellipticals, and free weights. The at-home fitness equipment market demand has increased globally, due to an increase in health awareness. The increase in the prevalence of obesity and the rise in health consciousness have majorly boosted the global at-home fitness equipment market growth. Moreover, the upsurge in urban population, rising disposable income, growing health consciousness, growing trend of bodybuilding, and increase in government initiatives to promote healthy life have fueled the adoption of at-home fitness equipment. Further, the demand for at-home fitness equipment in emerging markets is growing owing to a rise in disposable income, a desire to maintain physical and mental health, and the rising trend of bodybuilding.

KEY TAKEAWAYS FROM THE AT-HOME FITNESS EQUIPMENT MARKET REPORT

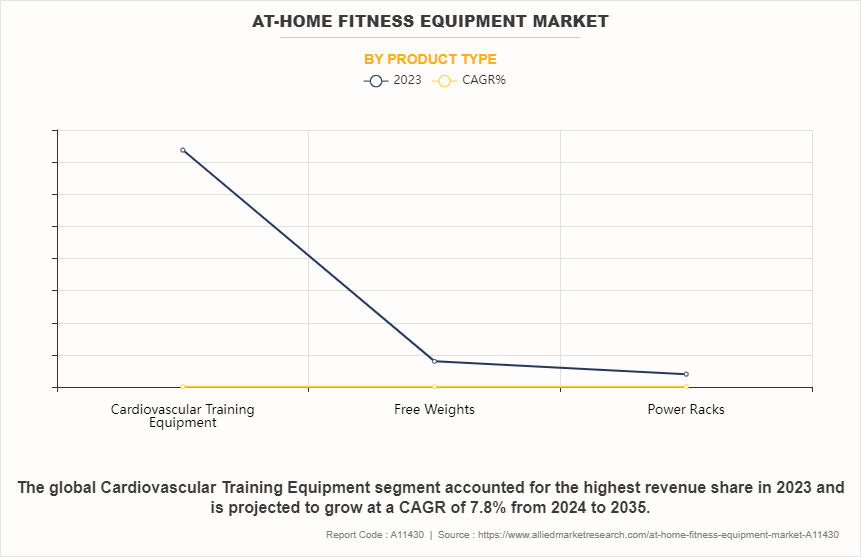

- On the basis of product type, the free weights segment is the fastest-growing segment with a 10.8% CAGR.

- On the basis of distribution channel, the dealers segment was the largest in the market in 2023.

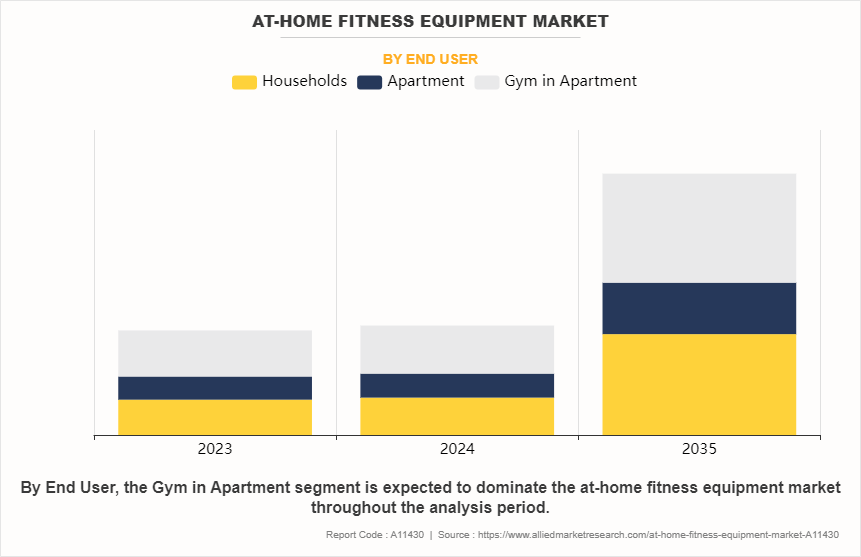

- On the basis of end user, the households segment is the fastest-growing segment with a 9.4% CAGR.

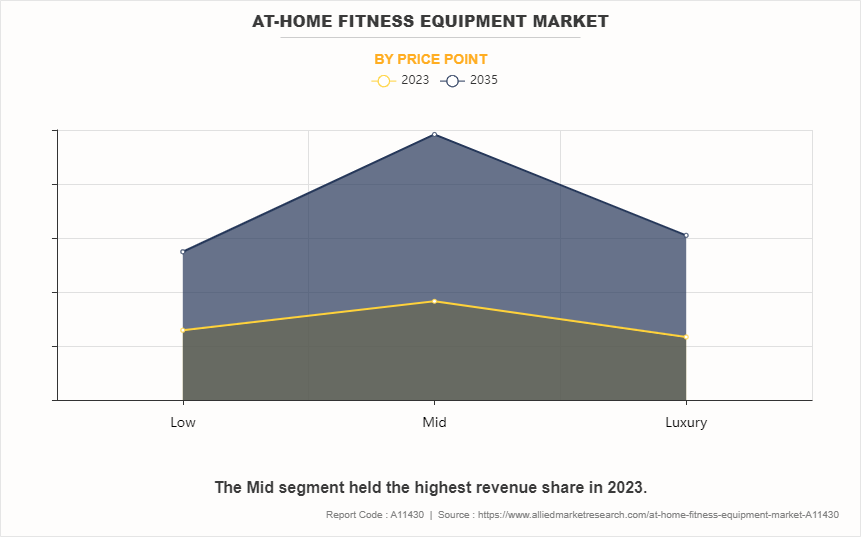

- On the basis of price point, the mid segment was the largest in the market in 2023.

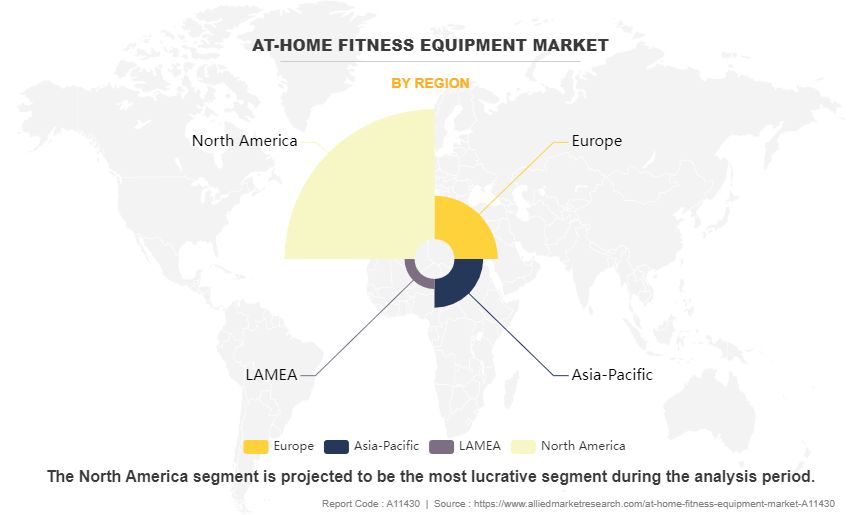

- Region-wise, North America was the highest revenue contributor to the market in 2023.

MARKET DYNAMICS

One important trend is the rise in desire for easily available fitness options, especially given the effects of the COVID-19 pandemic, busy lifestyles, and restricted access to conventional gyms. As a result, the market for at-home fitness equipment has expanded as people look for ways to maintain their wellness and health in the comfort of their own homes.

Furthermore, the dynamics of the market have been significantly shaped by technological advancements. Fitness equipment that is connected, such as smart mirrors, interactive exercise bikes, and all-in-one home gym systems, have become more and more popular because of their capacity to provide immersive training experiences via live streaming, recorded lessons, and virtual coaching. These developments have completely changed how individuals engage with physical activity, offering tailored and captivating experiences that are on par with those found in conventional gyms.

In addition, changing consumer attitudes toward wellness and health have an impact on the dynamics of the at-home fitness equipment market. A greater focus on overall well-being is driving manufacturers to include factors that deal with mental health, stress reduction, physical fitness, and recovery in addition to physical fitness. As a result, items that combine traditional training components with mindfulness exercises, meditation sessions, and relaxation features have been developed.

The integration of artificial intelligence (AI) and machine learning technology in at-home fitness equipment contributes to the growth of the global market. It is expected that the AI-based personal trainer is the upcoming trend in the at-home fitness equipment market. Tech giants such as Google and Apple are engaged in developing smart wearable devices that can virtually guide and assist users based on health data collection. Therefore, these technological advancements are expected to be the driving factor of the global at-home fitness equipment market in the foreseeable future.

Moreover, the sedentary lifestyles and hectic schedules have led to the adoption of at-home fitness equipment. Exercising at home using fitness equipment saves gym membership expenses. Furthermore, the outbreak of the COVID-19 pandemic significantly induced people to buy at-home fitness equipment as gyms and other fitness centers were completely shut down due to strict lockdown restrictions across the globe. Hence, the COVID-19 pandemic forced the global population to become health-conscious and fueled the demand for at-home fitness equipment. However, space limitations and the high cost of equipment restrain the market growth.

The market for at-home fitness equipment is therefore defined by rapid innovation, shifting customer preferences, and a stronger emphasis on offering feasible, customized, and all-encompassing fitness solutions. In order to stay competitive and satisfy changing demands from consumers, companies have to keep monitoring these market trends.

SEGMENTAL OVERVIEW

The global at-home fitness equipment market is segmented into product type, distribution channel, end user, price point, and region. Depending on product type, the market is categorized into cardiovascular training equipment, free weights, and power racks. The cardiovascular training equipment segment is sub-segmented into treadmills, stationary cycles, rowing machines, elliptical and others. By distribution channel, the global at-home fitness equipment market is segregated into dealers, online, retail, and gyms/clubs. The online segment is further segregated into direct distribution and 3rd party retailers. The retail segment is further fragmented into mass retailer and specialty retailer. By end user, the at-home fitness equipment market is segregated into households, apartment, and gym in apartment. By price point, the market is segmented into low, mid, and luxury.

BY PRODUCT TYPE

As per at-home fitness equipment market statistics, based on the product type, cardiovascular training equipment is the leading segment because of the increased consumer awareness regarding cardiovascular health. This segment is poised to grow with the highest CAGR during the at-home fitness equipment market forecast period. The market for cardiovascular training at-home fitness equipment has expanded, with products like elliptical machines, stationary bikes, and treadmills providing easy and efficient indoor exercise choices. The stationery cycles segment accounted for around 41.4% of the total market share in the global market. Convenience, accessibility, and the growing popularity of connected fitness platforms have all contributed to the market expansion of stationary cycles for at-home fitness equipment. The introduction of interactive stationary cycles with features like virtual coaching, live broadcasting of sessions, and performance-tracking capabilities is the result of technological innovations.

BY DISTRIBUTION CHANNEL

Based on the distribution channel, the dealers segment accounted for the highest at-home fitness equipment market share in 2023 as it is the most preferred distribution channel and it offers products at reasonable prices. These dealers offer easy access to equipment and knowledge to assist customers in making well-informed purchasing selections. They include department stores, online marketplaces, authorized distributors, and specialty fitness retailers. The online segment is expected to be the fastest-growing due to an upsurge in internet penetration and the growing infrastructure of e-commerce channels.

BY END USER

Based on the end user, the gym in the apartment segment dominated the market in 2023 because of the growing trend of adding gyms as basic amenities while constructing apartments in the majority of countries. The households segment is expected to grow at a significant pace during the forecast period. The market for household end users’ at-home fitness equipment is still growing as more people place a premium on convenience and wellness. With so many alternatives available, such as virtual platforms, smart home gyms, and connected fitness equipment, customers are investing more and more in solutions that make it easy and efficient for them to work out from home.

BY PRICE POINT

Based on the price point, the mid-price point segment is the dominating segment and is expected to retain its dominance during the forecast period. This is because most of the people opt for good quality equipment at a price that fits their budget. Customers looking for high-quality, cost-effective workout solutions without going over budget can choose from a variety of reasonably priced options in the mid-priced at-home fitness equipment market. Products in this market category usually target low-cost fitness enthusiasts and include basic strength training apparatuses, entry-level exercise machines, and accessories for use at home.

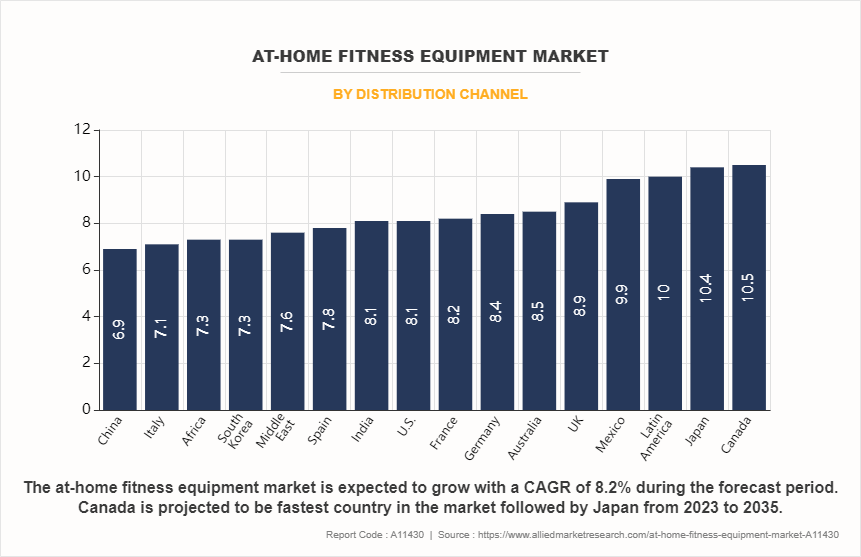

BY REGION

Based on region, the at-home fitness equipment industry is studied across North America, Europe, Asia-Pacific, and LAMEA. North America leads in terms of market share, however, Europe is estimated to grow with the highest CAGR during the forecast period. High disposable income, increased health consciousness, and a rising number of obese population in Europe will lead to increased adoption of exercising and good food habits. Moreover, there is an increased incidence of lifestyle diseases such as obesity, diabetes, heart disease, hypertension, and other bone diseases. Growing awareness among people about the long-term consequences of such diseases has encouraged people to stay fit by working out regularly at home. Furthermore, rapid urbanization in developing economies of Asia-Pacific, increasing youth population, and rising per capita disposable income are expected to propel the adoption of at-home fitness equipment in the region.

COMPETITION ANALYSIS

Companies can operate their business in a highly competitive market by launching new products or updated versions of existing products. Partnership/collaboration agreement with key stakeholders is expected to be a key strategy to sustain in the market. In the recent past, many leading players opted for product launch or partnership strategies to strengthen their foothold in the market. To understand the key trends of the market, the strategies of leading players are analyzed in the report. Some of the key players in the at-home fitness equipment market analysis include Tonal Systems, Inc., ICON Health & Fitness, Inc., PENT, Technogym, Louis Vuitton, PELOTON, NOHrD, Nordic Track, ProForm, Precor, Inc., Schwinn, JTX Fitness, Keiser Corporation, Corepump, and York Barbell.

RECENT DEVELOPMENT IN THE AT-HOME FITNESS EQUIPMENT MARKET

- In April 2021, Peloton acquired Precor to establish a U.S. manufacturing footprint and enhance R&D capabilities as well as accelerate the growth of commercial verticals.

- In March 2021, Peloton announced a partnership with Adidas to expand its selling capabilities in Australia.

- In February 2021, Schwinn partnered with Good Co Bike Club to collaborate with local businesses and city advocacy programs throughout the U.S. to celebrate and accelerate Black culture in cycling.

- In March 2021, Tonal partnered with Nordstrom to expand its products and services portfolio. Its equipment named Tonal launched in the Women's Active department in 40 Nordstrom locations across 20 states in the U.S.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis from 2023 to 2035 to identify the prevailing at-home fitness equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the at-home fitness equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global at-home fitness equipment market trends, key players, market segments, application areas, and market growth strategies.

At-Home Fitness Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 21.4 billion |

| Growth Rate | CAGR of 8.2% |

| Forecast period | 2023 - 2035 |

| Report Pages | 300 |

| By Price Point |

|

| By Product Type |

|

| By Distribution Channel |

|

| By End User |

|

| By Region |

|

| Key Market Players | Louis Vuitton, Keiser Corporation, NOHRD, PELOTON, JTX FITNESS, COREPUMP, NORDIC TRACK, Proform, Precor, ICON |

Analyst Review

As per the insights of CXOs of leading companies, to cater to the changing trends for physical activities and exercises across the globe, the at-home fitness equipment industry is continuously developing innovative exercise products for at-home use environments. The aim is to maximize fitness results while enhancing the overall workout experience. For instance, earlier, fitness equipment had a standard user interface; however, these user interfaces are now evolving to include more sophisticated smartphone-like features. In addition, to allow users to customize and monitor individual workouts, fitness machines provide advanced entertainment functionality, such as the ability to watch live TV, listen to music, and access the internet during workouts.

Major manufacturers of at-home fitness equipment are exploring options to improve overall user satisfaction and machine equipment effectiveness (OEE) by developing a next-generation fitness machine product line that has reduced machine downtime and improved user engagement. In addition, they are seeking a reliable and durable touch solution, while maintaining consistent optical clarity of the LCD and touch interface. To meet this requirement, OEMs have selected a micro-tech system based on 3M Surface Capacitive Technology (3M SCT). This robust touch interface offers easy cleaning after use. Along with developing innovative products, OEMs have adopted acquisition, partnership, and expansion as their key growth strategies to access other geographies, extend product lines, and garner maximum market share.

The global at-home fitness equipment market was valued at $8,574.0 million in 2023, and is projected to reach $21,422.1 million by 2035, registering a CAGR of 8.2% from 2024 to 2035.

The forecast period in the At-home fitness equipment market report is 2024 to 2035.

The base year calculated in the At-home fitness equipment market report is 2023.

The top companies analyzed for the At-home fitness equipment market report are Tonal Systems, Inc., ICON Health & Fitness, Inc., PENT, Technogym, Louis Vuitton, PELOTON, NOHrD, Nordic Track, ProForm, Precor, Inc., Schwinn, JTX Fitness, Keiser Corporation, Corepump, and York Barbell.

The cardiovascular training equipment segment is the most influential segment in the At-home fitness equipment market report.

North America holds the maximum market share of the At-home fitness equipment market.

The company profile has been selected on the basis of key developments such as partnerships, mergers, and acquisitions.

The market value of the At-home fitness equipment market in 2023 was $8,574.0 million.

Loading Table Of Content...

Loading Research Methodology...