Companion Diagnostic Technologies Market Overview:

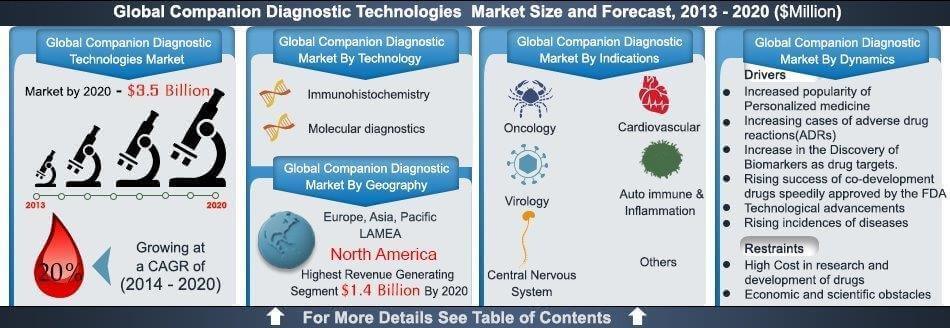

Companion diagnostics are in-vitro diagnostics that provide information about therapeutic responses of patients for a specific treatment. Companion diagnostics market is still nascent, and it is projected to reach $3.5 billion by 2020 from a base value of $1.1 billion in 2013, growing at a CAGR of 20% during 2014 to 2020.

The global companion diagnostic technologies market is segmented based on indication, technology and geography (North America, Europe, Asia Pacific and LAMEA). Geographically, LAMEA is the fastest growing region. The key drivers for this market are the increase in the discovery of biomarkers and co-development of drug and corresponding diagnostic. However, cost associated with developing drugs could impede the growth of this companion diagnostics tecnologies market. Opportunities for this market lie in developing companion diagnostics for various central nervous system conditions and hereditary conditions.

Companion Diagnostics Indication Market Analysis

Companion diagnostics is segmented on the basis of its use for indications such as oncology, cardiovascular conditions, central nervous system indications, inflammation and virology. Oncology is the highest revenue generating segment, as majority of the companion diagnostics have been developed for detection of various cancer biomarkers. The key driver for this market is an increase in research and development of targeted drugs, which require a corresponding companion diagnostic.

Companion Diagnostics Technologies Market Analysis

Companion diagnostics technologies market is segmented into Immunohistochemistry and Molecular diagnostics. Molecular diagnostics would be the fastest growing and highest revenue generator, mainly due to the use of techniques such as real time PCR, In Situ Hybridization and next generation sequencing. Other factors contributing to the growth is technological advancements in molecular diagnostics, which has resulted in increased accuracy and precision and also reduced cost of testing using these methods.

Companion Diagnostics Geography Market Analysis

Companion diagnostics tecnologies market has been segmented geographically into North America, Europe, Asia Pacific and LAMEA. North America has the major market share of 43.97% followed by Europe, which accounted for about 38% of the overall CD market in 2013. North America and Europe together accounted for over 82% in the global CD market in 2013 and they would continue to be the major markets through 2020. This is mainly due to the increasing incidence of cancer and other diseases and higher health care awareness in these regions.

Competitive Analysis

A study of some of the key players has showed that majority of the companies in this market are focusing on collaborations with drug companies. Companion diagnostics is a emerging market and companies are collaborating with drug companies to develop companion diagnostics for their pipeline drugs, which are in developing phase. Approvals for companion diagnostics are the second most popular strategy. Companies profiled in this report include Dako (Agilent Technologies), Qiagen, Roche, Abbott Laboratories, Inc., Ventana Medical Systems, bioMerieux, Myriad Genetics, Inc., Resonance Health Ltd., Leica Microsystems, and Life Technologies.

High Level Analysis

The report is focusing on the trends in technology and diagnosis of various indications, which are driving the growth of the companion diagnostics market. Analysis of the market based on porters five force model shows that the bargaining power of the suppliers is high as the products produced are highly differentiated. The threat of new entrants is low as significant research and development is required for developing diagnostic tests. Apart from the R&D requirements, the investment required is also high. These factors make it difficult for new companies to enter the market. The threat of substitutes is low in this market as companion diagnostics are developed for specific biomarkers and the products are highly differentiated. Competition in this market is moderate as the market is still emerging and there are a few companies in the market. Government regulations are favoring use of companion diagnostics for determining a particular treatment. Companies are focusing on collaborations with pharmaceutical companies as a key strategy to gain competitive advantage.

Reason for doing the study

Companion diagnostics are an important aspect of the personalized treatment approach and are essential for predicting the therapeutic response to a particular drug. With increasing awareness among the population and rising incidences of cancer, companion diagnostics would become an essential factor for targeted therapeutic approach. More and more companies are developing targeted therapeutics products and companion diagnostics is an integral part of their strategy.

KEY BENEFITS

- In-depth analysis of the companion diagnostic market by technology and indications give a clear idea of the scope of this market

- Analysis of the market by geography would help in making region specific plans

- Estimations for period of 2013 to 2020 have been given, taking into consideration the current market scenario and future trends, which would give a clearer picture of the potential of the market

- Porters five force model and SWOT analysis would help in a deeper understanding of the market and help in making strategic decisions

- Top factors impacting the market would help in making decisions for business development

KEY DELIVERABLES

MARKET BY INDICATIONS

- Oncology

- Cardiovascular

- Central Nervous System

- Auto immune & Inflammation

- Virology

- Others

MARKET BY TECHNOLOGY

- Immunohistochemistry

- Molecular diagnostics

- In situ Hybridization

- FISH

- CISH

- Real time PCR

- Gene Sequencing

- In situ Hybridization

MARKET BY GEOGRAPHY

- North America

- Europe

- Asia Pacific

- LAMEA

Companion Diagnostic Technologies Market Report Highlights

| Aspects | Details |

| By INDICATIONS |

|

| By TECHNOLOGY |

|

| By GEOGRAPHY |

|

| Key Market Players | Roche, Ventana Medical Systems, Qiagen, Abbott Laboratories, Inc., Myriad Genetics, Inc., Life Technologies, Dako (Agilent Technologies), Leica Microsystems, Resonance Health Ltd, BioMerieux |

Analyst Review

Companion diagnostics are used to identify patients most likely to benefit from treatment with a particular drug. This market is an emerging market with very few approved products currently available. The market is dependent on research and development of new drugs and discovery of biomarkers. Increase in research and development of targeted therapies and discovery of new biomarkers for various conditions is driving growth of this market. The challenge to this market is co-ordination of co-development of drug and diagnostic. The global companion diagnostics market is segmented into three categories viz. cancer biomarkers, technology and geography.

This market research report is an effort to provide the clear picture of the state of the market and sub markets over the next seven years. The report provides micro level analysis of the factors affecting the market, key market trends and industry drives and challenges for the better understanding of the market structure. The presentation of the market dynamics, competitive scenario and developments will enable marketers to aptly design their growth strategies and have competitive edge. Moreover, assessment of the top investment pockets and winning strategies will help in channelizing their investments in the right directions to garner better proceeds.

Loading Table Of Content...