IVF Devices and Consumables Market Research, 2032

The global ivf devices and consumables market was valued at $2.2 billion in 2022, and is projected to reach $12 billion by 2032, growing at a CAGR of 18.4% from 2023 to 2032. The growth of the IVF devices and consumables market is driven by a rise in prevalence of infertility, technological advancements in IVF devices, and increase in trend of delayed pregnancies. For instance, according to the World Health Organization (WHO) in 2022, around 17.5% of the adult population suffer from infertility across the globe.

Key Takeaways

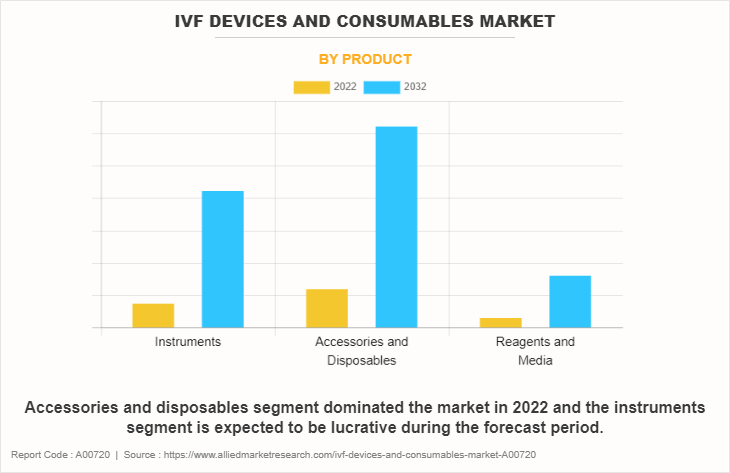

- By product, the accessories and disposables segment dominated the global market in 2022.

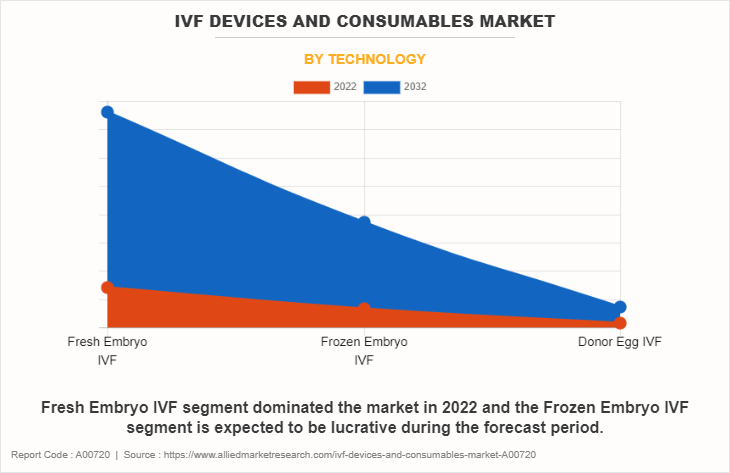

- By technology, the fresh embryo IVF segment dominated the global market in 2022.

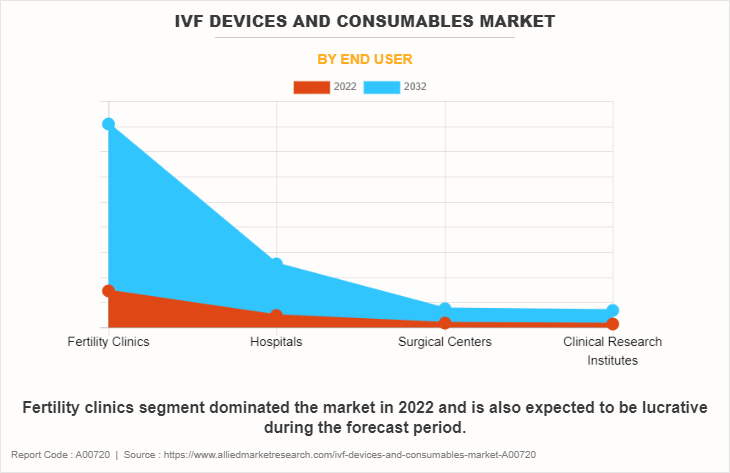

- By end user, the fertility clinics segment dominated the market in terms of revenue in 2022.

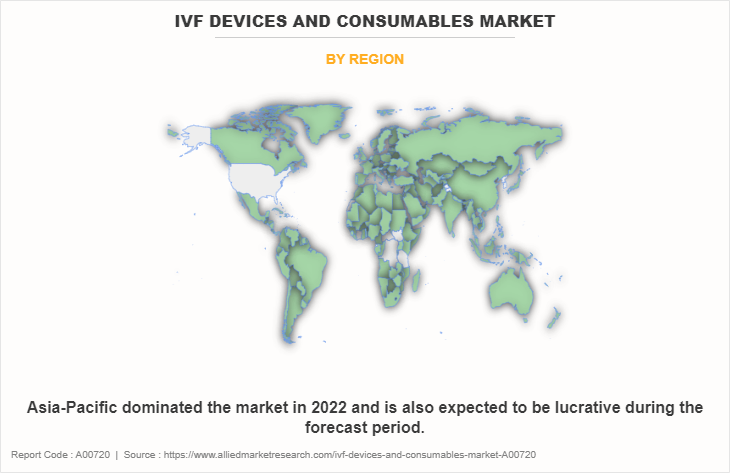

- By region, Asia-Pacific dominated the market share in terms of revenue in 2022 and is anticipated to grow at the highest CAGR during the forecast period.

In vitro fertilization (IVF) is a comprehensive fertility treatment aimed at overcoming reproductive challenges and addressing genetic concerns. The procedure involves the retrieval of mature eggs from the ovaries, which are then fertilized with sperm in a laboratory setting. The resulting embryos are then cultured for a few days before one or more are selected and transferred into the woman's uterus to establish a pregnancy. IVF is commonly employed to treat infertility caused by various factors, offering a solution for individuals or couples struggling to conceive naturally. IVF can be classified in five separate steps, including stimulation, also called super ovulation, egg retrieval, insemination & fertilization, embryo culture and embryo transfer. IVF devices and consumables include the products such as instruments, accessory & disposable, and reagent & media for the procedure.

Market Dynamics

The global IVF devices and consumables market is driven by increase in prevalence of infertility issues, growing awareness about fertility treatments, and a rising trend of delayed parenthood. For instance, an article published by National Center for Biotechnology and information (NCBI) in 2021, International Fertility Education Initiative (IFEI) mission is to improve fertility awareness and preconception health through public education and research. It aims to establish country-specific evidence about fertility awareness and evaluate the effectiveness of existing and emerging fertility education programs. Such initiatives taken by governments to spread awareness drive the IVF devices and consumables market growth.

In addition, advancements in assisted reproductive technologies (ART), coupled with a growing acceptance of IVF procedures, contribute significantly to market growth. The continuous development of innovative and technologically advanced devices, such as time-lapse incubators, embryo selection systems, and specialized micromanipulation tools, enhances the efficiency and success rates of IVF procedures, driving demand for IVF devices globally. Moreover, the expanding scope of fertility tourism, where individuals seek IVF treatments in different countries, further boosts the IVF devices market. Moreover high consumption of consumables also drives the IVF consumables market.

However, challenges include the high cost of IVF treatments and complications associated with IVF especially in underdeveloped economies may negatively impact the market growth. Despite these challenges, the market is poised for growth due to ongoing research, increased investments in healthcare infrastructure, and a rising global demand for fertility treatments, surge in utilization of consumables thus driving the IVF consumables market. Moreover, advancement in devices further drives the In-Vitro fertilization devices market.

A recession may lead to reduced demand and delayed purchases affects IVF devices market including pricing strategies, healthcare policies, and changes in consumer behavior, may influence the market dynamics. During a recession, individuals may face financial uncertainties, leading to a potential decline in the ability to invest in expensive fertility treatments like in vitro fertilization (IVF). Discretionary spending on elective medical procedures, such as assisted reproductive technologies, might be deprioritized as individuals prioritize essential needs. Additionally, healthcare budgets, both public and private, could be strained, impacting insurance coverage for fertility treatments, thus affecting IVF devices market.

Despite these challenges, the IVF devices and consumables market continues to experience moderate revenue growth owing to technological advancements in IVF procedures and surge in cases of infertility. Thus, the IVF devices and consumables market is moderately impacted by recession.

Segmental Overview

The IVF devices and consumables market analysis is segmented into product, technology, end user, and region. By product the market is categorized into instruments, accessories & disposables, and reagents & media. The instruments segment is further categorized into sperm separation systems, cryosystems, incubators, imaging systems, ovum aspiration pumps, cabinets, micromanipulators, and others. The reagents & media is sub segmented into cryopreservation media, semen processing media, ovum processing media, and embryo culture media.

By technology, the market is classified into fresh embryo IVF, frozen embryo IVF, and donor egg IVF. By end user, the market is classified into fertility clinics, hospitals, surgical centers, and clinical research institutes. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product

The accessories & disposables segment dominated the global IVF devices and consumables market share in 2022, owing to vital role of IVF accessories & disposables in every IVF procedure such as retrieval of oocytes, analysis & screening of sperms, and handling gametes.

However, the instrument segment is expected to register the highest CAGR during the forecast period, owing to a rise in technological advancements in equipment, increased precision in fertility treatments, and surge in demand for sophisticated equipment. Moreover, advancement in devices further drives the In-Vitro fertilization devices market.

By Technology

The fresh embryo IVF segment dominated the global IVF devices and consumables market size in 2022, owing to higher success rates associated with fresh embryo transfers, increase in preference for single embryo transfer to reduce multiple pregnancy risks, and advancements in culture media & incubation technologies optimizing the conditions for fresh embryo development.

However, frozen embryo IVF segment is expected to register the highest CAGR during the forecast period, owing to flexibility and convenience offered by frozen embryo transfer and rising awareness of the potential benefits of frozen embryo transfer, such as improved pregnancy outcomes and reduced risks of complications which contribute to its rising popularity, thus boosting IVF devices market size.

By End User

The fertility clinics segment held the largest global IVF devices and consumables market size in 2022 and is expected to register the highest CAGR during the forecast period, owing to availability of skilled medical professionals, advanced laboratory facilities, contribute to higher success rates in fertility treatments, rise in acceptance of assisted reproductive technologies (ART) as viable solutions and the pivotal role of fertility clinics offering comprehensive fertility services.

By Region

IVF devices and consumables industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific accounted for a major share of the IVF devices and consumables market in 2022 and is expected to register the highest CAGR during the forecast period. This is attributed to the increase in awareness about fertility treatments and acceptance of fertility treatments, coupled with changing socio-cultural norms, are contributing to a growing demand for IVF devices in the region. In addition, factors such as delayed parenthood, lifestyle changes, and a rise in infertility cases further fuel the adoption of IVF procedures.

Furthermore, growing healthcare infrastructure, advancements in medical technologies, and a surge in medical tourism for fertility treatments are enhancing accessibility to IVF procedures thereby propels the IVF devices market size. The increase in prevalence of reproductive health disorders and supportive government initiatives also play a pivotal role in fostering the expansion of the IVF devices and consumables market forecast in Asia-Pacific.

Competition Analysis

Competitive analysis and profiles of the major players in IVF devices and consumables market, such as Cook Group, Cooper Companies, Inc. Genea Limited, Fujifilm Holdings Corporation, Hamilton Thorne Ltd., Vitrolife AB, Esco Micro Pte. Ltd., Nidacon International AB, Kitazato Corporation, and Thermo Fisher Scientific, Inc. are provided in this report. Major players have adopted product launch, expansion, agreement, acquisition, and collaboration as key developmental strategies to improve the product portfolio of the IVF devices and consumables market and thus creates potential IVF devices and consumables market opportunity.

Recent Developments in the IVF Devices and Consumables Market

- In July 2022, Esco Lifesciences Group announced the full acquisition of Evidence Solution, a Danish software company offering In Vitro Fertilization (IVF) management technologies and quality management systems.

- In December 2021, Cooper Companies announced that it has completed the previously announced definitive purchase agreement to acquire Generate Life Sciences, a leading provider of donor egg and sperm for fertility treatments, fertility cryopreservation services and newborn stem cell storage (cord blood & cord tissue), for a purchase price of approximately $1.6 billion.

- In January 2021, CooperSurgical, a leading provider of women's health care solutions, acquired Embryo Options, an established leader in cryo-storage software solutions for clinics and patients. This acquisition complements CooperSurgical's comprehensive portfolio of innovative fertility offerings.

- In July 2023, Thermo Fisher Scientific launched two new next-generation sequencing-based options to support preimplantation genetic testing-aneuploidy (PGT-A) used commonly to inform in vitro fertilization (IVF) and intracytoplasmic sperm injection (ICSI) research. The Ion ReproSeq PGT-A Kit and the Ion AmpliSeq Polyploidy Kit mark the first research use reproductive health assays available on the Ion Torrent Genexus Integrated Sequencer.

- In July 2022, FUJIFILM Irvine Scientific, Inc., a world leader in the innovation, development, and manufacture of cell culture media and assisted reproductive technologies (ART) announced the launch of its Heavy Oil for Embryo Culture, a sterile mineral oil with an optimal weight viscosity that provides the ideal balance between ease of use and protection.

- In May 2022, Cook Medical launched MINC+ Benchtop Incubator for IVF clinics in the U.S. and Canada. The MINC+ Benchtop Incubator is now available to clinical embryologists and IVF clinics in the U.S. and Canada.

- In November 2020, Australian fertility innovator Genea Biomedx has entered into a collaboration agreement with Hamilton Thorne Ltd, a leading provider of products and services to the Assisted Reproductive Technologies markets. Under the terms of the collaboration agreement, Hamilton Thorne will exclusively commercialize and market Genea Biomedx flagship fertility technologies and products in the United States and Canada.

- In December 2021, FUJIFILM Irvine Scientific, Inc., announced that its new manufacturing facility in Tilburg, the Netherlands is now open and fully operational. The facility provides state-of-the-art Life Science manufacturing and joins locations in the U.S. and Japan to enable increased production capacity of cell culture media products.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the IVF devices and consumables market analysis from 2022 to 2032 to identify the prevailing IVF devices and consumables market opportunities.

- The market research is offered along with information related to key drivers, restraints, and IVF devices and consumables industry opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the IVF devices and consumables market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global IVF devices industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global IVF devices and consumables market trends, key players, market segments, application areas, and market growth strategies.

IVF Devices and Consumables Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12 billion |

| Growth Rate | CAGR of 18.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 282 |

| By End User |

|

| By Product |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Genea Limited, Fujifilm Holdings Corporation, Cooper Companies, Inc., Vitrolife AB, Esco Micro Pte. Ltd., Nidacon International AB, Thermo Fisher Scientific, Inc., Cook Group, Hamilton Thorne Ltd., Kitazato Corporation |

Analyst Review

This section provides various opinions of top-level CXOs in the global IVF devices and consumables market. According to the insights of CXOs, the global IVF devices and consumables market is expected to exhibit high growth potential attributable to rise in adoption of IVF procedures, technological advancements in IVF devices, and increase in awareness about assisted reproductive technology. However, the high cost of IVF procedures and complications associated with the IVF procedures limits the growth of IVF devices and consumables market.?

CXOs further added that the rise in the infertility rates, technological advancements in IVF, delayed pregnancies in among women, increase in awareness and acceptance of assisted reproductive technologies thereby driving the market growth.? Furthermore, Asia-Pacific dominated the market share in 2022 and anticipated to register highest CAGR during forecast period, owing to increase in awareness about fertility treatments, availability of technologically advanced devices, rise in infertility issues among the population, growing network of fertility clinics and rise in government initiatives and policies supporting reproductive health.?

In Vitro Fertilization (IVF) devices and consumables refer to the medical instruments, equipment, and materials used in the process of assisted reproductive technology known as in vitro fertilization.

The growth of the IVF devices and consumables market is driven by increase in infertility rates globally, rising awareness and acceptance of assisted reproductive technologies, advancements in IVF techniques and technologies, and supportive government initiatives and regulations.

Accessories & disposables segment dominated the market share in 2022, owing to widespread adoption of catheters and needles, that ensures sterility, and reduces the risk of infections during crucial stages of the IVF process.

Cooper Companies, Inc., Vitrolife AB, Fujifilm Holdings Corporation, Kitazato Corporation, and Cook Group held a high market position in 2022.

The base year is 2022 in IVF devices and consumables market.

The forecast period for IVF devices and consumables market is 2023 to 2032.

The market value of IVF devices and consumables market in 2032 is $12.0 billion.

The total market value of IVF devices and consumables market is $2.2 billion in 2022.

Loading Table Of Content...

Loading Research Methodology...