Plastic Additives Market Research, 2031

The global plastic additives market was valued at $50.6 billion in 2021, and is projected to reach $83.8 billion by 2031, growing at a CAGR of 5.3% from 2022 to 2031.

Chemicals used to polymerize, process, or help attain desirable qualities in the ultimate usage of plastics are known as plastic additives. Increased chemical, water, and scratch resistance, reduced coefficient of friction, improved gloss, improved water repellency, suppression of shark-skin, and reduced surface roughness are just a few benefits of plastic additives. Plastic additives are also used to improve the flow ability of polymers, making them easier to process. Internal lubricants reduce heat dissipation and viscosity, allowing materials to flow more freely. Plastic additives, as opposed to other additives, are more effective at preventing microbiological deterioration of plastic materials that are susceptible to staining, odor, discoloration, and aesthetic loss. These beneficial properties of plastic additives over other additives are responsible for boosting growth of the plastic additives market. Plastic additives are most importantly effective on materials with electrical insulating properties and mechanical properties.

Plastic additives are frequently utilized in the automotive and construction industries due to qualities such as greater impact strength, improved coupling, higher elongation, reduced brittleness, and increased plasticity. These additives have received significant acceptability in the automotive industry for applications, such as interior scratch resistance in trims or panels, and high glossy panels for the decoration of central consoles. The market for plastic additives is predicted to rise as the popularity of low-cost automobile interiors grows. The consumer products industry uses chemicals for the ease with which they can be recycled. In the construction industry, plastic additives are used to maintain appearance and properties, thermal protection, long-term durability, and for maintenance of integrity of polymer properties during processing. Plastic additives also extend the lifetime of UV sensitive construction applications. Growing construction industry around the globe, is in turn, expected to boost growth of the plastic additives market.

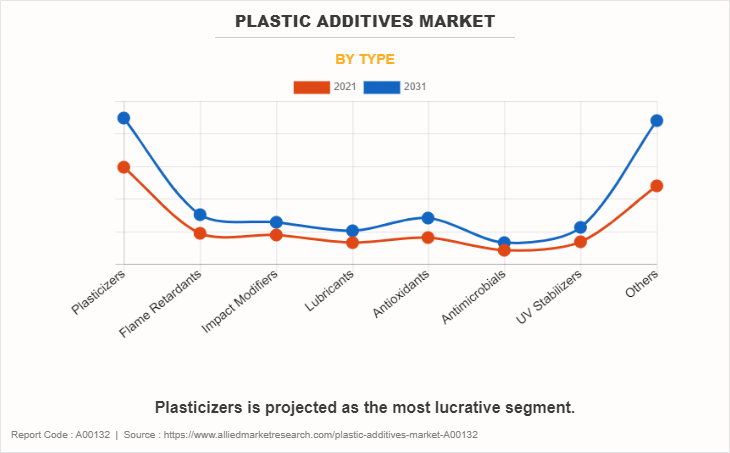

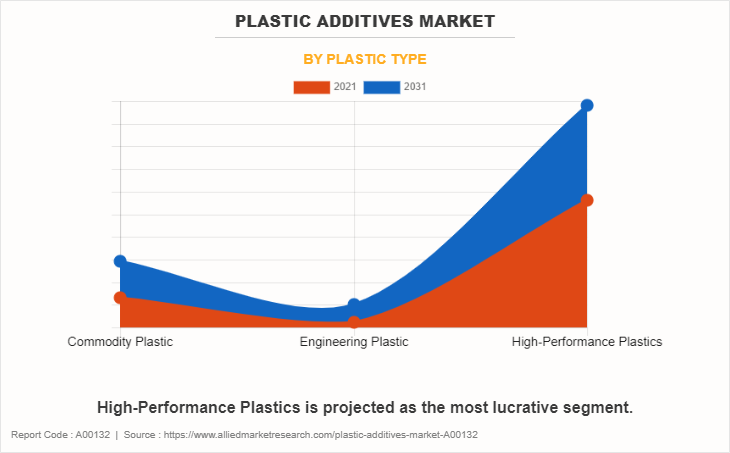

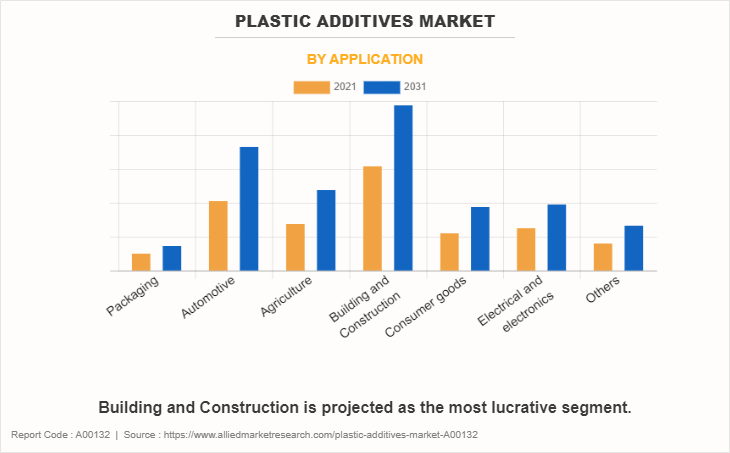

The plastic additives market is segmented into type, plastic type, application, and region. Depending on type, the market is categorized into plasticizers, flame retardants, impact modifiers, lubricants, antioxidants, antimicrobials, UV stabilizers, and others. On the basis of plastic type, it is fragmented into commodity plastic, engineering plastic, and high-performance plastics. As per application, it is classified into packaging, automotive, agriculture, building & construction, consumer goods, electrical & electronics, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global plastic additives market analysis covers in-depth information about the major industry participants. The key players operating and profiled in the report include Albemarle Corporation, Badische Anilin- und SodaFabrik SE, Clariant Ltd., Dow Chemical Co., Evonik Industries AG, Exxon Mobil Corporation, Kaneka Corporation, Lanxess Corporation, Nouryon, and Songwon Industrial Co. Ltd.

By type, the plasticizers segment is expected to retain its dominant position in the global plastic additives market, both by value and volume, largely due to the substantial usage of these additives in high-volume flexible PVC products.

Depending on plastic type, the high-performance plastics segment accounted for around 65.3% of the global plastic additives market share in 2021. The high-performance plastics segment is expected to remain dominant during the forecast period. High performing plastics are specially designed polymers with high mechanical strength, chemical resistance, and, all-importantly, temperature resistance. Stability at high temperature is the main criterion used to differentiate high performance plastics from regular plastics.

As per application, the building & construction segment accounted for around 30.3% of the global plastic additives market share in 2021. The developing construction industry, increasing demand for electrical and electronics products, and growing demand for e-buses will significantly drive plastic additives market growth in this region.

Region-wise, Asia-Pacific accounted for the largest share of around 56.2% in 2021. The Asia-Pacific region dominated the global market share. China is one of the lucrative markets for plastic additives due to low-cost raw materials and labor availability. China is one of the largest producers of plastic materials globally.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the plastic additives market analysis from 2021 to 2031 to identify the prevailing plastic additives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the plastic additives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global plastic additives market trends, key players, market segments, application areas, and market growth strategies.

Plastic Additives Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 83.8 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 389 |

| By Type |

|

| By Plastic Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | BASF SE, KANEKA CORPORATION, Clariant Ltd., Exxon Mobil Corporation, Evonik Industries AG, Nouryon, Dow, Songwon Industries Co. Ltd., Albemarle Corporation, Lanxess Corporation |

Analyst Review

According to the insights of the CXOs of leading companies, plastic additives are substances that are added to polymers to increase the polymer's strength, durability, heat sensitivity, processibility, and appearance. The need for plastic additives, which are used in automobile components, increases due to growth in demand for electric vehicles, particularly in the Asia-Pacific region. Furthermore, rise in population has increased the demand for residential construction, and the demand for consumer durable goods has fueled the expansion of the plastic additives market. Whereas, owing to the stringent environment norms, there is a growing demand for conventional and biodegradable plastics in several industrial applications, which in turn, is also expected to drive the growth of plastic additive market during the forecasted period.

Some of the prominent trends that the market is witnessing include the adoption of automation in the injection molding process, increasing use of lightweight materials and growing innovations in packaging.

The global plastic additives market was valued at $83.8 Billion in 2031.

Albemarle Corporation, BASF SE, Clariant Ltd, Dow chemical co., Evonik Industries AG, Exxon Mobil Corporation Companies are the top players in plastic additives market.

Packaging, automotive, agriculture, building, construction are projected to increase the demand for plastic additives market

The market for plastic additives is predicted to rise as the popularity of low-cost automobile interiors grows. The consumer products industry uses chemicals for the ease with which they can be recycled.

Loading Table Of Content...

Loading Research Methodology...