Smartwatch Market Research, 2032

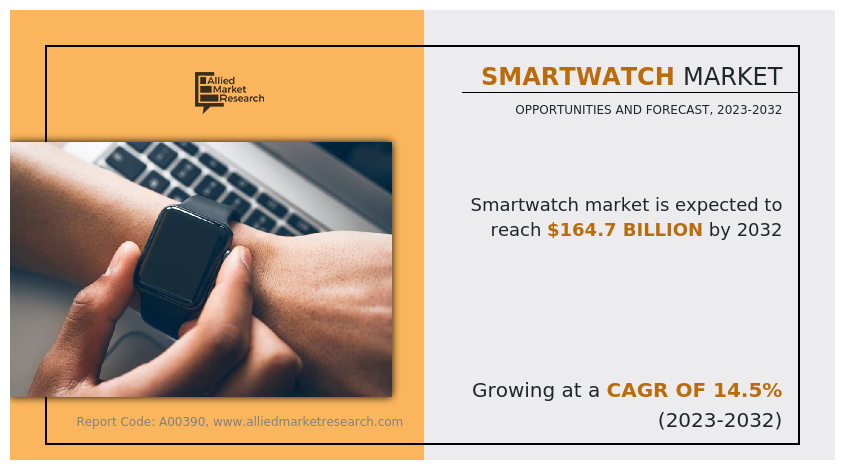

The Global Smartwatch Market was valued at $42.7 billion in 2022, and is projected to reach $164.7 billion by 2032, growing at a CAGR of 14.5% from 2023 to 2032.A smartwatch stands as a sophisticated wearable, surpassing its traditional timekeeping roots to emerge as a multifaceted device seamlessly fusing technology into our routines. Blending the classic wristwatch attributes with advanced computing capabilities, these gadgets act as an extension of smartphones, offering a variety of features directly on the user's wrist through a standard touchscreen interface. The progression of smartwatches has resulted in the availability of a broad array of applications, making them valuable instruments for a diverse range of users across different industries.

The smartwatch industry has seen significant expansion in recent years, fueled by technological advancements and an increasing desire for wearable tech. Embraced by fitness enthusiasts and the health-conscious, smartwatches offer comprehensive health tracking functionalities. These devices observe crucial metrics like heart rate, sleep patterns, and physical activity, providing valuable insights to users for managing and enhancing their well-being. The incorporation of GPS features has reinforced the smartwatch's significance, establishing it as a vital accessory for outdoor pursuits like running, cycling, and other activities. This integration enhances the overall user experience, catering to both health monitoring and active lifestyles.

Beyond health and fitness, smartwatches address the needs of professionals and individuals seeking productivity boosts. Seamless delivery of notifications for calls, messages, emails, and calendar reminders to the wrist allows users to stay connected without frequent smartphone interactions. Business professionals find smartwatches valuable for managing schedules, discreetly responding to messages in meetings, and staying organized on the move.

Key Takeaways

- The global smartwatch market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global smartwatch markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The global smartwatch market is fueled by increasing consumer demand for fitness tracking, health monitoring, and mobile connectivity. Market growth is driven by technological advancements, characterized by growing consumer health awareness and integration with mobile payment platforms. The smartwatch market has also seen an increase with the ongoing trend of wearable technology and freshly developing AI driven health diagnostics. The cost-sensitive consumers coupled with the high price of premium smartwatches restrain market growth. However, higher pricing in advanced smartwatches can pose a bottleneck to the increased penetration into the market as much as concerns over data privacy.

Segment Overview

The smartwatch market is segmented into application, operating system and product.

Smartwatches have evolved into essential tools for technology enthusiasts, offering vital features and extensive customization options. Their compatibility with diverse third-party applications, spanning social media, music streaming, productivity tools, and weather apps, enhances the user experience. This adaptability empowers individuals to tailor their devices according to unique preferences and requirements.

Beyond their primary role in health monitoring, smartwatches serve as versatile accessories, catering to a broad spectrum of digital and lifestyle needs. The integration of technology and personalization elevates smartwatches beyond mere functional gadgets, positioning them as indispensable tools for those desiring a personalized and seamlessly integrated digital lifestyle. Whether managing social connections, enjoying music, or optimizing productivity, smartwatches have become integral to shaping a tailored and interconnected digital experience for tech-savvy individuals.

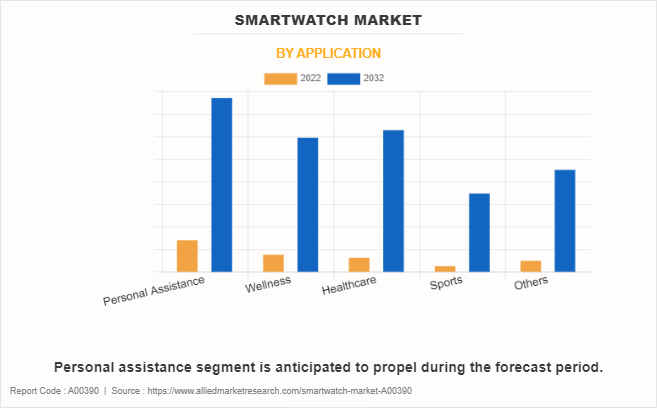

On the basis of application, the market is categorized into personal assistance, wellness, healthcare, sports, and others. The personal assistance segment acquired the largest share in 2022 and is expected to acquire a major market share by 2032.

The education sector has also embraced smart wearable, integrating applications designed to assist students in organization, deadline management, and discreet notifications during lectures. The growth in this market segment underscores the versatility of smart wearable in meeting diverse user needs.

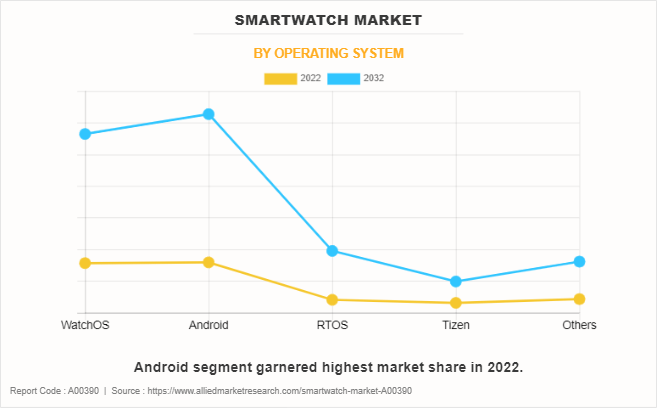

On the basis of operating system, the market is categorized into Watch OS, android, RTOS, Tizen, and Other. The android segment acquired the largest share in 2022 and is expected to acquire a major market share by 2032.

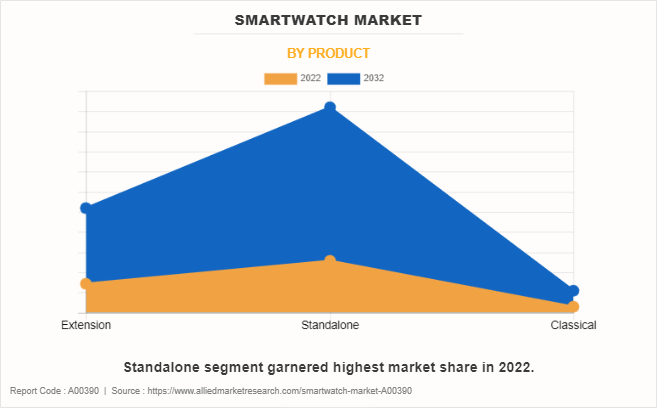

On the basis of product, the market is bifurcated into extension, standalone, and classical. In 2022, the standalone segment dominated the market, and is expected to acquire a major market share by 2032.

The expanding smartwatch market prompts manufacturers to explore advancements like extended battery life, improved processing capabilities, and heightened durability. Simultaneously, there's a notable shift towards enhancing the aesthetic appeal of these devices, aligning designs with a wider range of consumer preferences. Moreover, the smartwatch has evolved into a multifaceted and essential instrument, addressing diverse user needs from health and fitness to productivity.

This evolution underscores the dynamic integration of technology into a users daily lives, where smartwatches have transitioned beyond mere functional gadgets to stylish and practical accessories. The ongoing innovations not only focus on technical aspects but also prioritize fashion, recognizing the importance of blending technology seamlessly with personal style. Thus, smartwatches have become versatile companions, symbolizing the symbiotic relationship between technology and individual lifestyle choices.

On the basis of region, the Smartwatch Market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Regional/Country Market Outlook

- North America: The U.S. leads the market due to high disposable incomes, early adoption of wearables, and a robust ecosystem of tech-savvy consumers.

- Europe: Increasing health consciousness and a growing elderly population drive the market, especially in countries like Germany and the UK.

- Asia-Pacific: China and India are emerging as high-growth regions due to increasing consumer purchasing power and affordable smartwatch offerings by local manufacturers.

- Latin America & Middle East: While smaller, these regions show growth driven by rising smartphone penetration and interest in fitness-related technologies.

Competitive Analysis

Competitive analysis and profiles of the major global smartwatch market players that have been provided in the report include Apple, Fitbit (Google), Garmin, Huawei Technologies Co., Ltd., Fossil Group, Inc., Motorola Mobility LLC (Lenovo), Sony Corporation, Samsung Electronics Co. Ltd, TomTom International BV, Amazfit (Zepp Health Corporation). The key strategies adopted by the major players of the smartwatch market is product launch.

Report Coverage & Deliverables

The report covers key insights into the smartwatch market overview, including market segmentation by application, operating systems, product. It also examines the competitive landscape and offers market forecasts based on the latest trends and technological developments.

Type Insights

Extension Smartwatches function as companion devices to smartphones, requiring a connection to deliver notifications, GPS data, and media access. These smartwatches are often favored by users who prioritize lightweight designs and extended battery life for daily tasks such as fitness tracking and notifications. Popular models in this category include those from Fitbit and Garmin.

Application Insights

The sports application continues to drive significant growth in the market, as smartwatches are increasingly used by fitness enthusiasts and athletes. These devices offer features like GPS tracking, heart rate monitoring, and activity analytics for running, swimming, and cycling. Models from brands like Garmin and Apple are popular for these features, supporting performance optimization for users aiming to track and enhance their fitness goals.

Operating Systems Insights

WatchOS dominates the smartwatch market, offering seamless integration with the Apple ecosystem. Known for its user-friendly interface and extensive health features, WatchOS enables connectivity with iPhones, iPads, and other Apple devices. It supports a wide variety of third-party apps, making it a preferred choice for premium users looking for a smooth, integrated experience.

Regional Insights

North America holds a significant share of the global smartwatch market, driven by high levels of technological innovation and consumer spending power. The region is home to major industry players like Apple, Google, and Fitbit, which continually introduce cutting-edge products. The demand for smartwatches in this region is fueled by the integration of health-focused features such as ECG monitoring, blood oxygen level tracking, and fall detection. The U.S., in particular, sees a high penetration of smartwatches among fitness enthusiasts and tech-savvy consumers, while Canada is witnessing steady growth in healthcare and wellness applications.

Country Analysis

Country-wise, the U.S. acquired a prime share in the smartwatch industry in the North American region and it is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, UK, dominated the smartwatch market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. However, the Italy is expected to emerge as the fastest-growing country in Europe's Smartwatch market with a CAGR of 15.47%.

In Asia-Pacific, China, is expected to emerge as a significant market for the smartwatch market industry, owing to a significant rise in investment by prime players due to increase in growth of consumer electronics industries in rural and urban regions.

In the LAMEA region, the Latin America garnered significant market share in 2022. The LAMEA smartwatch market has witnessed an improvement, owing to the growth in inclination of prime vendors towards utilizing the smartwatch across this region in various applications such as healthcare, sports, and others. Moreover, the Middle East region is expected to grow at a high CAGR of 5.2% from 2023 to 2032.

Top Impacting Factors

The smartwatch market analysis is expected to expand significantly during the forecast period owing to growth in demand for wireless fitness & sports devices, increase in health awareness among the consumers, and emergence of large number of players in the market. In addition, during the forecast period, the smartwatch market is anticipated to benefit from rise in investment on building connected ecosystem. On the contrary, high initial cost of smartwatch is the restraint for smartwatch market growth during the forecast period.

Historical Data & Information

The global smartwatch market share is highly competitive, owing to the strong presence of existing vendors. Vendors of the smartwatch market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this smartwatch market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Apple, Fitbit (Google), Garmin, Huawei Technologies Co., Ltd., Fossil Group, Inc., Motorola Mobility LLC (Lenovo), Sony Corporation, Samsung Electronics Co. Ltd, TomTom International BV, Amazfit (Zepp Health Corporation) are the top companies holding a prime share in the Smartwatch market. Top market players have adopted various strategies, such as product launch, to expand their foothold in the Smartwatch market.

- In September 2023, Apple announced the Apple Watch Series 9, bringing new features to the world’s best-selling watch and achieving a significant environmental milestone. Apple Watch Series 9 is more powerful than ever with the new S9 SiP, which increases performance and capabilities; a magical new double tap gesture and a brighter display; faster on-device Siri, now with the ability to access and log health data Precision Finding for iPhone and more. Apple Watch Series 9 runs watchOS 10, which delivers redesigned apps, the new Smart Stack, new watch faces, new cycling and hiking features, and tools to support mental health.

- In August 2020, Fitbit (Google) announced the launch of Fitbit Sense, its most advanced health smartwatch, with innovative new sensors, like the world’s first electrodermal activity (EDA) sensor to help manage stress, along with advanced heart rate tracking technology, new ECG app and an on wrist skin temperature sensor, all powered by 6+ days battery life.

- In August 2023, Garmin announced the launch of Venu 3 and Venu 3S GPS smartwatches designed to support every health and fitness goal. Featuring extensive fitness insights, beautiful AMOLED touchscreen displays and an impressive battery life, Venu 3 series is purpose-built to help users get a more complete picture of their health. It also includes new features for wheelchair users—letting them track pushes, follow wheelchair-specific workouts and more.

- In September 2023, Garmin announced the launch of vívoactive 5, its latest health and fitness smartwatch with a bright AMOLED touchscreen display that is designed to be an essential part of everyday life at an affordable price. Featuring a broad range of health monitoring features, vívoactive 5 can help users learn about their bodies, coach them on how to live an active lifestyle, and support their fitness goals. With up to 11 days of battery life in smartwatch mode, users don’t have to worry about charging their watch every night and can therefore receive valuable around-the clock health metrics such as stress, Body Battery, and sleep with personalized sleep coaching and nap detection.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the smartwatch market size, current trends, estimations, and dynamics of the smartwatch market analysis from 2022 to 2032 to identify the prevailing smartwatch market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the smartwatch market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the smartwatch market outlook.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global smartwatch market trends, key players, market segments, application areas, market growth strategies, and smartwatch market demand.

Smartwatch Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 164.7 billion |

| Growth Rate | CAGR of 14.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 344 |

| By Application |

|

| By Operating System |

|

| By Product |

|

| By Region |

|

| Key Market Players | Fitbit (Google), TomTom International BV, Fossil Group, Inc., Samsung Electronics Co. Ltd, Apple, Amazfit (Zepp Health Corporation), Sony Corporation, Huawei Technologies Co., Ltd., Motorola Mobility LLC (Lenovo), Garmin |

Analyst Review

The insights from Chief Experience Officers (CXOs) of leading companies reveal a significant and swift surge in the adoption of smartwatches among end users. This trend is indicative of a paradigm shift in consumer preferences, with traditional watches being increasingly replaced by their smart counterparts. The appeal of smartwatches lies in their enhanced usability, expanded functionality, and convergence capabilities that closely resemble the transformative impact smartphones had on the market two decades ago.

The surge in smartwatch adoption can be attributed to their advanced capabilities. These devices have evolved beyond simple timekeeping, offering a range of features that meet diverse user demands. From comprehensive health tracking to communication and entertainment, smartwatches provide an integrated experience surpassing traditional watches. Their ability to receive notifications, make calls, monitor health metrics, and run applications directly from the wrist adds a level of convenience and efficiency unmatched by traditional timepieces. This advanced functionality positions smartwatches as versatile companions, meeting a broad spectrum of modern needs.

The convergence of smartwatches with smartphone-like capabilities is another compelling factor fueling their adoption. Individuals are attracted to the concept of having a compact computing device on their wrists, echoing the allure that smartphones held in the early 2000s. The smooth integration with smartphones enables smartwatches to function as extensions of users' digital lives, improving connectivity and offering swift access to information without requiring the retrieval of a smartphone.

This integration not only emphasizes the technological progression from traditional timepieces but also underscores the increasing preference for wearable devices that seamlessly complement and enhance the functions of smartphones. The appeal lies in the convenience and efficiency of having a miniature computing companion readily available on the wrist, embodying a technological synergy aligned with the contemporary lifestyle of users seeking seamless connectivity and instant access to information.

The convergence of style and functionality in smartwatches has contributed to their widespread acceptance, making them not just gadgets but fashion accessories that align with modern lifestyles. As technology continues to advance and smartwatches evolve, their adoption is expected to persist and expand, reshaping the way individuals perceive and interact with timepieces inthe contemporary era.

The key players of the market focus on introducing technologically advanced products to remain competitive in the market. Expansion and acquisition are expected to be the prominent strategies adopted by the market players. North America accounted for a major share of the market in 2022 owing to presence of major players in the region; however, Asia-Pacific and LAMEA are expected to grow at the highest CAGR, owing to rise in adoption of the market in a variety of fields during the forecast period.

The global smartwatch market was valued at $42.7 billion in 2022 and is projected to reach $164.7 billion by 2032, growing at a CAGR of 14.5% from 2023 to 2032.

The smartwatch market encompasses wearable devices that combine traditional timekeeping with advanced computing capabilities, offering features like health monitoring, GPS, and smartphone integration.

Leading companies in the smartwatch market include Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Fitbit, Inc., and Huawei Technologies Co., Ltd.

As of the latest data, the Asia-Pacific region is projected to drive significant growth in the smartwatch market, with countries like China serving as central hubs for this expansion.

Key drivers include technological advancements, increased health awareness among consumers, the integration of advanced features like health monitoring and GPS, and the growing demand for wearable technology that enhances daily life.

Loading Table Of Content...

Loading Research Methodology...