Aerogel Market Overview

The global aerogel market size was valued at $1.3 billion in 2022, and is projected to reach $7.5 billion by 2032, growing at a CAGR of 19.4% from 2023 to 2032.

Key Takeaways

- The global aerogel market has been analyzed in terms of value ($billion) and volume (kiloton). The analysis in the report is provided on the basis of application, end-use industry, 4 major regions, and more than 15 countries.

- The global aerogel market report includes a detailed study covering underlying factors influencing the industry opportunities and trends. The key players in the aerogel market are Active Aerogels, Aerogel Technologies, LLC., Armacell, Aspen Aerogels, Inc., BASF SE, Cabot Corporation, Dow, Guangdong Alison Hi-Tech Co., Ltd., Svenska Aerogel AB and Thermablok Aerogels Limited.

- The report facilitates strategy planning and industry dynamics to enhance decision-making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., India, Germany, and Brazil hold a significant share in the global market.

Introduction

Aerogels are a class of synthetic porous ultralight materials derived from a gel, where the liquid component of the gel has been replaced with gas without significant collapse of the gel structure. The result is a solid with extremely low density and low thermal conductivity. Aerogels are some of the lightest solid materials known to science and are often referred to as “frozen smoke” or “solid air” due to their translucent appearance and lightweight nature. Aerogels can be composed of a variety of chemical compounds including silica, carbon, metal oxides, polymers, and more recently, hybrid compositions. Among these, silica aerogels are the most widely studied and commercially used. These materials are known for their remarkable properties such as high surface area, low thermal conductivity, low density, and high porosity (up to 99.8% air), making them highly suitable for a range of advanced applications.

Market Dynamics

Rising demand in the oil & gas industry is expected to drive the growth of the aerogel market. The oil and gas industry is one of the largest and most critical end users of aerogel technology, primarily due to the material’s exceptional thermal insulation properties. Aerogels, particularly silica-based types, offer extremely low thermal conductivity, which is essential in maintaining optimal temperatures in pipeline systems. These pipelines often operate in extreme environments, from the frozen Arctic to high-temperature offshore platforms, where effective thermal management is vital to ensure operational efficiency and safety. Aerogel blankets are now standard in insulating pipelines for liquefied natural gas (LNG) transport. For instance, Cheniere Energy's Corpus Christi Stage III LNG project utilized 34,000 cubic feet of aerogel insulation for cryogenic piping, achieving 40% better thermal performance than conventional materials at -162°C. In September 2024, in Russia's Yamal Peninsula, aerogel wraps were used to insulate pipelines, while achieving 98% thermal efficiency and eliminating permafrost melt risks around above-ground supports.

However, the high production cost of aerogel is expected to restrain the growth of the aerogel market. Aerogel is renowned for its ultra-low density and superior thermal insulation, making it highly attractive for applications in construction, automotive, aerospace, and oil & gas. However, the manufacturing process is complex, requiring specialized facilities and expensive raw materials. The costliest step is supercritical drying, which is essential to achieve aerogel's unique structure but adds substantially to the overall production expense. For example, a small silica aerogel sample (2.5 cm x 2.5 cm x 1.0 cm) can cost up to $50, whereas an equivalent piece of extruded polystyrene foam board costs around $7. This means aerogel insulation can be two to five times more expensive than traditional alternatives, making it less accessible for projects with limited budgets. These elevated costs have a direct impact on market adoption. Many industries continue to favor conventional insulation materials due to their affordability, despite aerogel's superior performance. The high price also limits aerogel's penetration in cost-sensitive markets and applications, slowing its transition from niche uses to mainstream adoption.

The development of soundproofing and acoustic insulation is expected to offer lucrative opportunities in the aerogel market. Aerogels present a promising opportunity in the field of soundproofing and acoustic insulation due to their unique porous structure and lightweight properties. The interconnected nano-porous network within aerogels effectively absorbs and dissipates sound waves, reducing noise transmission through walls, floors, and ceilings. This makes aerogels highly valuable in building construction where controlling noise pollution is critical for improving occupant comfort, especially in urban environments or near busy roads and industrial zones. In April 2024, Aspen Aerogels inaugurated a state-of-the-art engineering and rapid prototyping facility in Marlborough, MA, to support manufacturers in optimizing the performance and safety of battery packs used in energy storage systems (ESS) and eMobility applications. Moreover, in November 2023, JIOS Aerogel opened a new manufacturing facility in Pioneer, Singapore, to produce aerogel-based technology aimed at improving the performance and safety of EV batteries.

Segments Overview

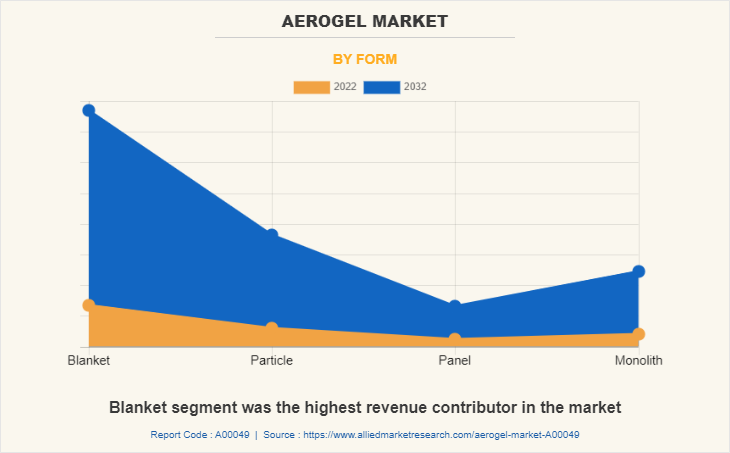

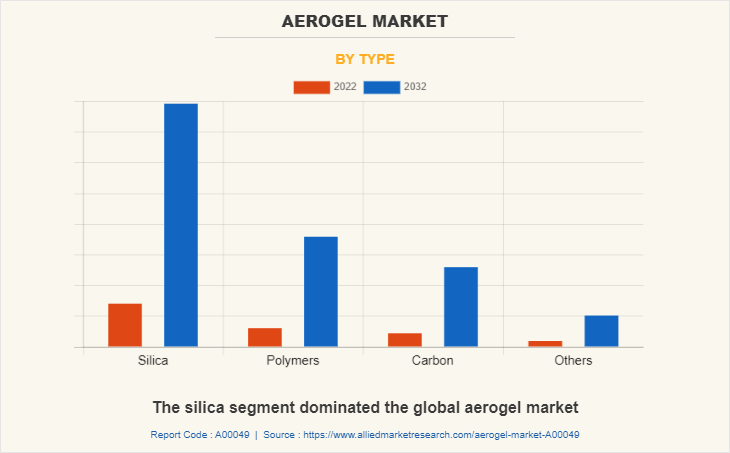

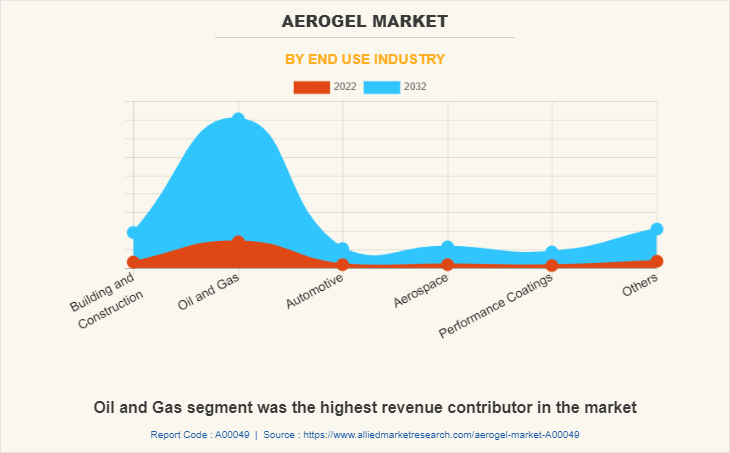

The aerogel market is segmented into form, type, end-use industry, and region. On the basis of form, the market is categorized into blanket, particle, panel, and monolith. On the basis of type, the market is divided into silica, polymers, carbon, and others. Depending on the end-use industry, the market is classified into building and construction, oil and gas, automotive, aerospace, performance coatings, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

By form, the blanket segment dominated the global aerogel market in terms of revenue in 2022. The primary uses of aerogel blankets are in the construction and building industry, where they are used to insulate walls, roofs, and pipes without adding significant bulk. Moreover, due to their thin profile and high thermal efficiency, aerogel blankets allow for improved energy savings by minimizing heat loss in colder climates and heat gain in warmer environments. In May 2023, Cabot Corporation launched the ENTERA™ aerogel particles portfolio, designed for ultra-thin thermal barriers in electric vehicle (EV) lithium-ion batteries. These products can be incorporated into various thermal barrier forms, including blankets, pads, sheets, films, foams, and coatings.

By type, the silica segment was the most revenue contributor in the global aerogel market in terms of revenue in 2022. Silica aerogel, a highly porous and ultra-lightweight material derived from silica, has found diverse applications across multiple industries due to its unique properties. Its exceptional thermal insulation capabilities make it ideal for use in construction and aerospace. Silica aerogel panels or blankets are often incorporated into walls, roofs, and windows to improve energy efficiency by significantly reducing heat transfer. In March 2024, in Paris Fashion Week, Coperni introduced the Air Swipe bag, made from 99% air and 1% glass using NASA's silica aerogel. Weighing only 33 grams, it represents the largest object ever made from this material, showcasing its potential in fashion design.

Based on end-use industry, the oil & gas segment garnered the highest revenue and is expected to experience a substantial growth in the near future. Aerogel insulators are used in the oil & gas industry to protect pipes from unprocessed oil materials. Vendors such as Cabot Technologies, Aspen Aerogel, and Aerogel Technologies offer their products for the industry. Aerogel functions between -200 to +1,600 degree Celsius, reducing the risk of equipment failure and extending the lifespan of pipelines. According to the U.S. Energy Information Administration, U.S. crude oil production reached 12.9 million barrels per day (b/d) in 2023, reflecting an 8.5% increase from 2022's output of 11.9 million b/d. The growth is primarily driven by rising production in the Permian Basin and the Gulf of Mexico. As oil production expands, the need for fully operational refineries and a reliable transport network becomes critical, which is expected to boost the aerogel industry.

Region-wise, North America emerged as the leading revenue contributor in the aerogel market, driven by the material's lightweight and highly porous nature. Its exceptional insulating properties have garnered considerable attention across the region. Aerogels have gained significant traction across various industries in North American countries, primarily the U.S. and Canada owing to their exceptional thermal insulation properties, lightweight nature, and versatility. These advanced materials are predominantly used in construction and building insulation to improve energy efficiency and reduce carbon emissions. Aspen Aerogels received a conditional commitment in October 2024 from the U.S. Department of Energy for a proposed loan of up to $670.6 million under the Advanced Technology Vehicles Manufacturing loan program. This funding aims to support the construction of a second aerogel manufacturing facility in Register, Georgia, which is expected to generate approximately $1.2 billion to $1.6 billion in incremental revenue from PyroThin® thermal barrier products.

Competitive Analysis

The major players operating in the global aerogel market include Active Aerogels, Aerogel Technologies, LLC., Armacell, Aspen Aerogels, Inc., BASF SE, Cabot Corporation, Dow, Guangdong Alison Hi-Tech Co., Ltd., Svenska Aerogel AB, and Thermablok Aerogels Limited.

Recent Key Developments in the Aerogel Market

In April 2024, Hamburg University of Technology (TUHH) and Aerogel-it inaugurated the largest bioaerogel pilot plant, producing 100% bio-based lignin aerogels. This facility can produce 150 liters of bioaerogel particles daily, emphasizing sustainable superinsulation solutions.

In September 2024, Armacell international S.A. acquired all the shares of JIOS Aerogel in their joint venture, Armacell JIOS Aerogels Limited (AJA), to fully own the subsidiary.

In November 2023, JIOS Aerogel launched an advanced manufacturing plant in Singapore to produce its "Thermal Blade" product, designed for thermal and electrical insulation in EV batteries. This move aims to meet the growing demand in the EV sector.

In September 2023, Beerenberg AS entered into a distribution agreement with Aerogel-it GmbH to introduce Oryza Aerogel insulation products to the European market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aerogel market analysis from 2022 to 2032 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the aerogel market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global aerogel market trends, key players, market segments, application areas, and market growth strategies.

Aerogel Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.5 billion |

| Growth Rate | CAGR of 19.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Form |

|

| By Type |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | BASF SE, Aerogel Technologies, LLC., Dow, Thermablok Aerogels Limited, Guangdong Alison Hi-Tech Co., Ltd., Svenska Aerogel AB, Active Aerogels, Cabot Corporation, Armacell, Aspen Aerogels, Inc. |

Analyst Review

According to the insights of the CXOs of the leading companies, the global aerogel market is expected to witness significant growth during the forecast period, owing to rise in adoption of aerogel on account of its lightweight and reusability. However, the major restraint of the market is its high cost of production. Conversely, surge in demand for aerogel products in various applications is anticipated to offer remunerative opportunities for market expansion during the forecast period.

The CXOs further added that many aerogel producers have developed their unique procedures to produce aerogel that is being commercialized through collaborations with end-use industries. This factor significantly contributes toward the growth of the global aerogel market.

Furthermore, increase in consumer acceptance of aerogel as an insulating material instead of the conventional products in the developing countries of Asia-Pacific and LAMEA is projected to fuel the market growth in the near future. Moreover, the commercialization of aerogel in its potential applications such as apparel, energy storage, oil spill cleaning, and space suit insulation significantly drives the market growth.

The global aerogel market was valued at $1.3 billion in 2022, and is projected to reach $7.5 billion by 2032.

Region-wise the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

North America largest regional market for Aerogel.

Oil and gas is the leading end-use industry of Aerogel Market.

Growing demand from oil & gas industry and superior thermal resistance of aerogel are the riving factor of Aerogel Market.

Effective substitution of fiber glass, foam, and cellulose and demand for of lightweight & protective equipment are the upcoming trends of Aerogel Market in the world.

Active Aerogels, Aerogel Technologies, LLC., Armacell, Aspen Aerogels, Inc., BASF SE, Cabot Corporation, Dow, Guangdong Alison Hi-Tech Co., Ltd., Svenska Aerogel AB and Thermablok Aerogels Limited are the top companies to hold the market share in Aerogel.

Loading Table Of Content...

Loading Research Methodology...