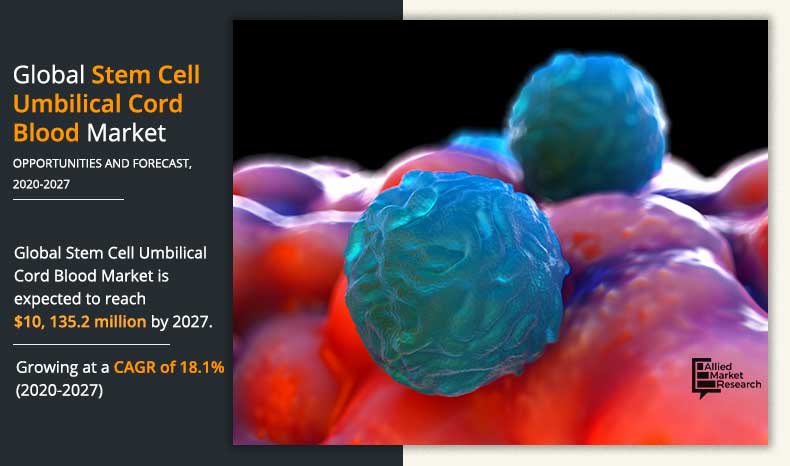

Stem Cell Umbilical Cord Blood Market (Statistics & Outlook) 2027

The global stem cell umbilical cord blood market was valued at $3,110.8 million in 2019, and is projected to reach $10,135.20 million by 2027, registering a CAGR of 16.9% from 2020 to 2027. Presently, the global stem cell market dominates the healthcare industry with its reliable and cost-effective methods of treatment and fewer side effects. The umbilical cord blood stem cell segmentis one of the potential segments of the stem cell market, which is projected to grow in the future. Cord blood is one of the rich sources of stem cells, which are treated as waste after pregnancy or childbirth; however, this blood has huge potential to treat chronic diseases such as cancer, diabetes, blood diseases, and immune diseases.

Currently, more than 80 genetic diseases can be treated with cord blood as it is a rich source of hematopoietic stem cells. Various governments are supporting the research and clinical trials of cord blood stem cells, which has increased the interest of healthcare companies to invest in research and commercialization of cord blood stem cell therapies. However, competition in the market is intense with companies trying to create brand awareness, therefore, compelling market players to adopt many market-based strategies. These stem cells are the only type of cells that are stored in controlled conditions due to their lower volume and higher cell count.

Cost structure of the stem cell treatment has a major impact on the growth of the market in developed countries. Stem cells collected from cord blood are used in treatment of many rare diseases that include metabolic diseases and immune diseases. The overall market is growing from clinical applications to commercialization. Companies involved in the research and commercialization of stem cell therapies are adopting approval and clinical trials as their primary strategy and product launch as their secondary strategy to maintain their dominance in the stem cell umbilical cord blood market.

On the basis of storage service, the stem cell umbilical cord blood market is segmented into private cord blood banks, public cord blood banks, and hybrid cord blood banks. The private cord banks segment was the highest contributor to the market, with $1,537 million in 2019, and is estimated to reach $4,765.90 million by 2027, at a CAGR of 15.3% during the forecast period.

By therapeutics, the stem cell umbilical cord blood market is categorized into cancer, diabetes, blood diseases, immune disorders, metabolic disorders, and other diseases. The diabetes segment was the highest contributor to the market, with $794.57 million in 2019, and is estimated to reach $2,655.58 million by 2027, at a CAGR of 16.4% during the forecast period.

By application, the stem cell umbilical cord blood market is categorized into transplant medicine and regenerative medicine. The regenerative medicine segment was the highest contributor to the market, with $1,854.12 million in 2019, and is estimated to reach $5,878.55 million by 2027, at a CAGR of 15.6% during the forecast period.

The stem cell umbilical cord blood market is more lucrative in North America and European countries. Most patents granted for cord blood were from the U.S. and European authorities. North America shared the largest revenue of $1,537.4 million in 2019, however Asia-Pacific is expected to grow at CAGR of 16.7% CAGR during the forecast period.

The companies offering stem cell umbilical cord blood storage services include Cordlife Group Limited, Cord Blood America, Cryo-Cell International, Medipost, Global Cord Blood Corporation, Americord Registry, and Cordvida.

Global Stem Cell Umblical Cord Blood market Segmentation

The stem cell umbilical cord blood market is segmented on the basis of storage service, therapeutics, application, and region. By type, it is categorized into public cord blood banks, private cord blood banks, and hybrid cord blood banks. On the basis of therapeutics, it is divided into cancer, diabetes, blood diseases, immune disorders, metabolic disorders, and other diseases. By application, it is categorized into transplant medicine and regenerative medicine. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Storage Service

Hybrid cord blood banks is projected as one of the most lucrative segments.

Segment review

Depending on storage service, the market is categorized into private cord blood banks, public cord blood banks, and hybrid cord blood banks. The private cord blood banks segment dominated the global market in 2019, and is anticipated to continue this trend during the forecast period. The key factors such as rise in use of stem cells to cure diseases and finding accurate match for transfer are expected to drive the growth of this segment.

On the basis of therapeutics, the market is categorized into cancer, diabetes, blood diseases, immune disorders, metabolic disorders, and others. The diabetes segment held a dominant position in the market, accounting for about $ 794.57 million revenue of the global market in 2019.

By application, the stem cell umbilical cord blood market is categorized into transplant medicine and regenerative medicine. The regenerative medicine segment held a dominant portion in the market, accounting for about $ 1,854.12 revenue of the global stem cell umbilical cord blood market in 2019.

By Application

Regenerative Medicine segment holds a dominant position in 2019

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global stem cell umbilical cord blood market size along with the current trends and future estimations to elucidate the imminent investment pockets.

- It offers stem cell umbilical cord blood market analysis from 2020to 2027, which is expected to enable the stakeholders to capitalize on the prevailing opportunities in the market.

- A comprehensive analysis on region assists to understand the regional stem cell umbilical cord blood market and facilitate the strategic business planning and determine prevailing opportunities.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook of the global stem cell umbilical cord blood market growth.

Stem Cell Umbilical Cord Blood Market Report Highlights

| Aspects | Details |

| By STORAGE SERIVCES |

|

| By THERAPEUTICS |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | Cordlife Group Limited, LifeCell International Pvt. Ltd., ViaCord, Medipost Co. Ltd., Esperite N.V., Americord Registry LLC, Vita34 AG, Cord Blood America, Inc., China Cord Blood Corporation, Cryo-Cell International, Inc. |

Analyst Review

In accordance with several interviews conducted with top-level CXOs in the industry, it was analyzed that they agree the stem cell from umbilical cord blood can be effectively used for applications such as regenerative medicine and transplant medicine, and is further anticipated to witness a significant rise with discovery of new related applications, rise in incidences of chronic diseases, and easily available facilities such as testing and storage.

According to CXOs, increase in economic strength of countries such as Canada as well as rise in healthcare expenditure are expected to drive the market growth during the forecast period. Rapid growth was observed in the adoption of stem cell umbilical cord blood in the healthcare industry. Moreover, hybrid storage service providers are expected to dominate the market during the forecast period, while private providers are expected to grow at the highest CAGR.

The total value of Stem Cell Umbilical Cord Blood market was $ 3,110 million in 2019.

The forecast period in the report is from 2020-2027.

The market value of Stem Cell umbilical Cord blood market in 2020 was $3,390 million.

The base year calculated is 2019 in the report.

As per the key industry leaders, rise in incidence of chronic diseases cases , increasing R&D initiatives to develop novel technologies and increasing applications for stem cells will drive the market

Rise in R&D efforts by the key players to develop novel therapies in the market is expected to drive the market growth during the forecast period.

The growth % of the market is 16.9%.

Private cord blood banks segment holds the maximum market share.

Loading Table Of Content...