DNA Diagnostics Market Overview:

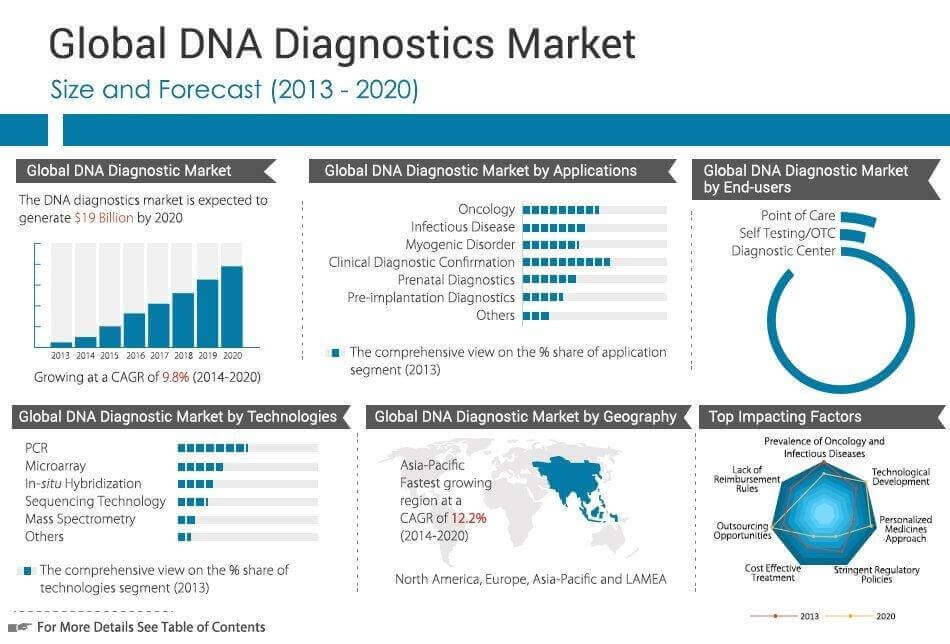

Global DNA diagnostics market size is expected to garner $19 billion by 2020, registering a CAGR of 9.8% during the forecast period 2014-2020. DNA diagnostics is a cutting edge method which is set to revolutionize the field of medical diagnostics. This technique enables medical professionals to identify various diseases, such as cancer, infectious diseases, and myogenic disorders, and to determine the appropriate treatment for the same.

It is also used for clinical diagnostic confirmation and in prenatal diagnostics. The concept of DNA diagnostics has evolved via the breakthrough human genome project that resulted in the discovery of various disease-causing agents. Technological development has played a major role in improving DNA diagnostic platforms and techniques.

Some of the significant technologies which incorporate DNA diagnostics include polymerase chain reaction (PCR), microarray techniques, sequencing technology and mass spectrometry; these technologies are used for sample preparation, DNA isolation etc. Technological developments, which have led to improvements in these methodologies, drive the growth of the DNA diagnostics market. The use of DNA diagnostic methods in prenatal diagnostics and clinical confirmation has also boosted market growth. The DNA diagnostics market is expected to experience a growth spurt in the foreseeable future. Innovations in product design and technology have prompted doctors and researchers to shift their focus from traditional diagnostic methods to personalized medicines. The increased adoption of the personalized medicines approach would positively impact the DNA diagnostics market in the foreseeable future. Next generation sequencing is a powerful tool for decoding a number of human diseases, including various forms of cancer. Next generation sequencing reduces the cost of sequencing and increases the throughput. The optimization of sequencing technology could greatly impact the DNA diagnostics market.

Segment Overview

The report breaks the market into segments based on product type, technology, application, end users and geography. Based on product types, the market is segmented into instruments, reagents and service & software. The instruments segment holds the dominant share in the market, due to improved healthcare facilities, availability of user-friendly instruments, its competitive cost structure, reliability, size and the growing demand for it in the DNA diagnostics market.

However, the service & software segment is expected to grow at a steady rate in the near future due to technological advancements and the incorporation of information technology in the DNA diagnostics market. There are several technologies used in the DNA diagnostics market; these include PCR, mass spectrometry, sequencing technology, in-situ hybridization and microarrays. PCR holds the dominant share due to its frequent usage in diagnostic procedures such as sample preparation, separation and isolation of DNA from collected samples. The DNA diagnostics market is also segmented based on its application in various diseases such as oncology, infectious diseases and myogenic disorders. The oncology segment leads the market and is followed by infectious diseases due to the rising incidence of these diseases and growing elderly population.

In terms of geography, the market is segmented into North America, Asia Pacific, Europe and LAMEA. North America holds the dominant share in the market due to the increased adoption of the DNA diagnostics technology and the high prevalence of chronic and infectious diseases. Companies profiled in the report include Roche Diagnostics, Bayer Diagnostic, Sysmex, Abbott laboratories, Gene-probe Inc., Cephide, Illumina, Inc., Bio-Rad Laboratories, Thermo Fisher Scientific, Johnson and Johnson, and Novartis.

KEY BENEFITS

- An in-depth analysis of various regions would provide a clear understanding of current and future trends so that companies can make region specific plans

- The report studies the application of next generation sequencing technology and biotechnology and their impact on the DNA diagnostics market

- A comprehensive analysis of the factors that drive and restrict the growth of the DNA diagnostics market is provided

- Key regulatory guidelines in various regions which impact the DNA diagnostics market are critically examined

- A quantitative analysis of the current market and estimations through 2013-2020 are provided to showcase the financial caliber of the DNA diagnostics market

- Detailed analysis of the Asia-pacific region provides insights that would enable companies to plan their business move strategically

- Value chain analysis in the report gives a clear understanding of the roles of the stakeholders involved in the supply chain of the DNA diagnostics market

DNA Diagnostics Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By TECHNOLOGY |

|

| By APPLICATIONS |

|

| By END-USERS |

|

| By GEOGRAPHY |

|

| Key Market Players | Thermo Fisher Scientific Inc., Bayer Diagnostic, Cephide Inc., Roche Diagnostics, Novartis, Gen-probe Inc. (Hologic), Johnson and Johnson, Sysmex, Illumina, Inc., Abbott Laboratories, Bio-Rad Laboratories |

Analyst Review

The global DNA diagnostic market is expected to grow at healthy rate during the forecast period. The adoption of new technology such as next generation sequencing, polymerase chain reaction and microarray are primarily driving the DNA diagnostic market. The global DNA diagnostic market in this report is segmented based on the technology, application and end users. Several diagnostic companies are exploiting the lucrative opportunities available in this market. DNA diagnostics is being used in several applications such as diagnosis of infectious diseases, oncology/cancer, myogenic disorders, prenatal diagnostics and pre-implantation diagnostics etc. The DNA diagnostics market has numerous opportunities in developed and developing economies due to increasing awareness amongst the public about healthcare, cost effective diagnostic solutions and accurate and faster test results. Demand for DNA diagnostic methods in developed economies would gain popularity in near future, as the consumer base in these countries shows an inclination towards effective diagnostic treatment instead of traditional medication; hence, the DNA diagnostic market is expecting sluggish growth in developed countries during the analysis period.

Loading Table Of Content...