Aluminum Market Overview:

The global aluminum market size was valued at $162.0 billion in 2023, and is projected to reach $285.4 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033. The major driver for aluminum market is the growth in the transportation industry, where aluminum's lightweight and durable properties make it indispensable for manufacturing vehicles, airplanes, and other transportation equipment. This sector's expansion significantly boosts aluminum demand.

Introduction

Aluminum is one of the abundant metals found in the earth’s crust. In terms of weight, it accounts for nearly 8% of the earth’s crust. Wide availability and numerous properties of aluminum make it a widely used metal across the world. Aluminum is used in various applications such as packaging, household products, electronics, and transportation. It possesses several properties such as high conductivity, ease of recycling, and corrosion resistance; however, aluminum has drawbacks such as moderate tensile strength and moderate machinability. This limits its direct usage in various end-user industries.

Key Takeaways

- The global aluminum market share is highly fragmented, with several players including China Hongqiao Group Limited, Rio Tinto, East Hope Group, Shandong Xinfa Aluminum Co., Ltd., Emirates Global Aluminium PJSC, Alcoa Corporation, RusAL, Norsk Hydro ASA, Hindalco Industries Ltd, and Aluminum Corporation of China Limited.

- More than 4,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study covers nearly 20 countries. The segment analysis of each country in terms of value and volume during the forecast period 2023-2033.

Market Dynamics

Aluminum is a critical material in the transport sector due to its lightweight, high strength, corrosion resistance, and recyclability. In the automotive industry, aluminum is extensively used to reduce vehicle weight, thereby enhancing fuel efficiency and lowering emissions. This lightweighting is crucial in the context of stringent environmental regulations and the global push towards reducing carbon footprints. Vehicles like the Tesla Model S and Ford F-150 utilize aluminum for body panels, engine components, and structural parts, significantly improving performance and safety. Aluminum's high strength-to-weight ratio also contributes to better crashworthiness, providing enhanced protection for passengers.This is anticipated to drive the aluminum market during the forecast period.

In the aerospace industry, aluminum's role is indispensable. Its lightweight and strong properties make it ideal for constructing airframes, fuselages, and wing structures. This not only improves fuel efficiency but also allows for greater payload capacity, which is essential for both commercial and military aircraft. Planes such as the Boeing 737 and Airbus A320 rely heavily on aluminum to optimize their performance. Additionally, aluminum's excellent corrosion resistance ensures the longevity and reliability of aerospace components, reducing maintenance costs and enhancing operational efficiency.

The marine industry also benefits from aluminum's properties. It is used in shipbuilding, particularly for high-speed vessels and passenger ferries, due to its lightweight and resistance to seawater corrosion. This leads to improved fuel efficiency and performance, which is crucial for both commercial and military vessels. The U.S. Navy, for example, uses aluminum in the construction of littoral combat ships to achieve high speeds and operational efficiency. Similarly, high-speed catamarans and luxury yachts often feature aluminum hulls and superstructures to enhance performance.

However, the growth of competition from substitutes poses a significant challenge to the aluminum industry. Materials such as steel, plastic, carbon fiber, and composites are increasingly being used in industries that traditionally relied on aluminum, particularly in sectors such as automotive, aerospace, and packaging. These substitutes offer comparable or superior performance in terms of strength, weight, and cost that makes them preferable alternatives. All these factors hamper the aluminum market growth.

The introduction of advanced alloys and enhanced aluminum composites is expanding the range of applications for aluminum. These new materials offer improved strength, durability, and corrosion resistance that makes aluminum an even more competitive option compared to traditional materials such as steel or newer alternatives such as carbon fiber. In sectors such as automotive, the lightweight nature of aluminum combined with its improved properties is helping manufacturers meet stringent emissions regulations by reducing vehicle weight without compromising safety or performance. Moreover, in construction, advancements in aluminum composites allow for more innovative architectural designs while maintaining structural integrity. These technological breakthroughs increase the versatility of aluminum and create new growth opportunities during the aluminum market forecast period. All these factors are expected to drive the demand for the aluminum industry during the forecast period.

Segments Overview

The aluminum market is segmented on the basis of series, processing method, end-user industry, and region. On the basis of series, the market is classified into series 1, series 2, series 3, series 4, series 5, series 6, series 7, and series 8. On the basis of processing method, the market is classified into flat rolled, castings, extrusions, forgings, pigments & powder, and rod & bar. As per end-user industry, the market is classified into transportation, building & construction, electrical engineering, consumer goods, foil & packaging, machinery & equipment, and others. Region-wise, the aluminum market share is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

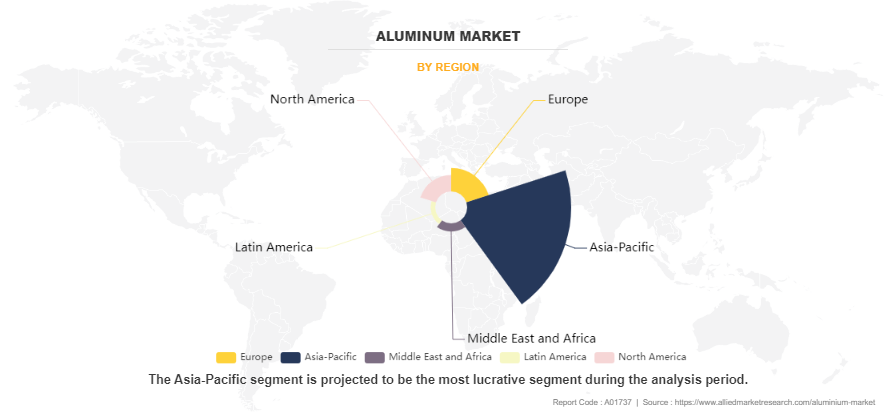

Aluminum Market, By Region

Based on region, Asia-Pacific is the fastest-growing region in terms of revenue in 2023 representing 6.1% of the CAGR. The surge in production and adoption of electric vehicles (EVs) in countries such as China, Japan, and South Korea contribute to aluminum demand, as EVs require a substantial amount of aluminum for batteries, frames, and other components. Furthermore, government policies promoting EVs and offering incentives for their manufacture and purchase are boosting the automotive sector's aluminum consumption. In addition, countries such as China, India, and Indonesia are experiencing significant urbanization, leading to increased demand for aluminum in construction materials due to its lightweight, strength, and corrosion resistance. Mega infrastructure projects, residential and commercial buildings, and transportation networks extensively utilize aluminum that drive the demand for the aluminum in Asia-Pacific during the forecast period.

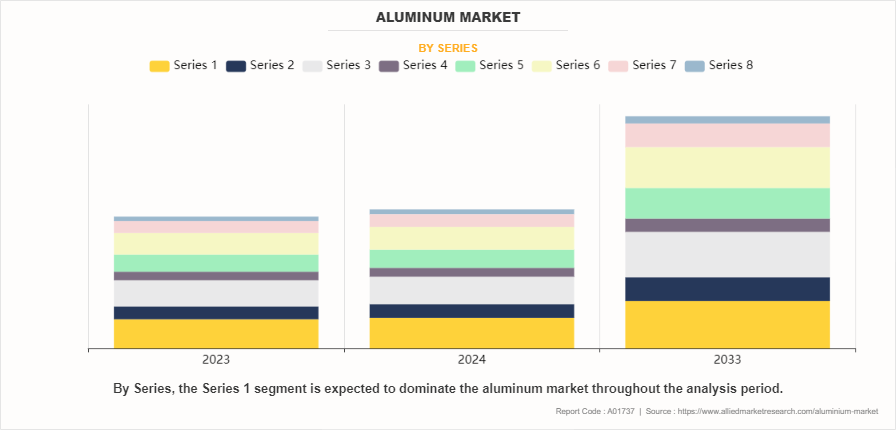

Aluminum Market, By Series

The series 1 segment held the highest market share in 2023, accounting for less than one-fourth of the global aluminum market revenue and is estimated to maintain its leadership status throughout the forecast period. The primary driver for the demand for Series 1 aluminum (1xxx series) is its exceptional electrical conductivity, which makes it indispensable in the electrical and electronics industry. This high conductivity is crucial for applications such as electrical conductors, wiring, and bus bars, where efficient and reliable transmission of electricity is paramount. Additionally, the excellent corrosion resistance of 1xxx series aluminum alloys makes them highly suitable for environments exposed to chemicals or food substances, leading to their widespread use in chemical processing equipment, food and beverage packaging, and storage tanks.

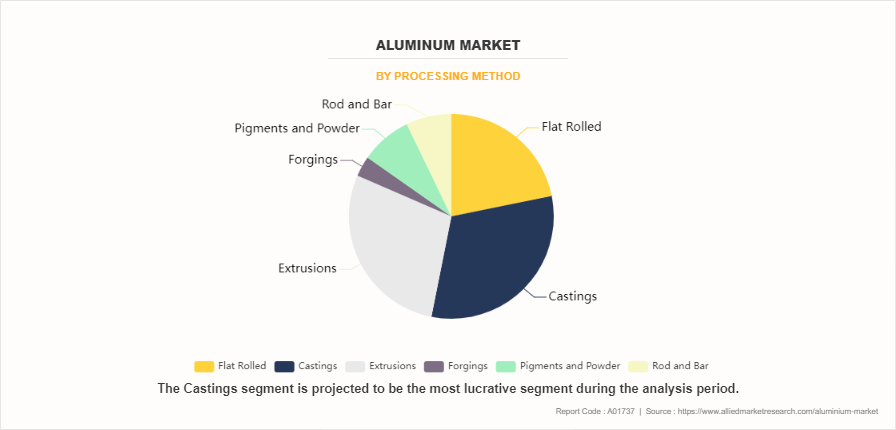

Aluminum Market, By Processing Mathod

Based on the processing method, the castings segment held the highest market share in 2023, accounting for less than one-third of the global aluminum market revenue and is estimated to dominate during the forecast period. Aluminum casting processes offer significant design flexibility and complexity, allowing manufacturers to produce intricate shapes and geometries with minimal machining, thereby reducing material waste and overall production costs. This versatility is particularly advantageous for industries requiring intricate components or customized designs, such as in the manufacturing of engine blocks, transmission cases, and structural components. In addition, advancements in aluminum casting technologies, such as improved alloys, casting methods, and computer-aided design (CAD) software, have expanded the capabilities and performance of aluminum castings. These advancements have enabled the production of lighter, stronger, and more complex components that drive the adoption of aluminum castings in various industries. Furthermore, global emphasis on sustainability and energy efficiency creates opportunities for lightweight materials such as aluminum in manufacturing processes.

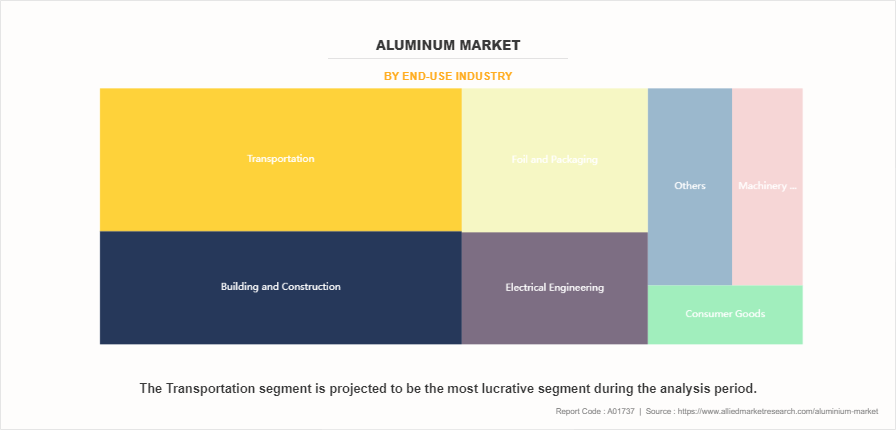

Aluminum Market, By End -Use Industry

By end-use industry, the transportation segment held the highest market share in 2023, accounting for more than one-fourth of the global aluminum market revenue and is estimated to maintain its leadership status throughout the forecast period. Aluminum is a lightweight material that makes it an ideal material for reducing the overall weight of vehicles. This reduction in weight contributes to improved fuel efficiency and lower emissions, aligning with global efforts to mitigate environmental impacts associated with transportation. Moreover, aluminum's corrosion resistance ensures durability and longevity, crucial qualities for components exposed to harsh environmental conditions on roads and in the air. This resistance reduces maintenance needs and extends the lifespan of vehicles, enhancing their economic viability. All these factors are expected to drive the demand for aluminum in the transportation industry.

Pricing Analysis

In 2023, aluminum prices per kg varied across regions due to factors such as local market conditions, production costs, and trade policies. Europe recorded the highest price at $2.41/kg, driven by stringent environmental regulations, higher labor costs, and reliance on imported raw materials. In the Middle East and Africa, aluminum was priced at $2.38/kg, benefiting from abundant natural resources and lower energy costs, despite political instability. Latin America's price was $2.36/kg, supported by rich mineral resources and lower labor costs, though infrastructure and political challenges impacted pricing. Moreover, the Asia-Pacific region had the lowest price at $2.35/kg, due to competitive labor costs, economies of scale, and China's significant production capacity.

Competitive Analysis

The major players operating in the aluminum market report include, China Hongqiao Group Limited, Rio Tinto, East Hope Group, Shandong Xinfa Aluminum Co., Ltd., Emirates Global Aluminium PJSC, Alcoa Corporation, RusAL, Norsk Hydro ASA, Hindalco Industries Ltd., and Aluminum Corporation of China Limited.

In the aluminum market, companies have adopted acquisition and agreement to expand the market or develop new products. For instance, in June 2024, Rio Tinto acquired Mitsubishi Corporation's 11.65% stake in Boyne Smelters Ltd (BSL), which owns and operates the Boyne Island aluminum smelter in Gladstone, Australia. Moreover, in June 2024, Emirates Global Aluminium PJSC, the largest industrial company in the UAE, and Aluminium Corporation of China (Chinalco) have signed a framework agreement for progressing their cooperation on the development of an alumina refinery in the Republic of Guinea. The companies now intend to further progress the project’s feasibility and joint investment.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aluminum market analysis from 2023 to 2033 to identify the prevailing aluminum market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aluminum market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aluminum market trends, key players, market segments, application areas, and market growth strategies.

Aluminum Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 285.4 billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2023 - 2033 |

| Report Pages | 484 |

| By Series |

|

| By Processing Method |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | East Hope Group, Norsk Hydro ASA, Alcoa Corporation, Hindalco Industries Ltd, Aluminum Corporation of China Limited, Emirates Global Aluminium PJSC, Shandong Xinfa Aluminum Co., Ltd., RusAL, Rio Tinto, China Hongqiao Group Limited |

Analyst Review

The aluminum industry is a highly competitive and extremely consolidated sector with six major producers, including China Hongqiao Group Limited, United Company RUSAL Plc., Aluminium Corporation of China Limited (CHALCO), Rio Tinto Alcan Inc., Alcoa Corporation, and China Power Investment Corp. (CPI). Various CXOs from leading companies perceive that development of the transportation industry and increase in construction spending in the advanced & developing economies which drive the growth of the aluminum market globally.

Rapid growth of cities and potential uses of aluminum as copper substitute in power industry further fuel the market growth. According to CXOs, rapid development and urbanization fuel the growth of the aluminum market in emerging economies such as India and China. Stringent regulations toward carbon emissions and strong focus on environment stewardship in most developed countries boosts the adoption of aluminum in the transportation sector in developed economies, as its use in vehicles reduces fuel consumption and assists to reduce hazardous emissions.

Transportation is the leading application of Aluminum Market.

There is a growing demand for aluminum in sustainable packaging solutions, as manufacturers seek environmentally friendly materials. The construction industry is also seeing increased use of aluminum due to its durability and recyclability.

Asia-Pacific is the largest regional market for Aluminum.

The aluminum market was valued at $162.0 billion in 2023, and is estimated to reach $285.4 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

The major players operating in the industry include China Hongqiao Group Limited, Rio Tinto, East Hope Group, Shandong Xinfa Aluminum Co., Ltd., Emirates Global Aluminium PJSC, Alcoa Corporation, RusAL, Norsk Hydro ASA, Hindalco Industries Ltd, and Aluminum Corporation of China Limited.

Loading Table Of Content...

Loading Research Methodology...