Aluminum Casting Market Overview:

The global aluminum casting market was valued at $72.9 billion in 2022, and is projected to reach $124.9 billion by 2032, growing at a CAGR of 5.6% from 2023 to 2032.

Key Market Insights

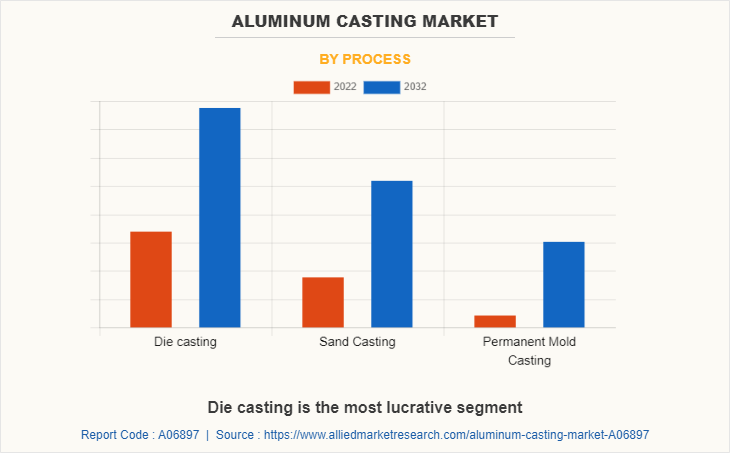

- By Process: Die casting leads as the most profitable segment.

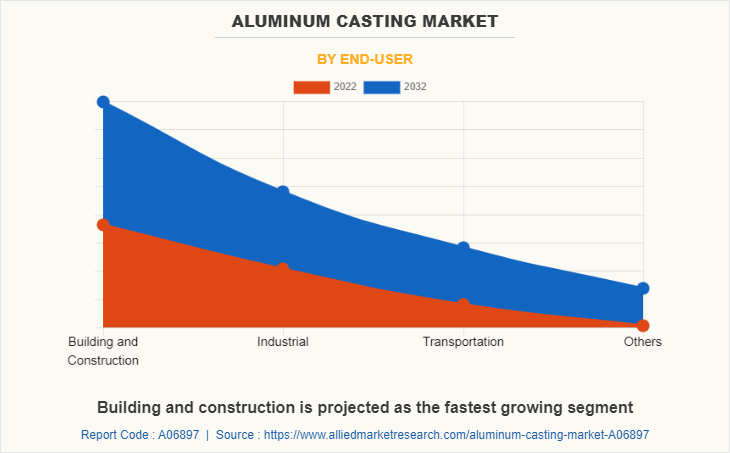

- By End-User: Building & Construction is the fastest-growing sector.

- By Region: Asia-Pacific is set to register the highest CAGR of 5.9% (2023–2032).

Market Size & Forecast

- 2032 Projected Market Size: USD 72.9 Billion

- 2023 Market Size: USD 124.9 Billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 5.6%

How to Describe Aluminum Casting

Aluminum casting is a process of forming aluminum casts of fixed dimensions. Aluminum casting is used for making aluminum objects by pouring molten aluminum into an empty shaped space. The metal then cools and hardens into the form given to it by this shaped mold. Aluminum casting is used in various end use sectors including automotive & transportation, electrical & electronics, building & construction, industrial, aerospace, and others.

Report Key Highlighters:

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The aluminum casting market is consolidated in nature among companies such as Alcoa Corporation, Bodine Aluminum, BUVO Castings, Consolidated Metco, Inc., Dynacast, Rio Tinto, RusAL, RYOBI Aluminium Casting (UK) Ltd., Shandong Xinanrui Casting, Walbro.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global aluminum casting market such as product designing & development, undergoing R&D activities, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,200 aluminum casting alloy-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global aluminum market.

Market Dynamics

Increase in investments in building infrastructure in countries such as the U.S., China, Japan, Mexico, and India, have led the building & construction sector to witness a significant growth where aluminum casting process is widely employed for deigning and production of both interior and exterior metallic structures, window frames, and others. Furthermore, factors such as increasing disposable income, technological upgrades, and spurring rise in original equipment manufacturers (OEMs) have led the automotive & transportation sector to witness a significant growth.

Aluminum castings are widely used in automotive sector for producing various automotive parts of different shapes. For instance, aluminum die castings are used in producing alloy wheels, body frames, pistons, engine blocks, valve covers, carburetors, fan clutches, and others. This is anticipated to fuel the growth of the aluminum casting market during the forecast period.

Moreover, the increase in government spending for manufacturing advanced aircrafts with modern armor facilities have surged the utilization of aluminum casting process for producing various aircraft components. This may act as one of the key drivers responsible for the growth of the aluminum casting market for defense sectors. Furthermore, countries such as the U.S., China, India, and others are constantly engaged in expanding their defense systems by introducing various high-tech equipment where aluminum casting is widely used for producing outer shell, fasteners, and other parts. This may propel the growth of the aluminum casting market in the defense sector.

However, aluminum casting involves several processes such as melting of metal, transferring the molten metal to mold cavity, and solidification of molten metal. These processes require a relatively large amount of heat energy. Furthermore, the overall process consists of different sophisticated equipment that are fabricated to work at high temperature application. These factors make aluminum casting an expensive process which in turn may restrain manufacturers with less investment potential to enter into aluminum casting market.

On the contrary, emerging economies such as China, India, and others are witnessing a rapid surge in demand for various consumer goods which in turn has increased the set-up of various manufacturing units. For instance, according to a report published by the China Industrial Production Index in 2023, China’s industrial production rose by 1.3% in 2022.

Aluminum castings are often considered to be the top metal of choice among manufacturing industries owing to its corrosion resistance, high strength, and low-density properties. These factors make aluminum castings best-suited for manufacturing a wide range of industrial components, outer coverings, structures, and others. Moreover, aluminum is a good conductor of heat attributed to which aluminum castings are widely used in industrial vessels. This factor may increase the demand for aluminum casting in the growing industrial manufacturing sector; thus, creating remunerative opportunities for the aluminum casting market.

Aluminum Casting Market Segments Review:

The aluminum casting market is segmented on the basis of process, end user, and region. On the basis of process, the market is categorized into die casting, sand casting, and permanent mold casting. As per end user, it is divided into transportation, industrial, building & construction, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

In 2022, the die casting segment was the largest revenue generator, and is anticipated to grow at a CAGR of 5.4% during the forecast period. Die casting is one of the aluminum casting processes where molten metal is forced under high pressure into the mold cavity. This mold cavity is made by using hardened tools steel dies that have a specific shape and size of the desired casting. Generally, die castings are made from non-ferrous metals such as zinc, magnesium, lead, and others.

They are used to manufacture a wide range of consumer, commercial, and industrial products such as automobiles, toys, electronic devices, and others. Moreover, the increasing establishment of industries in both developed and developing economies may enhance the demand for die casting for producing various instruments, measurement vessels, and other industrial machinery parts. This is anticipated to increase the adoption of die casting among the growing industrial facilities; thus, fueling the market growth.

By end user, the building and construction segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 5.9% during forecast period. The increasing population coupled with rapid urbanization have surged the demand for both residential and commercial facilities where aluminum castings are used for structural support purposes. This may act as one of the key drivers responsible for the growth of the aluminum casting market in the growing building & construction sector. Furthermore, the increasing building & construction activities based on modern theme architecture has surged the potential application of various aluminum castings for use in interior and exterior structural support applications. This may further aid the growth of the aluminum casting market during the forecast period.

The Asia-Pacific aluminum casting market size is projected to grow at the highest CAGR of 5.9% during the forecast period and accounted for 57.8% of aluminum casting market share in 2022. The rising electrical & electronics, building & construction, transportation, industrial, and other sectors have enhanced the performance of the aluminum casting market in the Asia-Pacific region. China's electronic sector is increasing rapidly which has forced the glass like carbon manufacturers to produce high-quality aluminum casting in the region. According to a report published by the United Nations Statistics Division, China witnessed around 28.7% of the global manufacturing output for consumer electronic products in 2019.

Also, countries such as India and Australia are witnessing a rapid increase in automotive & transportation sectors where aluminum castings are used to produce various automotive parts and transportation equipment. For instance, according to a report published by the Indian Ministry of Commerce and Industry, the transportation sector in India is expected to grow at a compound annual rate (CAGR) of 5.9% owing to the development of highways, widespread railway networks, aviation ports, and waterways structure. This may enhance the performance of the aluminum casting market in the Asia-Pacific region.

Which are the Leading Companies in Aluminum Casting

The global aluminum casting market profiles leading players that include Alcoa Corporation, Bodine Aluminum, BUVO Castings, Consolidated Metco, Inc., Dynacast, Rio Tinto, RusAL, RYOBI Aluminium Casting (UK) Ltd., Shandong Xinanrui Casting, and Walbro. The global aluminum casting market report provides in-depth competitive analysis as well as profiles of these major players.

What are the Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aluminum casting market analysis from 2022 to 2032 to identify the prevailing aluminum casting market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aluminum casting market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aluminum casting market trends, key players, market segments, application areas, and market growth strategies.

Aluminum Casting Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 124.9 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 464 |

| By Process |

|

| By End-user |

|

| By Region |

|

| Key Market Players | Bodine Aluminum, RYOBI Aluminium Casting (UK) Ltd., RusAL, Shandong Xinanrui Casting, Dynacast, Alcoa Corporation, Rio Tinto, Walbro, Consolidated Metco, Inc., BUVO Castings |

| Other Key Market Players | Alcast Technologies, Endurance Technologies Limited, Aluminum Corporation of China Limited |

Analyst Review

According to CXOs of leading companies, the global aluminum casting market is expected to exhibit high growth potential during the forecast period. Aluminum castings are used in a variety of end-use sectors such as automotive, electrical and electronics, defense, building and construction, and others for designing and production of various parts and equipment. Building & construction sector that requires finished metallic products of definite dimensions can be accomplished with the use of aluminum casting.??

In addition, sand casting serves as an excellent process used for maintaining the finish and dimension of equipment by using relatively less energy. Furthermore, factors such as rise in building & construction activities coupled with increasing sales of automotive vehicles has surged the popularity of aluminum casting for producing a wide range of interior and exterior metallic components. CXOs further added that sustained economic growth and development of the industrial sector have increased the popularity of aluminum casting.

Escalating demand from building & construction sector and robust demand from automotive sector are the upcoming trends of aluminum casting market in the world.

Building & construction sector is the leading application of aluminum casting market.

Asia-Pacific is the largest regional market for aluminum casting.

The aluminum casting market valued for $72.9 billion in 2022 and is estimated to reach $124.8 billion by 2032, exhibiting a CAGR of 5.6% from 2023 to 2032

Alcoa Corporation, Bodine Aluminum, BUVO Castings, Consolidated Metco, Inc., Dynacast, Rio Tinto, RusAL, RYOBI Aluminium Casting (UK) Ltd., Shandong Xinanrui Casting, and Walbro are the top companies that hold prominent share in aluminum casting market.

Loading Table Of Content...

Loading Research Methodology...