Bio Succinic Acid Market Size & Insights:

The global bio succinic acid market size was valued at $126.80 million in 2020, and is projected to reach $235.02 million by 2030, growing at a CAGR of 6.41% from 2021 to 2030.

The bio succinic acid market is segmented into End Use and Region.

Succinic acid is a chemical used directly in various industrial applications as an intermediate for the production of several polymers and resins. Conventionally, it was produced form crude oil and natural gas; however, owing to the decrease in the fossil fuel resources and its negative impact on the environment during extraction have led to stringent regulations of the government. In addition, decline in the demand for the products made from non-green materials and increase in awareness among the consumers has led to the increase in the investment of the manufacturers to discover green raw material source to extract succinic acid.

The surge in the demand for bio succinic acid is due to volatility in fossil fuel prices, rise in carbon footprints, and more usage of locally available raw materials. Furthermore, increasing global demand of green chemicals is expected to trigger its adoption in wide range of applications, especially, in bio plastics, making it a strong platform chemical. In addition, higher cost of crude oil, increase in investments for green chemicals, demand for renewable chemicals, and surge in government support are further anticipated to boost the growth of the market. However, higher price of bio succinic acid and lengthy extraction processes restrain the market growth. The production of succinic acid involves the application of many other chemicals. As a result, it has a negative effect on the surroundings and the environment at large. This led to the rise in demand for substitutes for the acid. One such substitute is bio-succinic acid. The production of bio-succinic acid helps in reducing climate change. Bio succinic acid replaces the utilization of petrochemicals in the production of various commercial and industrial products and ensures a clean environment through the usage of waste streams as it is perfectly decomposable. Bio-succinic acid is looked upon as a perfect substitute for many chemicals that may damage the environment.

Segment Overview

The bio succinic acid market is segmented on the basis of end use and region.

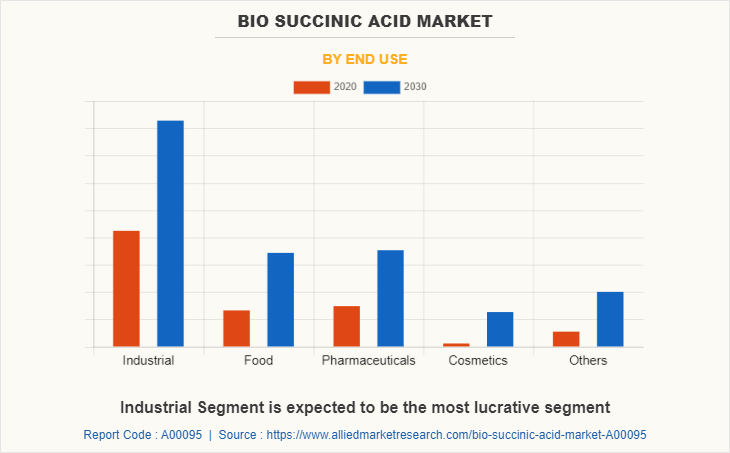

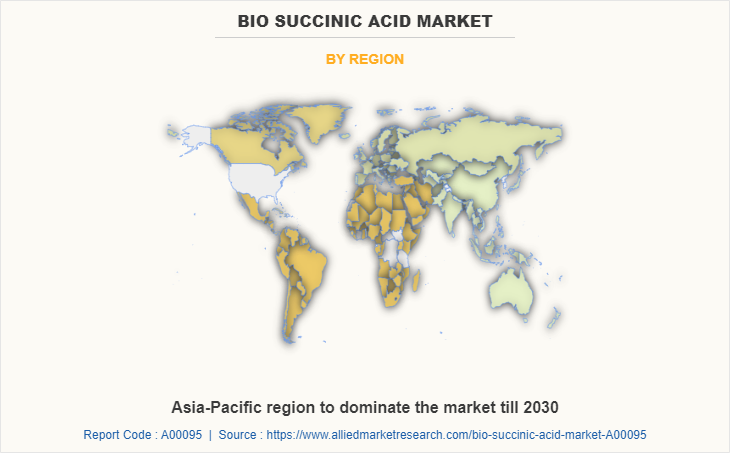

By end use, the global bio succinic acid market is segmented into industrial, food, pharmaceuticals, cosmetics and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region accounted for the largest market share of the total revenue in 2020, followed by North America and Europe. The high adoption of eco-friendly products in the region would continue to boost the market, due to the presence of huge industrial infrastructure with complete conditions have created opportunities for the market growth.

Bio Succinic Acid Market By End Use

The industrial application segment dominates the global bio succinic acid market.This segment held more than 40% of total market revenue in 2021, owing to the growing demand for the products in the process of production of polyurethane, tetrahydrofuran, and Polybutylene and many other products. Bio succinic acid is widely used in various industrial applications as a raw material to produce products such as adhesives, solvents, sealants, resins, coatings, and plastics. The rapid urbanization has led to increase in the demand for the bio succinic acid in wide range of industries. The increase in its utilization in the industrial area in the production of various products has augmented the market growth in the coming years.

Bio Succinic Acid Market Region

Asia-Pacific occupies the largest market revenue share of the bio succinic acids market. Asia-Pacific region has huge demand for the dyes & inks due to the presence of textile industries. The key factors escalating the demand for the bio succinic acid is mostly due to its eco-friendly nature, alongside with rising prevalence of allergic or adverse reactions to synthetic dyes. The presence of low fossil fuel resources in this region is another major factor for adopting the organic resources to manufacture bio-succinic acid for various commercial and industrial manufacturing purposes. The increase in the awareness among the people regarding the advantages of the utilization of bio-succinic acid instead of conventional compounds has created positive impact on the demand for various organic products. Hence, many manufacturers are exploring the use of sustainable dyes manufactured from bio-succinic acid in order to decrease their ecological impact. The above mentioned factors will provide lucrative opportunities for the bio-succinic acid market growth.

Competitive Analysis

The key players operating in the global bio succinic acid market are BioAmber, Myraint, DSM, Mitsui & Co, Mitsubishi Coporation, BASF SE, RoquetteFrerse S.A, Purac, Kawasaki Kasei chemicals, and Reverdia. Other players in the value chain (not profiled in the report) include Cargill Incorporated, Nippon shokubai, The Dow Chemical Company, and others, etc., are competing for the share of the market through product launch, joint venture, partnership, and expanding the production capabilities to meet the future demand for the bio succinic acid market in the forecast period.The market for bio-succinic acid is highly competitive due to the presence of a number of multinationals that are engaged in various production, research, and development activities constantly. The market has a variety of products that are in demand and their demand is expected to grow exponentially.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bio succinic acid market analysis from 2020 to 2030 to identify the prevailing bio succinic acid market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bio succinic acid market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bio succinic acid market trends, key players, market segments, application areas, and market growth strategies.

Bio Succinic Acid Market Report Highlights

| Aspects | Details |

| By End Use |

|

| By Region |

|

| Key Market Players | Bio Amber, Roquette Freres S.A., Myriant, Reverdia, Kawasaki Kasei chemicals, DSM, Mitsubishi Chemical Holdings, Mitsui Chemicals, BASF SE, Purac |

Analyst Review

Global demand for green chemical has obtained a further boost with the invention of bio-based succinic acid via means of fermentation process. The report is completely focused on bio-succinic acid (excludes petrol-based succinic acid) and its utility with respect to present utility along with solvent & lubricants, resins, coatings & pigments, de-icers, food, cosmetics, and pharmaceuticals. In addition, this report makes a detailed analysis of more recent utility applications of bio succinic acid, namely, BDO, PBS, plasticizers, polyurethanes, and alkyd resin.

Petroleum based chemical compounds and other chemical compounds such as maleic anhydride, adipic acid, phthalic anhydride are being replaced with bio based succinic acid. For instance conventional Butanediol is manufactured using petroleum based chemicals such as maleic anhydride, however bio succinic acid act as a powerful replacement due to its ease of availability and low cost.The increase in the massive transformation in chemical industry to replace conventional non-renewable materials with renewable and eco-friendly materials has positive impact on the market. The above mentioned developments and the advantages of the bio succinic acid provide lucrative possibilities for the growth in bio succinic acid market.

Asia-Pacific dominates the global bio based succinic acid market and is predicted to grow at a rapid rate. The presence of countries like China, India, Thailand, and Korea in Asia-Pacific region where industries are developing at a rapid pace will breed the demand for the bio succinic acid. Bio succinic acid is a key raw material which enables in production of more than 30 compounds that are utilized in commercial and industrial purposes. The increase in the stringent environmental regulations of the utilization of petroleum chemical products to make products and the rapid fluctuations in the price of crude oil have huge burden on the financial system of industries. The presence of above mentioned factors has created wide opportunity for the development of bio succinic acid market during the forecast period.

Increase in addressable market and Increase in investments for green chemicals are the key factors boosting the Bio Succinic Acid Market growth

The market value of Bio Succinic Acid in 2030 is expected to be US$ 235.02 Million

BioAmber, Myraint, DSM, Mitsui & Co, Mitsubishi Corporation, BASF SE, RoquetteFrerse S.A, Purac, Kawasaki Kasei chemicals, and Reverdia.

Food and beverage industry is projected to increase the demand for Bio Succinic Acid Market

The bio succinic acid market is segmented on the basis of end use and region. By end use, the global bio succinic acid market is segmented into industrial, food, pharmaceuticals, cosmetics and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Demand for renewable chemicals is the Main Driver of Bio Succinic Acid Market

Industrial applications are expected to drive the adoption of Bio Succinic Acid

Economic slowdown and strict lockdown further hampered the growth of the bio-succinic acid market. In addition, supply chain disruptions and unavailability of raw materials altered the growth outlook of the entire bio-succinic acid industry. Thus, this global health emergency has negatively impacted the global bio-succinic acid market.

Loading Table Of Content...