Petrochemicals Market Research, 2034

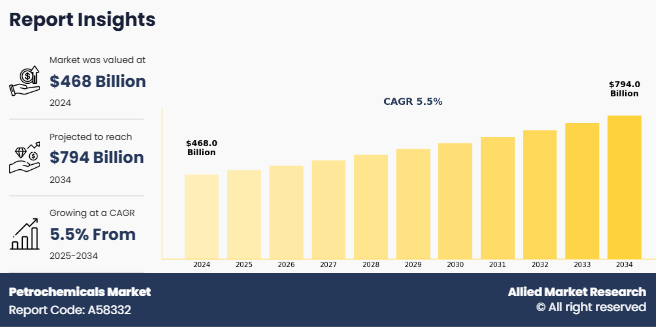

The global petrochemicals market was valued at $468.0 billion in 2024, and is projected to reach $794.0 billion by 2034, growing at a CAGR of 5.5% from 2025 to 2034. The demand for the petrochemicals market is driven by the rising consumption of plastics, synthetic fibers, and resins across diverse industries such as packaging, automotive, construction, electronics, and healthcare. Rapid industrialization and urbanization, particularly in emerging economies, are fueling the need for petrochemical-derived products used in infrastructure development, consumer goods, and mobility solutions. As a result, there is drive the demand for petrochemicals market in forecast period.

Introduction

Petrochemicals are chemical compounds derived primarily from petroleum and natural gas. These substances serve as the building blocks for a vast array of industrial and consumer products, such as plastics, synthetic rubber, fertilizers, detergents, solvents, and pharmaceuticals. Petrochemicals are typically classified into two main categories olefins such as ethylene and propylene and aromatics (such as benzene, toluene, and xylene), which are used in the production of polymers, resins, and synthetic fibers. The petrochemical industry plays a crucial role in modern economies, supporting various sectors, such as automotive, construction, packaging, and textiles.

Key Takeaways

The global petrochemicals market has been analyzed in terms of value ($billion). The analysis in the report is provided on the basis of type, product type, application, 4 major regions, and more than 15 countries.

The global petrochemicals market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

The Key players in the petrochemicals market include BASF SE, ExxonMobil Corporation, SABIC, Dow Inc, Mitsubishi Chemical Holdings Corporation, Linde plc, Air Liquide S.A., LyondellBasell Industries Holdings B.V., Chevron Corporation, Shell Plc.

The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

Countries such as China, the U.S., Canada, Germany, and Brazil hold a significant share in the global petrochemicals market.

Market Dynamics

The expanding chemical and fertilizer industry is a major driver of demand in the petrochemical market, as petrochemicals serve as essential raw materials for the production of a wide range of chemicals, fertilizers, and agrochemicals. The increasing global population and the need for higher agricultural productivity have led to a surge in fertilizer consumption, particularly nitrogen-based fertilizers such as ammonia and urea, which are derived from petrochemical feedstocks such as natural gas and naphtha. The rising demand for specialty chemicals, including pesticides, herbicides, and growth enhancers, further strengthens the need for petrochemical-based intermediates, contributing to the overall market growth.

In addition, the growth of the industrial and consumer chemical sectors such as detergents, solvents, adhesives, and coatings, continues to fuel the expansion of petrochemical production. The shift toward high-performance materials in industries such as automotive, construction, and packaging has also increased the demand for petrochemical-derived polymers and synthetic resins. Governments and private players worldwide are investing in large-scale chemical and fertilizer manufacturing facilities, particularly in regions such as Asia-Pacific and the Middle East, where abundant feedstock availability and favorable economic policies drive industry growth. All these factors are expected to drive the demand for the petrochemicals market during the forecast period.

However, volatility in crude oil and natural gas prices poses a significant challenge to the growth of the petrochemical market, as these raw materials serve as the primary feedstocks for petrochemical production. Fluctuations in oil and gas prices, driven by geopolitical tensions, supply chain disruptions, and changes in global energy policies, directly impact production costs and profit margins for petrochemical manufacturers. When feedstock prices rise sharply, petrochemical producers face increased operational expenses, which can lead to higher product prices and reduced demand from end-use industries such as automotive, packaging, and construction. Conversely, periods of low crude oil and natural gas prices create uncertainty in investment planning, delaying capacity expansions and technological advancements in the sector.

Moreover, the transition toward renewable energy sources and sustainability initiatives further adds to price instability, as governments and industries explore alternatives to fossil fuel-based petrochemicals. This volatility discourages long-term investments in petrochemical infrastructure and research, potentially slowing market growth. To mitigate these challenges, companies are increasingly diversifying their feedstock sources, investing in bio-based and circular economy solutions, and adopting advanced process technologies to enhance efficiency and reduce dependency on traditional hydrocarbons. All these factors are expected to hamper the petrochemicals market growth.

Advancements in catalytic cracking and process technologies are creating significant opportunities for the petrochemical market by improving efficiency, yield, and sustainability in petrochemical production. Catalytic cracking, particularly fluid catalytic cracking (FCC) and hydrocracking, plays a crucial role in breaking down heavy hydrocarbons into valuable petrochemical feedstocks such as ethylene, propylene, and aromatics. Innovations in catalyst design, including zeolite-based and nanostructured catalysts, have enhanced conversion rates, reduced energy consumption, and minimized unwanted byproducts, making production more cost-effective and environmentally friendly. These advancements allow petrochemical manufacturers to maximize output from crude oil and natural gas while optimizing resource utilization.

Furthermore, the integration of advanced process technologies such as digitalization, automation, and artificial intelligence (AI) in petrochemical refining is driving operational efficiencies and reducing downtime. Techniques like steam cracking, olefin metathesis, and gas-to-liquid (GTL) conversion are further expanding the range of petrochemical products that are derived from diverse feedstocks. These innovations are particularly crucial as the industry shifts towards more sustainable solutions, including bio-based and circular economy approaches. As demand for high-performance polymers, specialty chemicals, and lightweight materials continues to grow across industries such as automotive, construction, and packaging, advancements in catalytic cracking and process technologies are unlocking new growth avenues, attracting investments, and reinforcing the long-term expansion of the petrochemical market. All these factors are anticipated to offer new growth opportunities for the petrochemical market during the forecast period.

Segments Overview

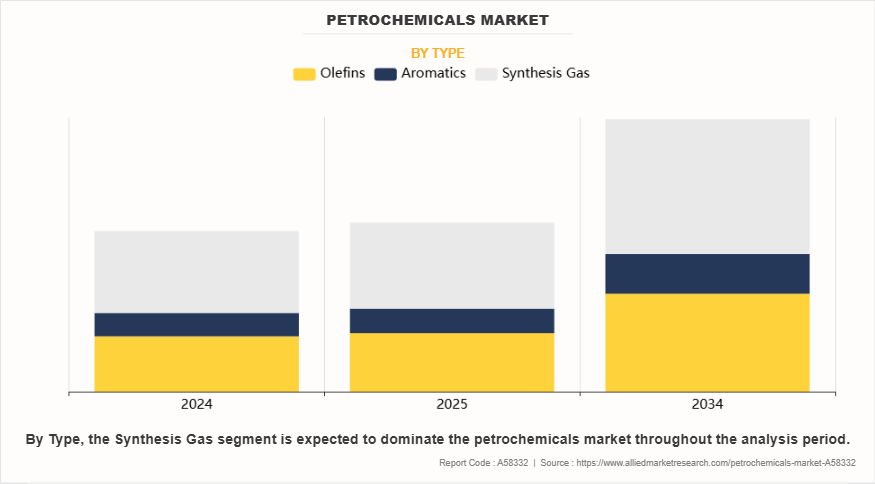

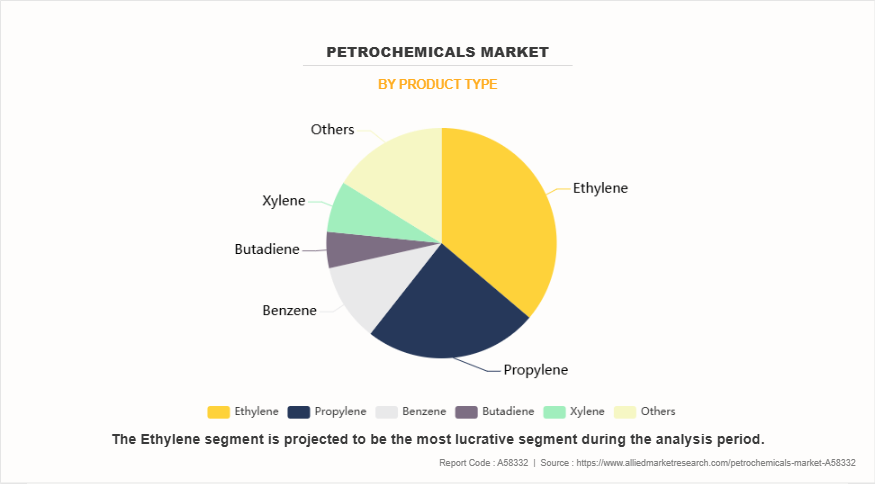

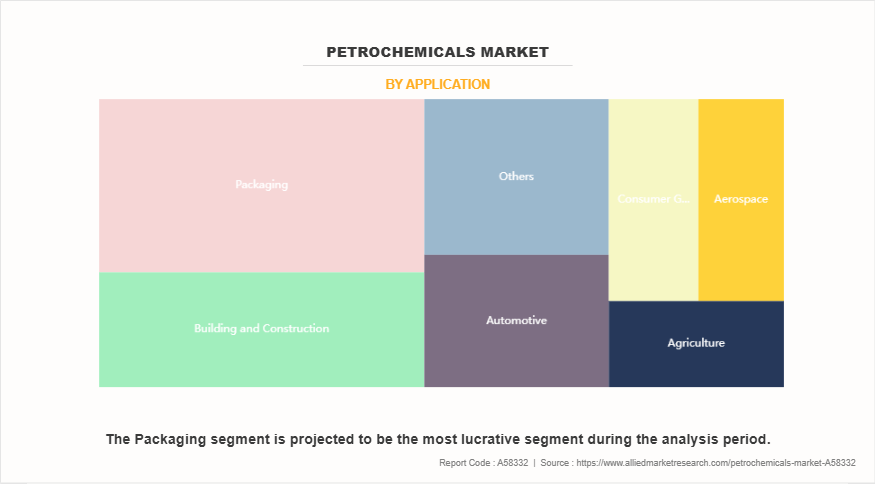

The petrochemicals market is segmented into type, product type, application, and region. On the basis of type, market is divided into olefins, aromatics, synthesis gas. On the basis of product type, the market is segmented into ethylene, propylene, benzene, butadiene, xylene, and others. On the basis of application, the market is classified into aerospace, agriculture, automotive, building & construction, consumer & industrial goods, packaging, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the market is divided into olefins, aromatics, synthesis gas. The olefins segment accounted for half of the petrochemicals market share in 2023 and is expected to maintain its dominance during the forecast period. Olefins segment is expected to maintain its leading position throughout the forecast period, driven by ongoing industrialization, growth in the packaging and automotive sectors, and increased consumption of consumer goods in emerging economies.

On the basis of product type, the market is segmented into ethylene, propylene, benzene, butadiene, xylene, and others. The ethylene segment accounted for more than one-third of the petrochemicals market share in 2023 and is expected to maintain its dominance during the forecast period. The ethylene segment is projected to maintain its dominance during the forecast period, supported by robust demand from end-use industries, rapid urbanization, and the expansion of manufacturing activities, particularly in emerging markets.

On the basis of application, te market is classified into aerospace, agriculture, automotive, building & construction, consumer & industrial goods, packaging, and others. The packaging segment accounted for more than one-fourth of the petrochemicals market share in 2023 and is expected to maintain its dominance during the forecast period. This dominance is largely driven by the widespread use of petrochemical-derived plastics and polymers in flexible and rigid packaging solutions across food and beverage, healthcare, and consumer goods sectors.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region accounted for half of the petrochemicals market share in 2023 and is expected to maintain its dominance during the forecast period.

Competitive Analysis

Key players in the petrochemical market includes BASF SE, ExxonMobil Corporation, SABIC, Dow Inc, Mitsubishi Chemical Holdings Corporation, Linde plc, Air Liquide S.A., LyondellBasell Industries Holdings B.V., Chevron Corporation, Shell Plc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the petrochemicals market analysis from 2024 to 2034 to identify the prevailing petrochemicals market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the petrochemicals market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global petrochemicals market trends, key players, market segments, application areas, and market growth strategies.

Petrochemicals Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 794 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 450 |

| By Type |

|

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Linde PLC, Dow Inc, Exxon Mobil Corporation, BASF SE, Mitsubishi Chemical Group Corporation., LyondellBasell Industries Holdings B.V., Chevron Corporation, Shell plc, PetroChina Company Limited, SABIC |

Analyst Review

According to the opinions of various CXOs of leading companies, the petrochemicals market is expected to witness an increase in demand during the forecast period. The rise in adoption of advanced process technologies and the increasing focus on sustainability are expected to drive growth in the petrochemical sector. Petrochemical processes are becoming more efficient with innovations in catalytic cracking, feedstock optimization, and recycling technologies, making them integral to sustainable manufacturing strategies. As industries focus on improving resource utilization and reducing production costs, these advancements provide an opportunity to enhance operational efficiency while minimizing environmental impact. This demand is particularly evident in sectors such as automotive, construction, packaging, and consumer goods, where petrochemical-based materials play a critical role in production.

Moreover, the growing emphasis on sustainability and circular economy principles is a key driver for the adoption of advanced petrochemical technologies. As industries across the globe aim to reduce their carbon footprint and transition toward greener alternatives, bio-based and recycled petrochemical products offer a promising solution. Innovations such as chemical recycling, carbon capture utilization, and bio-feedstocks enable petrochemical manufacturers to produce high-performance materials with reduced reliance on fossil fuels. Industries seeking to align with global sustainability goals are increasingly investing in eco-friendly petrochemical solutions to replace or supplement traditional production methods, achieving higher efficiency while reducing greenhouse gas emissions

Rising use of petrochemicals in pharmaceuticals and healthcare products and expanding chemical and fertilizer industry are the upcoming trends of petrochemicals market

Packaging is the leading application of petrochemicals market

Asia-Pacific is the largest regional market for petrochemicals.

The petrochemicals market was valued at $468.0 billion in 2024 and is estimated to reach $794.0 billion by 2034, exhibiting a CAGR of 5.5% from 2025 to 2034 is the estimated industry size of Petrochemicals.

BASF SE, ExxonMobil Corporation, SABIC, Dow Inc, Mitsubishi Chemical Holdings Corporation, Linde plc, Air Liquide S.A., LyondellBasell Industries Holdings B.V., Chevron Corporation, Shell Plc are the top companies to hold the market share in Petrochemicals.

Loading Table Of Content...

Loading Research Methodology...