Agritech Market Research, 2034

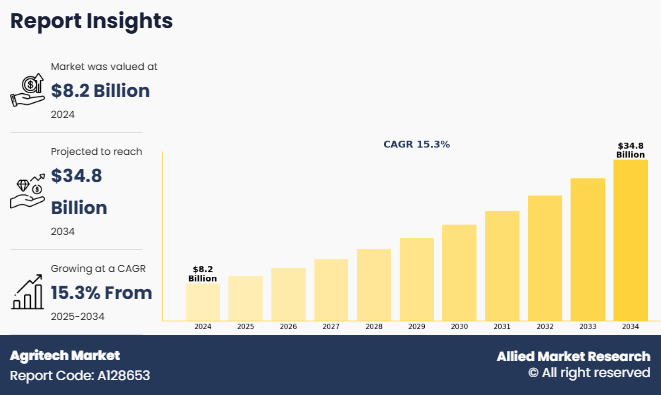

The global agritech market size was valued at $8,150.15 million in 2024, and is projected to reach $34,831.17 million by 2034, growing at a CAGR of 15.3% from 2025 to 2034. Agritech, also known as agricultural technology, refers to the application of modern technology and innovation to enhance the efficiency, productivity, and sustainability of agricultural practices. It involves the use of tools such as artificial intelligence, robotics, drones, sensors, biotechnology, and data analytics to improve various aspects of farming, from crop monitoring and soil analysis to irrigation and harvesting. Agritech aims to address challenges such as food security, climate change, and resource management by making farming more precise, cost-effective, and environmentally friendly. By integrating technology into agriculture, farmers can make better decisions, increase yields, reduce waste, and contribute to a more sustainable food system.

Key Takeaways:

By Component, the hardware segment held the largest share in the agritech market for 2024.

By Application, the precision farming and farm management segment held the largest share in the agritech market for 2024

By Technology, the automation and robotics segment held the largest share in the agritech market for 2024.

Region-wise, North America held the largest market share in 2024. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

The agritech market growth is significantly influenced by factors such as rising emphasis on food productivity and rising global population. In addition, governments support and favorable policies for agritech are expected to fuel the growth of the agritech market size during the forecast period. Furthermore, surge in the adoption of automation & robotics for agricultural activities such as planting, harvesting, and crop monitoring is expected to enhance efficiency and drive innovation in the sector, providing lucrative growth opportunities during the agritech market forecast period. Moreover, advancements in data analytics, artificial intelligence, and IoT are enabling real-time decision-making, further transforming traditional farming practices and supporting the evolution of smart agriculture, leading to a surge in agritech market demand during the forecast period.

Segment Review

The agritech market is segmented into component, application, technology, and region. On the basis of component, the market is classified into hardware, software, and service. By application, it is segregated into precision farming and farm management, livestock monitoring, quality management, and others. On the basis of technology, the market is classified into AI, IoT, automation and robotics, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the hardware segment dominated the agritech market share in 2024 and is expected to maintain its dominance in the upcoming years, owing to rise in demand for precision farming equipment, IoT-enabled devices, and automation solutions in agriculture. In addition, there is growing emphasis on sustainable farming practices and government subsidies for smart agriculture tools, accelerating the adoption of hardware solutions. However, the service segment is expected to experience the highest growth during the forecast period. This segment is experiencing increasing demand for data analytics, AI-driven farm management solutions, and maintenance/consulting services, as farmers seek to optimize productivity through digital transformation.

Region wise, North America dominated the market share in 2024, owing to increase in adoption of advanced technologies such as AI, robotics, and precision farming tools, along with strong government support and high investment in R&D. However, LAMEA is expected to experience the fastest growth during the forecast period, owing to increase in need for food security, climate-resilient farming solutions, and government initiatives promoting digital agriculture, which is expected to provide lucrative growth opportunities for the market in this region.

Competition Analysis

The report analyzes the profiles of key players operating in the agritech industry are Syngenta AG, Indigo Ag, Pivot Bio, ninjacart, Agreena ApS, CropX, Zuari FarmHub Limited, ARSR Tech, Crofarm Agriproducts Pvt Ltd., LettUs Grow, Ceres Imaging, Hortau Technologies Inc., Farmers Business Network, John Deere, AGCO Corporation., Microsoft Corporation, AgEagle Aerial Systems Inc., CNH Industrial N.V., topcon positioning systems, and BrioAgro Tech, S.L.

Recent Developments in the Agritech Market

In February 2024, Syngenta partnered with Lavie Bio to discover and develop novel bio-insecticides. This collaboration aimed to leverage Lavie Bio's unique technology platform to rapidly identify and optimize bio-insecticide candidates, while utilizing Syngenta's extensive global research, development, and commercialization capabilities. The goal is to address the significant challenge posed by insect pests to crop health, which costs the global economy an estimated $70 billion annually.

In September 2024, Indigo Ag launched the CLIPS device (Closed Loop Integrated Powder System), an innovative, hands-free system designed to revolutionize the biological seed treatment process. This device allows for the automatic application of dry powder formulations directly from bulk seed box containers, simplifying the process and reducing the need for manual intervention. The CLIPS™ device can be attached up to 24 months before use, releasing the biological products as seeds are planted, which enhances efficiency and consistency.

In January 2025, Pivot Bio partnered with MFA Incorporated, a leading Midwest-based farm supply and marketing cooperative. This collaboration aims to engage progressive corn farmers across Missouri and neighboring states with Pivot Bio's patented crop nutrition technology, specifically their PROVEN® 40 product. This partnership leverages MFA's extensive network and expertise to bring innovative nitrogen solutions to farmers, enhancing crop yields and sustainability.

Top Impacting Factors

Driver

Rise in emphasis on food productivity

Increase in emphasis on food productivity is a significant driver for the growth of the agritech market. Rise in global population, climate change, and less availability of farmland are driving increased emphasis on food productivity. In addition, surge in global food demand has led agricultural stakeholders to face immense pressure to produce more food with fewer resources. This challenge is driving innovation in agricultural technologies, resulting in surge of investments and adoption of solutions that enhance productivity, efficiency, and sustainability. Furthermore, upsurge in agritech companies utilizing precision farming, AI-driven analytics, Internet of Things (IoT) sensors, and biotechnology is transforming the way food is grown, harvested, and distributed, contributing to market expansion.

Moreover, increase in adoption of vertical farming and hydroponics is gaining traction in urban areas, offering year-round crop production in controlled environments. These innovations contribute significantly to increasing food production without the need to expand farmland, which is important as urban areas grow and environmental concerns intensify. In addition, governments and private investors are acknowledging the potential of agritech and are channeling resources into research and development, regulatory support, and pilot projects, supporting agritehc market growth. For instance, in December 2024, The EMBL Agri-Tech Partnership aimed to address global food security challenges through optimized agricultural research and data-driven innovation. This collaboration involves key industry players such as Bayer, Syngenta, and Unilever, focusing on developing climate-resilient crops and environmentally friendly pest and disease control strategies. By leveraging advanced technologies such as AI, ML, and remote sensing, the partnership seeks to create sustainable agricultural practices that ensure safe food production and environmental health. This partnership is expected to accelerate the adoption of precision agriculture techniques, enhance collaborative research across international borders, and deliver scalable solutions, thus driving the growth of the market.

Restraints

High initial investment

The major challenge for the growth of the agritech industry is the high initial investment required to develop, implement, and scale advanced agricultural technologies. Agritech solutions often require extensive research, development, and testing. For instance, creating precision farming tools or advanced biotech crops requires years of innovation and regulatory approvals. This can be costly, requiring significant upfront investment in R&D. In addition, many agritech solutions, such as automated machinery, drones, or IoT-based systems, require specialized infrastructure to function properly. This may involve setting up technology platforms, building data storage capabilities, or installing advanced sensors across large farm areas. Furthermore, equipment like drones, automated harvesters, and advanced irrigation systems can be very expensive. For small and medium-sized farms, purchasing these items might be a significant barrier, limiting the adoption of agritech solutions. In addition, sensors, machines, and software platforms require regular maintenance, updates, and repairs, which adds to the total cost. Moreover, implementation of new technology requires skilled personnel who can operate, manage, and troubleshoot complex systems. Training employees or hiring experts adds extra costs. This might be a challenge for smaller agricultural enterprises with limited resources. In addition, new agritech startups face significant challenges in entering the market due to the need for substantial capital to compete with established companies. Securing funding or partnerships for product development can also be difficult, potentially limiting their market entry. To address these challenges, agritech companies should develop strategies that increase value by offering more benefits, such as cost-effective solutions, enhanced productivity, and sustainability.

Opportunity

Adoption of automation and robotics

Increase in adoption of automation and robotics presents a significant opportunity for the agritech market to grow, as these technologies enhance efficiency, reduce labor dependency, and improve precision in farming operations. Increase in shortage of agriculture workers has led to surge in adoption of automated systems such as robotic harvesters, drones, and autonomous tractors, allowing for continuous operations and reducing dependency on manual labor. In addition, automation improves precision in farming practices. Technologies such as AI-driven sensors and satellite-guided equipment enable farmers to monitor soil health, apply fertilizers accurately, and manage irrigation efficiently leading to higher yields and reduced input costs. Furthermore, real-time data collection and analytics enhance decision-making, enabling proactive responses to weather changes, pest outbreaks, or crop diseases.

Moreover, robotic systems promote sustainable farming by enabling precise application of fertilizers and pesticides, reducing chemical usage and environmental impact. The integration of robotics further enhances scalability, allowing large-scale operations to manage vast farmlands more effectively. For instance, in March 2025, Carbon Robotics launched the Carbon AutoTractor, the first and only tractor autonomy solution with real-time remote supervision and control. This system, installed on existing tractors, is monitored by Carbon Robotics operators who can intervene immediately if needed. The Carbon AutoTractor aims to eliminate stoppages, operate 24/7, and increase efficiency, helping farmers boost productivity, reduce labor dependency, and scale operations. This is expected to improve field management by enabling consistent performance without the limitations of human labor or downtime. By operating continuously and autonomously, the Carbon AutoTractor maximizes equipment utilization and ensures timely execution of critical farming activities, such as planting and cultivation, which in turn, fuels the growth of the market.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the agritech market analysis from 2024 to 2034 to identify the prevailing agritech market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the agritech market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global agritech market trends, key players, market segments, application areas, and market growth strategies.

Agritech Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 34.8 billion |

| Growth Rate | CAGR of 15.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 255 |

| By Component |

|

| By Application |

|

| By Technology |

|

| By Region |

|

| Key Market Players | LettUs Grow, Farmers Business Network, Inc., Ninjacart Pvt. ltd., Microsoft Corporation, Crofarm Agriproducts Pvt Ltd., Agreena ApS, Zuari FarmHub Limited, John Deere, Pivot Bio, AgEagle Aerial Systems Inc., Ceres Imaging, ARSR Tech, CNH Industrial N.V., BrioAgro Tech, S.L., Indigo Ag, CropX, AGCO Corporation, Topcon Positioning Systems, Inc., Hortau Technologies Inc., Syngenta AG |

Analyst Review

The agritech market is experiencing significant growth, driven by rise in demand for sustainable farming solutions and rapid adoption of digital technologies in agriculture. With global emphasis on enhancing food security and improving crop yields, agritech innovations offer effective tools to optimize farming practices, reduce resource wastage, and increase productivity. Technologies such as precision farming, AI-powered analytics, IoT-based monitoring systems, and drone surveillance are transforming traditional agricultural methods. In addition, rise of climate-smart agriculture, government support, and growing investments from venture capital and corporates are accelerating the integration of agritech across both developed and developing regions. This ongoing technological advancement is expected to further fuel the market growth in the coming years.

Furthermore, technological advancements in precision agriculture, IoT-enabled devices, and AI-driven analytics are significantly propelling the growth of the agritech market. Advanced agritech solutions now offer enhanced features such as real-time crop monitoring, predictive yield modeling, automated irrigation systems, and integration with mobile platforms, allowing farmers to optimize operations efficiently and sustainably. Rise of agritech startups, coupled with growing collaboration between agricultural cooperatives, technology providers, and financial institutions, presents numerous opportunities for stakeholders to tap into the expanding agritech market.

Moreover, government policies and regulations aimed at promoting agricultural innovation and sustainability are significantly driving the growth of the agritech market. In many regions, governments are actively supporting the adoption of agritech solutions to enhance food security, improve farm productivity, and build climate resilience among smallholder farmers. Initiatives such as grants, subsidies, and tax incentives for agritech startups and farmers adopting smart farming technologies are accelerating market expansion. However, challenges persist, particularly in areas such as regulatory compliance, data security, and lack of clear and consistent technology standards. Protecting farmers' personal and farm data, along with ensuring fair and affordable access to digital tools, remains a major concern in the industry. The agritech market is expected to continue growing, as more farmers and agribusinesses look for affordable, tech-driven solutions, particularly in emerging markets where agricultural innovation is still developing.

The agritech market is expected to witness notable growth due to a rise in emphasis on food productivity and an increase in the demand for sustainable agriculture.

The agritech market is projected to reach $34,831.17 million by 2034.

The agritech market is estimated to grow at a CAGR of 15.3% from 2025 to 2034.

The key players profiled in the report include Syngenta AG, Indigo Ag, Pivot Bio, ninjacart, Agreena ApS, CropX, Zuari FarmHub Limited, ARSR Tech, Crofarm Agriproducts Pvt Ltd., LettUs Grow, Ceres Imaging, Hortau Technologies Inc., Farmers Business Network, John Deere, AGCO Corporation., Microsoft Corporation, AgEagle Aerial Systems Inc., CNH Industrial N.V., topcon positioning systems, and BrioAgro Tech, S.L.

The key growth strategies of agritech market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...