Ambulatory Blood Pressure Monitoring (ABPM) Devices Market Research, 2031

The global ambulatory blood pressure monitoring devices market size was valued at $160.8 million in 2021, and is projected to reach $309.3 million by 2031, growing at a CAGR of 6.7% from 2022 to 2031.

Ambulatory blood pressure monitoring is a diagnostic test which is used to determine the presence of hypertension by taking measurements during daily activities. These devices are available in two types such as arm ABPM devices and Wrist ABPM devices. Ambulatory blood pressure monitor is a non-invasive device which includes a special blood pressure cuff attached to a small monitor that an individual can wear for 24 hours. The wrist ABPM is used as a portable blood pressure machine which is worn as a belt, with the cuff being attached around the upper arm. Ambulatory blood pressure monitor can also detect the reverse condition, masked hypertension where the patient has normal blood pressure during the examination, however, it is uncontrolled at home.

Growth of the global ABPM devices market size is majorly driven by rise in prevalence of white coat hypertension cases, and high blood pressure condition in individuals increase demand for ambulatory blood pressure monitor and development of new blood pressure monitor by large number of key players. According to World Health Organization, in 2021, approximately 1.28 billion adults aged between 30-79 years were estimated to suffer from hypertension worldwide. Thus, rise in burden of hypertension cases increases the demand for ambulatory blood pressure monitoring devices, which is anticipated to foster the growth of the ambulatory blood pressure monitoring devices market. Furthermore, rise in geriatric population, and increase in the number of hypertension cases leads to increase demand for the portable monitoring devices are the factors that fuel the ambulatory blood pressure monitoring devices market growth. Furthermore, technological innovations in ambulatory blood pressure monitoring devices are expected to fuel the demand for global ABPM devices industry.

In addition, Numed healthcare a supplier of medical products provides ambulatory blood pressure monitoring devices such as IEM Mobil-O-Graph a 24 hour ambulatory blood pressure monitoring device, and Microlife WatchBP O3 ambulatory blood pressure Monitor. Thus, presence of large number of key players which provide ambulatory blood pressure monitoring devices drives the growth of the ambulatory blood pressure monitoring devices market. Also, the initiatives taken by government of various countries by creating awareness among people boost the growth of the market. For instance, in February 2019, the Integrated Health Model initiative was funded by American Medical Association launched a data management model to offer opportunities for improving health outcomes. Thus, this aforementioned factor drives the market growth.

The COVID-19 outbreak had a positive impact on the growth of the global ABPM devices market. The COVID-19 pandemic has significantly increased the demand for remote monitoring solutions for both in hospital and homecare settings. To check hypoxia during COVID-19, monitoring blood pressure level was crucial for infected and susceptible patients. Thus, rise in usage of ambulatory blood pressure for patient monitoring escalated the demand for ambulatory blood pressure monitoring devices and is also expected to show perpetual growth during the forecast period.

The ambulatory blood pressure monitoring (abpm) devices market is segmented into Product and End User. By product type, the market is categorized into arm ABPM devices and wrist ABPM devices. On the basis of end user the market is divided into hospitals, ambulatory surgical centers, and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and Rest of LAMEA).

Segment Review

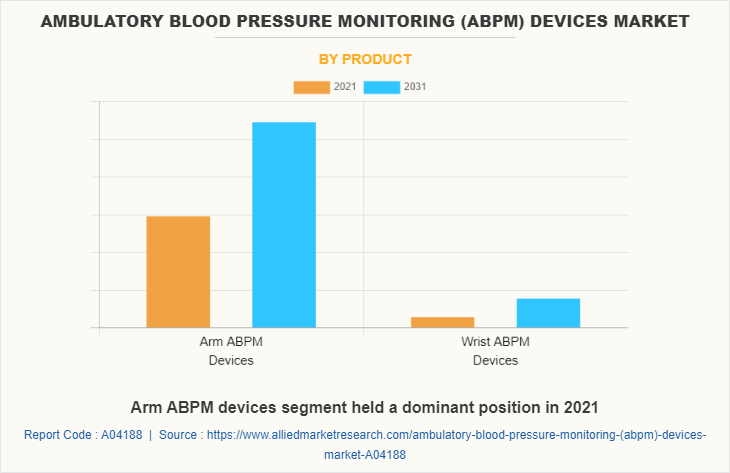

By Product

Depending on product, the arm ABPM devices segment dominated the market in 2021, and this trend is expected to continue during the forecast period owing to rise in demand and adoption of arm ABPM devices during the COVID-19 pandemic for continuous patient monitoring. However, the wrist ABPM devices segment is expected to witness fastest growth during the forecast period, owing to its highly accurate readings, long-time durability, and reduction in difficulties associated with overnight blood pressure studies. In addition, wrist ambulatory blood pressure monitoring devices allow patients to measure blood pressure level without restricting their wrist movement.

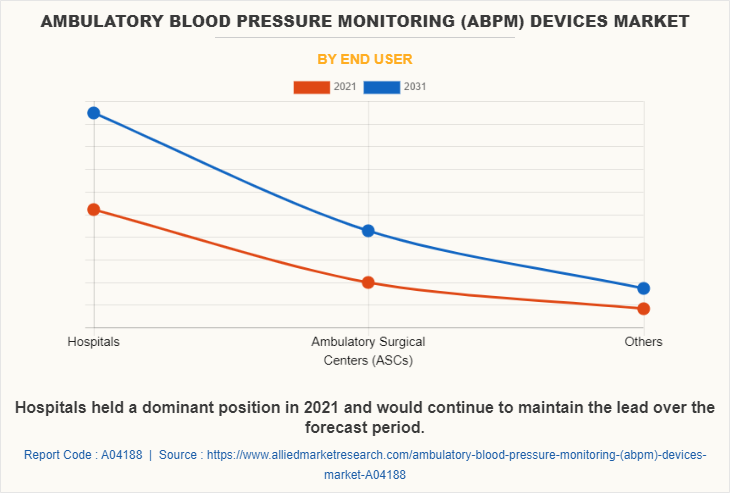

By End User

Depending on end user, the hospitals segment dominated the market in 2021, and this trend is expected to continue during the forecast period. The dominance is due to rise in number of surgeries and emergency room visits. However, the ambulatory surgical centers segment is expected to witness considerable growth during the forecast period, owing to rise in number of various types of surgeries led to increase demand for ambulatory blood pressure monitoring devices.

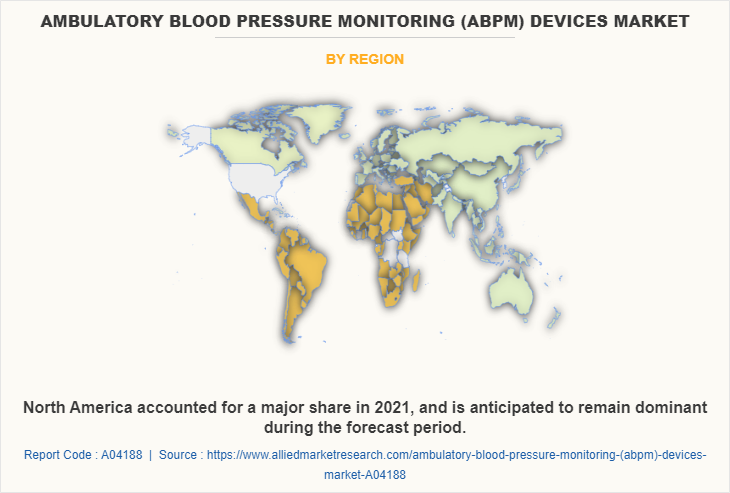

By Region

Region wise, North America garnered the major ambulatory blood pressure monitoring devices market share in 2021, and is expected to continue to dominate during the forecast period, owing to increase in the product launches and increase in number of regulatory approvals. However, Asia-Pacific is expected to register the highest CAGR during ambulatory blood pressure monitoring devices market forecast, owing to increase in incidence of hypertension and presence of advance healthcare infrastructure.

The key players that operate in the global ambulatory blood pressure monitoring devices market include Baxter International Inc., Bosch+Sohn GmbH Co KG, BPL Ltd, Contec Medical Systems Co., Ltd, GE Healthcare, Halma Plc, Omron Corporation, OSI Systems Inc. (Spacelabs Healthcare Inc.), Schiller AG, and Vaso Corporation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ambulatory blood pressure monitoring devices market analysis from 2021 to 2031 to identify the prevailing ambulatory blood pressure monitoring devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ambulatory blood pressure monitoring (abpm) devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ambulatory blood pressure monitoring devices market trends, key players, market segments, application areas, and market growth strategies.

Ambulatory Blood Pressure Monitoring (ABPM) Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 309.3 million |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 196 |

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | GE HEALTHCARE (A HEALTHCARE DIVISION OF GE COMPANY), OSI Systems, Inc. (Spacelabs Healthcare, Inc.), VASO CORPORATION, SCHILLER AG, CONTEC MEDICAL SYSTEMS CO. LTD., HALMA PLC., BPL LTD., BOSCH & SOHN GmbH & CO. KG, BAXTER (HILL ROM HOLDINGS, INC.), Omron Corporation |

Analyst Review

This section provides the opinions of the top level CXOs in the ambulatory blood pressure monitoring devices market. According to the CXOs, ambulatory blood pressure monitoring is a method to measure blood pressure on a regular basis. Ambulatory blood pressure monitoring also helps to predict likelihood of cardiovascular diseases which are linked to hypertension. As per the CXOs, the medical device industry is undertaking rapid and exceptional measures to bring more innovative products for patients and has opened new approaches in the medical device industry. According to American Heart Association’s Heart Disease and Stroke Statistics 2021 update, high systolic blood pressure was observed to be the first leading life lost risk factors globally in 2019. Thus, increase in problems of high blood pressure among people leads to surge in awareness about the usage of ambulatory blood pressure devices among people. This is expected to boost the growth of the ambulatory blood pressure monitoring devices market.

The CXOs further added that arm ABPM segment is expected to remain dominant during the forecast period, owing to strong availability of the ambulatory blood pressure monitoring devices among large number of key players in the market. Moreover, North America is expected to offer lucrative opportunities to the market during the forecast period. For instance, as per American Heart Association’s Heart Disease and Stroke Statistics 2019, around 48% of adults were estimated to have suffered from cardiovascular disease in the U.S. Thus, there is an increase in the demand for ambulatory blood pressure monitoring devices across the region. However, Asia-Pacific registered the fastest growth rate during the forecast period, owing to developments in healthcare infrastructure, rise in disposable incomes, and well-established presence of domestic companies in the region.

Increase in prevalence of white coat hypertension, and high blood pressure condition in individuals and development of new blood pressure monitor by large number of key players are some of the major driving factors of the market.

Among product, the arm ABPM devices dominated the Ambulatory Blood Pressure Monitoring (ABPM) Devices Market in 2021

North America is the largest regional market for Ambulatory Blood Pressure Monitoring (ABPM) Devices

The estimated industry size of Ambulatory Blood Pressure Monitoring (ABPM) Devices was around US$160.8 million in 2021

Omron Corporation, Baxter International Inc., Halma Plc are some of the top companies in Ambulatory Blood Pressure Monitoring (ABPM) Devices Market.

Loading Table Of Content...