Global Bio Based Polypropylene Market Overview:

The global bio based polypropylene market was valued at $32.0 million in 2017, and is projected to reach $53.0 million by 2025, growing at a CAGR of 6.5% from 2018 to 2025.

Bio based polypropylene is a polymer manufactured from natural materials such as corn, sugar cane, vegetable oil, and some other biomass. The properties of bio based polypropylene are similar to synthetic polypropylene. This polymer is used in injection molding, textiles, film, and other applications. The global bio based polypropylene market is witnessing a huge growth over the past few years, owing to various factors such as rise in product consumption in automobiles, increase in stress on manufacturers to consume bio based materials, and Horizon 2020, Circular Economy Package, and other stringent regulations in various regions such as Europe, North America, and Asia-Pacific.

Increase in trend toward the adoption of specialty polymers to improve the downsizing among the automobiles is predicted to enhance the demand for bio based polypropylene during the forecast period. This is further attributed by the rise in stress on reducing the carbon emissions from vehicles, owing to stringent regulations in various regions such as Europe, North America, and Asia-Pacific. Injection molded parts made from bio based polypropylene are light weight. This factor boosts its demand in the automobile sector. Moreover, increase in use of polypropylene films in various applications, such as food packaging, and shrink films further increase the requirement of the product during the forecast period.

Rise in availability of substitute products such as bio based PET and PLA restrict the growth of the bio based polypropylene market. Moreover, the substitute threats from synthetic polymers also hinder the growth during the forecast period.

Significant development in the global shale gas exploration & production enhances the production of various crude oil derivatives, which in turn favors the demand for synthetic polypropylene, which in turn restricts the growth of bio based polypropylene market over the coming years.

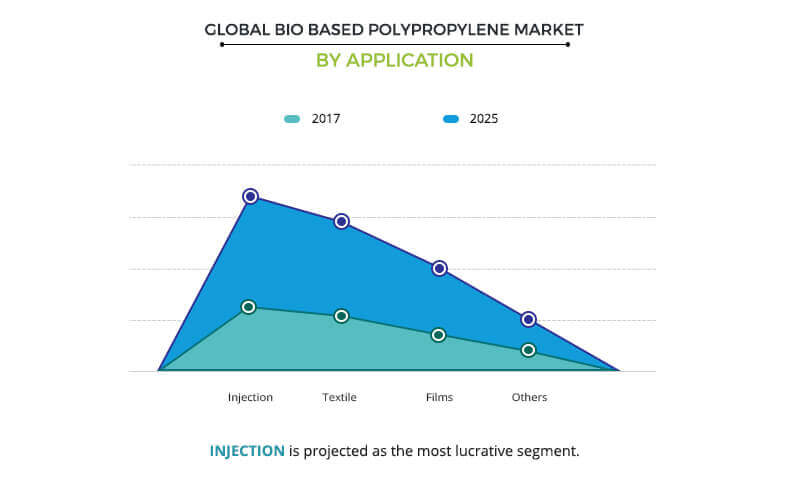

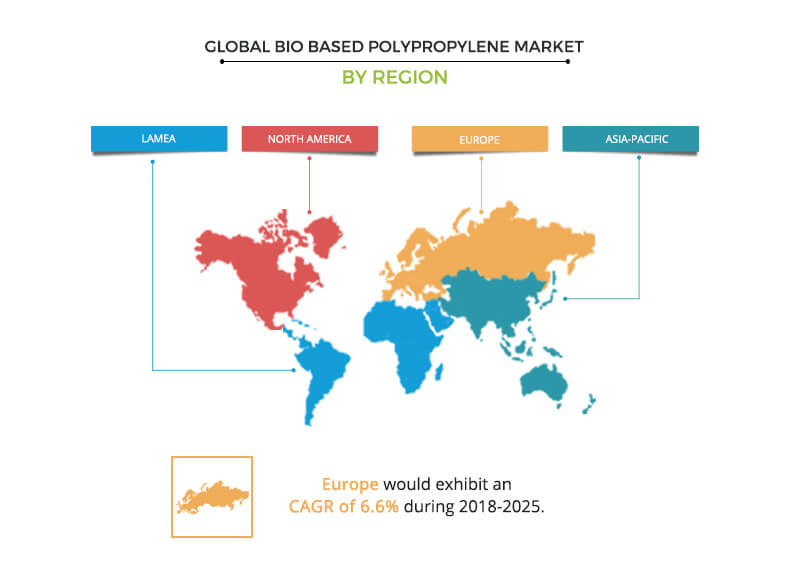

The global bio based polypropylene market is segmented based on application and region. Based on application, it is divided into injection, textile, film, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some of the major players in the global bio based polypropylene market include Braskem, SABIC, Biobent Polymers, Neste, FKuR Kunststoff GmbH, Novamont SpA, Sinopec Group, PTT Global, Global Bioenergies, Trellis Earth Products, Inc., and DowDuPont. Some other companies in the global bio based polypropylene market are Mitsubishi Chemical, LyondellBasell, ExxonMobil, and Reliance Industries.

The global bio based polypropylene market for injection molding is projected to hold a dominant share in the market during the forecast period. Rise in demand for injection molded parts in various end-use industries such as automotive, aerospace, and electrical & electronics boost the product demand. This in turn drives the growth of the global bio based polypropylene market for injection.

The Europe bio based polypropylene market is projected to dominate during the forecast period, owing to the increase in product consumption in the automotive end-use industry. Moreover, this region is further projected to increase its consumption for automobiles, owing to the favorable regulations to reduce the vehicular carbon emissions. Rise in automotive production in countries such as Germany, France, and Spain is expected to boost the growth of the Europe bio based polypropylene market during the forecast period. The North America bio based polypropylene market is predicted to experience fastest growth owing to the product consumption in aerospace applications.

Key Benefits for Global Bio Based Polypropylene Market:

- The report provides extensive qualitative and quantitative analysis of the current trends and future estimations of the global bio based polypropylene market from 2017 to 2025 to determine the prevailing opportunities.

- Comprehensive analysis of factors that drive and restrict the growth of the market is provided.

- Estimations and forecast are based on factors impacting the market growth, in terms of both value and volume.

- Profiles of leading players operating in the market are provided to understand the global competitive scenario.

- The report provides extensive qualitative insights on the significant segments and regions exhibiting favorable market growth.

Bio Based Polypropylene Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Region |

|

Analyst Review

The bio based polypropylene market holds a substantial scope for growth in the coming years. The market is in its growth stage; however, is expected to grow significantly within the coming years. Recent innovations are expected to enhance the product development from various natural products such as vegetables, corn, sugar cane, and others. As this market is in its nascent stage, there is a low presence of operating players. Increase in crude oil production is expected to decrease the prices of synthetic polypropylene, which in turn is predicted to restrain the demand for bio based polypropylene over the forthcoming years.

Loading Table Of Content...