Cardiovascular Diagnostic Device Market Research, 2034

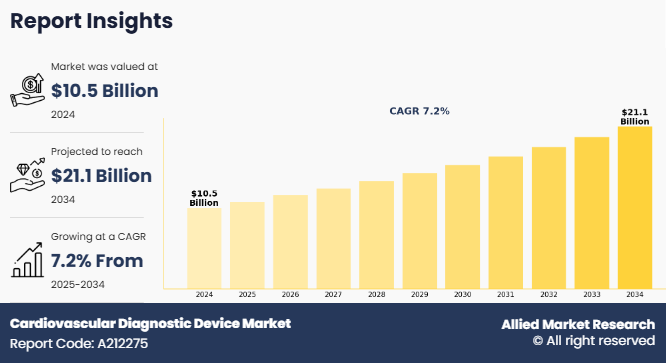

The global cardiovascular diagnostic device market was valued at $10.5 billion in 2024, and is projected to reach $21.1 billion by 2034, growing at a CAGR of 7.2% from 2025 to 2034. The growth of the cardiovascular diagnostics devices market is driven by the increasing prevalence of cardiovascular diseases (CVDs) and the rising adoption of advanced diagnostic technologies. For instance, according to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally, accounting for approximately 17.9 million deaths each year, representing 32% of all global deaths. This growing disease burden has led to a greater need for early detection and continuous monitoring, thereby fueling the demand for cardiovascular diagnostic tools.

Cardiovascular diagnostics devices refer to a range of medical devices used to detect and monitor heart-related conditions. These tools assess the electrical and functional activity of the heart, helping identify abnormalities such as arrhythmias, ischemia, or structural heart diseases. Unlike general health screenings, cardiovascular diagnostics devices provide precise, real-time insights into cardiac function, often using devices like electrocardiograms (ECGs), Holter monitors, cardiac patch monitors, event monitors, and implantable loop recorders. These tools are commonly used in hospitals, clinics, and even home care settings. Diagnostic results guide clinical decisions and treatment strategies, and may be followed by interventions such as medication management, lifestyle changes, or surgical procedures.

Key Takeaways

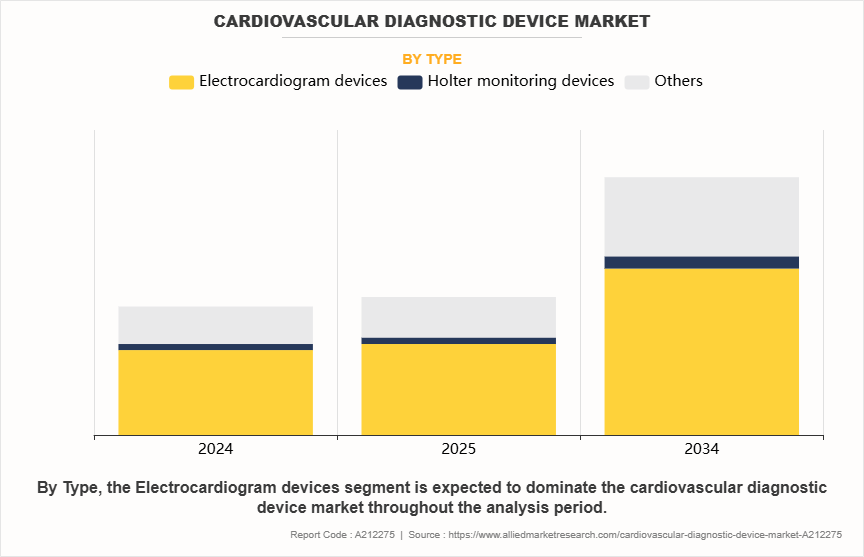

- By type, the electrocardiogram devices segment was the largest contributor to the cardiovascular diagnostic device market in 2024 and the others segment is expected to register the highest CAGR during the forecast period.

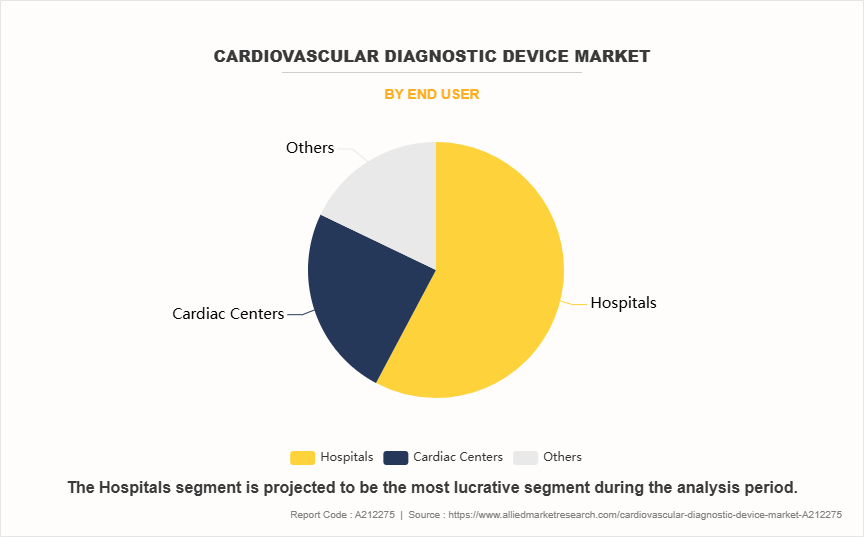

- By end user, the hospitals segment was the largest contributor to the market in 2024 and the others segment is expected to register the highest CAGR during the forecast period.

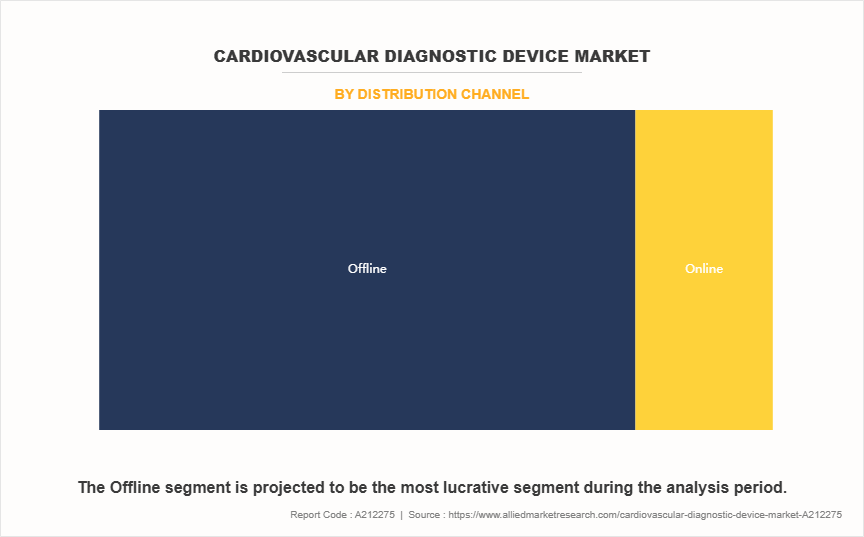

- By distribution channel, the offline segment dominated the cardiovascular diagnostic device market share in 2024 and the online segment is expected to grow at a highest CAGR during the forecast period.

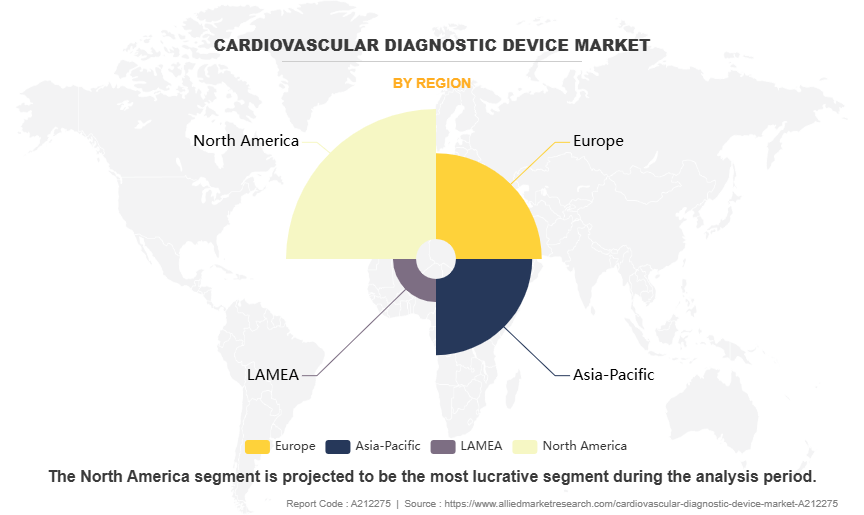

- Region wise, North America generated the largest revenue in 2024. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The rising global incidence of cardiovascular diseases (CVDs), particularly among aging populations and individuals with comorbidities such as diabetes, hypertension, and obesity, is a significant driver of the cardiovascular diagnostic device market growth. Early detection of cardiac abnormalities such as arrhythmias, ischemia, and heart failure has become a priority, leading to greater demand for diagnostic tools including electrocardiogram (ECG) devices, Holter monitoring systems, cardiac patch monitors, event monitors, and implantable loop recorders.

Moreover, the increasing burden of lifestyle related risk factors such as sedentary behavior, unhealthy diets, smoking, and stress has expanded the demographic base requiring cardiac monitoring, from middle-aged adults to younger populations in their 30s and 40s. This has significantly broadened the need for cardiac diagnostic solutions, thereby driving the cardiovascular diagnostic device market.

Furthermore, the growing awareness about preventive healthcare, especially post-COVID-19, is further accelerating the adoption of non-invasive and home-based cardiovascular diagnostic tools. Public health initiatives and social media campaigns emphasizing heart health have led more individuals to seek early evaluation for symptoms like palpitations, chest pain, and fatigue. This cultural shift toward proactive health management is driving demand for portable and easy to use cardiac monitoring devices, thereby cardiovascular diagnostic device market growth.

Additionally, technological advancements such as AI-integrated ECG interpretation, wireless monitoring, cloud-based diagnostics, and miniaturized implantable loop recorders are reshaping the cardiovascular diagnostics devices sector. These innovations enable real-time analysis, early warning alerts, and remote patient management, thus improving patient outcomes and reducing hospital readmissions. Devices with enhanced precision, extended battery life, and user-friendly interfaces are attracting both clinicians and patients, particularly in outpatient and home care settings, thereby driving cardiovascular diagnostic device market outlook.

Further, increased investments in telecardiology and the development of mobile cardiac telemetry platforms are improving access to cardiac diagnostics, especially in remote and underserved regions. The affordability and portability of modern devices are enabling wider adoption across ambulatory surgical centers (ASCs), clinics, particularly in emerging economies with rising middle-class populations,thereby driving cardiovascular diagnostic device market opportunity.

Additionally, the rapid expansion of cardiac care centers, diagnostic labs, and specialty clinics in urban and semi-urban areas has improved access, thereby driving cardiovascular diagnostic device market. Moreover, reimbursement support in developed markets and growth in health insurance coverage in developing countries have contributed to increased adoption of diagnostic procedures.

However, high costs of advanced diagnostic equipment and lack of access to specialized care in rural regions remain key restraints of the market. Implantable monitors and AI-based analytics platforms can be expensive, especially where infrastructure or trained personnel are limited. In low- and middle-income countries, inadequate public healthcare funding and out-of-pocket expenditure continue to hinder market cardiovascular diagnostic device market.

Moreover, emerging economies in Asia-Pacific and LAMEA regions present untapped opportunities due to growing awareness, increasing healthcare investments, and expanding telehealth infrastructure. As healthcare ecosystems evolve, market players offering cost-effective, AI-enabled, and integrated cardiovascular diagnostic solutions stand to gain significantly in the coming years, thereby driving cardiovascular diagnostic device market.

Segmental Overview

The cardiovascular diagnostic device market is segmented into product, end user, distribution channel, and region. By product, the market is categorized into electrocardiogram devices, Holter monitoring devices and others. On the basis of end user, it is segregated into hospitals, cardiac centers, and others. On the basis of distribution channel, the market is categorized into offline and online.

Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Type

Based on type, the cardiovascular diagnostic device market is segmented into electrocardiogram devices, Holter monitoring devices, and others. The electrocardiogram devices segment held the largest cardiovascular diagnostic device market size in 2024, primarily due to their widespread application as a primary diagnostic tool in hospitals, clinics, and emergency departments. Their cost-effectiveness, user-friendly design, and critical role in identifying a wide range of cardiac conditions have led to broad adoption worldwide.

However, the others segment is expected to witness the fastest growth rate in cardiovascular diagnostic device market during the forecast period. This growth is attributed to the increasing demand for continuous and remote cardiac monitoring solutions. The rising utilization of wearable devices such as cardiac patch monitors and implantable loop recorders, along with advancements in wireless technology and AI-powered ECG interpretation, is enhancing their value in outpatient and homecare environments, thus driving rapid market expansion.

By End User

Based on end user, the cardiovascular diagnostic device market is segmented into hospitals, cardiac centers, and others. The hospital segment held the largest cardiovascular diagnostic device market size in 2024, driven by the high patient inflow for cardiac evaluations, availability of advanced diagnostic infrastructure, and the presence of trained medical professionals. Furthermore, in many developing nations, hospitals function as the primary centers for cardiac diagnosis and treatment, reinforcing their leading position in the market.

However, the others segment is expected to grow with the highest CAGR during the cardiovascular diagnostic device industry forecast period. This growth is fueled by the rising demand for affordable and accessible cardiac diagnostics, especially in outpatient settings. The growing adoption of wearable ECG devices, the shift toward ambulatory and home-based care, and the expansion of diagnostic clinics and ambulatory care centers are key factors driving this segment, particularly for chronic condition monitoring and preventive health management.

By Distribution Channel

By distribution channel, the cardiovascular diagnostic device market is divided into online and offline channels. The offline segment held the largest cardiovascular diagnostic device market share in 2024, primarily due to the continued dependency on traditional procurement methods through hospitals, clinics, and authorized medical device distributors. Long-standing relationships between healthcare providers and suppliers, coupled with the benefits of bulk purchasing and on-site technical support, are the factors driving this channel.

However, the online segment is expected to witness the fastest CAGR during the cardiovascular diagnostic device market forecast period. This growth is driven by the increasing digitalization of healthcare procurement processes and the rising number of medical device e-commerce platforms. The convenience of direct-to-facility and direct-to-patient purchasing, particularly for portable and wearable cardiac monitoring devices, is accelerating the shift toward online channels, especially across urban and semi-urban markets where internet access is expanding.

By Region

The cardiovascular diagnostic device industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America led the market in revenue terms in 2024, supported by its well-established healthcare infrastructure, high expenditure on advanced diagnostic technologies, and early adoption of innovative cardiac monitoring devices. The region benefits from a strong presence of cardiology specialists, widespread availability of cardiovascular testing devices, Holter monitors, ECG systems, and implantable loop recorders, and early access to U.S. FDA-approved devices.

The U.S. cardiovascular diagnostic device market is expected to remain the leading contributor within North America, driven by the high prevalence of cardiovascular diseases, increase in focus on preventive cardiac care, and the presence of major heart diagnostic devices manufacturers and digital health companies. Additionally, the growing adoption of AI-powered diagnostic tools, along with supportive reimbursement policies, continues to fuel market growth.

However, the Asia-Pacific cardiovascular diagnostics devices market is projected to record the highest CAGR during the forecast period. This growth is attributed to a rising elderly population, increasing awareness of heart health, and improving access to cardiac care services. Rapid urbanization, rise in disposable income, and the expansion of diagnostic and ambulatory centers across countries like China, India, and Japan, are major contributors to this growth.

Moreover, the growing penetration of wearable cardiac monitoring devices, increased investments in telehealth and mobile cardiac telemetry platforms, and the emergence of public-private healthcare partnerships are supporting regional expansion. The region’s large population base and growing burden of lifestyle-related cardiovascular risks present significant growth opportunities for manufacturers and service providers in the cardiovascular diagnostics devices market.

Competition Analysis

Major key players that operate in the global cardiovascular diagnostics devices market are Medtronic plc, Koninklijke Philips N.V., VitalConnect, Abbott Laboratories, GE Healthcare, Boston Scientific Corporation, Nihon Kohden Corporation, Schiller AG, Baxter International Inc., and Biotronik.

Recent Developments in the Cardiovascular Diagnostics Devices Industry

- In May 2024, Koninklijke Philips N.V., announced the nationwide rollout of its ambulatory cardiac monitoring service in Spain using its unique wearable ePatch paired with its AI-driven Cardiologs analytics platform.

- In May 2023, Abbott announced that Assert-IQ insertable cardiac monitor (ICM) received U.S. Food and Drug Administration (FDA) clearance, giving physicians a new option for diagnostic evaluation and long-term monitoring of people experiencing irregular heartbeats.

- In November 2022, Boston Scientific Corporation announced the European launch of the LUX- Insertable Cardiac Monitor (ICM) System, a long-term diagnostic device inserted under the skin of patients to detect arrhythmias associated with conditions such as atrial fibrillation (AF), cryptogenic stroke, and syncope

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cardiovascular diagnostic device market analysis from 2024 to 2034 to identify the prevailing cardiovascular diagnostic device market opportunities.

The cardiovascular diagnostic device market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the cardiovascular diagnostic device market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global cardiovascular diagnostic device market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global cardiovascular diagnostic device market trends, key players, market segments, application areas, and market growth strategies.

Cardiovascular Diagnostic Device Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 21.1 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2024 - 2034 |

| Report Pages | 275 |

| By Type |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Schiller, Abbott Laboratories, Boston Scientific Corporation, Nihon Kohden Corporation, VitalConnect, GE HealthCare, Koninklijke Philips N.V., Biotronik SE & Co. KG, Baxter International Inc., Medtronic plc |

Analyst Review

This section provides insights from top-level CXOs in the global cardiovascular diagnostics device market. According to CXOs, the market is poised for robust growth, primarily driven by the rising global burden of cardiovascular diseases, growing awareness about early diagnosis, and increasing preference for remote and non-invasive monitoring technologies. As healthcare systems shift focus toward preventive care and chronic disease management, diagnostic tools like ECG systems, Holter monitors, and wearable cardiac patches are becoming integral to routine cardiac screening and follow-up.

CXOs highlighted that the demand for continuous cardiac monitoring solutions is accelerating due to their ability to detect asymptomatic arrhythmias, enable early intervention, and reduce emergency admissions. Technological advancements, including AI-enabled ECG interpretation, wireless data transmission, and compact device design, are making cardiac diagnostics more accessible across both clinical and homecare settings. Furthermore, collaborations between medtech companies, healthcare providers, and digital health platforms are improving diagnostic accuracy, patient compliance, and care outcomes.

2024 is the base year of cardiovascular diagnostic device market in the globe.

Hospitals is the leading end user of cardiovascular diagnostic device market.

The cardiovascular diagnostic device market was valued at $10,534.0 million in 2024 and is estimated to reach $21,134.05 million by 2034, exhibiting a CAGR of 7.2% from 2025 to 2034.

North America is the largest regional market for cardiovascular diagnostic device.

Major key players that operate in the global cardiovascular diagnostics devices market are Medtronic plc, Koninklijke Philips N.V., VitalConnect, Abbott Laboratories, GE Healthcare, Boston Scientific Corporation, Nihon Kohden Corporation, Schiller AG, Baxter International Inc., and Biotronik.

2025 to 2032 is the forecast year of cardiovascular diagnostic device market in the globe.

Loading Table Of Content...

Loading Research Methodology...