Cargo Drones Market Outlook, 2032

The global cargo drones market size was valued at $0.68 billion in 2022, and is projected to reach $16.9 billion in 2032, registering a CAGR of 38.1%. Cargo drones are unmanned aerial vehicles (UAVs) designed to transport goods, materials, or other payloads. Fixed-wing cargo drones are types of drones that have specialized cargo compartments or pods that can transport a variety of payloads, from light goods to heavy objects. Moreover, rotor-wing cargo drones, also known as rotary drones or quadcopters, are another type of cargo drone that use rotors or propellers to generate lift and provide vertical takeoff and landing (VTOL) capabilities.

Cargo drones can be used to transport medical supplies, such as vaccines, blood samples, and medicines, to remote and hard-to-reach areas. In urban areas, cargo drones can offer a quicker and more effective method of delivery for small and light e-commerce products. To increase crop yields and cut expenses, cargo drones are used for crop monitoring, mapping, and spraying. Emergency goods, including food, water, and shelter, can be delivered to disaster-affected areas using cargo drones.

North America includes the U.S., Canada, and Mexico. The cargo drones market is expected to grow in North America during the forecast period owing to the rise in demand for fast and efficient delivery. North America has witnessed an increase in the use of cargo drones in distribution center logistics to achieve faster delivery times, reduced costs, and increased efficiency. For instance, in February 2023, Ameriflight, U.S. based cargo airline announced a signed letter of intent to purchase 35 of Sabrewing Aircraft Company’s VTOL air cargo drones. The agreement is expected to aid the company in carrying heavy cargo and develop a faster and more efficient warehouse distribution network. Such developments to promote the utilization of cargo drones for the enhancement of warehouse distribution operations is expected to drive the growth of the market in the region.

Leading cargo drone manufacturers are aiming to increase the cargo drones market share by continuous product development and innovation.Cargo drones are increasingly being used in the U.S. to satisfy both B2B demands, such as transporting medical samples to labs, as well as a variety of last-mile consumer use cases, such as prepared food, convenience goods, and other compact packages. Moreover, there is a rise in the adoption of cargo drones by the military to deliver supplies and equipment to troops in distant or challenging-to-reach regions. For instance, in November 2021, Silent Arrow, a manufacturer of autonomous cargo drones and aerospace vehicles secured a contract with the U.S. Air Force, through the Air Force Research Laboratory (AFRL) for 15 Silent Arrow cargo delivery drones. These cargo drones are designed to transport cargo, such as food, water, and medical supplies, to remote locations that are difficult to access by traditional transportation methods.

Canada has many remote and rural communities that are difficult to access by traditional transportation methods. The government is providing contracts to cargo drone delivery companies to transport cargo, such as medical supplies and equipment, to remote communities in Canada. For instance, in March 2023, Drone Delivery Canada, a Canadian company that specializes in drone logistics was awarded a contract by the Government of Canada to provide delivery services using their heavy-lift Condor drone. The Condor drone can carry payloads of up to 180 kg over distances of up to 200 km.

The development of commercial drones in Mexico has advanced significantly, providing opportunities for cargo drone companies to operate in the country. Mexico has a vast topography, with many isolated and difficult-to-reach locales, especially in its rural and mountainous sections. Compared to conventional transportation methods, cargo drones can bring goods and supplies to remote locations more quickly, enhancing access to vital resources. Therefore, these factors are expected to increase the demand for cargo drones.

Factors such as the rise of e-commerce, the increase in demand for faster delivery & improved efficiency in freight transportation, and a surge in environmental concerns to reduce CO2 emissions and carbon footprint boost the cargo drones market growth. However, high initial costs and regulatory compliance are anticipated to hinder market growth. On the other hand, technological advancements, and the integration of cargo drones in middle-mile logistics provide a remarkable growth opportunity for the market players operating in the cargo drones market.

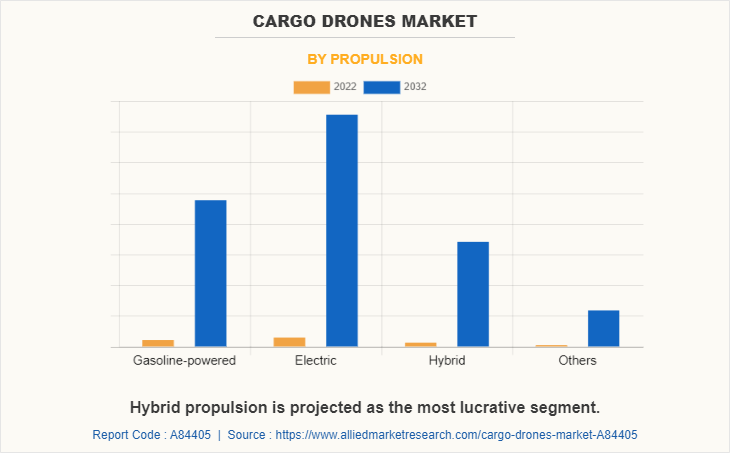

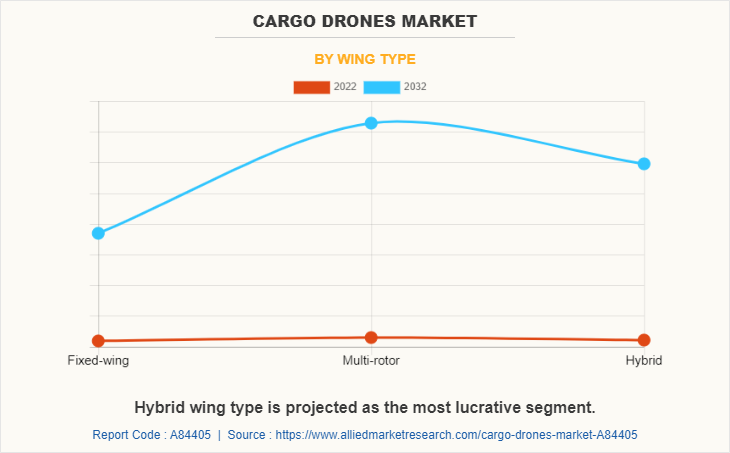

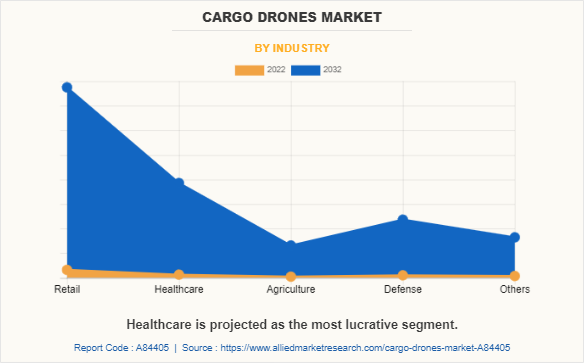

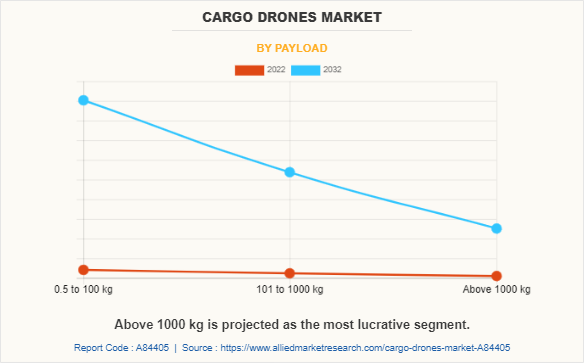

The cargo drones market is segmented on the basis of propulsion, wing type, industry, payload, and region. By propulsion, it is categorized into gasoline-powered, electric, hybrid, and others. By wing type, it is classified into fixed-wing, multi-rotor, and hybrid. By industry, it is divided into retail, healthcare, agriculture, defense, and others. By payload, it is segregated into 0.5 to 100 kg, 101 to 1000 kg, and above 1000 kg. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading companies profiled in the cargo drones market report include Dronamics, Volocopter GmbH, Ehang Holdings Ltd, Pipistrel d.o.o, Singular Aircraft, UAVOS Inc, Elroy Air, NATILUS, ARS Aerosystems, and SkyDrive Inc. Companies are adopting strategies such as product launch, agreement, expansion, and others to improve their market positioning.

Rise of e-commerce

The market for cargo drones is being significantly stimulated by the growth of e-commerce. According to Morgan Stanley’s growth forecast for 2022, global e-commerce rose from 15% of total retail sales in 2019 to 21% in 2021. It reached an estimated 22% of sales in 2022. Moreover, according to United Nations Conference on Trade and Development (UNCATD) figures, a significant surge occurred in online retail sales across countries such as U.S., and China. Moreover, there was a notable rise from approximately $2 trillion in 2019, just prior to the outbreak of the pandemic, to approximately $2.5 trillion in 2020 and $2.9 trillion in 2021.

The demand for quick and dependable product delivery has increased as more consumers purchase online. The growth of e-commerce has an immense effect on the cargo market, propelling its expansion and creating opportunities for companies in the industry. Demand for cargo services has significantly increased owing to the rise in popularity of online shopping as companies aim to efficiently address the needs of their customers by delivering goods to their doorsteps. Furthermore, the growth of e-commerce has led to an increase in cross-border trade, with businesses increasingly looking to expand their operations beyond their domestic markets. Therefore, cargo drones have become essential in facilitating global trade, providing businesses with the means to efficiently transport goods across borders and meet the demands of international customers.

The Increase In Demand For Faster Delivery And Improved Efficiency In Freight Transportation.

The growth of the cargo drones market is driven by a surge in demand for faster delivery and increased efficiency of cargo transportation. Freight drones are increasingly being used by companies to deliver goods quickly and efficiently, especially in remote areas where traditional delivery methods are difficult or expensive to operate. Cargo drones allow businesses to bypass transportation infrastructure such as roads and ports, traffic, and other logistical obstacles to reduce delivery times.

In addition, cargo drones can be operated more efficiently and cost-effectively than traditional delivery methods, making them an attractive option for companies looking to streamline their supply chain operations. As a result, demand for cargo drones is expected to continue to grow in the coming years, driven by the need for faster, more efficient, and cheaper cargo transportation solutions.

Furthermore, the use of drones in the transportation and logistics industry is not only limited to speeding up the delivery process, however, it also provides significant benefits to the reverse logistics process. With the rise of e-commerce, the return process has become a critical aspect of business operations. Customers expect quick and hassle-free returns to ensure they can obtain refunds and place new orders in a timely fashion. By utilizing drones for reverse logistics, businesses can reduce the time and effort involved in the return process, leading to faster turnaround times and improved e-commerce operations. This development represents a significant step forward for the transportation and logistics industry.

High Initial Cost

The high upfront cost associated with cargo drones can pose a significant challenge to the growth of the market. Although drones offer several advantages such as expedited delivery times, reduced emissions, and minimized traffic congestion, the cost of procuring and operating these drones can be a major obstacle for businesses, especially for small and medium-sized enterprises (SMEs) with limited budgets. Apart from the drone cost, businesses have to invest in essential infrastructure such as charging and maintenance facilities, as well as qualified personnel for drone operation and maintenance. Therefore, high initial expenses associated with procurement, and operation with regulations can restrict the growth of the market.

Regulatory Compliance

The commercial use of cargo drones is subject to strict regulations imposed by government agencies, which can be a time-consuming and expensive process for market players. Meeting these regulations requires businesses to invest in specialized personnel, training, and equipment, which can be a significant burden on limited budgets and resources. The cost and complexity of compliance create significant barriers to entry for businesses and can impede the growth of the market. Furthermore, cargo drones must comply with stringent safety standards and regulations, which can further escalate operational costs. Adherence to these rules may require additional investments in safety equipment, specialized training, and certification, which is expected to hamper the growth of the market during the forecast period.

Technological Advancements

Technological advancements present significant opportunities for the growth of the market. Improvements in battery technology, sensors, machine learning algorithms, and materials have enhanced the capabilities of cargo drones. With longer flight times, heavier payloads, and greater autonomy, cargo drones have become more efficient and effective than traditional delivery methods. Moreover, the integration of cargo drones with other technologies such as blockchain and AI is creating new possibilities for optimizing supply chain operations. For instance, real-time tracking and delivery route optimization can be achieved, which improves efficiency, reduces costs, and enhances customer satisfaction.

In addition, there is a surge in the adoption of clean energy technology such as hydrogen fuel cell technology in cargo drones. For instance, in October 2021, South Korean aerospace company LIG Nex1 introduced its new heavy-lift drone concept during the Seoul International Aerospace & Defense Exhibition (ADEX) 2021. The proposed aircraft was powered by a hydrogen fuel cell. Therefore, the cargo drones market is expected to grow owing to technological advancements that can enhance the performance and capabilities of cargo drones

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cargo drones market analysis from 2022 to 2032 to identify the prevailing cargo drones market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cargo drones market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cargo drones market trends, key players, market segments, application areas, and market growth strategies.

Cargo Drones Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 16.9 billion |

| Growth Rate | CAGR of 38.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 416 |

| By Propulsion |

|

| By Wing type |

|

| By Industry |

|

| By Payload |

|

| By Region |

|

| Key Market Players | DRONAMICS, Singular Aircraft, SkyDrive Inc., NATILUS, EHang Holdings Ltd., Elroy Air, ARC Aerosystems, VOLOCOPTER GmbH, UAVOS Inc, PIPISTREL d.o.o. |

The estimated industry size of Cargo Drones is 0.68 billion.

The top companies to hold the market share in Cargo Drones are Dronamics, Volocopter GmbH, Ehang Holdings Ltd, Pipistrel d.o.o, Singular Aircraft, UAVOS Inc, Elroy Air, NATILUS, ARS Aerosystems, and SkyDrive Inc.

The leading industry of Cargo Drones Market is retail.

The largest regional market for Cargo Drones is North America

The upcoming trends of Cargo Drones Market in the world are technological advancements, and the integration of cargo drones in middle-mile logistics.

Loading Table Of Content...

Loading Research Methodology...