Decentralized Insurance Market Research, 2032

The global decentralized insurance market was valued at $1.4 billion in 2022, and is projected to reach $135.6 billion by 2032, growing at a CAGR of 58.5% from 2023 to 2032.

Decentralized finance insurance, also known as decentralized risk coverage or decentralized insurance protocols, is a type of insurance that operates on blockchain technology and uses smart contracts to automate the process of insurance coverage. Furthermore, in decentralized insurance, users may collectively pool their funds to form a risk pool that provides coverage for specific events or risks. The terms of coverage and payouts are determined by the rules set in the smart contract, which are executed automatically based on predefined conditions.

The increase in demand for decentralized and peer-to-peer insurance products that offer greater transparency, lower costs, and faster claim processing times boosts the growth of decentralized insurance market. In addition, rise in awareness, and adoption of blockchain technology and smart contracts, which may automate insurance policies and claims boosts the decentralized insurance market growth. However, the regulatory uncertainty and lack of clarity around the legal and regulatory framework for decentralized insurance products in different jurisdictions is restraining the growth of the decentralized insurance market.

Furthermore, limited interoperability and standardization across different decentralized insurance platforms and protocols also hinder the decentralized insurance market growth. On the contrary, the ability to offer more personalized insurance products that meet the specific needs and preferences of individual policyholders is expected to fuel the growth of the market in the upcoming years. Furthermore, a reduction in costs and increase in efficiency using blockchain technology and smart contracts are expected to create lucrative opportunities for the market during the forecast period.

The report focuses on growth prospects, restraints, and trends in the decentralized insurance market. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the decentralized insurance market outlook.

Segment Review

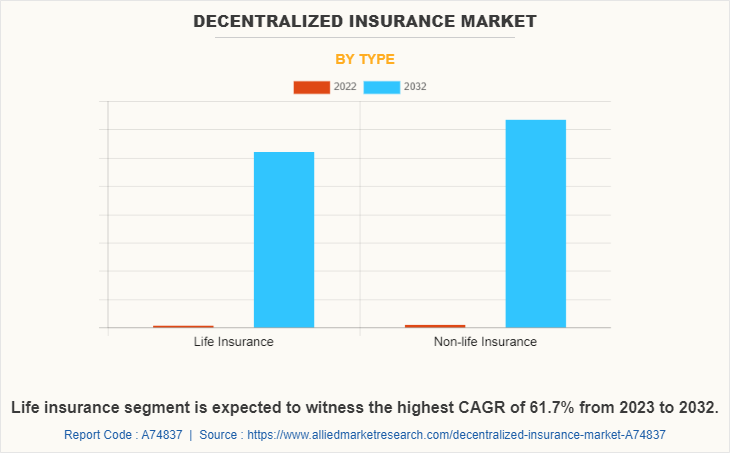

The decentralized insurance market is segmented into insurance type, end user, and region. By type, the market is classified into life insurance and non-life insurance. Depending on the end user, it is fragmented into businesses and individuals. Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the life insurance segment acquired a major decentralized insurance market size in 2021. The growth of this segment is attributed to the fact that decentralized insurance operates on a peer-to-peer network, which means that life insurance claims can be processed quickly and efficiently. This can provide policyholders with faster pay-outs and a more seamless claims experience.

By region, the North America dominated the decentralized insurance market share in 2021. This is attributed to the increasing popularity of blockchain technology and the need for more accessible and affordable insurance options. Further, the growth of the decentralized insurance market in North America is being driven by several factors which include security, accessibility, transparency, and lower cost of decentralized insurance.

The key players operating in the global decentralized insurance market include Nexus Mutual, Unslashed Finance, Neptune Mutual, Etherisc, InsurAce, Bridge Mutual, Tidal Finance, Copper, Evertas, and Opyn. These players have adopted various business strategies to increase their market penetration and strengthen their position in the decentralized insurance industry.

Country Specific Statistics & Information

Rise in partnerships to develop the financing practices and adoption of the advance technologies are some of the trends that have helped to augment the decentralized insurance market growth. For instance, in January 2022, Verida announced a partnership with Nimble to strengthen the Nimble decentralized insurance protocol and platform leveraging the Algorand blockchain. Verida will complement the Nimble technology and provide connectivity to Algorand as the blockchain choice for smart contracts and stable coin payments. With this secure framework, Nimble would provide connection to existing carrier systems both on and off chain allowing insureds and Nimble members to send and request data in an anonymous way and receive micropayments for these transactions.

Furthermore, in September 2022, SupraOracles partnered with Cover Compared, a novel decentralized business model to create the first insurance marketplace for the global cryptocurrency market. Cover Compact is redefining the decentralized insurance crypto industry and uses blockchain and cryptocurrency to amend some of the shortcomings of the current market. By integrating insurance and blockchain into a unified platform, Cover Compared offers lower insurance policy costs while still ensuring users have the same high-quality insurance protection. Furthermore, within the Cover Compared marketplace, users are connected with multinational insurance companies and will further rely on smart contracts to complete any transaction.

The pandemic has created new opportunities for decentralized insurance platforms, particularly in the area of parametric insurance. Parametric insurance policies use pre-defined triggers to automatically pay out when specific conditions are met, such as a certain level of rainfall or a certain number of confirmed COVID-19 cases. This has enabled faster and more efficient payouts compared to traditional insurance models, which often require time-consuming claims processing. However, the pandemic has also presented challenges for the decentralized insurance industry. One of the main challenges has been the difficulty in accurately assessing risk in a rapidly evolving situation. This has led to some uncertainty around payouts and coverage for certain events related to the pandemic. Thus, the pandemic had a moderate impact on decentralized insurance industry.

Top Impacting Factors

Transparency Offered by Decentralized Insurance

Decentralized insurance platforms operate on blockchain technology, which provides a high level of transparency and trust to users. Smart contracts, which are self-executing computer programs, are used to automate insurance policies, claims, and payouts. This means that all policy terms, conditions, and claim settlements are executed automatically without any human intervention. Therefore, there is less scope for fraud and manipulation in decentralized insurance, which improves trust and confidence among users.

Further, the key players in the market are increasingly offering new and innovative products in developing countries to boost their market presence. For instance, in December 2022, Nami Insurance launched the "Proof of Concept" that proves the feasibility and practicality of the first cryptocurrency insurance product in Vietnam. The decentralized hedging protocol Nami Insurance utilizes blockchain technology to enable a decentralized insurance service and transforms trade risk into the first opportunity. This insurance product is a member of the Nami Foundation, which will define a fully equipped ecosystem of decentralized financial products. Hence, the transparency offered by decentralized insurance is fueling the decentralized insurance market growth.

Cost-effectiveness

Decentralized insurance allows users to purchase insurance policies without the involvement of intermediaries, such as brokers or agents. This eliminates the need for payment of their commissions or fees, resulting in lower insurance costs for policyholders. In addition, decentralized insurance (DeFi insurance) can reduce overhead costs associated with traditional insurance, such as office rent, administration expenses, and regulatory compliance. Furthermore, decentralized insurance is accessible to anyone with an internet connection, regardless of their geographic location. The use of blockchain technology eliminates the need for physical presence, paperwork, and manual verification, making insurance more accessible to people in underserved or remote areas. Thus, the cost-effectiveness of DeFi insurance along with better accessibility is boosting the growth of the market.

Flexibility and Diversification Offered by DeFi Insurance

Decentralized insurance allows users to customize their policies according to their specific needs, which is not possible with traditional insurance. Policyholders can choose the coverage amount, duration, and terms of their policies, and pay premiums accordingly. Smart contracts automatically execute policy terms and payout claims in case of events that meet the predefined conditions. Further, it offers a variety of insurance products, including coverage for traditional risks such as fire, theft, and natural disasters, as well as emerging risks such as cybercrime, smart contract failure, and liquidity pool risks.

Furthermore, decentralized insurance platforms allow users to pool their funds and invest in insurance policies, which provides diversification benefits and reduces individual risk exposure. Moreover, decentralized insurance platforms use blockchain technology, which eliminates the need for intermediaries and streamlines insurance processes. This reduces the time and costs associated with policy issuance, claims processing, and payouts. Thus, the flexibility and diversification offered by DeFi insurance is propelling the growth of decentralized insurance market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the decentralized insurance market analysis from 2022 to 2032 to identify the prevailing decentralized insurance market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the decentralized insurance market size segmentation assists to determine the prevailing decentralized insurance market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global decentralized insurance market trends, key players, market segments, application areas, and market growth strategies.

Decentralized Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 135.6 billion |

| Growth Rate | CAGR of 58.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 230 |

| By End User |

|

| By Type |

|

| By Region |

|

| Key Market Players | InsurAce, Tidal Finance, Bridge Mutual, Nexus Mutual, Evertas, Opyn, Copper, Unslashed Finance, Etherisc, Neptune Mutual |

Analyst Review

The growth in popularity of parametric insurance products that use blockchain technology to automatically trigger payouts based on pre-defined parameters or events propels the growth of the market. Furthermore, increase in interest in decentralized autonomous organizations (DAOs) as a way to govern and manage decentralized insurance operations and the integration of decentralized insurance products with other blockchain-based services and applications, such as decentralized finance (DeFi) platforms fuels the adoption for decentralized insurance platforms. Furthermore, the development of new analytics and data management tools to improve risk assessment and pricing in decentralized insurance boosts the growth of the market.

The pandemic has brought increased attention to decentralized insurance as an alternative to traditional insurance models. One reason for this is that traditional insurance models have struggled to keep up with the rapidly evolving risks and uncertainties associated with the pandemic. Decentralized insurance, on the other hand, has the potential to be more agile and responsive, thanks to its use of blockchain technology and smart contracts.

The key players in the decentralized insurance market are Nexus Mutual, Unslashed Finance, Neptune Mutual, Etherisc, InsurAce, Bridge Mutual, Tidal Finance, Copper, Evertas, and Opyn. Major players that operate in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. Major players collaborate to provide differentiated and innovative products with increase in awareness & demand for decentralized insurance across the globe.

The decentralized insurance market is estimated to grow at a CAGR of 58.5% from 2023 to 2032.

The decentralized insurance market is projected to reach $135.59 billion by 2032.

Transparency offered by decentralized insurance, cost-effectiveness and Flexibility and diversification offered by DeFi insurance majorly contribute toward the growth of the market.

The key players profiled in the report include decentralized insurance market analysis includes top companies operating in the market such as Nexus Mutual, Unslashed Finance, Neptune Mutual, Etherisc, InsurAce, Bridge Mutual, Tidal Finance, Copper, Evertas, and Opyn.

The key growth strategies of decentralized insurance players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...