Digital Lending Market Overview

The global digital lending market was valued at $12.6 billion in 2022, and is projected to reach $71.8 billion by 2032, growing at a CAGR of 19.4% from 2023 to 2032. Technological advancements such as artificial intelligence (AI), machine learning, and blockchain in making process more efficient, inclusive, and secure by streamlining credit assessments, reduce fraud, and expand access to financial services for underserved populations, are contributing to the growth of the market.

Market Dynamics & Insights

- The digital lending industry in North America held a significant share of 38% in 2022.

- The digital lending industry in China is expected to grow significantly at a CAGR of 19.0% from 2023 to 2032.

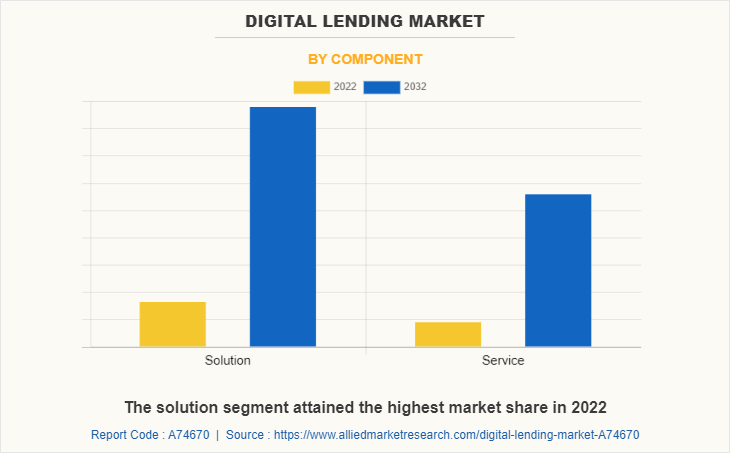

- By component, the solution segment is one of the dominating segment in the market, accounting for the revenue share of 65% in 2022.

- By deployment mode, the on-premise segment dominated the industry in 2022 and accounted for the largest revenue share of 58%.

Market Size & Future Outlook

- 2022 Market Size: $12.6 Billion

- 2032 Projected Market Size: $71.8 Billion

- CAGR (2023-2032): 19.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Digital lending is a platform which offers financial institutions an opportunity to improve productivity and increase the revenue per loan to deliver faster services. Furthermore, digital lending refers to the process of providing loans or credit to individuals or businesses using digital platforms, such as online or mobile applications, without the need for traditional, in-person interactions. It involves the use of technology and data analytics to assess creditworthiness, process loan applications, and disburse funds. Digital lending typically offers a convenient and streamlined experience for borrowers, with faster approval times and reduced paperwork. It has become increasingly popular in recent years due to advancements in technology, and it encompasses various types of loans, such as personal loans, business loans, student loans, and more.

Furthermore, with the widespread adoption of smartphones and other mobile devices, borrowers have access to digital lending platforms from anywhere at any time, making it more convenient and accessible for them to apply for loans. Moreover, the rise of mobile payments and mobile banking has made it easier for borrowers to receive and repay loans, which has helped to fuel the growth of the digital lending market. In addition, online banking has made it easier for consumers to access their financial information, monitor their accounts, and manage their money anywhere, at any time. This has created a more convenient and efficient environment for digital lenders to reach out to potential borrowers and offer them loans through online platforms and mobile apps. Hence, the growing popularity of online banking has created a more favorable environment for digital lenders to thrive and expand their market share, which in turn has contributed to the growth of the digital lending market.

However, regulations also impact the types of loans that digital lending platforms offer, as well as the interest rates they can charge. Thus, this can limit the revenue potential of these companies and make it harder for them to compete with traditional lenders. Hence, regulatory challenges significantly impact the growth of the digital lending market. In addition, the increasing sophistication of cyberattacks and the shortage of cybersecurity talent are adding further challenges to the cybersecurity landscape. Thus, this can result in a decline in demand for digital lending services and impact the growth of the market. On the contrary, artificial intelligence, machine learning, and block chain are among the emerging technologies that are expected to enhance the capabilities of digital lending platforms and open up new growth and opportunities. Therefore, adoption of cutting-edge technologies can significantly transform and enhance the digital lending landscape, creating new opportunities for lenders, borrowers, and other stakeholders in the financial ecosystem.

The report focuses on growth prospects, restraints, and trends of the digital lending market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the digital lending market.

Digital Lending Market Segment Review

The digital lending market is segmented on the basis of component, deployment mode, enterprise size, end user, and region. Based on component, the digital lending market is segmented into solution and service. By deployment mode, the digital lending market is segmented into on-premise and cloud. By enterprise size, the digital lending market is segmented into large enterprises and small and medium-sized enterprises. By end user, it is segmented into banks, NBFCs and credit unions. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on component, the solution segment attained the highest growth in 2022. This is because by leveraging digital lending technologies, lenders can offer faster and more convenient loan processing, which can be especially important for borrowers who need access to funds quickly. In addition, with the growing number of fintech startups and established financial institutions entering the digital lending market, there are abundant opportunities for innovative solutions that can cater to the changing needs and preferences of borrowers and lenders alike. However, the service segment is considered to be the fastest growing segment during the forecast period. This is because with the increasing adoption of digital lending platforms, there is a growing need for these services to facilitate the lending process and improve customer experience.

Region wise, North America attained the highest growth in 2022. This is because the market in North America is driven by factors such as the increasing demand for fast and convenient lending services, the growth of the fintech industry, and the adoption of new technologies. Thus, this has led to the growth of the digital lending market. However, the Asia-Pacific region is considered to be the fastest growing region during the forecast period. This is because the market has been experiencing significant growth in recent years due to the increasing use of technology and the internet, along with a growing demand for quick and easy access to credit. In addition, the market is poised for continued growth and innovation that is driven by the region's large and growing population and the increasing adoption of digital technologies.

The report analyzes the profiles of key players operating in digital lending market such as FIS, Fiserv inc, ICE Mortgage Technology, Intellect Design Arena Ltd, Nucleus software, Newgen Software Technologies Limited, Pegasystems Inc., Sigma Infosolutions, Temenos, and Tavant. These players have adopted various strategies to increase their market penetration and strengthen their position in the digital lending industry.

Digital Lending Market Landscape and Trends

The digital lending market has witnessed significant growth in recent years, driven by advancements in technology, changing consumer behaviour, and increasing demand for convenient and accessible financial solutions. Moreover, the market has seen a surge in online lending platforms, peer-to-peer lending, and mobile lending apps, offering borrowers quick and hassle-free access to loans with minimal documentation requirements. With the rise of big data analytics, artificial intelligence, and blockchain technology, digital lending has become more efficient in assessing credit risk, reducing fraud, and streamlining loan approval processes.

Furthermore, the integration of blockchain technology into digital lending has the potential to revolutionize the market by offering decentralized, transparent, and secure lending solutions. In addition, smart contracts, powered by blockchain, can automate loan origination, repayment, and asset-backed securities, improving efficiency, reducing fraud, and lowering costs. Hence, the digital lending market size is poised for continued growth in the future, driven by technology innovation, changing consumer preferences, and expanding market opportunities. Therefore, these are some of the major market digital lending market trends.

What are the Top Impacting Factors in Digital Lending Sector

Increase in Mobile Adoption

With the widespread adoption of smartphones and other mobile devices, borrowers have access to digital lending platforms from anywhere at any time, making it more convenient and accessible for them to apply for loans. Furthermore, digital lending platforms have capitalized on this trend by developing mobile-friendly applications and interfaces that are optimized for use on smartphones and tablets. Thus, this has made it easier for borrowers to apply for loans, receive real-time approvals, and manage their loan accounts on the go. Moreover, the rise of mobile payments and mobile banking has also made it easier for borrowers to receive and repay loans, which has helped to fuel the growth of the digital lending market. Hence, the increase in mobile adoption has played a significant role in driving the growth of the digital lending market size by making it more convenient and accessible for borrowers to access credit.

Growing Popularity of Online Banking

With more and more consumers turning to online banking for their financial needs, digital lenders have a larger pool of potential borrowers to target. Moreover, online banking has made it easier for consumers to access their financial information, monitor their accounts, and manage their money anywhere, at any time. This has created a more convenient and efficient environment for digital lenders to reach out to potential borrowers and offer them loans through online platforms and mobile apps. In addition, many digital lenders use the data and information from online banking to assess creditworthiness and risk factors, which allows them to offer loans to a wider range of borrowers.

Furthermore, online banking has also led to the development of new financial products and services that cater to the needs of digital consumers. For example, many digital lenders offer personalized loan options based on a borrower's online banking data, which provides a more tailored and efficient lending experience. Therefore, the growing popularity of online banking has created a more favorable environment for digital lenders to thrive and expand their market share, which in turn, has contributed to the digital lending market growth.

Rapidly Changing Consumer Behavior

Changing consumer behavior due to the availability of transformed digital services in numerous organizations to improve optimization is directly influencing the growth of the global digital lending market. Radical advancements in the banking and finance institutions, enabled through communication technologies, require revising present business models and maintenance strategies. As a consequence, internet technologies such as digital lending are gaining significant adoption to increase the use of lending platforms among the consumers. Consumers nowadays are increasingly looking for personalized and customized lending products that meet their specific needs. Digital lending platforms offer greater flexibility and customization compared to traditional lenders, allowing end users to tailor the loans to their specific requirements. Increased use of IoT and digital solutions helps lending operators to improve network availability, prolong asset lifetime, and empower technical staff to efficiently make maintenance. These factors are likely to contribute to the increased installation of digital lending market, globally.

Furthermore, many end users these days prefer the convenience of digital channels, including mobile apps and online platforms, for their financial transactions. Digital lending platforms are well-suited to meet this demand, offering borrowers an easy and streamlined online application process that can be completed from anywhere, at any time. Hence, these multiple benefits offered by digital technologies use in lending operations and maintenance services is expected to boost the demand for digital lending solutions in changing consumer's priorities, which in turn, is likely to drive the market growth globally.

Furthermore, the younger generation of consumers, such as Millennials and Gen Z, are more tech-aware and comfortable with digital platforms than previous generations. According to the Pew Research Center, in September 2019, almost all Millennials (nearly 100%) now use the internet, and 19% of them are smartphone-only internet users. Thus, such factors are likely to drive the demand for the digital lending platforms in younger generation, as they are more likely to turn to digital lending platforms for the borrowing needs, driving the growth of the digital lending market share.

Regulatory Challenges

As digital lending platforms operate across multiple jurisdictions, they need to comply with different rules and regulations, which can be challenging and costly. Moreover, failure to comply with regulations can lead to fines, penalties, and even suspension of operations. This is because different countries have different regulatory frameworks for lending, and digital lending platforms need to comply with these regulations. For instance, in some countries, lending is heavily regulated, and companies need to obtain licenses and follow strict lending criteria to operate. In contrast, other countries may have more relaxed regulations, allowing companies to operate more freely. Thus, this is a significant obstacle for companies looking to expand their operations globally.

Furthermore, regulations can also impact the types of loans that digital lending platforms offer, as well as the interest rates they can charge. Thus, this can limit the revenue potential of these companies and make it harder for them to compete with traditional lenders. Hence, regulatory challenges can significantly impact the growth of the digital lending market, and digital lending companies need to navigate these challenges carefully to succeed in this space.

Cybersecurity Risks

The use of digital platforms for lending involves the collection, storage, and transmission of sensitive personal and financial information, which makes it vulnerable to cyberattacks and data breaches. Furthermore, single data breach or cyberattack can lead to severe financial and reputational losses for digital lenders, as well as erode the trust of customers. This can result in a decline in demand for digital lending services and impact the growth of the market. Therefore, to mitigate cybersecurity risks, digital lenders need to adopt robust security measures such as encryption, two-factor authentication, firewalls, intrusion detection systems, and regular security audits. In addition, they should also ensure that their systems comply with data protection and privacy regulations, such as General Data Protection Regulation (GDPR) and Central Consumer Protection Authority (CCPA), and have a comprehensive incident response plan in place to quickly respond to security incidents. Moreover, the increasing sophistication of cyberattacks and the shortage of cybersecurity talent are adding further challenges to the cybersecurity landscape. Therefore, digital lenders need to continuously monitor and assess their security posture and invest in cybersecurity tools and training to stay ahead of cyber threats and maintain the trust of their customers.

High Prevalence of Advanced and Innovative Technologies

Artificial intelligence, machine learning, and block chain are among the emerging technologies that are expected to enhance the capabilities of digital lending platforms and open up new growth opportunities. The adoption of cutting-edge technologies can significantly transform and enhance the digital lending landscape, creating new opportunities for lenders, borrowers, and other stakeholders in the financial ecosystem.

Furthermore, these technologies are helping lenders to make quicker, more accurate credit decisions and assess the creditworthiness of borrowers in real-time, which helps to improve the overall efficiency of the digital loans. This has led to faster loan approvals, reduced costs, and better borrower experience. For example, artificial intelligence and machine learning algorithms can analyze large volumes of data from a borrower's credit history, social media activity, and other sources to create a more comprehensive and accurate picture of their creditworthiness. Moreover, blockchain technology can also help to increase transparency, security, and reduce the risk of fraud in the digital business loan process by providing a tamper-proof digital ledger of all loan transactions. Therefore, the increasing adoption of advanced and innovative technologies is creating new opportunities for the digital lending market and helping to improve the efficiency and effectiveness of the lending process.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital lending market forecast from 2023 to 2032 to identify the prevailing digital lending market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the digital lending market outlook segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global digital lending market trends, key players, market segments, application areas, and market growth strategies.

Digital Lending Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 71.8 billion |

| Growth Rate | CAGR of 19.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 468 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | Tavant, Nucleus software, Fiserv inc, Temenos, Newgen Software Technologies Limited, ICE Mortgage Technology, Pegasystems Inc., FIS, Sigma Infosolutions, Intellect Design Arena Ltd |

Analyst Review

The digital lending market refers to the use of technology to offer loans to individuals and businesses online. This type of lending is typically conducted through a digital platform or mobile application, allowing borrowers to complete the application process, receive funds, and make loan payments entirely online. Furthermore, the digital lending market has experienced significant growth in recent years, fueled by the increasing adoption of digital technologies and the changing consumer behavior toward finance. Moreover, one of the major trends in the digital lending market is the rise of peer-to-peer lending platforms that connect borrowers directly with lenders, bypassing traditional financial institutions. In addition, the emergence of blockchain technology has led to the development of decentralized lending platforms, enabling borrowers to access loans without the need for intermediaries. Therefore, the digital lending market is expected to continue to grow in the coming years as more consumers shift toward digital channels and fintech companies innovate to meet their changing needs.

Furthermore, market players are adopting strategies like product launch for enhancing their services in the market and improving customer satisfaction. For instance, in November 2022, RazorpayX, the business banking platform of Razorpay, has launched RazorpayX Digital Lending 2.0, a complete digital lending solution for Non- Banking Corporations and FinTechs to adhere to the new digital lending guidelines issued by RBI recently. This solution will help in automating direct disbursals & repayments between the borrower's and the regulated entity's account and make it easier for NBCs and Fintechs to work together more efficiently than ever before. Therefore, such strategies are expected to boost the growth of the digital lending market in the upcoming years.

Moreover, some of the key players profiled in the report are FIS, Fiserv Inc., ICE Mortgage Technology, Intellect Design Arena Ltd., Nucleus Software, Newgen Software Technologies Limited, Pegasystems Inc., Sigma Infosolutions, Temenos, and Tavant. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The rise in online banking has made it easier for consumers to access their financial information, monitor their accounts, and manage their money anywhere, at any time. This has created a more convenient and efficient environment for digital lenders to reach out to potential borrowers and offer them loans through online platforms and mobile apps. Hence, the growing popularity of online banking has created a more favorable environment for digital lenders to thrive and expand their market share, which in turn has contributed to the growth of the digital lending market. Furthermore, with the widespread adoption of smartphones and other mobile devices, borrowers have access to digital lending platforms from anywhere at any time, making it more convenient and accessible for them to apply for loans. Thus, the rise of mobile payments and mobile banking has made it easier for borrowers to receive and repay loans, which has helped to fuel the growth of the digital lending market.

North America is the largest regional market for Digital Lending Market

The global digital lending market was valued at $12,584.36 million in 2022, and is projected to reach $71,812.91 million by 2032, growing at a CAGR of 19.4% from 2023 to 2032.

FIS, Fiserv inc, ICE Mortgage Technology, Intellect Design Arena Ltd, Nucleus software, Newgen Software Technologies Limited, Pegasystems Inc., Sigma Infosolutions, Temenos, and Tavant

Loading Table Of Content...

Loading Research Methodology...