Direct Satellite-To-Phone Cellular Market Research, 2034

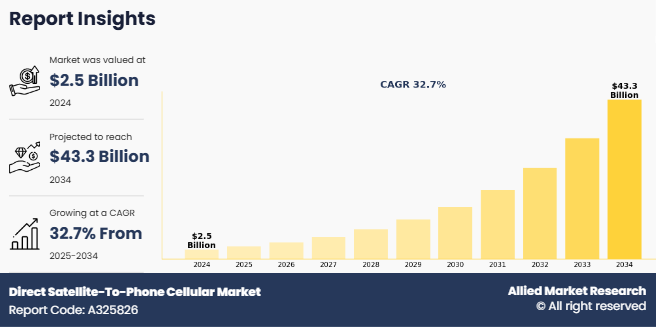

The global direct satellite-to-phone cellular market was valued at $2.5 billion in 2024, and is projected to reach $43.3 billion by 2034, growing at a CAGR of 32.7% from 2025 to 2034.

The direct satellite-to-phone cellular market was valued at $2.5 billion in 2024 and is estimated to reach $43.3 billion by 2034, exhibiting a CAGR of 32.7% from 2025 to 2034. Direct satellite-to-phone cellular is a new technology that allows regular smartphones to connect directly to satellites in space, without needing nearby cell towers. This means people can make calls, send texts, or use data even in remote areas like mountains, oceans, or deserts where there is no mobile signal. The satellites act like mobile towers in the sky and send signals straight to the phone. This technology is helpful in emergencies, natural disasters, or places where traditional networks don’t reach. It does not require any special phone; modern smartphones can use it with some software support. Companies like Apple, SpaceX, and AST SpaceMobile are working on making this service available globally to improve mobile coverage everywhere.

Key Takeaways:

- By service, the data segment segment held the largest share in the direct satellite-to-phone cellular market for 2024.

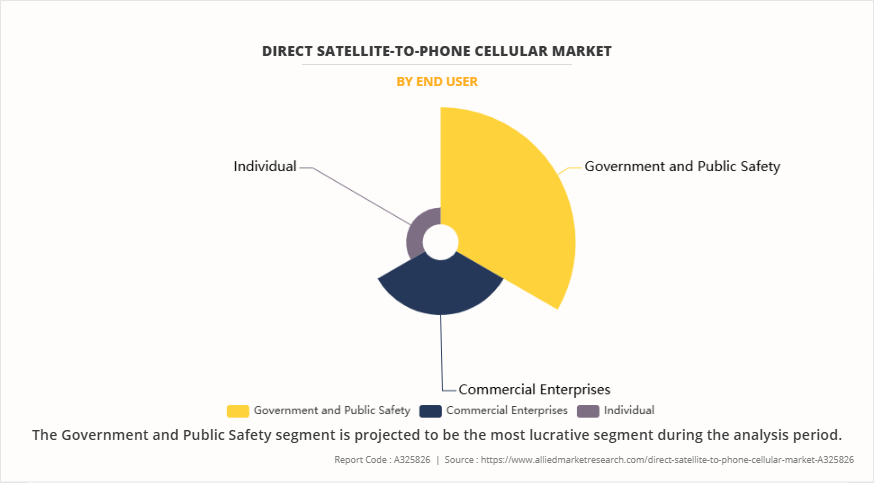

- By end user, the government and public safety segment held the largest share in the direct satellite-to-phone cellular market for 2024.

- Region-wise, North America held the largest market share in 2024. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

The increase in need for remote connectivity is driving the growth of the direct satellite-to-phone cellular market. Many parts of the world, especially rural and isolated regions, still lack reliable access to mobile networks. The setup of traditional cell towers in these areas remains costly and difficult due to harsh terrain or limited infrastructure. Direct satellite-to-phone technology offers a strong alternative by allowing standard mobile phones to connect directly with satellites, removing the need for ground-based towers. This proves helpful for people living in remote villages, workers in oilfields, miners in isolated zones, travelers in off-grid locations, and fishermen at sea. In times of natural disasters or emergencies when regular networks collapse, satellite connectivity provides a dependable way to stay connected. The expanding direct satellite-to-phone cellular market size reflects this growing demand for seamless communication in uncovered areas. The rise in demand for uninterrupted communication and safety across uncovered regions pushes governments, emergency services, and telecom companies to adopt satellite-based mobile solutions, leading to steady market expansion. Emerging direct satellite-to-phone cellular market trends also show increased partnerships between telecom firms and satellite operators to address these connectivity gaps.

Furthermore, the rise in public safety and disaster recovery needs supports the growth of the direct satellite-to-phone cellular market. During natural disasters like earthquakes, floods, or hurricanes, regular mobile networks often stop working. In such times, satellite-based phone connections become important for emergency teams, rescue workers, and affected people. These connections help in sending alerts, sharing updates, and coordinating relief work when normal systems fail. Governments and disaster response agencies prefer satellite services for their wide coverage and reliability. The rise in focus on safety, quick communication, and rapid response in emergencies is increasing the demand for direct satellite-to-phone cellular solutions worldwide.

Segment Review

The direct satellite to phone cellular market is segmented on the basis of service, end-user and region. By service, it is segmented into voice, emergency sos and alerts, data and others. By end user, it is classified into individual, commercial enterprises, and government and public safety, and By region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of service, the direct satellite to phone cellular market was dominated by the data segment in 2024 and is expected to maintain its dominance in the upcoming years. This is attributed to the growing demand for seamless internet connectivity in remote and underserved areas, increased usage of smartphones for streaming, browsing, and real-time applications, and the rising adoption of IoT and connected devices. In addition, advancements in satellite technology are enhancing data transmission capabilities, further fueling segment growth.

However, the emergency sos and alerts segment is expected to register the highest CAGR during the forecast period owing to the increasing need for reliable communication during natural disasters, remote travel, and critical situations, along with growing government initiatives to enhance public safety and emergency response infrastructure.

On the basis of end-user, the Direct Satellite-to-Phone Cellular Market was dominated by the government and public safety segment in 2024 and is expected to maintain its dominance in the upcoming years, due to the increasing demand for reliable, secure, and uninterrupted communication during natural disasters, emergencies, and defense operations in remote or underserved regions.

However, the commercial enterprises are expected to register the highest CAGR during the forecast period. This is attributed to This is attributed to growing adoption for remote asset tracking, maritime connectivity, and business continuity in off-grid areas.

Competition Analysis

The report analyzes the profiles of key players operating in the direct satellite-to-phone cellular market such as SPACEX, AST & Science, LLC, Globalstar, Inc., Lynk Global, Inc., Connecta Satellite Solutions LLC, Hughes Network Systems, LLC., Viasat, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the direct satellite-to-phone cellular market.

Recent Key Developments in the Direct satellite-to-phone cellular market

- In January 2025, T-Mobile officially launched its satellite messaging and location-sharing service using Starlink for U.S. customers, supporting over 60 common smartphone models. Texting and emergency support are live, with voice/data support coming soon.

- In September 2024, Vi announced a strategic tie-up with AST SpaceMobile to bring satellite-to-smartphone connectivity to India using existing smartphones, without special hardware or apps. Launch dates are still under wraps.

Top Impacting Factors

Driver

Increase in Smartphone Penetration

Increase in smartphone penetration is driving the growth of the direct satellite to phone cellular market. As more people gain access to smartphones, especially in remote and rural regions, the demand for reliable and uninterrupted connectivity is growing. Traditional cellular networks often fail to provide coverage in hard-to-reach areas due to lack of infrastructure. This has made people look for better ways to stay connected, and direct satellite-to-phone service helps with that. With the ability to connect directly to satellites without the need for towers or ground infrastructure, this technology allows smartphones to maintain connectivity in areas with little or no cellular coverage. The rise in popularity of smartphones has also driven the demand for services like emergency communication, GPS tracking, messaging, and internet access in off-grid locations, further boosting the market growth. The rising direct satellite-to-phone cellular market demand is a direct response to this growing reliance on mobile connectivity. Moreover, telecom companies and satellite providers are collaborating to integrate satellite connectivity into standard mobile devices, making the service more accessible and affordable. As a result, the direct satellite-to-phone cellular market share is expected to grow steadily in the coming years, as more users rely on consistent and universal mobile coverage. As smartphones become more advanced and widespread, users need continuous network availability everywhere they go, and direct satellite-to-phone solutions are becoming essential to meet that demand. This increase in the dependence on smartphones is boosting the market expansion.

Restraints

High Cost of Satellite Infrastructure

The high cost of satellite infrastructure is hampering the growth of the Direct satellite to phone cellular market. Setting up and maintaining satellite networks requires a massive investment in advanced technology, launch services, and ground control stations. Moreover, building low earth orbit satellite constellations involves high manufacturing and deployment costs, which can limit the entry of new players in the market. In addition, satellite infrastructure needs regular upgrades and maintenance to ensure uninterrupted service and meet the growing demand for high-speed connectivity. This adds to the operational expenses and increases the financial burden on service providers. Furthermore, launching and operating satellites require specialised expertise and compliance with international space regulations, making the process even more complex and costly.

The high initial investment acts as a barrier for telecom operators and smaller tech firms looking to enter the direct satellite-to-phone market. As a result, only a few large companies with significant financial and technological resources can afford to participate actively. This limits market expansion and slows down the adoption of satellite-based mobile communication. Thus, the high cost of infrastructure remains a key challenge that may hinder the growth of the market during the forecast period.

Opportunity

Emerging Markets & Rural Coverage

Emerging markets and rural areas present a strong opportunity for the direct satellite-to-phone cellular market. These regions often lack stable mobile network infrastructure due to difficult terrain, low population density, or high setup costs. In such areas, direct satellite connectivity allows people to make calls, send messages, and access basic internet services without relying on traditional cell towers. This is especially helpful during emergencies, natural disasters, or in remote villages where communication is limited. Moreover, governments and organizations in developing countries are increasingly focusing on improving digital inclusion. The direct satellite-to-phone cellular market growth in these regions is expected to be strong due to rising digital demand. In addition, satellite providers are launching more cost-effective and powerful low-Earth orbit satellites, making this technology more accessible. According to recent Direct satellite-to-phone cellular market forecasts, the industry is poised to expand significantly in low-connectivity zones. Furthermore, the growing use of smartphones in rural regions supports the demand for better connectivity options. Many companies see a big chance to expand their user base by offering affordable satellite services in these markets. For example, sectors like agriculture, education, and healthcare in rural areas can benefit greatly from reliable satellite communication. Overall, the direct satellite-to-phone cellular market outlook remains positive as innovations continue to bridge the digital gap in rural and emerging areas. As technology improves and becomes cheaper, direct satellite-to-phone services will likely become an important way to bring better communication to people in emerging and rural areas.

Key Benefits for Stakeholders

- The study provides an in-depth direct satellite-to-phone cellular market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, & opportunities, and their impact analysis on the direct satellite-to-phone cellular market size is provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the direct satellite-to-phone cellular industry.

- The quantitative analysis of the global direct satellite-to-phone cellular market for the period 2024–2034 is provided to determine the direct satellite-to-phone cellular industry potential.

Direct Satellite-To-Phone Cellular Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 43.3 billion |

| Growth Rate | CAGR of 32.7% |

| Forecast period | 2024 - 2034 |

| Report Pages | 162 |

| By Service |

|

| By End User |

|

| By Region |

|

| Key Market Players | Connecta Satellite Solutions LLC, Hughes Network Systems, LLC., AST & Science, LLC, SPACEX, Lynk Global, Inc., Globalstar, Inc., Viasat, Inc. |

Analyst Review

As the direct satellite-to-phone cellular market continues to evolve, CXOs are evaluating the opportunities and challenges regarding this emerging technology. The direct satellite-to-phone cellular market is growing rapidly due to the increasing demand for reliable, uninterrupted, and wide-area mobile connectivity. As more people depend on mobile phones for communication, safety, and work, the need for coverage beyond traditional networks is increasing—especially in rural, remote, and disaster-prone regions. Satellite service providers are now using advanced technologies like low-Earth orbit (LEO) satellites, AI-powered signal tracking, and real-time coverage optimization to improve service delivery. Users highly value features like 24/7 availability, emergency communication, and stable connections in off-grid areas. These intelligent systems also help operators manage network traffic, optimize satellite performance, and improve user experience. With more individuals, businesses, and governments seeking secure and far-reaching mobile access, the adoption of satellite-to-phone solutions is fueling strong market growth.

In addition, the market is expanding as providers introduce flexible and cost-effective pricing plans. These include emergency-use packs, unlimited satellite messaging plans, and pay-per-use data bundles designed for specific needs. Such models are gaining popularity among outdoor travelers, remote workers, rural residents, and emergency services. Mid-sized and new entrants in the market are also offering app-based satellite activation, cloud-managed virtual SIMs, and simplified billing systems to reduce user costs and support ease of access. These innovations are improving the overall service quality while making the technology accessible to more people. Government programs and public-private partnerships are also supporting satellite connectivity rollouts in unserved and underserved areas through subsidies and infrastructure initiatives.

Moreover, the direct satellite-to-phone cellular market is witnessing growth as more service providers introduce subscription-based models. These monthly plans often include benefits such as unlimited emergency usage, global messaging coverage, real-time location sharing, and disaster alerts. Subscription models offer regular access at fixed prices, making them convenient for families, field workers, and travelers who require constant communication access. These plans also build user trust and support routine usage, especially in regions where cellular networks remain weak or unavailable. However, some challenges persist. Not all mobile devices currently support direct satellite connectivity, and some users may lack clarity on coverage limits or service conditions. Network congestion and high usage periods can also affect service quality. Still, the market continues to move forward. As satellite technologies improve and pricing becomes more user-friendly, direct satellite-to-phone cellular services are becoming a vital solution for individuals and industries seeking dependable and far-reaching mobile communication.

The integration with 5G networks, expansion of low-Earth orbit (LEO) satellite constellations, partnerships between telecoms and satellite providers, advancements in handset compatibility, and increased focus on emergency and disaster-resilient communication systems are the upcoming trends of Direct Satellite-To-Phone Cellular Market in the globe.

Data is the leading service of Direct Satellite-To-Phone Cellular Market.

North America is the largest regional market for Direct Satellite-To-Phone Cellular.

$43.3 billion is the estimated industry size of Direct Satellite-To-Phone Cellular.

SPACEX, AST & Science, LLC, Globalstar, Inc., Lynk Global, Inc., Connecta Satellite Solutions LLC, Hughes Network Systems, LLC., Viasat, Inc. are the top companies to hold the market share in Direct Satellite-To-Phone Cellular

Loading Table Of Content...

Loading Research Methodology...