Electrochromic Glass Market Research, 2033

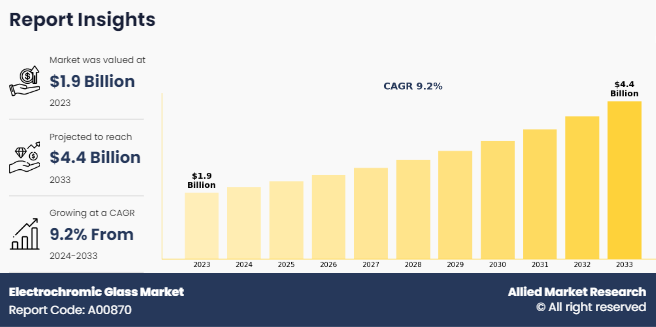

The global electrochromic glass market size was valued at $1.9 billion in 2023, and is projected to reach $4.4 billion by 2033, growing at a CAGR of 9.2% from 2024 to 2033. The adoption of smart building technologies in both commercial and residential sectors is significantly driving the demand for the electrochromic glass market. Smart buildings often integrate advanced energy management systems. Electrochromic glass can be controlled via these systems to optimize light and heat management, reducing the reliance on HVAC systems and artificial lighting.

Introduction

Electrochromic glass, often referred to as smart glass or switchable glass, is a specialized type of glass that has the remarkable property of changing its transparency or opacity when an electrical voltage is applied. This transformation is achieved through the electrochromic effect, where the glass changes color or becomes more or less translucent in response to an electric current. This technology allows dynamic control over the amount of light, heat, and glare that enters a space, providing numerous benefits in terms of energy efficiency and user comfort.

Electrochromic glass has found a valuable place in the automotive industry. It is used for sunroofs, rearview mirrors, and side windows in high-end vehicles. The ability to control the level of tint in these areas enhances driver comfort and safety. Electrochromic mirrors automatically dim to reduce glare from headlights of vehicles behind, while sunroofs get adjusted to prevent excessive sunlight and heat from entering the cabin. This technology contributes to a better driving experience.

Electrochromic technology has made its way into consumer electronics as well. Some e-readers and smartphones feature electrochromic displays. These devices use electrochromic materials to create screens that mimic the appearance of paper, making them easier on the eyes and more readable in bright sunlight. The ability to change the screen's reflective properties is a testament to the versatility of electrochromic materials.

Key Takeaways

- The global electrochromic glass industry has been analyzed in terms of value ($billion). The analysis in the report is provided on the basis of application, end-use industry, 4 major regions, and more than 15 countries.

- The global electrochromic glass market forecast includes a detailed study covering underlying factors influencing the industry opportunities and trends. The key players in the electrochromic glass market are AGC Inc., ChromoGenics AB, Saint-Gobain S.A., SAGEGLASS, Pleotint LLC, Polytronix, Inc., Gentex Corporation, Guardian Industries Corporation, Suntuitive Glass, and, View, Inc.

- The report facilitates strategy planning and industry dynamics to enhance decision-making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., India, Germany, and Brazil hold a significant share in the global electrochromic glass market.

Market Dynamics

The growth of smart buildings and the Internet of Things (IoT) is expected to drive the growth of the electrochromic glass market during the forecast period. Electrochromic glass, known as smart glass, has received importance in the context of smart buildings and the Internet of Things (IoT). This technology allows the dynamic control of light and heat entering a building, leading to expanded energy effectivity and comfort. In clever building systems, electrochromic glass is built-in to optimize lights and temperature based on factors such as occupancy and weather conditions. It mechanically adjusts its tint to limit the need for blinds or shades, enhancing both aesthetics and energy efficiency. In February 2022, Gauzy, an Israeli smart glass technology provider, acquired Vision Systems, a French company, to expand its offerings and enter the Advanced Driver Assistance System (ADAS) industry the use of Vision Systems' camera-based image evaluation and monitoring solutions.

The high cost of electrochromic glass industry is expected to hinder growth during the forecast period. Installing and integrating electrochromic glass into existing buildings is quite expensive. Retrofitting involves substantial modifications to support electrical systems and smart glass controls, driving up material and labor costs. Architectural changes and additional support structures are necessary, adding to the expenses. In addition, ongoing maintenance is required, albeit less costly than the initial purchase, contributing to the total cost of ownership.

The demand for green building certifications is expected to provide lucrative opportunities in the electrochromic glass market. The demand for green building certifications, such as LEED (Leadership in Energy and Environmental Design), has been a significant driving force behind the adoption of innovative technologies in both commercial and residential construction. Among these technologies, electrochromic glass has gained prominence as a sustainable and energy-efficient solution.

LEED certification, issued by the U.S. Green Building Council, sets the standard for sustainable building practices, and recognizes environmentally responsible construction. Buildings pursuing LEED certification aim to achieve energy efficiency and minimize their environmental impact. Electrochromic glass plays a pivotal role in this pursuit by dynamically controlling natural light and heat, enhancing energy efficiency. It is a smart glass technology that allows for on-demand adjustment of tint or opacity to regulate the amount of sunlight and heat that enters a building.

Segments Overview

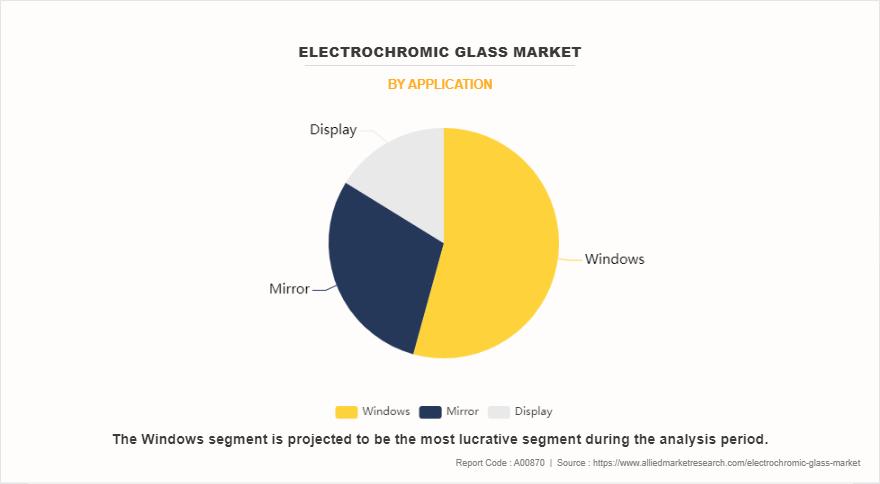

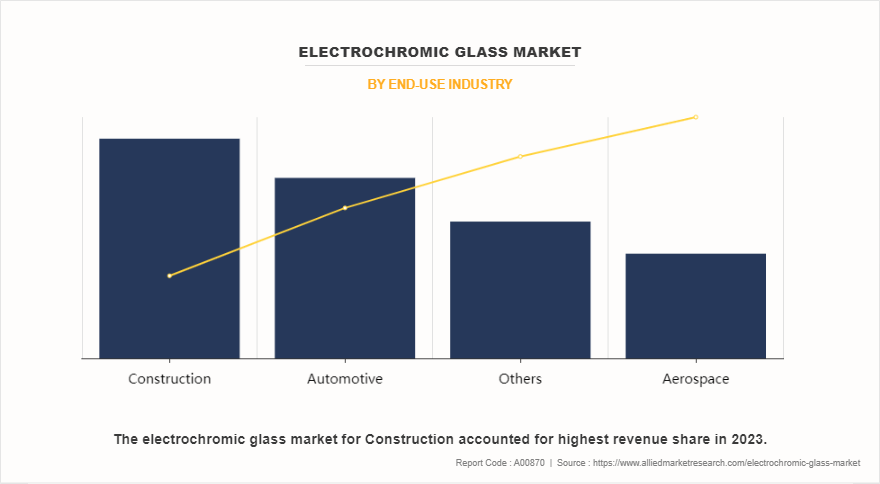

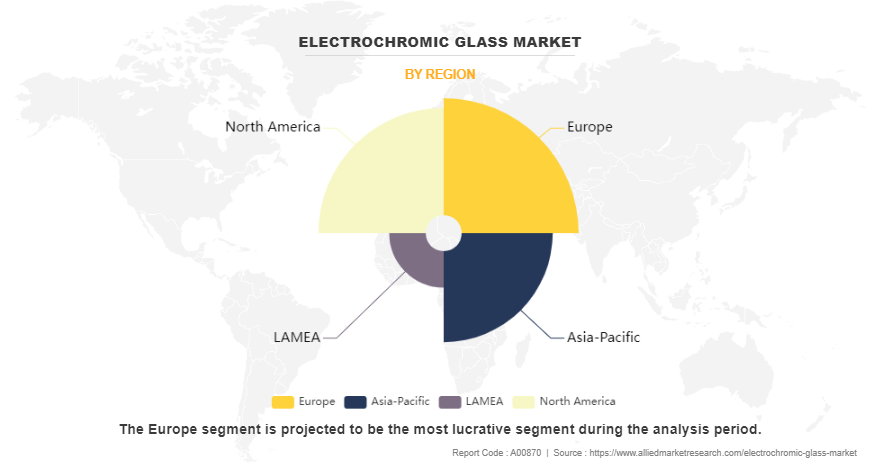

The electrochromic glass market is segmented into application, end-use industry, and region. On the basis of application, the market is divided into windows, mirror, and display. Depending on the end-use industry, the market is classified into construction, automotive, aerospace, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of application, windows segment dominated the market in 2023 accounting for more than half of the market in the market. As the temperature and amount of sunshine change, electrochromic windows have the ability to change their tint or opacity. Buildings with dynamic and modern designs are made with electrochromic glass. A building's aesthetic attractiveness is improved by applying it on partitions, skylights, and facades. Energy efficiency and comfort is maximized by integrating them with other building systems, such as HVAC and lighting.

On the basis of end-use industry, construction industry dominated the market in 2023 accounting for three fourth of the market share in the market. Electrochromic glass blocks a significant amount of harmful UV rays, which help protect interior furnishings and artwork from fading. In construction of conference rooms or bedrooms, electrochromic glass is used for privacy and to reduce glare from outside. Users adjust the tint to their preference, maintaining privacy without sacrificing natural light. Using electrochromic glass to regulate building temperature and lighting leads to reduced energy consumption, making it an environmentally friendly choice.

Region-wise Europe dominated the market in 2023. Electrochromic glass is utilized in contemporary European buildings to manage natural light and heat, reducing the need for artificial lighting and air conditioning for energy efficiency. In addition, it is employed in countries with rich architectural heritage such as Italy and France to safeguard historical structures and artworks by controlling light and UV radiation, preserving valuable artifacts and interiors. Moreover, some European artists and designers have integrated electrochromic glass into interactive art installations that respond to environmental conditions or user interactions.

Competitive Analysis

The major players operating in the global electrochromic glass market include AGC Inc., ChromoGenics AB, Saint-Gobain S.A., SAGEGLASS, Pleotint LLC, Polytronix, Inc., Gentex Corporation, Guardian Industries Corporation, Suntuitive Glass, and, View, Inc.

Historic trends of electrochromic glass market:

- In 1960s, research on electrochromic materials began. Early studies explore the electrochromic properties of tungsten oxide (WO3) and other transition metal oxides.

- In 1973, the first patent for electrochromic glass was indeed granted to Harold J. Byker. He is often credited with pioneering technology and played a significant role in the early development of electrochromic materials and their applications.

- In the 1980s, significant advancements in electrochromic technology led to practical applications, and one of the notable uses was in the automotive industry for rearview mirrors. The development of electrochromic rearview mirrors represented a breakthrough in automotive safety and convenience.

- In the 1990s, electrochromic windows began to gain popularity in both architectural and automotive applications. These innovative windows offered dynamic control of sunlight and privacy.

- In the 2000s, R&D efforts in the field of electrochromic glass led to significant advancements, particularly in terms of improved performance and increased energy efficiency. Electrochromic glass saw increased adoption in architectural applications, such as windows for commercial and residential buildings.

- In 2010s, the adoption of electrochromic glass in energy-efficient building designs became more widespread due to its ability to reduce solar heat gain and improve indoor comfort. Electrochromic glass is increasingly used in smart homes and commercial buildings, with the ability to be controlled electronically and integrated into building automation systems.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electrochromic glass market analysis from 2023 to 2033 to identify the prevailing electrochromic glass market growth.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electrochromic glass market share assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electrochromic glass market trends, key players, market segments, application areas, and market growth strategies.

Electrochromic Glass Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.4 billion |

| Growth Rate | CAGR of 9.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 265 |

| By End-Use Industry |

|

| By Application |

|

| By Region |

|

| Key Market Players | SAGEGLASS, Gentex Corporation, ChromoGenics, Polytronix, Inc., PLEOTINT LLC, View, Inc., RavenWindow, AGC Inc., Guardian Industries, Saint-Gobain |

Analyst Review

According to the opinions of various CXOs of leading companies, the global electrochromic glass market was dominated by the construction segment. Electrochromic glass is a key component of daylight harvesting systems. These systems optimize the use of natural light by automatically adjusting the glass to control glare and heat gain. This enhances indoor comfort and minimizes the need for electric lighting.

The increase in usage of electrochromic glass in automotive sunroofs and windows drives the growth of the electrochromic glass market during the forecast period. The electrochromic glass allows drivers and passengers to adjust the tint of the windows and sunroof, reducing glare and heat from direct sunlight. This enhances driving comfort and safety. The sleek appearance of smart glass in automotive applications enhances the overall aesthetics of the vehicle. Electrochromic glass technology enhances the overall user experience and is integrated with the vehicle's electronics for easy control.

However, the high cost of electrochromic glass is expected to restrain industry expansion. Electrochromic glass is more expensive than traditional glass due to its complex manufacturing process, involving costly materials and specialized techniques. The installation and integration of electrochromic glass into existing structures is also expensive, as it often requires significant modifications for electrical systems and controls, making it less appealing for many building projects.

The Europe region is projected to register robust growth during the forecast period. Many European countries have integrated electrochromic glass into smart building systems. These systems automatically adjust the tint of the glass based on real-time weather conditions and sunlight exposure, ensuring a comfortable indoor environment and less energy consumption.

The global electrochromic glass market was valued at $1.9 billion in 2023, and is projected to reach $4.4 billion by 2033, growing at a CAGR of 9.2% from 2024 to 2033.

The report covers profiles of key industry participants such as AGC Inc., ChromoGenics AB, Saint-Gobain S.A., SAGEGLASS, Pleotint LLC, Polytronix, Inc., Gentex Corporation, Guardian Industries Corporation, Suntuitive Glass, and, View, Inc.

Europe is the largest region for electrochromic glass market.

The growth of smart buildings and the Internet of Things (IoT) and increase in usage of electrochromic glass in automotive sunroofs and windows are the main drivers of electrochromic glass market.

The demand for green building certifications is upcoming trends of electrochromic glass market.

Windows is the leading application of electrochromic glass market.

The electrochromic glass market is segmented into application, end-use industry, and region. On the basis of application, the market is divided into windows, mirror, and display. Depending on the end-use industry, the market is classified into construction, automotive, aerospace, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...

Loading Research Methodology...