Fertilizer Market Overview:

The global fertilizer market size was valued at $184.60 billion in 2021, and is projected to reach $251.57 billion by 2030, growing at a CAGR of 3.55% from 2022 to 2030. The fertilizer market is driven by the growing global population and rise in food demand, necessitating higher agricultural yields. Limited arable land and urbanization further emphasize the importance of fertilizers for sustainable crop production. In addition, rise in adoption of advanced farming practices, such as precision agriculture and nutrient management systems, enhances the efficient use of fertilizers. These factors support the market growth by addressing food security challenges and improving productivity.

Key Market Insights

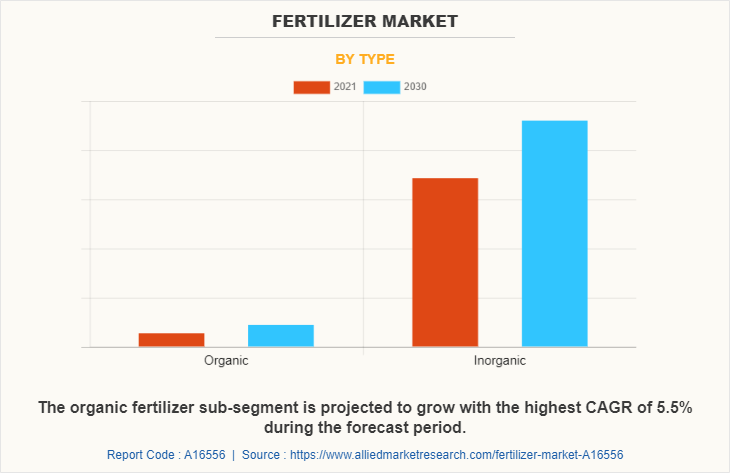

- By Type: Organic fertilizers are projected to grow at the highest CAGR of 5.5% during the forecast period.

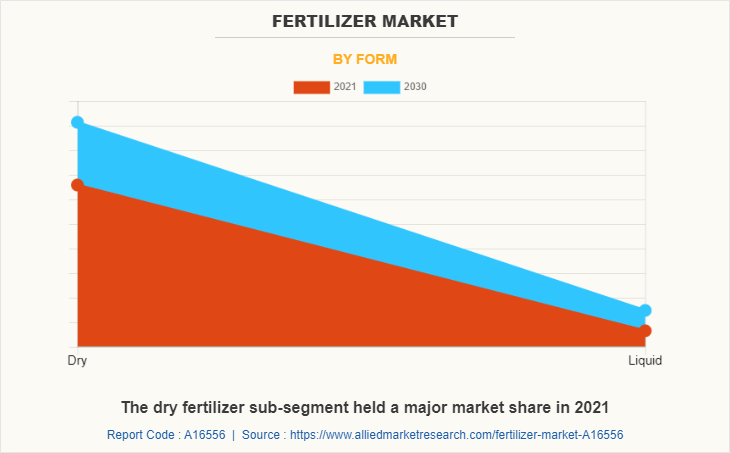

- By Form: Dry fertilizers held the largest market share in 2021.

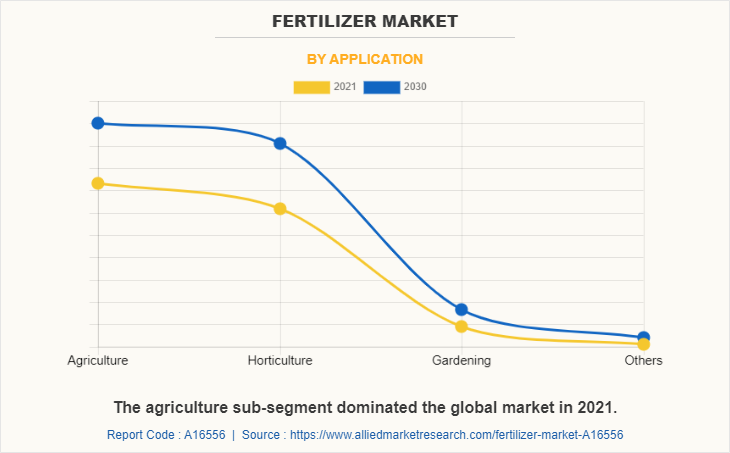

- By Application: Agriculture is expected to remain the dominant application segment.

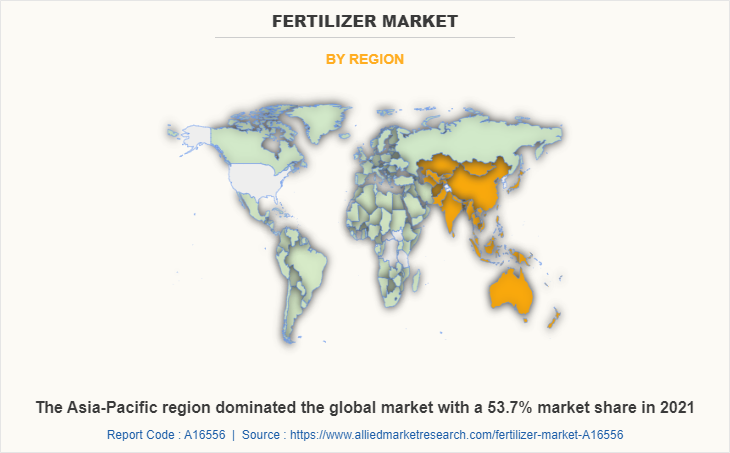

- By Region: Asia-Pacific led the market in 2021 and is expected to retain its dominance.

Market Size & Forecast

- 2030 Projected Market Size: USD 251.57 Billion

- 2022 Market Size: USD 184.60 Billion

- Compound Annual Growth Rate (CAGR) (2022-2030): 3.55%

How to Describe Fertilizer

Fertilizer is a natural or synthetic substance that is added to soil or plants to provide essential nutrients that promote healthy growth and increase agricultural productivity. It typically contains key elements such as nitrogen, phosphorus, and potassium, which are vital for plant development. Fertilizers help improve soil fertility, replenish nutrient deficiencies, and support the growth of crops, especially in areas where the soil lacks the necessary minerals.

Market Dynamics:

Fertilizers of synthetic or natural origin are applied to soil or plant tissue to increase crop performance by enabling plant growth nutrients. Nitrogen-based fertilizers, for example, contain nitrogen, which is the primary constituent of chlorophyll, which aids in plant photosynthesis. Phosphorus fertilizers are beneficial to plant roots because phosphorus is found in cell protoplasm, which promotes cell growth and proliferation. Organic fertilizers, on the other hand, are made from agricultural residues, toxic pollution, municipal silt, or animal waste. These fertilizers increase soil water retention capacity, promote microorganism reproduction, and improve soil physical and chemical properties.

Growth in global population significantly drives the fertilizer market, as it leads to rise in demand for food production. With limited arable land, farmers must increase crop yields to meet rise in food requirements. Fertilizers play a critical role by supplying essential nutrients that enhance soil fertility and plant growth. In addition, changing dietary patterns and urbanization further amplify agricultural output needs. This reliance on fertilizers ensures sustainable food supply chains, addressing the challenges of feeding a rapidly expanding population while maintaining soil health and productivity in the long term.

However, environmental concerns about excessive fertilizer use restrain the growth of the fertilizer market due to the harmful effects of nutrient runoff, which leads to water pollution and eutrophication in aquatic ecosystems. Overapplication of fertilizers depletes soil health and impacts biodiversity, prompting stricter regulations and restrictions on fertilizer use. These challenges encourage the adoption of sustainable farming practices, such as organic farming and precision agriculture, reducing dependence on traditional fertilizers. Thus, the market growth faces limitations due to environmental and regulatory pressures.

Rise in agricultural activities in emerging economies presents a significant opportunity for the growth of the fertilizer market. Increase in demand for higher crop yields to meet the needs of growing populations leads to rise in adoption of fertilizers. Governments in these regions are actively promoting agricultural development through subsidies, infrastructure improvements, and access to modern farming techniques. In addition, expansion of cash crops and export-oriented agriculture enhances the need for specialty and balanced fertilizers, further fueling the market growth in these areas.

Fertilizer Market Market Segment Review:

The global fertilizer market share is segmented on the basis of type, application, and region. By type, market has been divided into organic and inorganic. By form, the analysis has been divided into dry and liquid. By application, the market is further divided into agriculture, horticulture, gardening, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Fertilizer Market, By Type

By type, the market has been divided into organic and inorganic. Among these, the inorganic sub-segment accounted for the highest revenue share in 2021. Inorganic fertilizers are made up of nutrient-rich salts like potassium, phosphorous, nitrogen, and others that disintegrate rapidly and are immediately available to the plants. Because the use of inorganic fertilizers is regulated by law, they have precise nitrogen, phosphate, and potassium, effectively meeting plant and soil requirements.

Fertilizer Market, By Form

By form, the dry sub-segment accounted for the highest revenue share in 2021. Dry fertilizers are commonly used fertilizers. Dry fertilizers are best suited for slow-release formulations because they are absorbed more slowly by plants and must first be broken down. Because they do not "settle out" over time or in cold weather, these fertilizers are less expensive and easier to store. This is one of the reasons for the fertilizer market growth.

Fertilizer Market, By Application

By application, the agriculture sub-segment is anticipated to have the dominant share during the forecast period. Agriculture sub-segment accounted for the highest revenue share in 2021. Fertilizer demand in agriculture has skyrocketed as a result of rising global population, globalization, and the development of smart cities, all of which have resulted in a decrease in arable land availability and an increase in food demand. Fertilizers are important for maintaining soil nutrient levels, meeting crop nutritional needs, and increasing agricultural productivity. According to Future Farming, a brand focusing on smart farming, the world's population is expected to reach 10 billion by 2050. As a result, increasing agricultural productivity is critical in order to meet the food needs of the growing population. As a result, the use of fertilizers in the agricultural sector is critical to balancing nutrients in the soil.

Fertilizer Market, By Region

By region, Asia-Pacific dominated the global fertilizer market share in 2021 and is forecasted to remain the dominant region during the forecast period. The growing agricultural practices and demand for high-quality agricultural produce are expected to drive the growth of the nitrogenous fertilizers market in this region. Rice, sugar beet, fruits and vegetables, cereals, and grains are among the major crops grown in Asia; the region consumes 90 percent of the world's rice production. Asian countries such as Korea, China, Japan, and, more recently, Vietnam are using high nitrogenous fertilizer rates per hectare for both short-term and perennial crops. As a result, the region has a high demand for specialty fertilizers.

Which are the Leading Companies in Fertilizer

The key players profiled in this report include Yara International, Nutrien Ltd., The Mosaic Company, Haifa Group, Syngenta AG, ICL Group Ltd., EuroChem Group, OCP Group S.A., K+S Aktiengesellschaft, and Uralkali.

Which key developments have shaped the market recently

January 2023: ICL entered a strategic partnership with General Mills, becoming a key supplier of specialty phosphate solutions. The long-term agreement also includes plans for global market expansion.

May 2022: ICL introduced three new NPK formulations under its Solinure brand, enhanced with increased trace elements aimed at optimizing crop yields.

May 2022: ICL secured supply agreements with customers in India and China to deliver 600,000 and 700,000 metric tons of potash, respectively, throughout 2022. The agreed price was USD 590 per ton.

What are the Key Benefits For Stakeholders

- The report provides an in-depth analysis of the global fertilizer market trends along with the current and future market forecast.

- This report highlights the key drivers, fertilizer market opportunities, and restraints of the market along with the impact analyses during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the global fertilizer market growth for strategy building.

- A comprehensive global fertilizer market analysis covers factors that drive and restrain the market growth.

- The qualitative data in this report aims on market dynamics, trends, and developments.

Fertilizer Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Type |

|

| By Form |

|

| By Region |

|

| Key Market Players | OCI, cf industries, Nutrien, Yara International, OCP, PhosAgro, eurochem, K+S, Mosaic Company, Uralkali, Israel Chemicals Limited |

Analyst Review

According to the CXOs of the leading companies, the global fertilizer market possesses a substantial scope for growth in the future. The global fertilizer industry is fragmented, with many large and small-scale fertilizer businesses operating in both developed and emerging nations. Fertilizers are an important factor for enhancing agricultural output that players in the industry have been trying to form strategic alliances and partnerships to expand one‘s geographical footprint and product portfolio. In 2019, for instance, Haifa Group increased its fertilizer production capacity in France by 8,000 MTPA. Using this method, the corporate entity was able to boost its production capacity by up to 24,000 MTPA. In 2018, Yara International ASA paid USD 255 million for Brazil's Vale Cubato Fertilizantes Complex. As a result, the company's nitrogen manufacturing assets and market position in the Brazilian fertilizer industry improved. All such factors and initiatives will drive the global fertilizer market growth. According to the CXOs, Asia-Pacific is projected to register faster growth as compared to North American and European markets

The rising population, particularly in developing countries like India, is expected to increase demand for fertilisers. Fertilizers help crops grow because they play an important role in increasing crop productivity by improving soil fertility. Food demand has increased as the world's population has grown, which may create lucrative opportunities for the market

Agreement, business expansion, and product launch are the key growth strategies of global Fertilizer market players.

Asia-Pacific will provide more business opportunities for global Fertilizer market in the future.

Yara International, Nutrien Ltd., The Mosaic Company, Haifa Group, Syngenta AG, ICL Group Ltd., EuroChem Group, OCP Group S.A., K+S Aktiengesellschaft, and Uralkali. are the leading market players active in the Fertilizer market.

Agriculture segment held the maximum share of the global fertilizer market in 2021.

To meet demand, the agriculture industry is under pressure to produce more food crops. Fertilizers are heavily used in agriculture to increase soil productivity. To increase crop yield, synthetic or chemical fertilisers are commonly used. However, there is a shift toward the use of organic fertilisers due to increased awareness of the harmful effects of chemical fertilisers on both humans and the environment. People are choosing organic foods and are willing to pay a slightly higher price for them, which will ultimately accelerate the global Fertilizer market growth in the next few years

Organic fertilizers improve soil nutrients, water retention capability, and soil structure. Synthetic or inorganic chemicals contain chemical molecules such as ammonium nitrate, potassium sulphate, and others that are disruptive to the soil. All such factors are predicted to drive the adoption of fertilizers.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global fertilizer market from 2021 to 2030 to determine the prevailing opportunities.

Loading Table Of Content...