Financial Wellness Benefits Market Research, 2032

The global financial wellness benefits market was valued at $2 billion in 2022, and is projected to reach $7 billion by 2032, growing at a CAGR of 13.8% from 2023 to 2032.

Financial wellness benefits is a place where businesses shop for tools that can make their employees' financial lives better. In this market, companies find all sorts of resources to support their workers' financial well-being. These resources might include financial education programs, retirement planning assistance, or access to financial advisors. It's like a one-stop shop for everything related to money management. Businesses invest in these benefits to help their employees thrive financially, reduce stress, and achieve their financial goals. When employees have access to these benefits, they can worry less about money and focus more on their jobs, creating a win-win situation for both employers and employees.

Employee retention and productivity play pivotal roles in fueling the growth of the market. As businesses recognize the tight link between a satisfied, financially secure workforce and their bottom line, they are increasingly offering financial wellness benifits as a strategic investment. Improved employee retention is a direct result of these programs. When employees have access to resources that help them manage their finances effectively, they experience reduced stress and anxiety. This, in turn, fosters a more positive work environment and decreases turnover rates, as employees are less likely to seek employment elsewhere.

However, when employees are disengaged, they are less likely to take advantage of these valuable resources. In addition, disengaged employees often fail to recognize the benefits of financial wellness benefits or understand how these programs can positively impact their lives. As a result, they are less motivated to participate, attend workshops, or seek financial guidance.

Furthermore, without employee engagement, it becomes challenging to gather data on the effectiveness of financial wellness benefits. Employers may struggle to assess the impact of these benefits on employee productivity, job satisfaction, and retention rates, making it harder to justify further investment in these programs. On the other hand, the growing innovation in financial wellness benefits offerings is ushering in exciting opportunities for the market. the synergy of AI-driven financial tools and mobile apps is transforming the financial wellness landscape, creating a win-win scenario where individuals and organizations alike benefit from improved financial health and stability.

The report focuses on growth prospects, restraints, and trends of the financial wellness benefits market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the financial wellness benefits market.

Segment Review

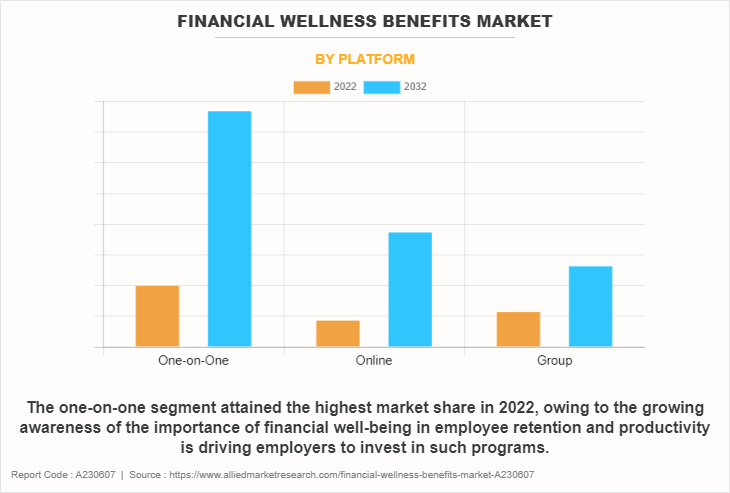

The financial wellness benefits market is segmented on the basis of program, platform, end user, and region. On the basis of the program, the market is bifurcated into financial planning, financial education and counselling, retirement planning, debt management, and others. Based on the platform, the market is segmented into one-on-one, online, and group. By end user, it is bifurcated into large businesses and small & medium-sized businesses. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By platform, the one-on-one segment held the highest share in the financial wellness benefits market. This was attributed to the rise of technology that has made it easier to deliver personalized financial advice efficiently through digital channels. Furthermore, with increasing financial complexities, employees are seeking more guidance to navigate their financial lives, fueling the demand for financial wellness benefits. Meanwhile, the online segment is forecasted to be the fastest-growing segment in the financial wellness benefits market. This is attributed to the fact that the online financial wellness benefits segment has witnessed significant growth due to the increasing digitalization of workplaces and the rise of remote work. Employers are increasingly adopting online platforms to provide financial education and tools to their employees, further fueling growth.

Based on region, North America attained the highest market share in the financial wellness benefits market. This can be attributed to the surge in demand for financial wellness benefits has been steadily increasing in North America. Employees are more aware of the importance of financial well-being, and they expect their employers to provide resources and support to help them manage their finances effectively. However, The Asia-Pacific region is forecasted to be the fastest-growing segment in the financial wellness benefits market trends. This growth can be attributed as Asia-Pacific region is witnessing a digital transformation in financial services. Fintech companies are playing a significant role in delivering financial wellness benefits. Mobile apps and online platforms are increasingly being used to provide financial education, budgeting tools, and access to investment options.

Some of the key players profiled in the financial wellness benefits market report include Aon plc, Bank of America Corporation, FMR LLC, Mercer LLC., MetLife Insurance Limited, Morgan Stanley, Prudential Financial, Inc., Social Finance, Inc., The Charles Schwab Corporation, and Virgin Pulse. These players have adopted various strategies to increase their market penetration and strengthen their position in the financial wellness benefits market size.

Market Landscape and Trends

The financial wellness benefits market has seen significant growth due to rising awareness about the importance of financial well-being. One prominent trend is Numerous startups and established financial firms are entering the market, offering a range of services from budgeting tools to investment advice. In addition, financial wellness is linked to physical and mental health, so some companies are integrating it with healthcare benefits. Another notable trend is employers are focusing on financial literacy programs to help employees make informed financial decisions. Overall, the financial wellness benefits market is expanding rapidly, driven by the growing demand for financial security and employers' recognition of its importance in maintaining a happy and productive workforce.

Top Impacting Factors

Increasing Financial Stress Among Individuals

These benefits often include financial education programs, budgeting assistance, debt management support, and retirement planning guidance. By providing these services, employers aim to reduce employees' financial stress, which, in turn, can lead to improved job satisfaction, increased focus, and reduced absenteeism. Moreover, companies have realized that investing in their employees' financial wellness can result in higher employee retention rates and better recruitment outcomes. It's a win-win situation where employees gain the knowledge and tools to better manage their finances, while employers benefit from a more engaged and financially secure workforce. This trend reflects a growing understanding that financial well-being is interconnected with overall health and job performance, making it a critical component of comprehensive employee benefits packages are major factors in the financial wellness benefits market growth.

Employee Retention and Productivity

When employees have access to resources that help them manage their finances effectively, they experience reduced stress and anxiety. This, in turn, fosters a more positive work environment and decreases turnover rates, as employees are less likely to seek employment elsewhere. In addition, enhanced productivity is a byproduct of financial wellness. Employees burdened with financial concerns are often distracted at work, leading to reduced productivity. Financial wellness benefits industry provide guidance on budgeting, saving, and investing, empowering employees to gain control over their finances. As a result, they can focus better on their tasks, leading to increased productivity and overall job satisfaction. This dual benefit of higher retention rates and improved productivity drives the financial wellness benefits industry.

Lack of Employee Engagement

The lack of employee engagement poses a significant obstacle to the growth of the financial wellness benefits market share. Financial wellness benefit programs are designed to help employees manage their money, reduce financial stress, and improve their overall financial health. However, when employees are disengaged, they are less likely to take advantage of these valuable resources. In addition, disengaged employees often fail to recognize the benefits of financial wellness benefits or understand how these programs can positively impact their lives. As a result, they are less motivated to participate, attend workshops, or seek financial guidance. Furthermore, without employee engagement, it becomes challenging to gather data on the effectiveness of financial wellness benefits program. Employers may struggle to assess the impact of these benefits on employee productivity, job satisfaction, and retention rates, making it harder to justify further investment in these financial wellness programs.

Leveraging Technology such as AI-driven Financial Tools and Mobile Apps

Mobile apps make these resources easily accessible, putting financial management literally at users' fingertips. In addition, people can track their spending in real-time, receive automated reminders for bills and savings goals, and even access robo-advisors for investment guidance. This fosters financial literacy and encourages responsible financial habits. Moreover, these technologies break down barriers to entry for traditionally underserved communities, promoting financial inclusion. For businesses, offering AI-driven financial wellness benefits can enhance employee satisfaction and productivity. Employees equipped with these tools are better equipped to manage their financial stress, leading to reduced absenteeism and turnover. Therefore, leveraging technology in the financial wellness benefits market will provide ample opportunities for growth in the upcoming years.

Key Benefits for Stakeholders

- This financial wellness benefits market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the financial wellness benefits market forecast from 2022 to 2032 to identify the prevailing financial wellness benefits market opportunity.

- financial wellness benefits market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the financial wellness benefits market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global financial wellness benefits market.

- financial wellness benefits market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global financial wellness benefits market outlook, key players, market segments, application areas, and market growth strategies.

Financial Wellness Benefits Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7 billion |

| Growth Rate | CAGR of 13.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 407 |

| By Program |

|

| By Platform |

|

| By End User |

|

| By Region |

|

| Key Market Players | The Charles Schwab Corporation, Advocate Inc. (Nava), Aon plc., Mercer LLC, Prudential Financial, Inc., Virgin Pulse, LLC, Morgan Stanley, Bank of America Corporation, MetLife Insurance Limited, FMR LLC |

Analyst Review

The financial wellness benefits market is witnessing significant growth as organizations recognize the importance of employee financial well-being. This trend gained momentum due to the pandemic's financial impact. Companies offering financial wellness benefits are providing employees with tools and resources to manage their finances effectively, reduce stress, and improve productivity. These benefits include financial education, debt management, budgeting tools, and retirement planning. From a CXO prospective, investing in financial wellness benefits is a strategic move. It enhances employee engagement, loyalty, and ultimately, the company's bottom line. It also attracts top talent in a competitive job market. However, it's essential to evaluate ROI and tailor benefits to your workforce's needs. Regularly measuring the impact of these programs is crucial.

Furthermore, the financial wellness benefits market is diverse, with a mix of traditional financial institutions, fintech startups, and HR tech companies offering solutions. As the market grows, customization and personalization of benefits are becoming key differentiators. Regulatory changes and data security concerns also play a significant role in shaping this market's future. Moreover, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in March 2022, Fidelity Investments introduced Innovative Benefits Equity Scorecard to help organizations ensure employee benefits are equitable and inclusive for all workers. These scorecards offer holistic framework to align employee benefits with diversity, equity and inclusion strategy and address specific needs of workforce. Fidelity expands diversity, equity and inclusion resources available to employers and employees as part of its efforts to improve financial outcomes for all

Some of the key players profiled in the report include Aon plc, Bank of America Corporation, FMR LLC, Mercer LLC., MetLife Insurance Limited, Morgan Stanley, Prudential Financial, Inc., Social Finance, Inc., The Charles Schwab Corporation, and Virgin Pulse. These players have adopted various strategies to increase their market penetration and strengthen their position in the financial wellness benefits market.

The financial wellness benefits market has seen significant growth due to rising awareness about the importance of financial well-being. One prominent trend is Numerous startups and established financial firms are entering the market, offering a range of services from budgeting tools to investment advice.

Financial wellness benefits is a place where businesses shop for tools that can make their employees' financial lives better. In this market, companies find all sorts of resources to support their workers' financial well-being. These resources might include financial education programs, retirement planning assistance, or access to financial advisors.

North America is the largest regional market for Financial Wellness Benefits

The global financial wellness benefits market was valued at $1,981.56 million in 2022 and is projected to reach $6,997.40 million by 2032, growing at a CAGR of 13.8% from 2023 to 2032.

Aon plc, Bank of America Corporation, FMR LLC, Mercer LLC., MetLife Insurance Limited, Morgan Stanley, Prudential Financial, Inc., Social Finance, Inc., The Charles Schwab Corporation, and Virgin Pulse

Loading Table Of Content...

Loading Research Methodology...