Floating Production Storage And Offloading (FPSO) Market Research, 2033

The global floating production storage and offloading (FPSO) market size was valued at $25.2 billion in 2023, and is projected to reach $46.2 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033.

Market Introduction and Definition

A Floating Production Storage and Offloading (FPSO) unit is a floating vessel used by the offshore oil and gas industry for the production, processing, and storage of hydrocarbons. The FPSO is anchored at sea and equipped with production facilities to process extracted hydrocarbons and storage tanks to hold the processed oil until it can be offloaded to shuttle tankers or pipelines for transportation to shore. FPSOs are especially advantageous in deepwater and remote locations where seabed infrastructure is challenging or uneconomical. They offer flexibility in relocation, allowing for reuse in different fields after the depletion of the current reservoir. This adaptability makes FPSOs a vital component in the offshore production landscape, providing an efficient solution for the exploitation of underwater oil and gas resources.

Key Takeaways

- Over 1, 500 product literatures, industry releases, annual reports, and various documents from major floating production storage and offloading market participants, along with credible industry journals, trade association releases, and government websites, have been reviewed to generate valuable industry insights.

- The floating production storage and offloading market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets and floating production storage and offloading market overview, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

- Floating production storage and offloading market news and key industry trends are also included in the report.

Market Dynamics?

A key driver propelling the floating production storage and offloading market is the increasing exploration and production activities in deepwater and ultra-deepwater regions. As conventional onshore and shallow-water oil reserves become more challenging and less productive, tThe industry has shifted its focus to offshore fields located in deeper waters as conventional onshore and shallow-water oil reserves become more challenging and less productive. These areasOffshore fields, typically defined as depths beyond 400 meters (approximately 1, 300 feet) for deepwater and exceeding 1,500 meters (about 5, 000 feet) for ultra-deepwater, hold substantial untapped hydrocarbon resources. In 2020, global oil production saw witnessed significant contributions from key players such as the U.S., Saudi Arabia, and China. Among these, Saudi Arabia emerged as the largest producer, contributing 519.6 million tonnes to the global supply. The U.S. followed closely behind, producing 252.2 million tonnes of oil, showcasing its position as a major player in the global energy market. China, despite being the third-largest producer in this group, produced 194.8 million tonnes, demonstrating its significant role in meeting both domestic and international energy demands.

However, developing and deploying FPSOs involve substantial upfront costs, including vessel construction, installation, and infrastructure setup. The complexity and size of these investments can pose financial challenges for operators, especially in periods of economic uncertainty or fluctuating oil prices. Moreover, FPSO projects often require long lead times for engineering, procurement, and construction, which can further delay returns on investment. Nevertheless, the global push towards sustainable energy solutions presents an opportunity for FPSOs. Integrating renewable energy sources, such as wind and solar power, with FPSO operations can reduce carbon emissions and environmental impacts, aligning with increasingly stringent regulatory requirements and corporate sustainability goals. Integrating renewable energy into FPSO operations offers several compelling advantages. Firstly, offshore facilities, particularly FPSOs, operate in remote and challenging environments where access to traditional power grids may be limited.

By harnessing wind and solar energy, FPSOs can reduce their reliance on fossil fuels for electricity generation, thereby lowering operational emissions and decreasing their environmental footprint. This aligns with global efforts to combat climate change and meet stringent regulatory requirements aimed at reducing greenhouse gas emissions from industrial activities. Moreover, incorporating renewable energy sources enhances the resilience and sustainability of FPSO operations. Renewable energy can provide a stable and predictable power supply, complementing traditional energy sources and improving overall energy efficiency. This not only contributes to operational cost savings but also enhances the reliability of offshore operations, crucial for maintaining continuous production and ensuring energy security.

Market Segmentation?

The floating production storage and offloading market is segmented on the basis of type, propulsion, hull type, application, and region. By type, the market is classified bifurcated into converted and new build. By propulsion, the market is classified divided into self-propelled and towed. By hull type, the market is classified into single hull and double hull. By application, the market is classified categorized into shallow water, deepwater, and ultra-deepwater. Region-wise, the floating production storage and offloading market share is studied across North America, Europe, Asia-Pacific, and LAMEA.?

Regional/Country Market Outlook

The floating production storage and offloading market in the Middle East and Africa is experiencing robust growth, driven by the regions' vast untapped offshore hydrocarbon reserves and increasing investment in offshore exploration and production. In the Middle East, countries such as Saudi Arabia, the UAE, and Qatar are expanding their offshore capabilities, with national oil companies like Saudi Aramco and ADNOC leading strategic investments in FPSO projects to enhance and diversify their production portfolios.

Furthermore, Africa, with its rich offshore oil fields in regions like West Africa (notably Nigeria, Angola, and Ghana) , is leveraging FPSOs to overcome the logistical and infrastructural challenges posed by deepwater exploration. The flexibility, mobility, and efficiency of FPSOs make them an ideal solution for these remote and deepwater environments, supporting sustained production and contributing to the energy security of both regions.

Competitive Landscape

Key players in the floating production storage and offloading market include MODEC, Inc, SBM Offshore N.V., BW Offshore, ABB Group, Exxon Mobil Corporation, Emerson Global, Teekay Corporation, Chevron Corporation, Bluewater Energy Services B.V., and Yinson Holdings Berhad.

Key Developments

- MODEC, Inc. ("MODEC") was announced that it proceeded with engineering, procurement, and construction on the Uaru Floating Production, Storage, and Offloading (FPSO) vessel following a final investment decision on the Uaru project by ExxonMobil Guyana and its co-venturers in April, 2023. Uaru represents a significant addition to MODEC’s portfolio, covering the Engineering, Procurement, Construction, and Installation (EPCI) of the FPSO. The FPSO will have a topside designed to produce around 250, 000 barrels of oil per day. Additionally, it will have the capability to treat approximately 540 million cubic feet of associated gas per day, inject 350,000 barrels of water per day for reservoir pressure maintenance, and handle produced water up to 300,000 barrels per day.

- MODEC, Inc. (“MODEC”) announced its intention to establish a new office in Kuala Lumpur, Malaysia in May 2024. This expansion, under the auspices of Offshore Frontier Solutions Pte. Ltd., aims to support Engineering, Procurement, Construction, and Installation (EPCI) projects for floating offshore solutions. The initiative will create over 200 new positions in engineering and various corporate support functions, to be filled by early 2025.

- In January 2024, Offshore Frontier Solution Pte Ltd in Singapore, a joint venture between MODEC and Toyo Engineering Corporation awarded ABB the contract to provide a comprehensive electrical system and related digital solutions for an ExxonMobil floating production storage and offloading (FPSO) vessel serving the South American Uaru oil field. Named Errea Wittu, the offshore FPSO will operate approximately 200 kilometers off the coast of Guyana. It represents ExxonMobil's fifth FPSO in Guyana and will integrate the Snoek, Mako, and Uaru resources within the Stabroek block. Expected to commence operations by 2026, the vessel will initially produce 250,000 barrels of oil per day and feature a gas treatment capacity of 540 million standard cubic feet per day.?

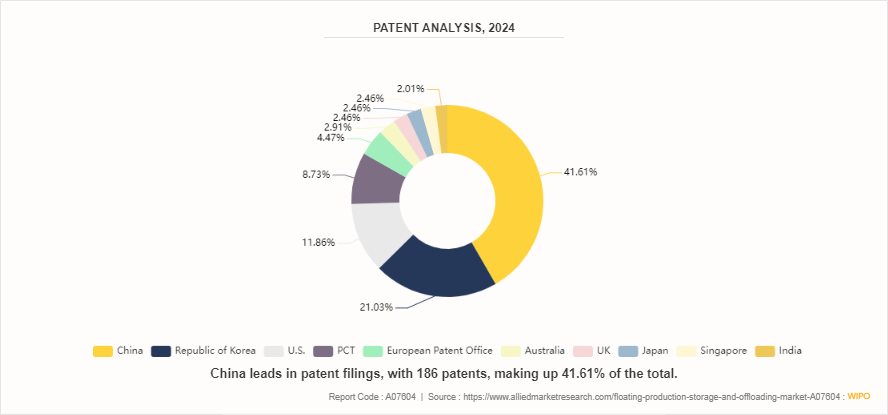

Patent Analysis

Key Industry Trends

- Subsea7 was awarded a "sizeable" contract by Dana Petroleum (E&P) Limited in June 2024 to develop the Bittern offshore oil and gas field, located approximately 190 kilometres east of Aberdeen in the UK Central North Sea at a water depth of 90 metres. According to the statement, the contract is worth between $50 million and $150 million. The contract covers project management, engineering, procurement, construction, and installation (EPCI) of a 22-kilometer 12-inch water injection pipeline. Subsea7's scope also includes subsea infrastructure and tie-ins to the Triton Floating Production Storage & Offloading (FPSO) vessel and the Bittern field.

- In June 2024, China National Offshore Oil Corporation (CNOOC) announced?that the first cylindrical floating oil-gas production, storage, and offloading (FPSO) facility in Asia, known as "Haikui No. 1, " has been successfully deployed at sea.?According to CNOOC, ?this achievement represents a significant milestone in the country's ability to deploy floating infrastructure in deepwater oilfields.?"Haikui No. 1" is a self-developed cylindrical FPSO facility in China. It is placed in the sea of the Liuhua Oilfield in the Pearl River Mouth Basin, which is more than 320 metres deep and approximately 240 kilometres southeast of Shenzen. "Haikui No. 1" weighs 37, 000 tonnes and is about thirty floors high. It incorporates crude oil production, storage, and offloading activities. It has almost 600, 000 components and?a maximum oil storage capacity of 60, 000 tonnes.

Key Sources Referred

- International Maritime Organization (IMO)

- American Bureau of Shipping (ABS)

- Lloyd's Register

- International Association of Oil & Gas Producers (IOGP)

- Society of Petroleum Engineers (SPE)

- DergiPark

- IEEE Xplore

?Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the floating production storage and offloading (FPSO) market analysis from 2024 to 2033 to identify the prevailing floating production storage and offloading (FPSO) market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the floating production storage and offloading (FPSO) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global floating production storage and offloading (FPSO) market trends, key players, market segments, application areas, and market growth strategies.

Floating Production Storage and Offloading (FPSO) Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 46.2 Billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Region |

|

| By Type |

|

| By Propulsion |

|

| By Hull Type |

|

| By Application |

|

| Key Market Players | Bluewater Energy Services B.V., SBM Offshore N.V., BW Offshore Limited, MODEC, Inc., Emerson Global, ABB Group, Teekay Corporation, Chevron Corporation, Exxon Mobil Corporation, Yinson Holdings Berhad |

The floating production storage and offloading (FPSO) market was valued at $25.2 billion in 2023, and is estimated to reach $46.2 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033.

Key players in the floating production storage and offloading market include MODEC, Inc, SBM Offshore N.V., BW Offshore, ABB Group, Exxon Mobil Corporation, Emerson Global, Teekay Corporation, Chevron Corporation, Bluewater Energy Services B.V., and Yinson Holdings Berhad.

The increasing exploration and production activities in deepwater and ultra-deepwater offshore fields drive the floating production storage and offloading market.

The shallow water segment is expected to grow faster throughout the forecast period.

LAMEA is the largest regional market for Floating Production Storage and Offloading (FPSO).

Loading Table Of Content...