Gas Treatment Market Research, 2032

The global gas treatment market size was valued at $4,139.9 million in 2022, and is projected to reach $6,928.8 million by 2032, growing at a CAGR of 5.3% from 2022 to 2032. Gas treatment, also known as gas conditioning, is a pivotal process integral to enhancing the quality of gases by eliminating undesirable components. This method primarily involves the absorption of corrosive gases, such as hydrogen sulfide and carbon dioxide, from the atmosphere using amine solutions. By effectively removing these unwanted gases, gas treatment plays a critical role in the processing of natural gas and the refining of crude oil. The process ensures that the resulting gas stream aligns with quality standards and environmental regulations, as it efficiently captures and removes harmful gases using amine solutions.

This not only safeguards infrastructure and equipment from corrosion but also enhances the overall efficiency of natural gas. Recognized as a major and essential step in the energy industry, gas treatment contributes significantly to the production of cleaner and safer gas products for diverse applications. Ultimately, gas treatment is pivotal in advancing the industry's commitment toward delivering environmentally compliant and high-quality gas resources.

The rising demand for natural gas driven by a global shift towards cleaner energy sources has boosted the importance of efficient gas treatment proceduresand thus support gas treatment market growth. As societies worldwide prioritize greener alternatives to conventional fossil fuels, natural gas emerges as a key player due to its reduced carbon footprint in comparison to coal and oil. This increase in demand, driven by both residential and industrial dependence on natural gas for energy needs, necessitates comprehensive gas treatment processes. Purifying and conditioning natural gas to meet stringent quality standards has become imperative, requiring the elimination of pollutants, contaminants, and unwanted byproducts. Companies specializing in gas treatment technologies are witnessing increased significance and growth as they play a crucial role in maintaining the integrity and efficacy of the natural gas supply. The entire effectiveness and reliability of the natural gas infrastructure, along with environmental concerns, focus on advancements in gas treatment technology. This rising demand for natural gas not only propels innovation in gas treatment but also attracts substantial investments, fostering a dynamic industry environment geared towards meeting the evolving needs of a cleaner and more sustainable future. Gas treatment, in enabling the utilization of natural gas as a cleaner energy source, is poised to play an increasingly vital role in the ongoing transformative changes in the global energy landscape.

The gas treatment market outlook faces a formidable dual challenge of insufficient supply and increasing raw material costs posing a serious threat to its operational landscape. The industry's capacity to meet increasing demand is expected to be hampered by a shortage of raw materials essential for gas treatment operations. Environmental constraints that restrict the extraction or utilization of specific commodities, along with disruptions in the supply chain and geopolitical uncertainties, intensify this shortage. Adding to the complexity, the high costs of raw materials strain the financial condition of gas treatment companies, creating a ripple effect that extends to their operating margins. The industry's heavy reliance on specialized components and chemicals for effective gas purification makes it vulnerable to any disruptions in the supply chain. This leads to decreased overall productivity and efficiency. The soaring expenses of raw materials not only challenge the long-term objective of achieving affordable and sustainable environmental solutions but also hampers the economic viability of gas treatment projects, urging a strategic reevaluation of the sector's dynamics.

The energy sector stands at the forefront of a transformative era driven by the digital revolution, particularly in gas treatment. The integration of cutting-edge technologies such as machine learning, data analytics, and Internet of Things (IoT) sensors indicates a paradigm shift in the efficiency, sustainability, and overall operational performance of gas treatment processes. Real-time monitoring facilitated by these advancements empowers proactive maintenance and early detection of potential issues within gas treatment facilities, elevating safety standards and cost-effectiveness. Automation and smart sensors streamline procedures, diminishing the reliance on manual intervention and mitigating the risk of human error. This not only encourages safety measures but also increases the overall cost-effectiveness of gas treatment operations. Beyond immediate benefits, the digital transformation opens doors to predictive modeling and advanced analytics, enabling companies to forecast gas treatment requirements with unprecedented precision.

The key players profiled in the gas treatment market report are Amines & Plasticizers Ltd, Ecolab Inc, Huntsman International LLC, BASF SE, SAMSON CONTROLS INC, Eunisell Chemicals, DowDuPont Inc., Akzo Nobel N.V., Clariant, and Berryman Chemicals Inc. Acquisition and strategic partnership are common strategies followed by major market players. For instance, in November 2023, Aramco, attained a significant achievement by successfully extracting the first unconventional tight gas from its South Ghawar operational area. This achievement aligns with Aramco's overarching strategy to boost gas production by more than 50% compared to 2021 levels, and this target extends through the year 2030, contingent upon domestic demand dynamics. Tight gas refers to natural gas trapped in reservoirs with low permeability, necessitating advanced extraction techniques. Aramco's success in this not only showcases technological capability but also positions the company to play a crucial role in meeting the growing global demand for cleaner energy sources. The operational area at South Ghawar, is now equipped with commissioned facilities boasting a robust processing capacity. These facilities can process 300 million standard cubic feet per day (scfd) of raw gas and 38,000 barrels per day (bpd) of condensate. The condensate processing capacity is a noteworthy aspect, as it highlights the concurrent extraction of valuable liquid byproducts, further enhancing the economic viability of the gas production.

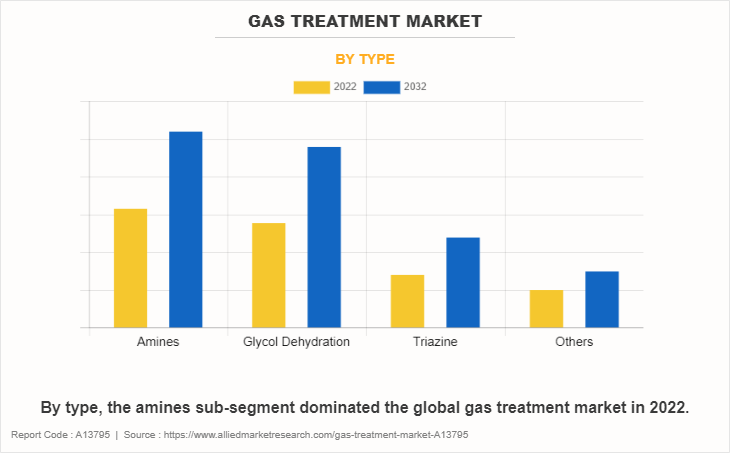

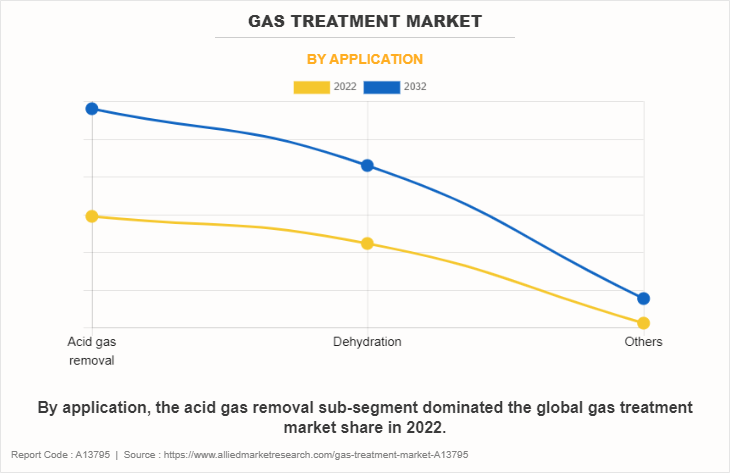

The gas treatment market overview is segmented on the basis of type, application, and region. By type, the market is divided into amines, glycol dehydration, triazine, and others. By application, the market is classified into acid gas removal, dehydration, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The gas treatment market is segmented into Type and Application.

By type, the amines sub-segment dominated the global gas treatment market in 2022. Amine compounds are poised to dominate the gas treatment sector, marking a transformative shift in industrial gas purification. Their unique ability to extract contaminants, particularly carbon dioxide and hydrogen sulfide, positions them as indispensable agents in enhancing gas cleaning procedures. Amines adaptability stems from their strong affinity for acidic gases, forming stable chemical complexes that are easily separated, thereby boosting the efficiency of purification processes. This versatility not only facilitates widespread utilization but also contributes significantly to environmental sustainability by minimizing the release of hazardous chemicals into the atmosphere. The dominance of amidates highlights the increasing focus on environmentally friendly practices, aligning with stringent international emission regulations. During the evolving landscape, amines emerge as reliable and cost-effective solutions for industries seeking to meet regulatory requirements. Beyond their environmental benefits, amines play a pivotal role in diverse applications within petrochemicals, chemical processing, and oil & gas sectors, demonstrating their indispensability. The high demand for amines arises from their optimal performance across a spectrum of gas compositions and operating conditions, reinforcing their central role in modern industrial gas treatment methods.

By application, the acid gas removal sub-segment dominated the global gas treatment market share in 2022. The increasing dominance of the acid gas removal segment can be recognized for its pivotal role in addressing stringent environmental legislation and gas emission regulations. Industries driven by the constraint to adhere to increasingly stringent emission laws and reduce their carbon footprint, are experiencing a noteworthy surge in demand for effective methods to eliminate acid gases from structures. This application significance lies in its capacity to limit the release of harmful pollutants such as sulfur dioxide and hydrogen sulfide, ensuring compliance with environmental regulations and concurrently elevating operational efficiency. With corporate social responsibility and sustainable practices assuming increased importance, the widespread adoption of advanced acid gas elimination technology has become more prevalent. Consequently, this trend has not only stimulated innovation but has also supported the expansion of the market, reflecting a dynamic interaction between environmental consciousness, regulatory adherence, and technological advancement in the pursuit of a cleaner and more sustainable industrial landscape.

By region, North America dominated the gas treatment market in 2022. The significance of North America in the gas treatment industry is attributed to the abundant natural gas resources, particularly in the U.S. and Canada, raising a robust expansion in gas production and exploration. The increasing demand for efficient gas treatment systems arises from the obligation to eliminate pollutants and impurities from extracted gases, driven by stringent environmental regulations and a growing emphasis on sustainability. North America emerges as a pivotal market for gas treatment solutions, leveraging its well-developed energy infrastructure and robust industrial base. The region's strategic position is strengthened by the surge in nontraditional gas sources, such as shale gas, necessitating specialized treatment procedures to address their unique challenges. As the industry adapts to evolving needs with innovative technologies, the gas treatment market is poised for sustained growth.

Impact of COVID-19 on the Global Gas Treatment Industry

- Lockdowns and restrictions led to a decline in industrial activities, resulting in decreased demand for gas treatment services, especially in sectors such as manufacturing, construction, and energy production.

- The oil & gas industry, a major consumer of gas treatment technologies, experienced a downturn due to reduced demand for energy amid lockdowns and economic uncertainties.

- Gas treatment operations often require on-site monitoring and maintenance. The shift to remote work posed challenges in terms of managing and maintaining gas treatment facilities, leading to potential operational inefficiencies.

- The pandemic accelerated the adoption of digital technologies, including remote monitoring and control systems, in the gas treatment sector to enhance operational efficiency and enable remote management.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gas treatment market analysis from 2022 to 2032 to identify the prevailing gas treatment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gas treatment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gas treatment market trends, key players, market segments, application areas, and market growth strategies.

Gas Treatment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.9 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 311 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | SAMSON Controls Inc., CLARIANT, Amines & Plasticizers Ltd., BASF SE, DowDuPont Inc., Huntsman International LLC, Berryman Chemicals Inc., Eunisell Chemicals, Akzo Nobel N.V., Ecolab Inc. |

The amines sub-segment of the type acquired the maximum share of the global gas treatment market in 2022.

The acid gas removal application anticipates sustained expansion in gas treatment. This growth is driven by increasing demand for effective solutions to mitigate acid gas emissions.

The gas treatment market size is expected to grow due to an increase in demand for natural gas globally.

Oil & gas companies are the major customers in the global gas treatment market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global gas treatment market from 2022 to 2032 to determine the prevailing opportunities.

The major growth strategies adopted by the gas treatment market players are product launches and partnership agreements.

Asia-Pacific will provide more business opportunities for the global gas treatment market in the future.

Amines & Plasticizers Ltd, Ecolab Inc, Huntsman International LLC, BASF SE, SAMSON CONTROLS INC, Eunisell Chemicals, DowDuPont Inc., Akzo Nobel N.V., Clariant, and Berryman Chemicals Inc. are the major players in the gas treatment market.

The energy sector stands at the forefront of a transformative era driven by the digital revolution, particularly in gas treatment.

Loading Table Of Content...

Loading Research Methodology...