Geothermal Heat Pump Market Research, 2031

The global geothermal heat pump market size was valued at $6.0 billion in 2021, and geothermal heat pump industry is projected to reach $12.5 billion by 2031, growing at a CAGR of 7.6% from 2022 to 2031.

A geothermal heat pump is a building heating/cooling system that adopts a heat pump to transfer heat from or to the ground, taking advantage of the earth's relatively constant temperatures throughout the seasons. Additionally, geothermal heat pumps reduce energy usage and aid in reducing greenhouse gas (GHG) emissions, which benefits the market even more. In addition, a geothermal water pump has lower long-term costs than a conventional water heater system. A major obstacle to the widespread adoption of this technology in the world's major developing nations is the high installation cost of geothermal heat pump systems as well as the lack of public understanding or confidence in the benefits of geothermal heat pump systems. Geothermal heat pumps have the advantage of concentrating natural heat rather than creating heat through the burning of fossil fuels. Some of the other popular name of geothermal heat pump in various part of the world includes geoexchange, earth energy systems and earth-coupled heat pumps.

The U.S. government has favorable policies encouraging the installation of heat pumps, such as personal tax credits and direct incentives on the product installation. One of the top priorities of governments all over the world is to increase energy efficiency in all sectors of the economy. The market is expected to be driven by rise in demand for renewable energy sources and considerable government assistance in the form of subsidies, incentives, and other financial benefits during the forecast period. Global energy consumption has increased dramatically as a result of rising population and fast industrialization.

Growing use of fossil fuels for heating, such as coal, oil, and natural gas, has a detrimental effect on the environment. The demand for energy-efficient goods and solutions is anticipated to increase with growing awareness about climate change and greenhouse gas emissions. Moreover, government regulations and emission standards are projected to increase the demand for energy-saving products, such as geothermal heat pumps, in the industrial and residential sectors, thereby supporting geothermal heat pump market growth.

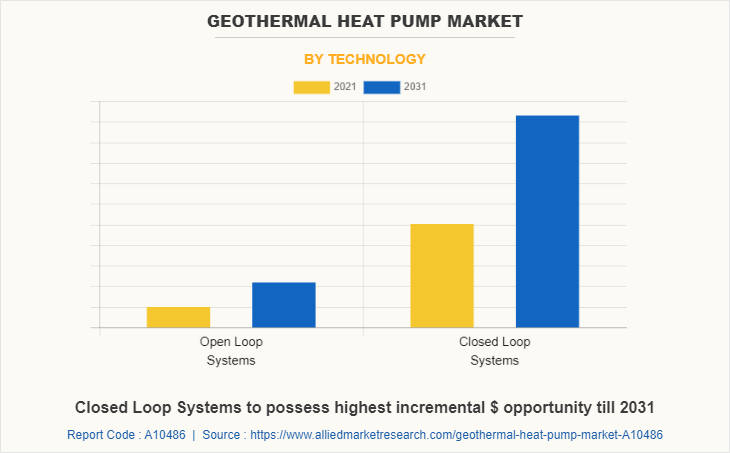

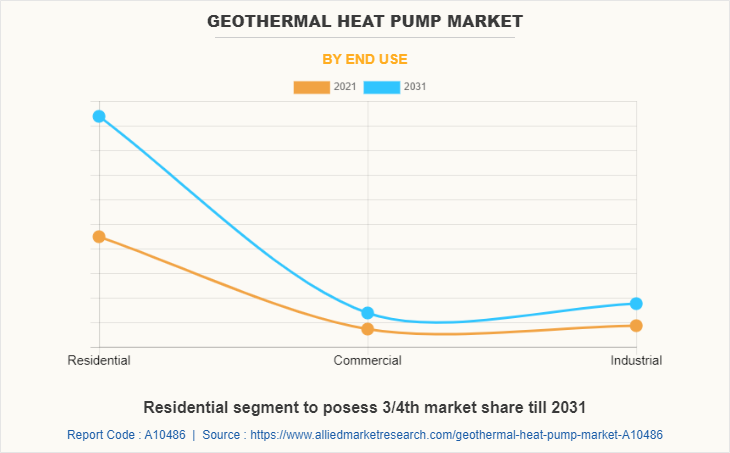

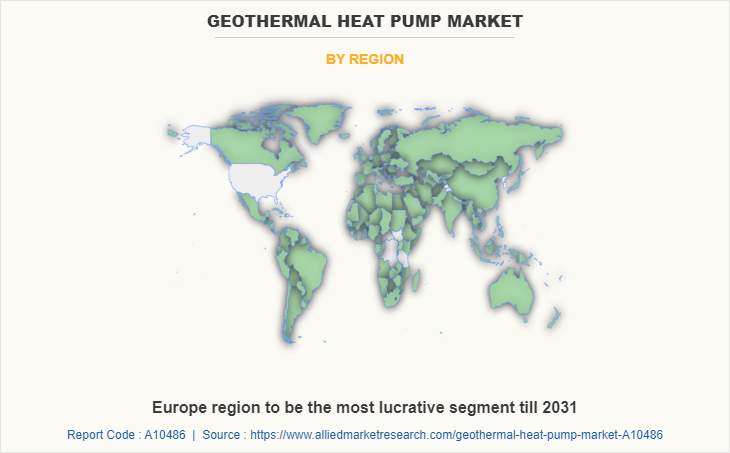

The geothermal heat pump market forecast is segmented on the basis of technology, end use, and region. Depending on technology, the market is categorized into open loop systems and closed loop systems (vertical loops and horizontal loops). On the basis of end use, the market is categorized into residential (new building systems and retrofit systems), commercial, and industrial. On the basis of region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the industry include, Bosch Terotechnology Ltd, Bostech Mechanical Ltd., Carrier global Corporation, Climate Master, Inc., Daikin Industries, Ltd., Danfoss Technologies, Dandelion Energy, De Dietrich Process Systems, Ecoforest S.A, Energy Smart Alternatives, GeoComfort Geothermal systems, GeoSmart Energy Inc., Maritime Geothermal Ltd., Mitsubishi Electric Corporation, Pfister’s Energy, Viessmann, and Wolf GmbH. These players have adopted product launch, acquisition, and business expansion as their key strategies to increase their market shares.

By type, the closed loop systems segment dominated the global geothermal heat pump market in 2021, and is projected to remain the fastest-growing segment during the forecast period. The closed-loop circulates water and antifreeze solution through a system of plastic pipe, which makes it of less maintenance and offer high equipment life than compared to an open loop.

By end use, the residential segment accounted for the highest geothermal heat pump market share of around 74.3% in 2021, and is projected to maintain the same during the forecast period. The residential sector is one of the booming sectors, which is expected to propel the demand for GHP. Favorable government initiatives and tax rebates offered on the installation of energy-saving products are projected to augment the demand for GHP in the residential sector.

By region, Europe is projected to be the fastest growing market. Rise in expenditure toward ecological construction coupled with surging demand for heating & cooling system, are observed as the key regional drivers. Further, governments across the region are focusing on energy efficiency and reducing carbon footprints, thus further pushing the geothermal heat pump market.

IMPACT OF COVID-19 ON GEOTHERMAL HEAT PUMP MARKET

- The outbreak of COVID-19 in China and its spread across numerous countries globally, halted the manufacturing activities of industrial sectors, which correspondingly hampered geothermal heat pump manufacturing as well. The raw material procurement was also challenged owing to the outbreak of COVID-19.

- The COVID-19 pandemic's global crises and commercial uncertainties have had a substantial impact on the operations of many firms and their sales. The implementation of lockdown restrictions in various nations along with the closure of heat pump manufacturing operations had a detrimental effect on the expansion of the domestic heat pump market. The supply of raw materials including iron castings, stainless steel components, and aluminum tubing was further impeded by travel restrictions, a closed border, and an import-export prohibition.

- Governments in several nations have taken steps to restart the economy and achieve the net zero carbon emission goal in the upcoming years in order to cope with the slowing business growth caused by the COVID-19 epidemic. For example, as per the news published in Electrical Times, an online news publishing platform, in 2020, the UK government issued a 10-point plan in 2020, to meet its net-zero carbon objective by 2050. The government has planned to install nearly 600,000 heat pumps by the end of 2028, along with investment in renewable energy and other low-carbon technology.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the geothermal heat pump market analysis from 2021 to 2031 to identify the prevailing geothermal heat pump market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the geothermal heat pump market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global geothermal heat pump market trends, key players, market segments, application areas, and market growth strategies.

Geothermal Heat Pump Market Report Highlights

| Aspects | Details |

| By Technology |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Mitsubishi Electric Corporation, Dandelion, Sauer-Danfoss Inc., ClimateMaster, Inc., Wolf GmbH, EnergySmart Alternatives, Bostech Mechanical Ltd, Free Energy Innovations, Ecoforest S.A., GeoSmart Energy, Daikin Industries Ltd., Carrier Corporation, GeoComfort, Bosch Thermotechnology, De Dietrich S.A.S., Pfister Energy, Maritime Geothermal Ltd |

Analyst Review

Growing demand for reliable, cost-effective, and energy-efficient solutions are projected to drive market growth over the forecast period. The geothermal heat pump (GHP) extracts heat from the ground for space heating, cooling, and hot water generation. Such a pump extracts heat by the horizontal or vertical collector. The extracted heat is commonly distributed through a hydronic distribution system. A GHP offers higher efficiency than air-source owing to the advantage of the stable temperature of its geothermal subsoil heat source. The U.S. is one of the prominent markets for a geothermal heat pump. Increasing carbon emission and fluctuating energy prices led the consumers to use renewable heat sources, which is expected to drive the product demand in the country.

High adoption in the residential sector and contribution of heat pump technology in reducing CO2 emission are the key factors boosting the Geothermal heat pump market growth.

Residential application is projected to increase the demand for Geothermal heat pump Market

Bosch Terotechnology Ltd, Bostech Mechanical Ltd., Carrier global Corporation, Climate Master, Inc., Daikin Industries, Ltd., Danfoss Technologies, Dandelion Energy, De Dietrich Process Systems, Ecoforest S.A, Energy Smart Alternatives, GeoComfort Geothermal systems, GeoSmart Energy Inc., Maritime Geothermal Ltd., Mitsubishi Electric Corporation, Pfister’s Energy, Viessmann, and Wolf GmbH.

Increase in demand for energy-efficient solutions is the Main Driver of Geothermal heat pump Market.

The geothermal heat pump market is segmented on the basis of technology, end use, and region. Depending on technology, the market is categorized into open loop systems and closed loop systems (vertical loops and horizontal loops). On the basis of end use, the market is categorized into residential (new building systems and retrofit systems), commercial, and industrial. On the basis of region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The market value of Geothermal heat pump in 2031 is expected to be $12.5 billion

The COVID-19 pandemic's global crises and commercial uncertainties have had a substantial impact on the operations of many firms and their sales. The implementation of lockdown restrictions in various nations along with the closure of heat pump manufacturing operations had a detrimental effect on the expansion of the domestic heat pump market.

Loading Table Of Content...