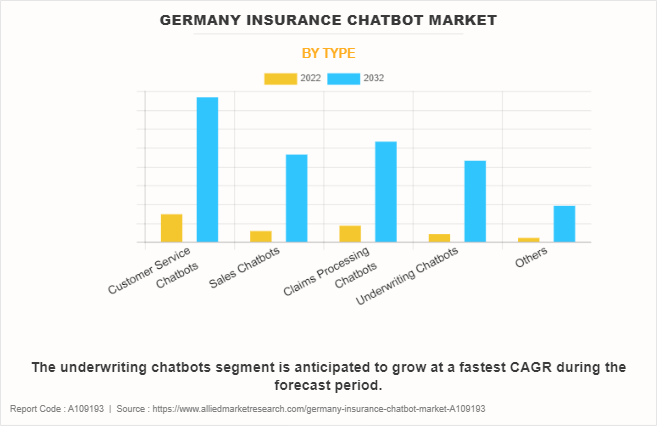

The Germany insurance chatbot market has witnessed substantial growth during the projection period due to several factors. In this market, rise in need for customer service enhancement is the primary driving factor. Insurance companies are increasingly relying on chatbots to provide efficient and round-the-clock customer support. The ability of chatbots to offer quick responses, reduce waiting times and enhance customer satisfaction, is a key allure. In addition, cost-effectiveness of chatbots serves as a potent motivator for their widespread adoption by insurance providers. These factors present a compelling case for the growth of customer service chatbots in the insurance sector.

Moreover, sales chatbots have emerged as a crucial instrument for insurance companies to engage with potential customers and transform leads into policies. These chatbots offer a range of services, including information dissemination, quotation provision, and application process assistance. The automation of sales procedures curtails expenses and simplifies the entire sales cycle, thereby propelling the growth of sales chatbots in the market.

On the other hand, the Germany insurance chatbot market faces obstacles, including challenge of integration. Insurance companies often have existing legacy systems and processes, which make it difficult to seamlessly incorporate chatbots into their operations. The integration process is expected to be complex and time-consuming, discouraging some companies from exploring this area. Moreover, customers exhibit a persistent reluctance to wholeheartedly adopt chatbots for their insurance requirements. Concerns regarding trust and security impede users from depending on chatbots for delicate tasks, including claims processing and underwriting. This hesitancy serves as a hindrance to the expansion of the market, resulting in a paradox where technology intended to streamline processes occasionally make them more intricate.

However, the Germany insurance chatbot market holds vast untapped potential, with hidden opportunities waiting to be discovered. As the market continues to develop, specialized chatbots for claims processing and underwriting are expected to emerge, providing a significant boost to these essential functions and improving operational efficiency. Furthermore, introduction of AI and machine learning is anticipated to bring about more intelligent and intuitive chatbots. These advanced chatbots is expected to address inquiries and predict customer requirements and offer proactive assistance. This transformation has the potential to greatly enhance user experiences and drive the widespread adoption of chatbots within the insurance industry.

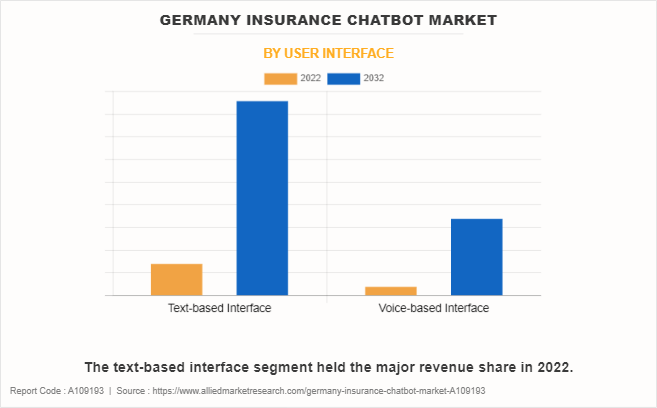

The Germany insurance chatbot market is segmented into type, and user interface. Depending on type, the market is classified into customer service chatbots, sales chatbots, claims processing chatbots, underwriting chatbots, and others. On the basis of user interface, it is bifurcated into text-based interface and voice-based interface.

The insurance sector, often considered conservative and risk-averse, is embracing innovation through the implementation of chatbots. Insurance providers are actively investing in R&D to develop chatbots that cater to a wide range of customer needs. The development of new products in this field is characterized by a dedication to improving user experiences and enhancing operational efficiency. In addition, journey toward creating more advanced chatbots involves ongoing R&D. Chatbots are trained to understand the complexities of insurance policies and regulations, ensuring that they provide users with accurate and comprehensive information. Furthermore, R&D activities are focused on making chatbots more adaptable, allowing them to keep up with the ever-changing insurance landscape.

Moreover, perception and acceptance of chatbots by end users play a crucial role in determining their success in the insurance sector. Insurance companies are actively seeking feedback from customers to enhance their interactions with chatbots. They have established continuous feedback loops to ensure that chatbots are more user-centric and responsive to the needs of consumers. In addition to improving operational efficiency, chatbots offer cost advantages. Insurance companies are leveraging chatbots to optimize their pricing strategies, enabling them to offer more competitive rates to customers. By analyzing large volumes of data, chatbots customize insurance packages to meet individual needs, creating a mutually beneficial situation for both insurance companies and customers.

The Porter’s five forces analysis analyzes the competitive scenario of the Germany insurance chatbot market and role of each stakeholder. These forces include the bargaining power of suppliers, bargaining power of buyers, threat of substitutes, threat of new entrants, and competitive rivalry.

The chatbot market poses a formidable threat of new entrants, owing to requirement of cutting-edge technology, data accessibility, and adherence to regulatory norms. This deters new players from venturing into the market, thereby consolidating the position of established firms. The bargaining power of suppliers of AI and machine learning technologies is significant, given the high dependence of insurance companies on their offerings. This translates into a robust demand for suppliers' products and services.

Insurance companies hold significant bargaining power as the primary buyers of chatbot services in this market, with various providers to choose from. Despite the potential substitutes of traditional customer service and manual sales processes, the cost and efficiency benefits of chatbots make them the preferred choice for insurance companies, thus higher the threat of substitutes. The Germany insurance chatbot market is experiencing fierce competitive rivalry among established players, with companies continuously innovating and expanding their chatbot offerings to gain a competitive advantage.

In the complex landscape of the Germany insurance chatbot market, a SWOT analysis provides a holistic view of the market's strengths, weaknesses, opportunities, and threats. The market's strengths are evident in its capacity to improve customer service, lower expenses, and streamline sales and underwriting procedures. Chatbots provide continuous support, enhancing both customer contentment and operational effectiveness. On the other hand, the market's weaknesses stem from the difficulties associated with integration, user trust, and security apprehensions. The implementation of chatbots hindered by existing systems, and user reluctance may impact their acceptance in insurance processes that require sensitivity.

Opportunities for specialized chatbots in claims processing and underwriting, along with the incorporation of AI and machine learning for enhanced chatbot interactions, are plentiful. The expansion of voice-based interfaces and the advancement of text-based interfaces present promising opportunities. However, potential regulatory changes and possibility of technical failures pose threats to the market, potentially eroding customer trust. In addition, the chatbot market is fiercely competitive, with the risk of market saturation.

Key market players include IBM Corporation, Nuance Communications, Inc., Lemonade, Inc., Inbenta Technologies Inc., Artivatic Data Labs Pvt. Ltd., Insurify, Inc., Cognicor Technologies, e-bot7 GmbH, GetJenny Oy, and Simplesurance GmbH.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in Germany insurance chatbot market.

- Assess and rank the top factors that are expected to affect the growth of Germany insurance chatbot market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the Germany insurance chatbot market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

Germany Insurance Chatbot Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 90 |

| By Type |

|

| By User Interface |

|

| Key Market Players | MunichRe, VHV Group, Ergo Group, Württembergische Versicherung, Talanx, Axa, STONEX, Deutsche Apotheker- und Ärztebank, Generali Deutschland, Allianz |

The Germany Insurance Chatbot Market is estimated to reach $238.7 million by 2032

Allianz, MunichRe, Talanx, STONEX, Deutsche Apotheker- und Ärztebank, Ergo Group, Generali Deutschland, Axa, Württembergische Versicherung, VHV Group are the leading players in Germany Insurance Chatbot Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in germany insurance chatbot market.

3. Assess and rank the top factors that are expected to affect the growth of germany insurance chatbot market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the germany insurance chatbot market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

Germany Insurance Chatbot Market is classified as by type, by user interface

Loading Table Of Content...

Loading Research Methodology...