Insurance Chatbot Market Research, 2032

The global insurance chatbot market was valued at $467.4 million in 2022, and is projected to reach $4.5 billion by 2032, growing at a CAGR of 25.6% from 2023 to 2032.

An insurance chatbot powered by artificial intelligence is a virtual assistant capable of communicating with clients through instant messaging platforms, websites, or mobile applications. Insurance chatbots are designed to comprehend and address customer inquiries promptly and precisely. These chatbots offer immediate and accurate information on insurance products, policy specifics, and claims processing. Furthermore, chatbots enable continuous customer service, facilitate ordinary and repetitive tasks as well as offer multiple messaging platforms for communication. Moreover, it can collect information about the customer’s finances, properties, vehicles, health status, and relevant data to provide advice on quotas and insurance claims, and offer potential customers an overview of the available insurance solutions that fit their criteria.

The insurance chatbot market is growing as a result of the rising demand for automated services and increasing adoption of AI and NLP technologies. To address the insurance needs, many clients prefer to use self-service options such as chatbots. Customers can use chatbots to find answers quickly and conveniently to their inquiries and carry out simple operations, such as submitting a claim or monitoring the status of their insurance policy. In addition, the insurance sector is increasingly adopting technologies such as artificial intelligence (AI) and natural language processing (NLP). The use of chatbots to automate a variety of insurance-related processes is a logical development of these technologies.

Furthermore, there is a surge in NLP technology adoption as artificial intelligence (AI) and machine learning (ML) technologies became more widely used in the insurance industry. However, high implementation and maintenance cost of insurance chatbots hinder the growth of the insurance chatbot market. On the contrary, technological advancements in the insurance chatbot such as emergence of artificial intelligence (AI) is expected to fuel the growth of the insurance chatbot market in the upcoming years. For instance, Allstate’s AI-driven chatbot, Allstate Business Insurance Expert (ABIE), offers personalized guidance to small business owners. ABIE can answer questions related to different types of business insurance, recommend appropriate coverage, and provide quotes for the suggested policies. By using ABIE, Allstate has streamlined the insurance buying process for small businesses and improved customer satisfaction.

The report focuses on growth prospects, restraints, and trends of the insurance chatbot market. The study provides Porter’s five forces analysis to understand the impact of several factors, such as bargaining power of suppliers; competitive intensity of competitors; threat of new entrants; threat of substitutes; and bargaining power of buyers on the insurance chatbot market outlook.

The insurance chatbot market is segmented into Type and User Interface.

Segment Review

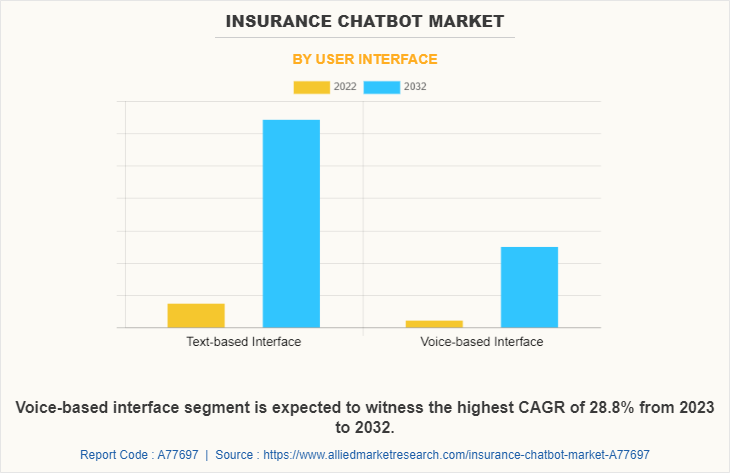

The insurance chatbot market is segmented on the basis of type, user interface, and region. On the basis of type, it is categorized into customer service chatbots, sales chatbots, claims processing chatbots, underwriting chatbots, and others. By user interface, it is bifurcated into text-based interface and voice-based interface. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By user interface, the text-based interface segment acquired major insurance chatbot market size in 2022. This is attributed to the fact that text-based interfaces are being designed to support multiple languages, allowing insurance companies to serve a global customer base. Furthermore, these are increasingly using emojis and GIFs to provide a more engaging and personalized experience for customers.

By region, North America dominated the insurance chatbot market share in 2022. This is attributed to a rise in the individual user demand owing to an increase in the number of mobile and wireless customers. In addition, surge in adoption of bring your own device (BYOD) trends has contributed to the evolution of remote working in the region, which fuels the demand for insurance chatbots.

The report insurance chatbot market analysis includes the profiles of key players operating in the insurance chatbot market such as Amazon.com, Inc., IBM, Oracle, Verint Systems, Inc., AlphaChat, Chatfuel, LivePerson, Botsify, Nuance Communications, Inc., and Inbenta Holdings Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the insurance chatbot market.

Country Specific Statistics & Information

Chatbots provide a convenient, intuitive, and interactive way for customers to engage with insurance companies. It leads to a more positive experience and stronger brand loyalty. Intelligent chatbots foster stronger bonds between clients and insurance providers through immediate support and tailored suggestions, cultivating more meaningful relationships. Furthermore, the information gathered by chatbots can provide valuable insights into customer’s behavior, preferences, and issues. This information can help insurance companies improve their products, services, and marketing strategies to exceed customer needs and expectations.

For instance, Capacity is an AI-powered support automation platform designed to streamline customer support and business processes for various industries, including insurance. By connecting with a company’s existing tech stack, Capacity efficiently answers questions, automates repetitive tasks, and tackles diverse business challenges. The platform features a low-code interface, enabling smooth human handoffs, intuitive task management, and easy access to information. Insurance companies can benefit from Capacity’s all-in-one helpdesk, low-code workflows, and user-friendly knowledge base, ultimately enhancing efficiency and customer satisfaction.

Furthermore, to reduce administrative burden and empower clinicians to spend more time taking care of patients and less time on paperwork, in March 2023, Nuance Communications, Inc., a Microsoft Company, launched Dragon Ambient eXperience (DAX™) Express, a workflow-integrated, fully automated clinical documentation application that is the first to combine proven conversational and ambient AI with OpenAI's newest and most capable model, GPT-4.

The COVID-19 pandemic has had a significant impact on the insurance chatbot industry, and as a result, it has also affected the insurance chatbot market. The pandemic has increased the demand for digital services, and insurance chatbots have emerged as a critical component of the digital transformation of the industry. With social distancing measures and lockdowns, customers rely more on digital channels to communicate with their insurance providers. As a result, there has been an increased demand for insurance chatbots that can provide quick and efficient customer service. Furthermore, insurance companies have had to adopt remote work policies, and this has made it challenging to manage customer interactions efficiently. Chatbots have emerged as a viable solution that can automate customer interactions and provide continuous support. Moreover, the pandemic has forced insurance companies to think creatively and innovate to meet the needs of their customers. This has led to the development of new chatbot functionalities that can assist customers with pandemic-related issues such as coverage for COVID-19-related claims.

Top Impacting Factors

Growth in Demand for Automated Services

Many customers prefer to use self-service options, such as chatbots, to handle their insurance needs. Chatbots allow customers to get answers quickly and easily to their questions and complete simple tasks, such as filing a claim or checking their policy status. Further, many people prefer to communicate through messaging apps rather than phone calls or email. Insurance chatbots are integrated into these messaging apps, allowing customers to get the insurance-related information they need in a convenient and familiar format.

Furthermore, insurance companies are majorly focusing on delivering their core skills, with minimal emphasis dedicated to addressing client queries and guiding them to the relevant items online. By providing an additional mode of contact, the chatbot aids the company in serving consumers. Furthermore, customers can also seek help from virtual assistants on any topic relevant to a certain organization. Thus, boost in demand for better customer alignment propels the expansion of the industry.

Increase in Adoption of AI and NLP Technologies

The use of artificial intelligence (AI) and natural language processing (NLP) technologies is becoming more widespread in the insurance industry. Chatbots are a natural extension of these technologies and are being used to automate a wide range of insurance-related tasks. In addition, there is a surge in NLP technology adoption as artificial intelligence (AI) and machine learning (ML) technologies became more widely used in the insurance industry. The AI-driven NLP empowers insurance companies to keep up-to-date with the latest data, automate repetitive task, and internal processes, and improve productivity. In addition, it improves customer experience through predictive analytics and automate function where manual processes were previously required and personalize user-interface capabilities.

Moreover, artificial intelligence (AI) accelerates numerous operations across the insurance industry and internal processes to achieve faster responses, produce quick projections, and provide rapid responsiveness. Furthermore, for improved security, artificial intelligence (AI) uses its unique capability of machine learning (ML) to recognize patterns, the ability to quickly identify and remediate possible risks with built-in self-recovery improves security. Furthermore, the integration of ML and deep learning (DL) with chatbots automates all claims processing operations, which helps to handle more easily growing concerns about cost, scalability, and security while protecting vital data, as well as enhance the operational efficiency. Thus, this factor is driving the growth of the market.

Rise in Adoption of Chatbots by Insurance Companies

Chatbots are becoming crucial in delivering better help to clients, allowing many businesses to streamline and improve the customer experience at every stage of the process. Several insurance companies have moved their priority to quickly respond to client concerns. The capacity to respond to consumer queries has become a vital component to the success of the company. Thus, businesses see chatbots as a strong conversational interface for engaging consumers and offer a dynamic and rich user experience.

Furthermore, several companies have incorporated virtual assistants that employ AI and predictive analytics to allow consumers to converse via voice and text. They assist users in making payments, saving money, transferring funds, and checking account balances, all of which improve the quality of services supplied to clients. Thus, rise in adoption of chatbots by insurance companies is expected to fuel the insurance chatbot market growth in the upcoming years.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the insurance chatbot market forecast from 2022 to 2032 to identify the prevailing insurance chatbot market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities of insurance chatbot market overview.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the insurance chatbot market segmentation assists in determining the prevailing insurance chatbot market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global insurance chatbot market trends, key players, market segments, application areas, and market growth strategies.

Insurance Chatbot Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.5 billion |

| Growth Rate | CAGR of 25.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Type |

|

| By User Interface |

|

| By Region |

|

| Key Market Players | Amazon.com, Inc., Botsify, IBM, Inbenta Holdings Inc., Oracle, Verint Systems, Inc., Chatfuel, LivePerson, Nuance Communications, Inc., AlphaChat |

Analyst Review

The insurance chatbot refers to the use of chatbots in the insurance industry to provide customer support, automate processes, and improve overall customer experience. A chatbot is a computer program that simulates human conversation through text or voice interactions, providing users with a personalized experience that can answer their questions and provide solutions to their problems. The insurance chatbot market has been growing rapidly in recent years, driven by the increase in demand for digital solutions and the need for efficient customer service. Furthermore, insurance companies are using chatbots to handle a range of tasks, from answering basic queries to guiding customers through the claims process. For instance, GEICO launched a virtual assistant, Kate, which is designed to help customers with various insurance-related tasks. Some instances include accessing policy information, getting answers to frequently asked questions, and changing their coverage. Kate’s ability to provide instant assistance has enhanced GEICO’s customer service and reduced the need for customers to call or email support teams for basic inquiries.

The emergence of the COVID-19 pandemic resulted in a number of marketing firms, financial institutions, and banks to start using intelligent virtual assistants and conversational AI solutions to improve customer experience throughout the crisis. Businesses were eager to attempt new technology channels such as virtual assistants to stay afloat during the pandemic. In addition, in these difficult times, online virtual assistants have aided a variety of industrial sectors. Chatbots have been adopted by a number of medical insurance firms and public health organizations across the world to aid users/patients in receiving correct COVID-19 guidance. Moreover, the use of virtual assistants in insurance helped insurers to simplify online claims processing operations for customers during the pandemic. Some of the key players profiled in the report include Amazon.com, Inc., IBM, Oracle, Verint Systems, Inc., AlphaChat, Chatfuel, LivePerson, Botsify, Nuance Communications, Inc., and Inbenta Holdings Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The insurance chatbot market is estimated to grow at a CAGR of 25.6% from 2023 to 2032.

The insurance chatbot market is projected to reach $4.45 billion by 2032.

Growth in demand for automated services, increase in adoption of AI and NLP technologies and rise in adoption of chatbots by insurance companies majorly contribute toward the growth of the market.

The key players profiled in the report include insurance chatbot market analysis includes top companies operating in the market such as Amazon.com, Inc., IBM, Oracle, Verint Systems, Inc., AlphaChat, Chatfuel, LivePerson, Botsify, Nuance Communications, Inc., and Inbenta Holdings Inc.

The key growth strategies of insurance chatbot players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...