Integration Platform as a Service Market Research, 2031

The global integration platform as a service market was valued at $3.4 billion in 2021, and is projected to reach $37.9 billion by 2031, growing at a CAGR of 27.5% from 2022 to 2031.

Factors such as growth in adoption of hybrid and multi-cloud Infrastructure and the surge in importance of cloud real-time monitoring in business sectors impact the growth of the integration platform as a service market globally. In addition, the market growth is affected by interoperability issues. Furthermore, rise in demand for streamline business process and growth in cloud adoption among SMEs influences the market growth. However, each of these factors is anticipated to have a definite impact on the Integration Platform as a Service Market Growth during the forecast period.

Integration platform as a service (iPaaS) is a cloud-based suite of tools, hosted by a third-party provider, that enables organizations to integrate, automate, and manage applications, business systems, and data that reside in different business environments, whether on-premises or in public or private clouds.

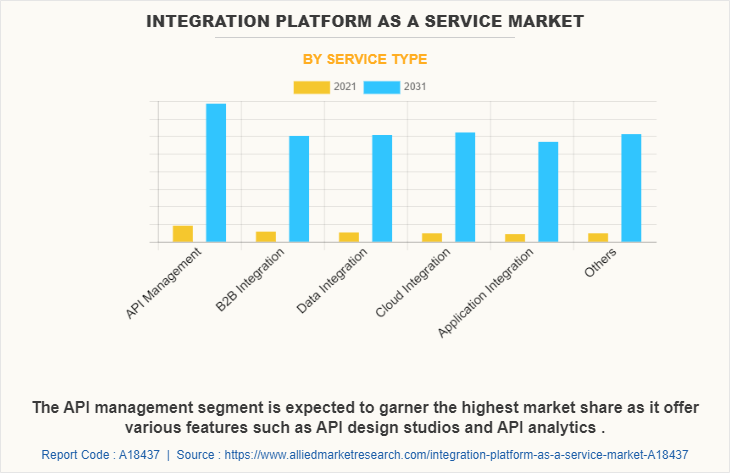

On the basis of service type, the market is segmented into API management, B2B integration, data integration, cloud integration, application integration, and others. On the basis of API management, the market is segmented into solution and service. Further, on the basis of solution, the market is categorized into API analytics, API platform, and API security.

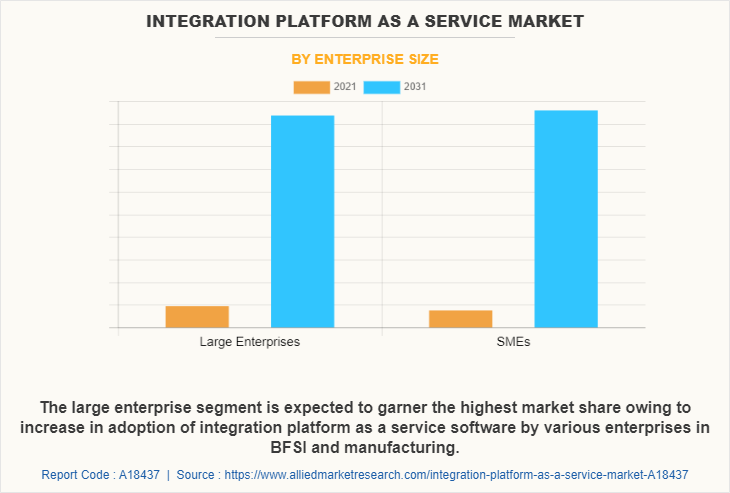

On the basis of deployment, the market is segmented into private, public, and hybrid. On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. Depending on industry vertical, it is segregated into BFSI, energy and & utilities, IT & telecom, government and & public sector, healthcare, manufacturing, retail, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in the Integration platform as a service market are Boomi Inc., Celigo, DBSync, elastic.io, Flowgear, Microsoft Corporation, IBM Corporation Jitterbit Inc., Oracle Corporation, SAP SE, MuleSoft LLC, Scribe Software Corporation, Seeburger AG, SnapLogic Inc., TIBCO Software Inc., Workato Inc., and Zapier. These players have adopted various strategies to increase their market penetration and strengthen their position in the Integration Platform as a Service Industry.

By service type, the API management segment dominated Integration Platform as a Service Market Share in 2021, and is expected to maintain its dominance in the upcoming years. Businesses must disclose more data through APIs to create rich, personalized app experiences for internal users, customers, and partners, as the number of apps and smart devices required in the digital world grows exponentially. Organizations across all industries require a strong life cycle API Management Software solution that allows them to track the success of their API-driven enterprises.

By organization size, the large enterprises segment dominated the global market in 2021, and is expected to continue this trend during the forecast period, owing to increase in adoption of integration platform as a service software by various enterprises in BFSI and manufacturing. Conversely, the small- & medium-sized enterprises segment is expected to grow at the highest CAGR during the forecast period, owing to surge in adoption of cloud-based IPaaS services, as it provides cost-effective and efficient solution for SMEs.

Region wise, the IPAAS Market size was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the presence of major players that offer advanced solutions and invest heavily in IPaaS technologies. However, Asia-Pacific is expected to witness significant growth during the Integration Platform as a Service Market Forecast period due to presence of many SMEs, which are investing in IPaaS services.

Top Impacting Factors

Growth in Adoption of Hybrid and Multi-cloud Infrastructure

Hybrid clouds offer the benefits of public and private clouds with increased flexibility to work between both cloud solutions. In addition, organizations can protect sensitive data by storing it in a private cloud while using the public cloud to store public data. As professional services grow, application and feature-specific needs will vary. This allows business managers to choose multi-cloud and hybrid solutions to run their systems effectively and efficiently. In addition, it is cost-effective and reduces the risk of business losses. The adoption of hybrid clouds will also drive the growth of the Integration Platform as a Service Market Size.

The surge in importance of cloud real-time monitoring in business sectors

Rise in importance of cloud real-time monitoring across businesses is boosting the demand for the integration platform as a service. Companies need to have a good understanding of what real-time network monitoring is and how it can help their business so they can have a clear picture of how their systems are performing. Using programs and tools to track and capture continuous snapshots of overall network performance is called real time monitoring. Real-time monitoring is used by businesses to track network activity, improve network security, and identify problems as they occur. All businesses, regardless of size, can benefit from real-time network monitoring.

COVID-19 Impact Analysis

The IPAAS Market has witnessed significant growth in past few years; however, due to the outbreak of the COVID-19 pandemic, the market is projected to witness a slight downfall in 2020. This is attributed to implementation of lockdown by governments in majority of the countries and the shutdown of travel across the world to prevent the transmission of virus. The integration platform as a service industry is projected to prosper in the upcoming years after the recovery from the COVID-19 pandemic.

Various organizations have initiated work-from-home culture for their employees, which is creating demand for the cloud-based IPaaS to manage critical information of organizations, thus creating lucrative opportunity for the market expansion during the forecast period. Moreover, the remote working culture during COVID as positively impacted integration platform as service market due to adoption of IPaaS technology by various verticals such as BFSI, manufacturing and retail.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the integration platform as a service market analysis from 2021 to 2031 to identify the prevailing integration platform as a service market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the integration platform as a service market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global integration platform as a service market trends, key players, market segments, application areas, and market growth strategies.

Integration Platform as a Service Market Report Highlights

| Aspects | Details |

| By Service Type |

|

| By Component |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Workato Inc., MuleSoft LLC, Boomi Inc., SAP SE, elastic.io, Jitterbit Inc., Scribe Software Corporation, IBM Corporation, Zapier, SnapLogic Inc., DBSync, Microsoft Corporation, Oracle Corporation, Celigo, Flowgear, Seeburger AG, Tibco |

Analyst Review

The global integration platform as a service market is projected to witness prominent growth, especially in Asia-Pacific and North America. This growth is attributed to increased investments by organizations and governments for automation tools and adoption of cloud-based integration platform. In addition, the adoption of IoT (Internet of Things) based devices globally provides ample growth opportunities for integration platform as a service market.

Moreover, IPaaS allows for real-time data sharing and processing thereby eliminating delays in access and providing a quick and accessible solution and iPaaS mitigates confusion, data loss, and inconsistencies by creating a centralized system for the management of all parties involved.

The rapid adoption of containerized, micro-services-based applications that communicate via APIs has created the demand for automation of deploying and managing applications across the cloud. This increase in complexity has created the demand for IPaaS services that can manage the dependencies across multiple clouds, with policy-driven security and management capabilities. As organizations increasingly adopt a hybrid cloud architecture, the need for both public and hybrid cloud has increased.

Furthermore, IPaaS reduces overall costs while accelerating delivery of services, automates management & coordination of complex hybrid environments, eliminates provisioning errors, and enables self-service provisioning of services without the need for IT intervention. Moreover, enterprises make significant investments in R&D to enhance their existing solutions and deliver new solutions as well as develop new machine intelligence and automation technologies. For instance, in August 2021, SnapLogic and Schneider Electric introduced a new citizen developer approach to application and data integration. With SnapLogic’s self-service, low-code platform as the foundation for Schneider Electric’s new operating model, the multinational energy provider has empowered nearly 150 citizen developers to integrate more than 100 cloud and on-premises systems across the company, driving up employee productivity and resulting in faster innovation and greater business impact.

Prominent market players are exploring new technologies and platforms to meet the increase in customer demands. Product launches, partnerships, and acquisitions are expected to enable them to expand their product portfolios and penetrate different regions. For instance, in May 2021, Boomi and Solace, a leading provider of event streaming and management capabilities, announced that the European retail distributor, The Mousquetaires Group, has chosen both companies to support its digital transformation and the adoption of a hybrid integration platform.

Asia-Pacific exhibits the highest adoption of integration platform as a service platform. On the other hand, LAMEA is expected to grow at a significant growth rate, anticipating a lucrative market growth for integration platform as a service, especially in countries such as Brazil, South Africa, and UAE.

The global integration platform as a service market was valued at $3,389.56 million in 2021, and is projected to reach $37,916.92 million by 2031, registering a CAGR of 27.5% from 2022 to 2031.

The BFSI segment is expected to garner the highest market share.

North America region dominated the global market in 2021

Rise in demand for streamline business process and growth in cloud adoption among SMEs provide ample growth opportunities for IPaaS market

The key players that operate in the Integration platform as a service market are Boomi Inc., Celigo, DBSync, elastic.io, Flowgear, Microsoft Corporation, IBM Corporation Jitterbit Inc., Oracle Corporation, SAP SE, MuleSoft LLC, Scribe Software Corporation, Seeburger AG, SnapLogic Inc., TIBCO Software Inc., Workato Inc., and Zapier.

Loading Table Of Content...