The Italy insurance chatbot market has been witnessing significant growth during the forecast period, owing to rise in consumer demand for quick and efficient customer service. Moreover, chatbots offer 24/7 availability, which is a key factor driving the market growth. This round-the-clock accessibility is a significant selling point, driving the market growth.

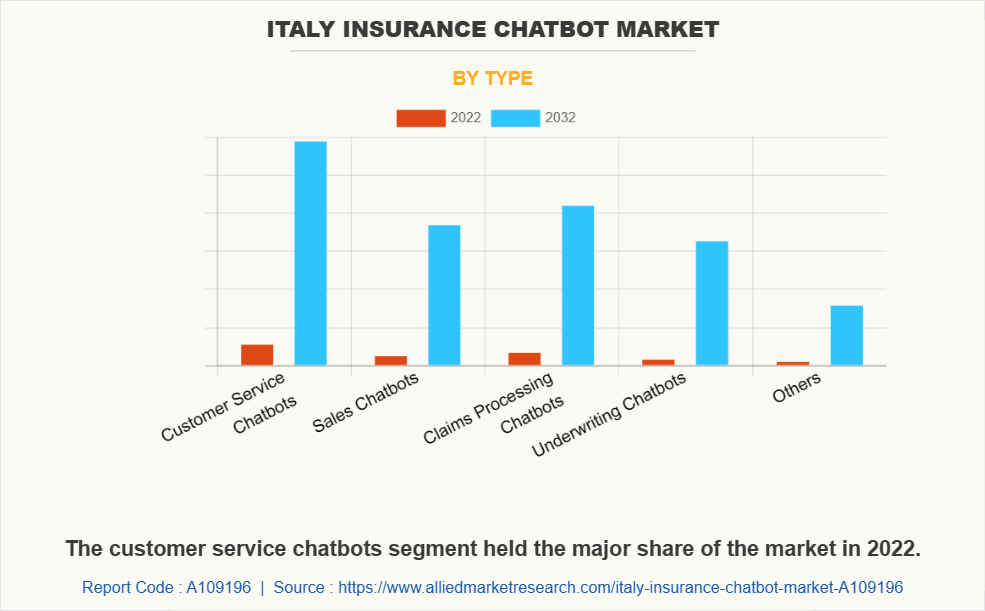

However, increase in concerns regarding data security and privacy is one of the key factors restraining the market growth. Furthermore, the resistance of traditional insurance institutions to embrace change is one of the key factors restraining the growth of the Italy insurance chatbot market. On the contrary, claims processing chatbots streamline the process of filing a claim, which reduces paperwork and improves efficiency. Sales chatbots provide customized services to the customer to guide them through policy options and enhance the overall experience.

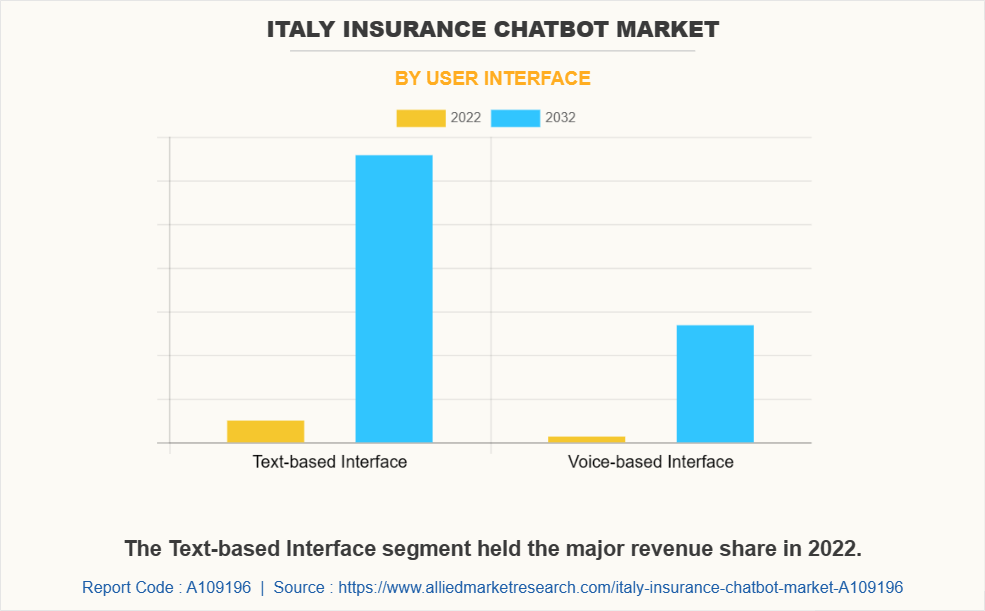

The Italy insurance chatbot market is bifurcated into type and user interface. On the basis of type, the market is categorized into customer service chatbots, sales chatbots, claims processing chatbots, underwriting chatbots, and others. By user interface, it is bifurcated into text-based interface and voice-based interface.

In addition, the integration of artificial intelligence (AI) and natural language processing (NLP) in chatbots is a key trend driving the market growth. Moreover, rise in popularity of voice assistants such as Siri, Alexa, and Google Assistant is a key factor driving the growth of the Italy insurance chatbot market. Furthermore, the interplay between text-based and voice-based interfaces is another factor driving the market growth. In addition, companies are focusing on finding a balance between innovation and compliance with regulatory frameworks to gain a competitive edge in the market. Moreover, customer service chatbots provide a virtual concierge service that answers queries, guides clients, and offers support in real-time. Furthermore, sales chatbots are designed to be virtual sales agents. They engage potential clients in personalized conversations, understand their needs and recommend suitable insurance policies.

In addition, claims processing chatbots aim to simplify and expedite the process of filing insurance claims. They assist policy holders to submit their claims, ensure the necessary documentation is complete, and guide them through the entire process. Moreover, underwriting chatbots add an intriguing layer to the market. They utilize advanced algorithms and data analysis to assess risk and determine the pricing and eligibility of insurance policies. Furthermore, there are various other chatbots with specialized functions, such as fraud detection chatbots, which use advanced analytics to identify fraudulent claims. In addition, companies are investing in R&D and new product development to refine and expand their chatbot offerings. Moreover, companies are increasingly seeking feedback from customers to enhance chatbot performance. Furthermore, companies are focusing on providing customized insurance policies to customers based on individual risk profiles and behaviors.

The Porter's five forces analysis assesses the competitive strength of the players in the Italy insurance chatbot market. These five forces include the bargaining power of buyers, the bargaining power of suppliers, the threat of new entrants, the threat of substitutes, and competitive rivalry. The bargaining power of buyers is high. The bargaining power of suppliers is high. The threat of new entrants is high. The threat of substitutes is low. The competitive rivalry is high, as several market players compete for market share.

A SWOT analysis of the Italy insurance chatbot market includes strengths, weaknesses, opportunities, and threats. The strengths include the ability of chatbots to offer 24/7 customer service, reduce operational costs, and enhance customer engagement. The weaknesses include the potential for data security breaches, customer trust issues, and the need for continuous refinement and improvement of chatbot technology. The opportunities include expansion of chatbot applications and integration of voice-based interfaces. The threats include potential for data breaches, regulatory hurdles, and competition from both traditional and digital channels.

The key players operating in the Italy insurance chatbot market include IBM Corporation, Oracle Corporation, Microsoft Corporation, Nuance Communications, Inc., Artificial Solutions, Inbenta Technologies Inc., CogniCor Technologies, Pypestream, eGain Corporation, and Rulai, Inc.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in Italy insurance chatbot market.

- Assess and rank the top factors that are expected to affect the growth of Italy insurance chatbot market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the Italy insurance chatbot market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

Italy Insurance Chatbot Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 90 |

| By Type |

|

| By User Interface |

|

| Key Market Players | IBM Corporation, Rulai, Inc., Pypestream, Inbenta Technologies Inc., eGain Corporation, Microsoft Corporation, Oracle Corporation, Nuance Communications, Inc., Artificial Solutions, CogniCor Technologies |

The Italy Insurance Chatbot Market is projected to grow at a CAGR of 30.7% from 2022 to 2032

IBM Corporation, Oracle Corporation, Microsoft Corporation, Nuance Communications, Inc., Artificial Solutions, Inbenta Technologies Inc., CogniCor Technologies, Pypestream, eGain Corporation, Rulai, Inc. are the leading players in Italy Insurance Chatbot Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in italy insurance chatbot market.

3. Assess and rank the top factors that are expected to affect the growth of italy insurance chatbot market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the italy insurance chatbot market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

Italy Insurance Chatbot Market is classified as by type, by user interface

Loading Table Of Content...

Loading Research Methodology...