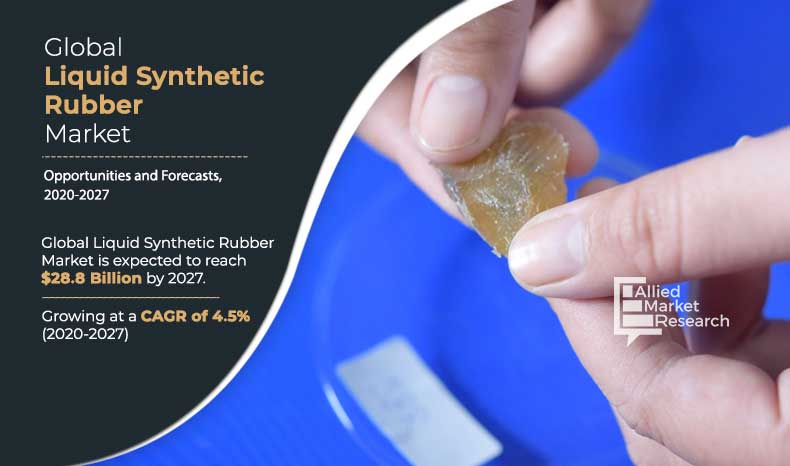

Liquid Synthetic Rubber Market Outlook - 2027

The global liquid synthetic rubber market size was valued at $20.3 billion in 2019, and is projected to reach $28.8 billion by 2027, growing at a CAGR of 4.5% from 2020 to 2027.

Synthetic rubber is an artificial elastomer, which is produced from the by-products of petroleum. Liquid synthetic rubber is a polyurethane in liquid state, which exhibits enhanced flow properties superior abrasion resistance. It finds its major application in industrial rubber manufacturing, tyre manufacturing, polymer modification, and adhesive manufacturing.

The growth of the global liquid synthetic rubber market is driven by surge in tyre production and increase in demand for rubber with low concentration of volatile organic compounds (VOCs) across the globe. Liquid synthetic rubber is majorly used in the production of tyres and tyre components, such as tread, apex/rim/flange, and carcass. Rise in focus on prolonged durability and superior performance of tyres along with the adoption of tyre labeling regulations is driving the demand of liquid synthetic rubber from the tyre manufacturing industry. In addition, the expansion of the automotive industry—which is a major consumer of liquid synthetic rubber in Europe and Asia-Pacific augments the liquid synthetic rubber market growth. The presence of major tyre manufacturing companies across these regions, including Bridgestone, Michelin, Pirelli, and Apollo and innovative manufacturing techniques incorporated by the manufacturers are expected to contribute toward the growth of market. Furthermore, rapid development of the manufacturing sector in the emerging economies such as China and India primarily automotive and construction materials is expected to propel the growth of liquid synthetic rubber market during the forecast period.

However, fluctuating raw material prices is expected to restrain the growth of liquid synthetic rubber market. On the contrary, increase in product penetration in industrial rubber manufacturing is expected to offer lucrative opportunities for the growth of liquid synthetic rubber market.

Segments Overview

The global liquid synthetic rubber market size is segmented into product, application, and region. On the basis of product, it is divided into liquid isoprene rubber, liquid butadiene rubber, liquid styrene butadiene rubber, and others. By application, it is fragmented into adhesives, industrial rubber, tyre manufacturing, polymer modification, and others. Region wise, the liquid synthetic rubber market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Global Liquid Synthetic Rubber Market, By Region

Asia-Pacific accounted for the major liquid synthetic rubber market share in 2019, owing to rapid development of the manufacturing and construction sector across the China, India, and Japan due to which the demand for liquid synthetic rubber has been surged considerably. In addition, rise in infrastructure development and construction activities across the region especially in countries such as China and India have led to surge in demand for adhesives. Due to this the demand for liquid synthetic rubber from adhesive manufacturers has been surged significantly. Furthermore, growing demand and production of electric vehicles across the region has led to surge in demand for tyres from automotive sector. Owing to this the demand for liquid synthetic rubber from tyres manufacturers has been increased considerably which is expected to augment the growth of the market during the forecast period.

By Region

Asia-Pacific would exhibit an CAGR of 4.8% during 2020-2027.

Global Liquid Synthetic Rubber Market, By Product

Depending on product, the liquid styrene butadiene segment garnered the major share in 2019. This is attributed to the fact that liquid styrene butadiene rubber is majorly used in the production of tyres and tyre components, such as tread, apex/rim/flange, and carcass. Increased focus on durability and performance of tyres along with the adoption of tyre labeling regulations is driving its demand from the tyre manufacturing industry.

By Product

Liquid Styrene Butadiene Rubber is projected as the most lucrative segment.

Global Liquid Synthetic Rubber Market, By Application

On the basis of application, the tyre segment dominated the market, in terms of share, in 2019, as liquid synthetic rubber is majorly used in the production of tyres. In addition, presence of major tyre manufacturing companies in China and Japan, due to abundant availability of raw materials, low manufacturing cost, and wide scope of application industries is expected to drive the demand for liquid synthetic rubber from tyre manufacturers.

By Application

Tyre Manufacturing is projected as the most lucrative segment.

Competitive Analysis

The key players operating in the global liquid synthetic rubber market include Evonik Industries, H.B. Fuller, Synthomer PLC, Asahi Kasei Corporation, Kuraray Co., Ltd., Efremov Synthetic Rubber, Saudi Aramco, Nippon Soda Co., Ltd., Sibur International GmbH, and Puyang Linshi Chemical New Material Co., Ltd. These players adopt strategies, such as product launch, business expansion, and acquisition to stay competitive in the global market.

Key benefits for stakeholders

- The global liquid synthetic rubber market analysis covers in-depth information of major industry participants.

- Porter’s five forces analysis helps to analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- Major countries have been mapped according to their individual revenue contribution to the regional market.

- The report provides in-depth analysis of the global liquid synthetic rubber market forecast for the period 2020–2027.

- The report outlines the current global liquid synthetic rubber market trends and future scenario of the global liquid synthetic rubber market from 2019 to 2027 to understand the prevailing opportunities and potential investment pockets.

- Key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

Liquid Synthetic Rubber Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | EFREMOV SYNTHETIC RUBBER, PUYANG LINSHI CHEMICAL NEW MATERIAL CO., LTD, ASAHI KASEI CORPORATION, EVONIK INDUSTRIES, KURARAY CO., LTD, SIBUR INTERNATIONAL GMBH, SAUDI ARAMCO, SYNTHOMER PLC, H.B. FULLER, NIPPON SODA CO., LTD |

Analyst Review

The usage of liquid synthetic rubber is expected to grow in tyre manufacturing, which is likely to drive the growth of the global liquid synthetic rubber market. The expansion of the automobile industry across the countries such as Germany and China and rise in demand for electric vehicle have led to surge in demand for tyres. This, in turn, is likely to fuel the demand for liquid synthetic rubber from tyre manufacturers across, thereby driving the market growth significantly. In addition, surge in investment from the emerging economies such as China and India toward the development of housing infrastructure has boosted the demand for adhesives across, which eventually will drive the demand for liquid synthetic rubber during the forecast period. This is a major trend in the liquid synthetic rubber market, and is expected to provide lucrative opportunity for the market players to capitalize in the near future.

However, fluctuation in raw material prices is expected to restrain the liquid synthetic rubber market growth. Conversely, increase in product penetration in industrial rubber manufacturing is expected to offer potential growth opportunities for the global market during the forecast period.

Surge in tyre production and increase in demand for rubber with low concentration of volatile organic compounds (VOCs) across the globe are the key factors boosting the liquid synthetic rubber market growth

The global liquid synthetic rubber market was valued at $20.3 billion in 2019, and is projected to reach $28.8 billion by 2027, growing at a CAGR of 4.5% from 2020 to 2027.

Evonik Industries, H.B. Fuller, Synthomer PLC, Asahi Kasei Corporation, Kuraray Co., Ltd., Efremov Synthetic Rubber, Arlanxeo Holding B.V., Nippon Soda Co., Ltd., and Sibur International GmbH are the top companies in the liquid synthetic rubber industry

Tyre and adhesive manufacturing industry is projected to increase the demand for liquid synthetic rubber market.

Liquid styrene butadiene rubber segment accounted for the largest liquid synthetic market share.

Rising tyre production is the major factor propelling the growth of this segment as it offers excellent characteristics like high abrasion resistance, tensile strength, and good resilience to tires are the main drivers of liquid synthetc rubber market.

Tyre and adhesives manufacturing are expected to drive the adoption of liquid synthetic rubber.

The coronavirus (COVID-19) pandemic crisis has negatively affected the growth of the liquid synthetic rubber market, as the demand from the tyres, automotive, and construction industry has declined, globally. Owing to the lockdown implemented across various countries, national and international transport have been hampered, which has significantly impacted the supply chain of liquid synthetic rubber across the globe, thereby increasing the supply–demand gap. Thus, insufficiency in raw material supply is expected to hamper the production rate of liquid synthetic rubber, which negatively impacts the market growth

Loading Table Of Content...