P2P Payment Market Research, 2034

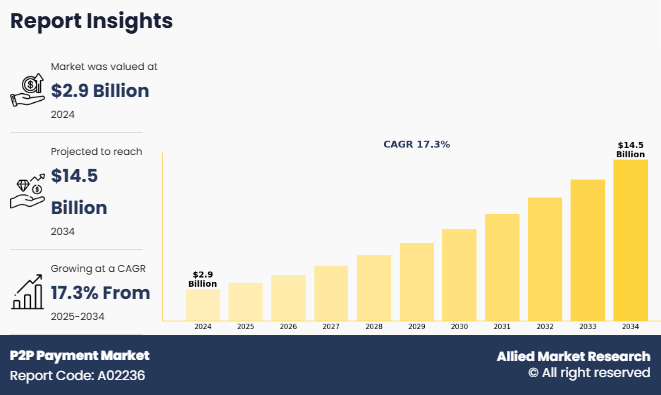

The global P2P payment market was valued at $2,851.1 million in 2024, and is projected to reach $14,506.8 million by 2034, growing at a CAGR of 17.3% from 2025 to 2034.

P2P payments allow users to send money directly from one person's account to another person's account without going through a traditional banking institution. These payments are typically facilitated through digital platforms, mobile apps, or online services. Unlike traditional bank transfers, P2P payments bypass the need for a bank or financial institution to handle the transaction. P2P payments offer a fast and convenient way to transfer money, often requiring just an internet connection and a smartphone. PayPal and Zelle are popular platforms that facilitate P2P payments. In a P2P transaction, both parties use a platform that facilitates these payments. The funds can be transferred directly between bank accounts, credit and debit cards, or stored in an online wallet.

Key Takeaways:

By Transaction Mode, the mobile web payments segment held the largest share in the P2P payment market for 2024.

By Payment Type, the proximity segment held the largest share in the P2P payment market for 2024

By End User, the personal segment held the largest share in the P2P payment market for 2024.

Region-wise, Asia-Pacific held the largest share of the P2P payment market in 2024. However, LAMEA is expected to witness the highest CAGR during the forecast period.

Factors such as the increase in smartphone penetration and internet connectivity along with the growth in consumer preference for digital payments positively impact the growth of the P2P payment market. In addition, the government's initiatives and support in promoting cashless economies and enhancing digital infrastructure are expected to fuel the growth of the market during the forecast period. Furthermore, surge in the integration of P2P payments with IoT devices, such as wearable technology and smart home systems, enables seamless and instant transactions, is expected to provide lucrative growth opportunities during the P2P payment market forecast period. Moreover, advancements in blockchain technology and the rise in the adoption of secure payment protocols are further creating favorable environments for the growth of the P2P payment market size.

Segment Review

The P2P payment market is segmented into transaction mode, payment type, end-user, and region. On the basis of transaction mode, the market is classified into mobile web payments, near field communication, SMS/direct carrier billing, and others. By payment type, the market is divided into remote and proximity. As per end-user, the market is bifurcated into personal and business. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of transaction mode, the global P2P payment market share was dominated by the mobile web payments segment in 2024 and is expected to maintain its dominance in the upcoming years, owing to the increase in smartphone penetration and improved mobile internet access. In addition, there is a growing demand for contactless and instant digital payment options, supported by expanding fintech innovations and regulatory encouragement toward cashless transactions, contributing to market expansion. However, the near field communication segment is expected to experience the highest growth during the forecast period. This segment is experiencing increase in the adoption of near field communication (NFC) technology, enabling quick, secure, and contactless money transfers between devices in close proximity.

Region wise, Asia-Pacific dominated the market share in 2024 for the P2P payment market. This is due to the dominance of mobile app-based payments, which have become the preferred mode for P2P transactions. This trend is supported by the widespread use of smartphones, improved mobile internet connectivity, and the integration of P2P payment features into messaging and social media platforms, contributing significantly to the region’s market growth. However, LAMEA is expected to experience the fastest growth during the forecast period. The region is experiencing notable growth, driven by factors such as increase in the use of smartphones and internet access expanding the reach of digital payment platforms, enabling more users to engage in P2P transactions, which is expected to provide lucrative growth opportunities for the market in this region.

Competition Analysis

The report analyzes the profiles of key players operating in the P2P payment market are PayPal Holdings, Inc., Google LLC, Apple Inc., Payoneer Inc., Block, Inc., National Association and Bremer Insurance Agencies, Inc., ONE97 COMMUNICATIONS LIMITED, PAYTM), N26 Bank SE, Circle Internet Financial, LLC, Wise plc, Samsung Electronics Co., Ltd., Remitly, Inc., Skrill (Paysafe Holdings UK Limited), NetSpend Corporation, Vodafone Group Plc., Chime Financial, Inc., Early Warning Services, LLC, Tencent Holdings Limited, Alipay, and Paysend. These players have adopted various strategies mergers and acquisitions, partnerships and collaborations, product innovations, geographic expansions, and technological advancements to enhance their service offerings, increase market share, and strengthen their foothold in the global P2P payment industry.

Recent Developments in the P2P Payment Market

In May 2025, Samsung Electronics America introduced a new Tap to Transfer feature for Samsung Wallet, designed to make peer-to-peer (P2P) payments faster and more convenient. Users can now send money to friends and family simply by tapping their phone to a recipient’s debit card using NFC technology, without needing a separate app. The feature supports transfers to both digital wallets for P2P payments and physical debit cards with tap-to-pay capabilities. Samsung partnered with Visa and Mastercard to enable this functionality, aiming to simplify shared expenses and everyday money transfers directly from Galaxy smartphones.

In October 2024, Alipay+ launched on Cambodia’s KHQR system, enabling seamless cross-border mobile payments. This partnership between the National Bank of Cambodia and Ant International allows users of 12 international e-wallets including Alipay, GCash, Kakao Pay, and Touch ‘n Go—to pay over 1 million Cambodian merchants by scanning KHQR codes. The initiative supports payments in Cambodian riels and aims to boost tourism, local business, and digital financial inclusion, highlighting regional innovation in the P2P payment market outlook.

In August 2023, Marqeta extended its partnership with Block, Inc. for another four years, continuing to power Cash App’s card issuing and payment infrastructure through 2027. This move followed a strong Q2 performance, where Marqeta reported a 25% year-over-year revenue spike and a 33% increase in total processing volume, reaching $54 billion. The deal also includes a new collaboration in Brazil with Fitbank and positions Block as Marqeta’s BIN sponsor, enabling faster market entry for new customers. The partnership reflects Marqeta’s strategy to scale its embedded finance offerings and deepen its role in the global digital payments ecosysystem.

Top Impacting Factors

Driver

Increased in smartphone penetration and internet connectivity

Rising smartphone penetration and internet connectivity are key drivers of the P2P payment market, enabling easier access to digital transactions. Affordable smartphones are now widely available, even in emerging and developing markets, enabling a broader segment of the population to access digital financial services. These devices come equipped with secure operating systems and features that support mobile wallets and P2P payment applications. In addition, the expansion of mobile internet infrastructure, including 4G and 5G networks, has significantly improved connectivity, allowing users to perform fast, seamless, and reliable financial transactions virtually from anywhere, augmenting the growth of the P2P payment market. Furthermore, the widespread adoption of smartphones has fueled the rapid growth of the mobile wallet and P2P payment ecosystem. The P2P payment platforms such as Venmo, Cash App, Google Pay, and Paytm offering intuitive, user-friendly interfaces that make sending and receiving money simple and accessible for users of all ages, has further fueled adoption, solidifying the role of smartphones in shaping P2P payment market trends, .which further accelerates the P2P payment market growth.

Furthermore, advancements such as biometric security, encrypted communication, and two-factor authentication have made smartphones safer for financial transactions, thus increasing user trust in P2P payment systems. For instance, in May 2025, Green Dot Corporation partnered with Samsung to enhance the Samsung Wallet experience for nearly 12 million U.S. users. Through Green Dot’s embedded finance platform, Arc, the partnership introduces a new “Tap to Transfer” feature, enabling fast and secure peer-to-peer (P2P) payments directly from Samsung Wallet to other digital wallets or contactless debit cards. This collaboration aims to deliver seamless, user-friendly financial services, with more features expected in the future, thus supporting in the expansion of the P2P payment market.

Restraints

Security concerns and risks of fraud

The major challenge for the growth of the P2P payment market is the security concerns and risks of fraud associated with unauthorized access, data breaches, and phishing attacks, which can undermine user trust and hinder widespread adoption. The key challenge is protecting sensitive user data and transaction details from cyberattacks, which can exploit weak authentication methods, phishing schemes, or malware to gain unauthorized access. The speed and anonymity of P2P payments make them attractive targets for fraudsters who use tactics such as fake payment requests, impersonation, or account takeovers to deceive users. As many P2P transactions are irreversible, victims often struggle to recover lost funds, especially on platforms with limited regulatory oversight and insufficient verification processes. To address these risks, it is crucial to impose strict security measures, including multi-factor authentication, continuous transaction monitoring, and robust identity verification. In addition, educating users regarding common fraud techniques and promoting vigilance can help reduce vulnerabilities. Regulatory frameworks also play a vital role in establishing security standards and ensuring compliance across platforms. In summary, robust regulatory frameworks and proactive security practices are essential to maintaining trust and safeguarding users in the rapidly evolving P2P payment industry.

Opportunity

Integration with IoT Devices

The surge in the integration of P2P payment platforms with IoT devices presents significant opportunity for the P2P payment market to enable seamless, automated transactions across connected devices, enhancing user convenience and driving widespread adoption. IoT devices facilitate seamless and instant payments by enabling real-time transaction processing without the need for manual intervention. For instance, wearables and smart home devices can automatically initiate payments, making transactions quicker and more convenient for users. These factors are expected to fuel the growth of the P2P payment market.

Moreover, the increase in the integration of P2P payments with IoT devices enables payments to be initiated using voice commands, biometric authentication, or automated triggers, streamlining the money transfer process and enhancing convenience, thus offering remunerative P2P payment market opportunity. For instance, voice-activated assistants such as Amazon Alexa and Google Assistant allow users to send money through simple voice commands, making mobile P2P transfers more accessible to a wider audience, including individuals who are less familiar with technology. For instance, in August 2024, NPCI, IRCTC, and AI startup CoRover launched a conversational voice payment system for UPI, allowing users to complete transactions using voice commands or by entering their UPI ID or mobile number. Powered by CoRover’s BharatGPT and integrated with IRCTC’s AskDISHA assistant, the system supports multiple Indian languages and aims to make digital payments more accessible, especially for users with limited digital literacy. This innovation enhances the ease and inclusivity of UPI transactions by removing language and interface barriers.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the P2P payment market analysis from 2024 to 2034 to identify the prevailing p2p payment market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces of P2P payment market analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the P2P payment market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global P2P payment market trends, key players, market segments, application areas, and market growth strategies.

P2P Payment Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 14.5 billion |

| Growth Rate | CAGR of 17.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 262 |

| By Transaction Mode |

|

| By Payment Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | ONE97 COMMUNICATIONS LIMITED (PAYTM), Chime Financial, Inc., Vodafone Group Plc., N26 Bank SE, Samsung Electronics Co., Ltd., Tencent Holdings Limited, Payoneer Inc., Early Warning Services, LLC, Circle Internet Financial, LLC, PayPal Holdings, Inc., Skrill (Paysafe Holdings UK Limited), Paysend plc, National Association and Bremer Insurance Agencies, Inc., Alipay, NetSpend Corporation, Apple Inc., Wise plc, Remitly, Inc., N26 Bank SE, Block, Inc. |

Analyst Review

The Peer-to-Peer (P2P) payment market is undergoing a significant global transformation, fueled by increasing smartphone penetration, the proliferation of mobile banking, and the rising demand for instant, user-friendly financial transactions. P2P payment platforms have evolved far beyond simple money transfers between individuals—they are now integral to the way consumers manage their finances, split bills, and even conduct small-scale business transactions. In both developed and emerging markets, users are embracing P2P solutions for their convenience, speed, and security. These platforms are also being integrated with digital wallets, social media, and e-commerce ecosystems, further embedding them into everyday financial behavior. As trust in digital financial services grows, P2P payments are playing a pivotal role in accelerating financial inclusion, reshaping the payments landscape, and laying the groundwork for a more connected, cashless economy.

Furthermore, the adoption of mobile-first and cloud-based P2P payment platforms is rapidly accelerating across regions such as North America, Europe, Asia-Pacific, and Latin America, driven by their accessibility, scalability, and low infrastructure requirements. These platforms enable real-time, seamless transfers, remote account management, and integration with broader digital ecosystems such as e-commerce, social media, and banking apps. The shift toward mobile wallets, QR code-based payments, and contactless transfers is enhancing user convenience and expanding financial access, particularly in underbanked populations. P2P payment systems that integrate with technologies like digital identity verification, transaction categorization, budgeting tools, and loyalty incentives are helping users manage their finances more intelligently and securely. Advanced technologies such as artificial intelligence, machine learning, biometric authentication, and blockchain are increasingly being integrated into P2P platforms to enhance fraud detection, ensure compliance, and deliver personalized financial experiences. This evolution is transforming P2P payments from simple transfer mechanisms into intelligent, secure, and user-centric financial ecosystems that drive financial inclusion and digital innovation globally.

Despite the positive outlook, several challenges continue to impact the global adoption of P2P payment solutions. Key barriers include concerns regarding data privacy, cybersecurity threats, regulatory inconsistencies across regions, and resistance from traditional financial institutions. In emerging and rural areas, limited internet connectivity, low smartphone penetration, and gaps in digital literacy can further hinder widespread adoption. In addition, the risk of fraud and identity theft remains a major concern for both users and service providers. However, the ongoing development of secure, user-friendly, and mobile-optimized P2P platforms along with increased efforts in financial education and regulatory standardization helps to overcome these obstacles. Scalable and accessible solutions are enabling broader participation across demographics, advancing the role of P2P payments in promoting financial inclusion and digital financial empowerment.

The global P2P payment market is projected to sustain considerable growth, driven by the rapid expansion of digital ecosystems, increasing consumer preference for instant and contactless transactions, and the growing need for accessible, secure, and user-centric financial solutions. As individuals across all age groups embrace mobile and digital payments for everyday transactions, P2P platforms are becoming an essential part of modern financial behavior. Organizations and fintech providers that invest in secure, scalable, and innovative P2P technologies are expected to enhance user trust, expand market reach, and remain competitive in the dynamic and digitally driven financial environment.

The P2P payment market is expected to witness notable growth due to increase in smartphone penetration and internet connectivity along with growing consumer preference for digital payments.

The P2P payment market is projected to reach $14,506.8 million by 2034.

The P2P payment market is estimated to grow at a CAGR of 17.3% from 2025 to 2034.

The key players profiled in the report include PayPal Holdings, Inc., Google LLC, Apple Inc., Payoneer Inc., Block, Inc., National Association and Bremer Insurance Agencies, Inc., ONE97 COMMUNICATIONS LIMITED, PAYTM), N26 Bank SE, Circle Internet Financial, LLC, Wise plc, Samsung Electronics Co., Ltd., Remitly, Inc., Skrill (Paysafe Holdings UK Limited), NetSpend Corporation, Vodafone Group Plc., Chime Financial, Inc., Early Warning Services, LLC, Tencent Holdings Limited, Alipay, and Paysend.

The key growth strategies of P2P payment market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...