Programmatic Display Advertising Market Overview

The global programmatic display advertising market was valued at USD 451.3 billion in 2021, and is projected to reach USD 9473.3 billion by 2031, growing at a CAGR of 35.8% from 2022 to 2031.

The rise in demand for work-from-home and remote working policies during the period of the COVID-19 pandemic aided in propelling the growth of social media and online platforms, hence empowering the demand for programmatic display advertising solutions. Moreover, the growth in demand for easily accessible and shorter forms of entertainment and media is positively impacting the growth of the programmatic display advertising market.

However, data privacy and sharing challenges on programmatic display advertising platforms can hamper the programmatic display advertising market growth. On the contrary, the integration of advanced tools such as machine learning and data analytics with programmatic display advertising solutions suites is expected to offer remunerative opportunities for expansion of the programmatic display advertising industry forecast during the period.

Programmatic display advertising refers to the deployment of automated equipment for the purchase and sale of desktop display, video, and mobile adverts through real-time bidding Moreover, with the help of programmatic display advertising services, businesses can target specific audiences and demographics by utilizing key indicators based on audience preferences. Targeted advertising campaigns are powered by algorithms and software. Programmatic display advertising is regarded as a time-saving strategy since it reduces the work required to make transactions, set prices, and other operational capabilities. The programmatic display advertising market is segmented into Ad Format, Type and Industry Vertical.

Segment Review

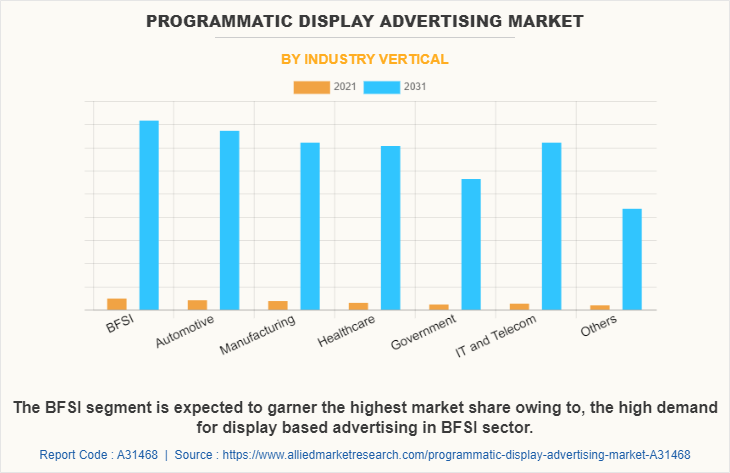

The programmatic display advertising market is segmented on the basis of ad format, type, application, industry vertical, and region. On the basis of ad format, the industry is divided into online video, online display, mobile video, and mobile display. Depending on type, the market is classified into private marketplaces, real time bidding, and automated guaranteed. The industry vertical covered in the study include BFSI, automotive, manufacturing, healthcare, government, IT and telecom, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on industry vertical, the BFSI segment dominated the programmatic display advertising market share in 2021, and is expected to continue this trend during the forecast period owing to the surge in influence of online media platforms on people’s financial expenditure, incentivizing major businesses of the sector to invest in effective programmatic display advertising solutions for their organization. However, the IT and telecom segment is expected to witness the highest growth in the upcoming years, owing to growth in number of digital businesses.

Region wise, the programmatic display advertising market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to its high concentration of programmatic display advertising solutions vendors such as Google Inc., IBM Corporation, and Microsoft Corporation. Presence of large advertising solution vendors in the region is expected to drive the market for programmatic display advertising technology within the region during the forecast period. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to rapid economic and technological developments in the region, which is expected to fuel the growth of programmatic display advertising solutions in the region in the coming few years.

The report focuses on growth prospects, restraints, and analysis of the global programmatic display advertising market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global programmatic display advertising market share.

Major Industry Players

The key players profiled in the programmatic display advertising market analysis are Adobe, Basis Technology, Connexity, Google, LLC, Integrated Ad, Science, Inc, IPONWEB Limited, Kayzen, LG Electronics, MediaMath, Magnite, Inc, NextRoll, Inc, RythmOne, LLC, Samsung Electronics, The trade desk, Verizon, Voyage Group, Xandr. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Top Impacting Factors

Growing adoption of smartphones and improving communication networks

The use of smartphones has grown rapidly and the way consumers interact with various brands or sellers has transformed drastically over the past few years, owing to the growing accessibility to high-speed internet on smartphones is expected to fuel online advertising solutions and services such as programmatic display advertising market as it has become crucial for the brands to understand consumers’ interests with the help of smartphone advertisements and stimulate their decision to purchase. Smartphones are providing real-time marketing opportunities for advertisers to engage with the users who truly want to associate with their brands.

In addition, the market players are offering new programmatic display advertising solutions due to the rapidly growing demand for smartphone-based programmatic display advertising, which is expected to further drive the programmatic display advertising market. For instance, in October 2020, Tech Mahindra, an IT services provider, collaborated with InMobi, a marketing cloud firm, to offer a video advertising solution. The solution is expected to enable advertisers to develop and distribute engaging and innovative video advertisements on mobile phones.

Proliferation of social media

The number of people who frequently use different social media platforms has grown dramatically. These platforms are observing huge popularity around the world as they enable people to connect with friends and family; however, they are also proving to be excellent tools for advertisers. The proliferation of social media drives the programmatic display advertising market due to various aspects such as better reach to much larger audiences than ever before, engaging with customers, enabling them to increase brand awareness, and cultivating new leads. These features of social media advertising have enabled marketers/advertisers to spend more of their advertising budgets on advertising on social media. . For instance, according to data published by Facebook, it had 1,562 million active users daily, as of the first quarter of 2019, which grew to over 1,960 million by the first quarter of 2022.

In addition, Twitter stated that 500 million Tweets are sent each day and 9% more people are using Twitter every day, reinstating the growing penetration of social media networks at a global level. In addition, social media players are adopting various strategies to attract more users to put ads on their platforms. For instance, in May 2020, Facebook offered to help small businesses who routinely advertise with it and some news publishers in the form of ad credits and grants. Facebook is expected to deposit $100 million in both ad credits and cash grants to support up to 30,000 small businesses across 30 countries around the world and another $100 million in grants and advertising credits to publishers. Such developments by social media players fuel the programmatic display advertising industry as it enables social media platforms to connect with more businesses and maintain a good relationship with their existing clients.

COVID-19 Impact Analysis

The COVID-19 outbreak has had a low impact on the growth of the programmatic display advertising market. However, various brands reduced their advertising spending given the economic impact of COVID-19; however, the uptick in social media traffic presented unique opportunities for engaging with online audiences as well as keeping brand awareness high during the period. In addition, with the rapid spread of the coronavirus pandemic governments across the globe enforced the closing of public spaces, schools, and borders, which empowered many businesses and marketers to update their online marketing strategies. Businesses also invested more in online advertising due to the pandemic, which is fueling the market growth.

For instance, according to the Interactive Advertising Bureau (IAB), reported a 24% decline in traditional TV advertising spend for 2020 vs the previous year of 2019; however, connected TV advertising spend is estimated to grow at 19% year-over-year. The growth of the programmatic display advertising market during the pandemic and post-pandemic is expected to be driven by factors such as extensive rise in social media advertising, increase in influencers, rapid growth in opportunities in OTT advertising, and growth in voice searches.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the programmatic display advertising market analysis from 2021 to 2031 to identify the prevailing programmatic display advertising market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the programmatic display advertising market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global programmatic display advertising market trends, key players, market segments, application areas, and market growth strategies.

Programmatic Display Advertising Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 9473.3 billion |

| Growth Rate | CAGR of 35.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 320 |

| By Ad Format |

|

| By Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | NextRoll, Inc, Integrated Ad, Science, Inc, Basis Technology, Magnite, Inc, Adobe, LG Electronics, Samsung Electronics, RythmOne, LLC, Kayzen, The trade desk, Xandr, Verizon, IPONWEB Limited, Voyage Group, MediaMath, Connexity, Google, LLC |

Analyst Review

Demand for programmatic display advertising platforms has been on a rise for the past few years and the market is expected to grow in the coming years as well, owing to growth in popularity of social media platforms and other digital services that can help provide an immersive and a more center stage advertising solution for many businesses, without having to spend too much capital on customer acquisition. In addition, rise in digital and internet penetration in many regions of the world is promising new opportunities for the growth of the digital advertising and programmatic display advertising industry.

Key providers of the programmatic display advertising market such as Google Inc. (Alphabet Inc.), Adobe Inc., and LG Corporation account for a significant share of the market. With larger requirements for programmatic display advertising tools and services, various companies are establishing partnerships to increase their display advertising capabilities. For instance, in September 2020, Verizon announced a collaboration with Broadsign. This partnership is to integrate Verizon Media’s programmatic demand-side platform with the Broadsign Reach programmatic DOOH supply-side platform. With this combination, Verizon Media advertisers can access Broadsign’s global programmatic DOOH inventory as part of their omnichannel buys. This is a strategic partnership for Verizon as it plans to expand into DOOH with the growing demand for new advertising medium in omnichannel campaigns with the ability of DOOH to capture consumer’s notes.

In addition, with the increase in demand for programmatic display advertising, various companies are expanding their current product portfolio with increasing diversification among customers. For instance, in July 2022, Google LLC announced the launch of its My Ad Center. This new tool has features that enable the users to define which brands and topics they like for their customization. This is an option that allows users to have control over the ads and content that they want.

Moreover, market players have expanding their business operations and customers by increasing their acquisitions. For instance, in May 2020, Connexity announced the acquisition of Skimlinks. SKimlinks develops monetization solutions for commerce-oriented publishers. This is a strategic acquisition for Connexity as it will develop an independent customer acquisition channel for e-commerce. It will add thousands of new retail-oriented publishers such as consumer-facing media brands.

The global programmatic display advertising market size was valued at $451.26 billion in 2021, and is projected to reach $947.33 billion by 2031

The programmatic display advertising market is projected to grow at a compound annual growth rate of 35.8% from 2022 to 2031.

The key players profiled in the programmatic display advertising market analysis are Adobe, Basis Technology, Connexity, Google, LLC, Integrated Ad, Science, Inc, IPONWEB Limited, Kayzen, LG Electronics, MediaMath, Magnite, Inc, NextRoll, Inc, RythmOne, LLC, Samsung Electronics, The trade desk, Verizon, Voyage Group, Xandr. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Region wise, the programmatic display advertising market was dominated by North America

The rise in demand for work-from-home and remote working policies during the period of the COVID-19 pandemic aided in propelling the growth of social media and online platforms, hence empowering the demand for programmatic display advertising solutions.

Loading Table Of Content...