Three Phase Sectionalizer Market Research, 2034

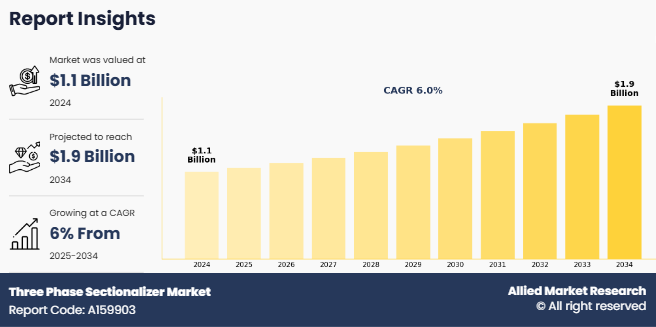

The global three phase sectionalizer market size was valued at $1.1 billion in 2024, and is projected to reach $1.9 billion by 2034, growing at a CAGR of 6% from 2025 to 2034.

A three-phase sectionalizer is a protective device used in electrical distribution systems to enhance reliability and minimize the scope and duration of outages. It is designed to detect fault conditions such as short circuits or line-to[1]ground faults and to automatically isolate the faulty section of the power distribution line, allowing the rest of the system to continue operating normally. Three-phase sectionalizers operate on all three phases simultaneously, making them especially important for medium-voltage power distribution networks that rely on balanced, three phase power. These devices are generally pole-mounted in overhead distribution systems or installed in pad-mounted enclosures in underground systems. They can be either mechanically or electronically controlled, with electronic sectionalizers offering greater flexibility, data monitoring, and integration with SCADA (Supervisory Control and Data Acquisition) systems.

Three-phase sectionalizers play a vital role in electric utility networks, where they serve as key devices for improving reliability and operational efficiency. Utilities deploy these sectionalizers in both urban and rural distribution systems to segment power lines and quickly isolate faulted sections without affecting the entire network. By doing so, they significantly reduce the number of customers impacted by outages, enhance grid resiliency, and contribute to improved performance indicators such as the System Average Interruption Duration Index (SAIDI). This targeted fault isolation minimizes downtime and ensures more reliable energy delivery, particularly critical during peak usage or in areas with aging infrastructure.

Key Takeaways

- The three phase sectionalizer market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global three phase sectionalizer markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the hrtee phase sectionalizer industry.

- The key players in the three phase sectionalizer market are ABB Ltd., Eaton Corporation PLC, Hubbell Inc., Tavrida Electric AG, G&W Electric Company, Schneider Electric SE., Bevins Co, SandC Electric Company, Hughes Power System, NOJA Power Switchgear Pty Ltd. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Market Dynamics

Integration of renewable energy with three-phase sectionalizer is expected to drive the growth of three-phase sectionalizer market. The growing integration of intermittent and decentralized renewable energy sources like solar and wind has heightened the complexity of power distribution networks. This shift necessitates advanced solutions for load balancing, real-time monitoring, and fault isolation. Three-phase sectionalizers have emerged as vital components, offering automatic fault detection and selective disconnection to maintain grid stability and continuity. Their relevance is increasing with the rise of bi-directional power flows and localized generation, particularly in microgrids and rural areas. Government initiatives, such as India’s July 2023 ISTS charge waivers for renewable projects, further support this transition. As global clean energy targets drive grid modernization, the demand for smart sectionalizers is expected to grow, ensuring reliable and efficient power distribution across evolving networks.

However, competition from reclosers and other smart grid devices is expected to hamper the growth of the three phase sectionalizer market. Three-phase sectionalizers face increasing competition from reclosers and other advanced smart grid devices, which can perform similar or even more comprehensive functions in certain scenarios. Reclosers, for instance, not only isolate faults like sectionalizers but also have the capability to automatically restore power if the fault is temporary. This makes them a more attractive option for utilities looking to enhance system reliability and reduce downtime without manual intervention. Depending on the network’s design and the utility’s fault management strategy, reclosers can often serve as substitutes for sectionalizers, especially in distribution systems where automated fault clearing is a priority. In some cases, utilities may prefer to invest in a recloser that combines the functionality of multiple devices, including protection, control, and communication, thus reducing the need for sectionalizers altogether.

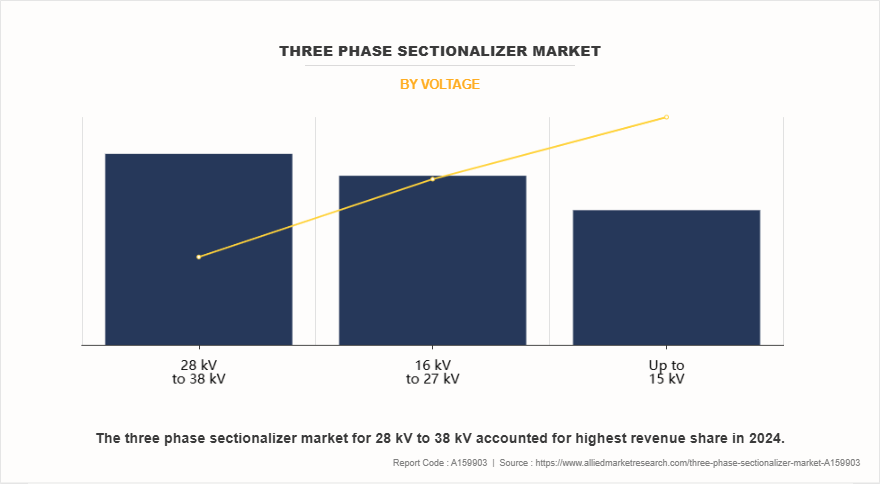

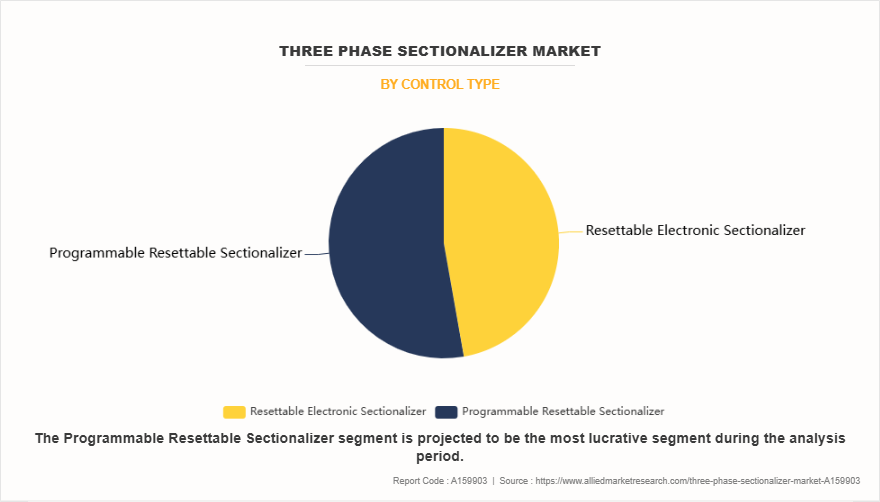

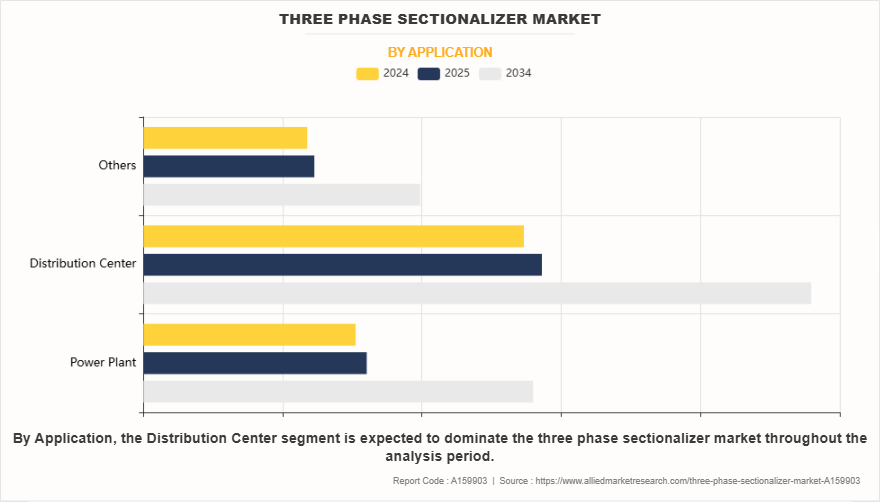

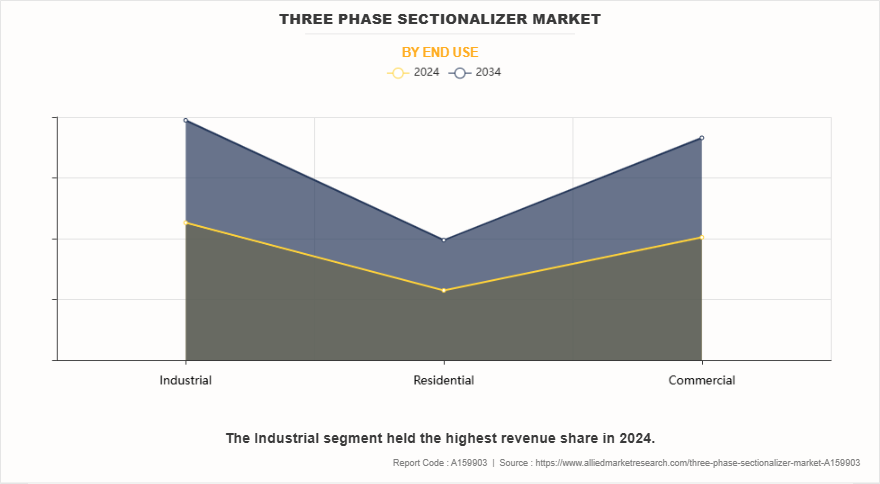

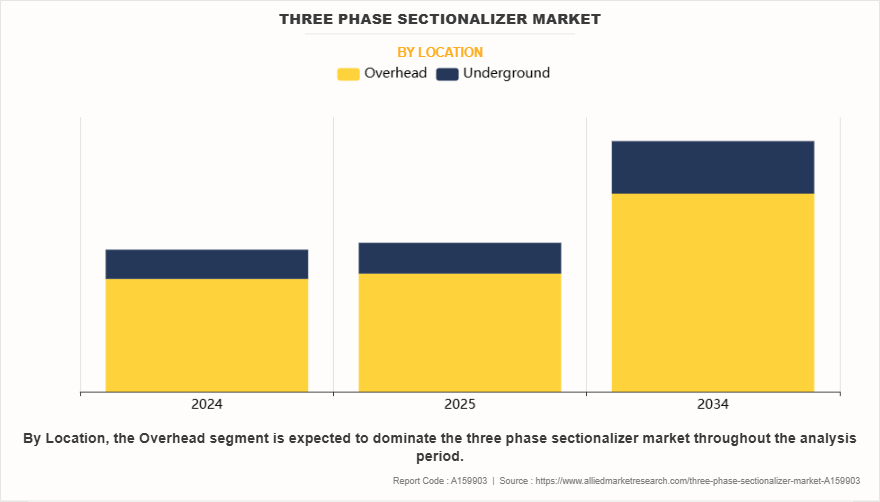

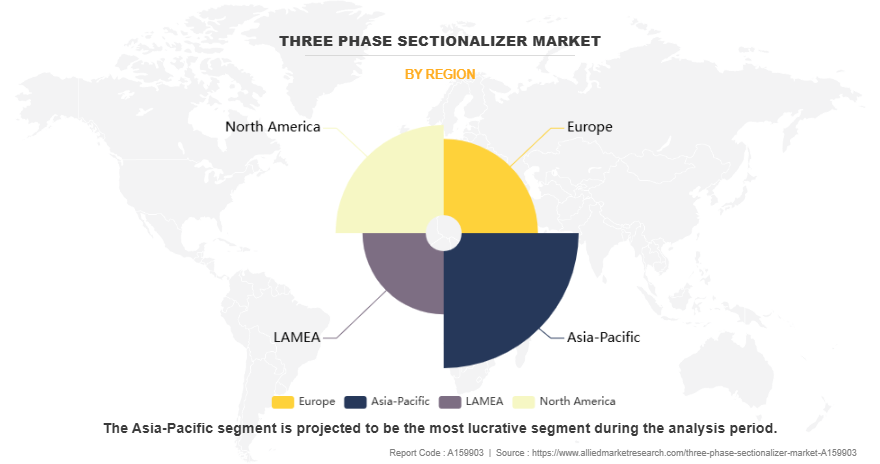

The three phase sectionalizer market is segmented into voltage, control type, application, end-use, location, and region. On the basis of voltage, the market is categorized into up to 15 KV, 16 KV to 27 KV, and 28 KV to 38 KV. On the basis of control type, the market is bifurcated into resettable electronic sectionalizer, and programmable resettable sectionalizer. On the basis of application, the market is divided into power plant, distribution center, and others. On the basis of end-use, the market is classified into industrial, residential, and commercial. On the basis of location, the market is categorized into overhead, and underground. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of voltage, the 28 kV to 38 kV segment dominated the market in 2024, accounting for one-third of the market share. In the 28 kV to 38 kV voltage range, the three-phase sectionalizer works by detecting fault conditions, typically caused by short circuits, line-to-ground faults, or equipment failure. Once a fault is detected, the sectionalizer automatically opens the circuit to isolate the faulted section. It is designed to coordinate with upstream protective devices like circuit breakers, allowing them to operate in sequence and effectively clear faults while minimizing downtime. Unlike fuses, which are one-time-use devices, sectionalizers can be reset after a fault is cleared, making them more efficient in high-voltage systems where frequent interruptions could be costly.

By control type, the programmable resettable sectionalizer segment dominated the market in 2024 accounting for more than half of the market share. In a three-phase system, the sectionalizer monitors the current flow in each of the three phases (R, S, and T), which are the standard phases in an alternating current (AC) distribution system. The device is designed to detect abnormal current levels that may indicate a fault, such as short circuits or line-to[1]ground faults. Upon detecting such anomalies, the sectionalizer will automatically open the circuit, isolating the faulty section and preventing the spread of the fault to other parts of the system. In the United States, all 50 states, along with the District of Columbia and Puerto Rico, undertook actions related to grid modernization in the third quarter of 2023. A total of 468 grid modernization actions were reported, aiming to enhance grid reliability, accommodate renewable energy integration, and ensure resilience against natural calamities and external threats.

On the basis of application, the distribution center segment was the most lucrative three phase sectionalizer applications in the market in 2024 accounting for more than half of the share. In a distribution center, where electrical power is managed and distributed to various loads or sub-networks, the use of a three-phase sectionalizer is vital. Distribution centers often handle large volumes of electricity, and any fault or disturbance can have widespread consequences. By integrating sectionalizers, utilities can ensure that only the faulty section of a feeder is taken offline, while the rest of the system continues operating normally. This helps in improving system reliability, reducing downtime, and protecting critical equipment from damage.

On the basis of end-use, the industrial segment was the most lucrative segment in the market in 2024, accounting for one third of the market share growing with the CAGR of 5.84% during the forecast period. A three-phase sectionalizer is a key component in electrical distribution systems, commonly used in industrial settings to enhance the reliability and safety of electrical networks. Its primary function is to detect faults in the system, automatically isolate the faulty section, and allow the rest of the network to continue operating without interruption. This is achieved through its ability to monitor the flow of electrical current and respond to abnormal conditions, such as short circuits or overcurrent situations, by opening the circuit breaker and disconnecting the faulty section.

On the basis of location, the overhead segment dominated the market in 2024. A three-phase sectionalizer is an essential protective device used in overhead power distribution systems to improve reliability and minimize the duration of outages. It is primarily designed to isolate faulted sections of the distribution network, allowing the rest of the system to continue operating normally. The sectionalizer is typically installed along the overhead lines and works in conjunction with circuit breakers, fuses, or reclosers. When a fault occurs, such as a short circuit or equipment malfunction, the sectionalizer detects the fault and quickly isolates the affected section, preventing the spread of the fault to the rest of the system.

By region, Asia-Pacific dominated the three phase sectionalizer market in 2024. The adoption and use of three[1]phase sectionalizers in Asia-Pacific countries have grown significantly, fueled by rapid urbanization, expanding industrial activities, and rising demand for reliable power distribution systems. These devices, which are crucial for isolating faulted sections of power lines in distribution networks, are gaining prominence as utilities in the region modernize their infrastructure to reduce power outages and improve grid reliability. Countries like China, India, Japan, South Korea, and Australia are at the forefront of deploying advanced distribution automation systems, with three-phase sectionalizers playing a vital role in these initiatives. In November 2023, India undertook active measures to promote energy conversion by increasing the budget for green and clean energy from $22 million in FY21 to $43 million in FY23. In addition, in June 2024, the Government of India approved funding of $5.6 million (INR 50 crore) for each of the four upcoming green hydrogen valley projects. These initiatives are expected to fuel the adoption of protective equipment like sectionalizers

Competitive Analysis

The major prominent players operating in the three phase sectionalizer market include ABB Ltd., Eaton Corporation PLC, Hubbell Inc., Tavrida Electric AG, G&W Electric Company, Schneider Electric SE., Bevins Co, SandC Electric Company, Hughes Power System, NOJA Power Switchgear Pty Ltd.

- In February 2025, TARIL Switchgear Private Limited, a subsidiary of Transformers and Rectifiers (India) Limited, launched 245 kV high-voltage bushings. These bushings are engineered with eco-friendly materials and processes, supporting a sustainable future and aligning with the industry's focus on environmental sustainability.

- In April 2024, the production of the 100,000th OSM Recloser marked a significant milestone, highlighting its widespread global adoption across more than 106 countries. Renowned for its advanced autoreclosing functionality and remote control features, the OSM Recloser plays a key role in renewable energy integration. It also serves as an environmentally friendly alternative to conventional recloser designs.

- In November 2022, EcoBreaker Launch the world's first solid dielectric insulated substation circuit breaker, the EcoBreaker. Designed as an alternative to SF₆ and oil-based breakers, it offers a 40.5 kV rating, 2,500 A continuous current, and 31.5 kA interruption capacity. The EcoBreaker emphasizes reliability with dual independent trip coils per phase and is maintenance-free for 50 years

- In 2022, BHEL developed a Bus Potential Transformer Module for 33 kV Gas Insulated Switchgear (GIS). This innovation reduced costs by 57% and panel size and weight by 80%, showcasing advancements in switchgear technology.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the three phase sectionalizer market analysis from 2024 to 2034 to identify the prevailing three phase sectionalizer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities along with three phase sectionalizer growth forecast.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the three phase sectionalizer market segmentation assists to determine the prevailing market opportunities including electrical distribution automation.

- Major countries in each region are mapped according to their revenue contribution to the global three phase sectionalizer market growth.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players including automatic load management.

- The report includes the analysis of the regional as well as global three phase sectionalizer industry trends, key players, market segments, application areas, and market growth strategies.

Three Phase Sectionalizer Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 1.9 billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 382 |

| By Voltage |

|

| By Control Type |

|

| By Application |

|

| By End Use |

|

| By Location |

|

| By Region |

|

| Key Market Players | Schneider Electric S.E., Hughes Power System, G&W Electric Company, ABB Ltd., SandC Electric Company, Bevins Co, Hubbell Inc., Tavrida Electric AG, Eaton Corporation PLC, NOJA Power Switchgear Pty Ltd |

Analyst Review

According to the opinions of various CXOs of leading companies, urbanization and infrastructure development globally is expected to drive the growth of the three phase sectionalizer market. The rapid pace of urbanization worldwide is reshaping the demand for electricity infrastructure, placing unprecedented pressure on power distribution systems. As cities expand and new urban centers emerge, the need for uninterrupted, high-quality power supply becomes critical for both residential and commercial developments. Three-phase sectionalizers have become vital components in modern power infrastructure. These devices enable utilities to isolate faulted sections of the grid swiftly and restore service without extensive manual intervention, ensuring minimal downtime and improved service continuity. In densely populated urban areas, where even short power interruptions can lead to significant disruptions impacting everything from public services to businesses and smart city operation sectionalizers play a crucial role in maintaining grid stability. Governments worldwide have introduced schemes that include reliability components, imposing penalties for utilities that fail to meet standards and offering bonuses for exceeding them. For instance, in May 2023, Michigan regulators updated service quality and reliability standards for power utilities, lowering thresholds for unacceptable performance during outages and increasing bill credits for affected customers.

However, the significant restraints in the adoption of three-phase sectionalizers is the challenge of integrating them with legacy power infrastructure. In many regions particularly in developing countries electrical grids are built on decades-old technology. These systems often lack the automation, communication protocols, and sensor capabilities that modern sectionalizers require for effective operation. As a result, deploying sectionalizers in such environments isn't just a matter of installing new equipment; it often necessitates comprehensive upgrades to the broader grid infrastructure. These upgrades can include replacing or retrofitting distribution lines, transformers, communication systems, and control centers to ensure seamless compatibility. This not only drives up the cost but also increases implementation time and operational complexity. Utilities operating on tight budgets or within regulatory constraints may find it difficult to justify these additional investments, especially when immediate returns are not guaranteed.

The major prominent players operating in the three phase sectionalizer market include ABB Ltd., Eaton Corporation PLC, Hubbell Inc., Tavrida Electric AG, G&W Electric Company, Schneider Electric SE., Bevins Co, SandC Electric Company, Hughes Power System, NOJA Power Switchgear Pty Ltd.

The global three phase sectionalizer market was valued at $1.1 billion in 2024, and is projected to reach $1.9 billion by 2034, growing at a CAGR of 6% from 2025 to 2034.

Aiia-Pacific is the largest regional market for three phase sectionalizer.

Distribution center is the leading application of three phase sectionalizer market.

Smart grid modernization initiatives and increase in electrification of public transport are the upcoming trends of three phase sectionalizer market.

Loading Table Of Content...

Loading Research Methodology...