Vinyl Flooring Market Overview:

The Global Vinyl Flooring Market size was valued at $20,194.76 million in 2016 and is projected to reach $48,471.15 million by 2023, registering a CAGR of 13.3% from 2017 to 2023.

Vinyl flooring is a finished flooring material predominately made from a combination of limestone-base material mixed with composites of natural and synthetic polymer materials such as polyvinyl chloride and plasticizers. It is type of robust and resilient flooring, which is primarily used in construction application related to commercial and residential projects. Other factors such as development of infrastructures in various sectors such as healthcare, education, industrial automotive, and others and growth of residential construction and homeowners fuel the growth of the market.

The vinyl flooring market is segmented into product, end-user industry, and region. Based on product, the market is classified into luxury vinyl tile and vinyl sheets & vinyl composite tile. By end-user industry, the market is divided into residential, healthcare, retail, education, sport, hospitality, office, industrial, and automotive. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in vinyl flooring market are Armstrong World Industries, Inc., Berkshire Hathaway Inc., CBC Flooring, Congoleum Corporation, Forbo Holding AG, Tarkett S.A., Mannington Mills, Inc., Mohawk Industries, Inc., Gerflor SAS, and IVC Group.

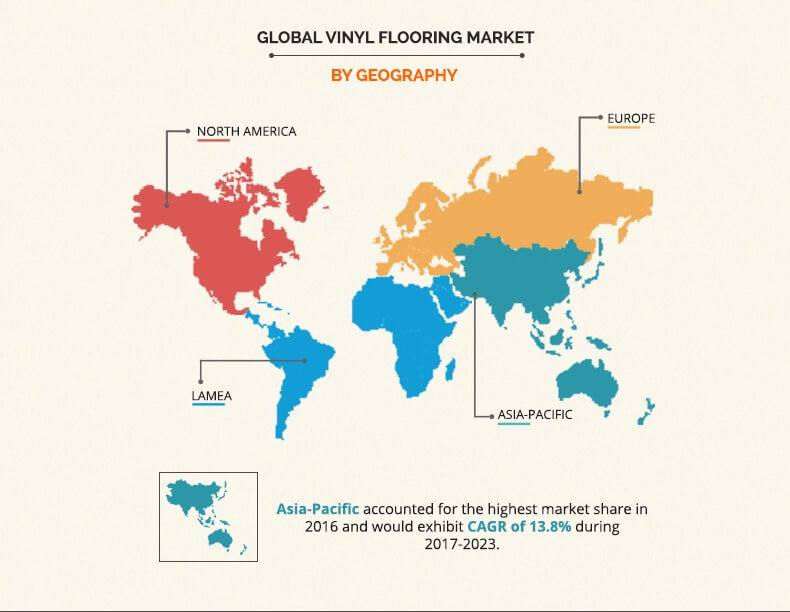

In 2016, Asia-Pacific accounted for the largest vinyl flooring market share in the global market, and is anticipated to maintain this trend during the forecast period. Growth in number of construction of healthcare, educational, and industrial infrastructures across India and China majorly drives the market toward growth. Moreover, growth in population, rise in disposable income, and changes in lifestyles increase the demand for modified and better residential construction, which in turn surge the need for renovation and construction of residential places such as family-homes, apartments, and condominiums. This factor supplements the growth of the market in this region. Moreover, India and China experience expansion in various industries such as sports, automotive, hospitality, and others, which further boost the demand for vinyl flooring.

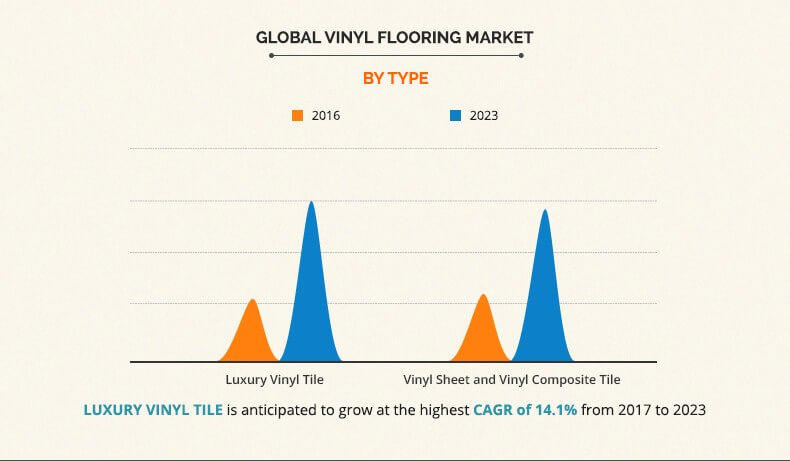

In 2016, the vinyl sheets & vinyl composite tile segment of vinyl flooring accounted for more than half of the share in the global vinyl flooring market in terms of value. However, luxury vinyl tile is anticipated to grow at the highest CAGR of 14.1% overtaking vinyl sheet and vinyl composite tile in year 2020. Due to the versatility of its graphic layer, luxury vinyl tile (LVT) provides superior design capabilities as compared to other traditional materials such as wood, marble, and concrete. It is commonly used in commercial sectors such as offices, retail, and hospitality.

Vinyl sheets & vinyl composite tiles possess superior properties such as water-resistance and slip resistance. These are also easy to clean, and hence are used in health care and educational construction applications. In addition, shock absorbent and cushion effect characteristics of vinyl floor tiles have raised their usage in construction of sports surfaces, fitness centers, and gymnasium.

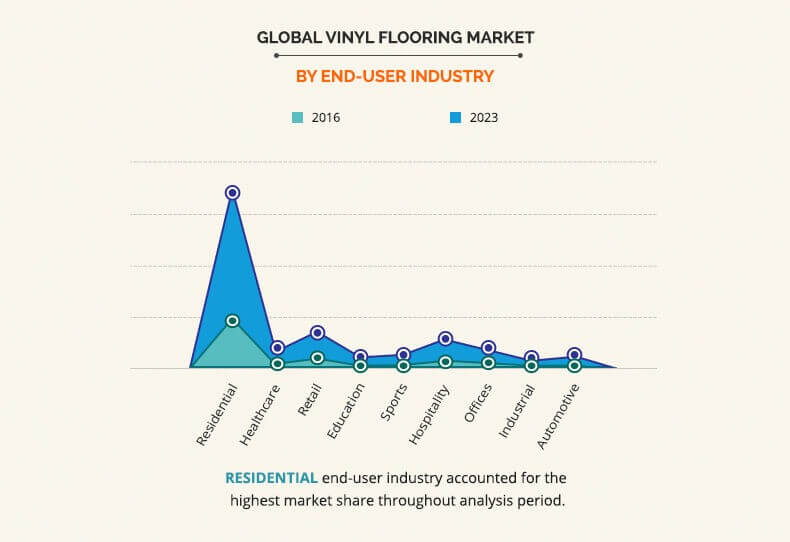

In 2016, the residential segment accounted for the highest market share in the global market. Vinyl flooring is available in the form of sheets, tiles, and planks having impact resistance and easy maintenance, thus used for construction and renovation applications of houses. Low cost, availability in wide range of sizes, colors, patterns, and texture has raised its demand for constructing floor of different areas of homes such as kitchen, bathrooms laundry area, and others.

As these are easy to clean, as well as water and slip resistant, they are widely used in health care, retail, education, sport, hospitality, and office. In addition, it offers the cushion backing technology to reduce the risk of injuries and provide the best indoor air quality, thus making it ideal for basketball, volleyball, martial arts, yoga, and other activities.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the current trends, estimations, and dynamics of the global vinyl flooring market from 2016 to 2023 to identify the prevailing market opportunities.

- The key countries in all the majors regions are mapped based on their market share.

- Porters Five Forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier buyer network.

- In-depth analysis of the market segmentation assists in determining the prevailing vinyl flooring market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global vinyl flooring industry. Market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of vinyl flooring market players.

- The report includes in details the analysis of the regional as well as global market, key players, market segments, and application areas, and vinyl flooring market growth strategies.

Vinyl Flooring Market Report Highlights

| Aspects | Details |

| By Product |

|

| By End Use Industry |

|

| By Geography |

|

| Key Market Players | Mannington Mills, Inc., Berkshire Hathaway Inc. (Shaw Industries Group, Inc.), Armstrong Flooring, Inc., CBC Co., Ltd. (CBC AMERICA LLC.), Mohawk Industries, Inc., Gerflor, Congoleum Corporation, Tarkett S.A., Novalis Innovative Flooring |

Analyst Review

Vinyl flooring is a finished flooring material predominately made from a combination of limestone-base material mixed with composites of natural and synthetic polymer materials, such as polyvinyl chloride and plasticizers. It is a type of robust and resilient flooring, primarily used in construction application related to commercial and residential projects.

According to the U.S. Census Bureau annual spending of U.S. on construction hits record high in 2017 with value of $1,250 billion. Factors such as growth in population, increase in disposable income, and changes in lifestyles are responsible for the increased demand for goods and services among consumers, which enforce developing regions to modify the existing industrial, public, and private infrastructures. Construction of non-residential structures demands for resilient, durable, and low-cost maintenance floor coverings, which has increased the demand for vinyl flooring. Characteristics such as durability, low cost, ease of maintenance, and premium finishes fuel the adoption of vinyl flooring over other traditional modes of flooring, such as wood, concrete, ceramic, and marble. The large number of renovation projects in Europe has expanded the use of vinyl flooring in construction application, which further supplements the market growth. Moreover, the superior properties of vinyl flooring such as sound absorbing and water-resistant nature, slip resistant, and warm underfoot, boost the demand for vinyl flooring in many modern health care and educational infrastructures. Furthermore, the growth in construction of residential places such as family-homes, apartments, and condominiums, and increase in number of homeowners in the developing countries such as India & China are anticipated to have a positive impact on the market growth.

Loading Table Of Content...