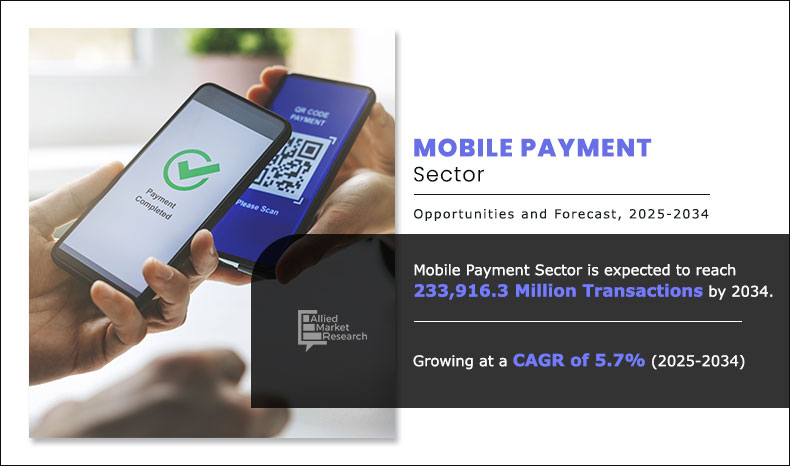

Volume Insights on Mobile Payment Sector

The global mobile payment sector volume projection was valued at 132,209.5 million transactions in 2024 and is projected to reach 233,916.3 million transactions by 2034, registering a CAGR of 5.7% from 2024 to 2034.

Volume Insights Strategic Overview

Allied Market Research announces the release of its comprehensive analysis of mobile payment. Designed to offer speed, convenience, and enhanced security, mobile payment serves as a critical financial tool for individuals seeking seamless transactions and greater control over their spending. This mobile payment product provides a flexible platform and real-time accessibility, allowing users to manage their payments and financial activities based on changing lifestyle and economic needs. Mobile payment is becoming an essential component of personal finance and business operations, ensuring financial efficiency, security, and digital inclusion as economic uncertainty and the demand for mobile payment solutions rise.

The report highlights the increasing demand for mobile payment, particularly among consumers and businesses looking for faster and more reliable solutions. Market growth is driven by the rise in smartphone penetration, e-commerce activity, and digital banking services that offer seamless integration, real-time processing, and enhanced user experiences. In addition, advancements in near-field communication (NFC) technology and artificial intelligence (AI) are accelerating innovation in the sector, aligning with industry trends toward dynamic and customer-centric mobile payment solutions. Key factors such as enhanced security features, increase in financial inclusion, and regulatory support for mobile payment products further contribute to the expansion of the mobile payment market globally.

The steady growth in the adoption of mobile payment is attributed to increasing smartphone usage, evolving consumer preferences, and the rising demand for fast, contactless payment solutions. These factors, combined with the growing emphasis on digital security and user convenience, are shaping the future of the mobile payment sector volume. The global volume of mobile payment in light commercial vehicles is expected to grow from 132,209.5 million transactions in 2024 to 233,916.3 million transactions by 2034, registering a CAGR of 5.7% over the forecast period. This growth is driven by the proliferation of mobile devices, improved internet connectivity, and heightened awareness of digital payment benefits among consumers and businesses. The increasing availability of mobile payment infrastructure, including digital wallets and contactless technologies, has enabled service providers to offer secure and convenient transaction experiences, boosting adoption among tech-savvy and younger consumers. In addition, regulatory initiatives promoting financial inclusion in emerging economies are expected to further accelerate market expansion.

Regional Mobile Payment Sector Volume Growth?

Asia-Pacific dominates the mobile payment sector sales with 61.0% share in 2024 and a 5.9% CAGR, while North America, Europe, and LAMEA show strong growth at 4.4%, 5.1%, and 6.5% CAGR respectively, fueled by rising smartphone penetration, expansion of digital infrastructure, increasing consumer preference for cashless transactions, and the growing demand for secure and convenient payment solutions.

The regional analysis highlights significant variations in adoption trends and field potential across the globe. Asia-Pacific leads the mobile payment sector volume share, contributing over 61.0% of the total transactions in 2024 and expected to grow at a CAGR of 5.9%, driven by a large unbanked population, rapid urbanization, widespread smartphone usage, and the presence of key market players offering innovative mobile wallet and payment gateway options. North America, led by countries such as U.S. and Canada, is projected to maintain steady growth at a 5.9% CAGR, fueled by rising mobile internet penetration, growing fintech innovation, expanding digital payment infrastructure, and regulatory initiatives promoting financial inclusion and cashless economy products. Europe, with key players such as the UK, Germany, France, Italy, Spain, and other countries, is expected to grow at a 5.1% CAGR, supported by increase in demand for contactless payment solutions, favorable regulatory frameworks, rise in adoption of digital wallets, and a growing emphasis on data privacy and secure transactions. Meanwhile, LAMEA offers significant growth opportunities with a 6.5% CAGR, fueled by rising smartphone adoption and internet penetration, increasing urbanization, regulatory reforms to enhance financial inclusion, and the expansion of mobile banking services across Latin America, the Middle East, and Africa.

Mobile Payment Sector Volume Growth, By Region, 2024-2034 (Million Transactions)

Region | 2024 | 2028 | 2034 | CAGR (2024–2034) |

North America | 15007.9 | 18698.6 | 23449.7 | 4.4% |

Europe | 23082.4 | 29551.3 | 38499.1 | 5.1% |

Asia-Pacific | 80019 | 106262.4 | 145108.8 | 5.9% |

LAMEA | 14100.2 | 19036.2 | 26858.7 | 6.5% |

Total | 132209.5 | 173548.5 | 233916.3 | 5.7% |

Source: AMR Analysis

Mobile Payment Country Sector Sales

U.S. and China lead the mobile payment sector volume forecast, projected to reach 18665.1 million transactions and 27030.7 million transactions by 2034 at 3.3% and 7.7% CAGR respectively, while Canada (10.1% CAGR) and Japan (6.6% CAGR) emerge as high-growth regions driven by rising smartphone penetration, the expansion of digital infrastructure and financial inclusion initiatives, and increase in consumer demand for contactless and seamless payment experiences for both online and offline retail transactions.

The report identifies the U.S. and China as the largest contributors to the mobile payment ecosystem in terms of active transactions. U.S., with its well-established insurance and healthcare infrastructure, strong consumer preference for customized and tech-enabled products, and favorable tax benefits, is projected to account for 18665.1 million transactions by 2034, driven by a high level of financial awareness, a strong network of insurance providers, innovative policy offerings with investment-linked benefits, and a growing demand for retirement and estate planning solutions. China, on the other hand, remains a critical player in the Asia-Pacific region, growing at a steady 7.7% CAGR and accounting for 27030.7 million transactions by 2034.

Major areas such as Canada and Japan are expected to drive significant growth due to increasing digital payments, rising smartphone adoption, urbanization, and the expansion of 5G networks and financial technology ecosystems. In Canada, the growth is fueled by the rising demand for convenient and secure mobile transactions, increasing contactless payment adoption, digital banking innovations, and the expansion of e-commerce platforms. In addition, factors such as government support for fintech innovation, a strong regulatory framework driving demand for secure payment technologies, and the active role of financial institutions in promoting cashless economy solutions further support in mobile payment sector volume for market expansion.

Mobile Payment Sector Volume Share, By Country, 2024-2034 (Million Transactions)

Country | 2024 | 2028 | 2034 | CAGR (2025-2034) |

China | 12607.2 | 17953.4 | 27030.7 | 7.7% |

India | 44297.7 | 55976.5 | 70527.4 | 4.5% |

Latin America | 5483.2 | 6974.9 | 8951.8 | 4.8% |

Japan | 6422.8 | 8761.3 | 12446 | 6.6% |

U.S. | 13248.9 | 15854.3 | 18665.1 | 3.3% |

Germany | 5693.3 | 7130.2 | 8981.1 | 4.5% |

Source: AMR Analysis

Key Highlights by Stakeholders?

Highlighting the significance of this report, Ashwani Ajwani, Vice-President of Allied Market Research, stated, “The mobile payment sector is experiencing steady growth, with rising policy sales driven by increasing consumer demand for convenient, secure, and contactless payment solutions. Key markets such as North America, Europe, and Asia-Pacific are witnessing strong adoption, supported by technological advancements, digital distribution channels, and evolving customer preferences. This report provides a comprehensive analysis of policy sales trends, regional market dynamics, and the factors influencing future growth in the mobile payment sector.”

Mobile Payment Sector Volume Trends?

The report highlights the growing demand for flexible and secure mobile payment transactions in mobile payment sector volume application, driven by increasing consumer awareness and evolving digital lifestyles. With regulatory frameworks adapting to encourage innovation and interoperable solutions, the market is shifting toward transactions that offer greater customization, value-added benefits, and long-term sustainability. This trend is prompting providers to innovate and develop tailored solutions that align with diverse customer preferences.

Moreover, emerging technologies are redefining the M-commerce payments such as biometric authentication, artificial intelligence (AI), and omnichannel payment channels are significantly influencing the mobile payment sector volume sales. The integration of cloud computing, machine learning for fraud detection, and real-time transactions is improving security, enhancing operational efficiency, and offering customers a more seamless and transparent experience. These innovations are expected to drive the demand for digitally-enabled mobile payment solutions that cater to a tech-savvy consumer base. As eWallet adoption continues to rise, especially among millennials and Gen Z, the industry is moving toward scalable, user-friendly mobile ecosystems. These platforms support digital identification, loyalty programs, and integrated financial services, fostering long-term customer engagement.

Furthermore, the study discusses the impact of shifting demographics and changing economic conditions on mobile payment adoption. With rising demand for convenience, financial inclusion, and cost-efficiency, service providers are focusing on transactions that provide sustainable growth, scalability, and tax advantages. In addition, as digital transformation reshapes the financial services landscape, companies are increasingly leveraging online platforms, AI-driven advisory services, and mobile-based transaction management tools to expand their market reach and improve customer engagement.

Mobile payment stakeholders should use the report’s insights to grab new opportunities and plans.

About Allied Market Research

Allied Market Research is a full-service market research and business consulting firm, which provides actionable insights and strategic recommendations to help clients make informed decisions and achieve sustainable growth. For more inquiries, please visit alliedmarketresearch.com