Volume Insights on Pancreatic Cancer Diagnostic Sector

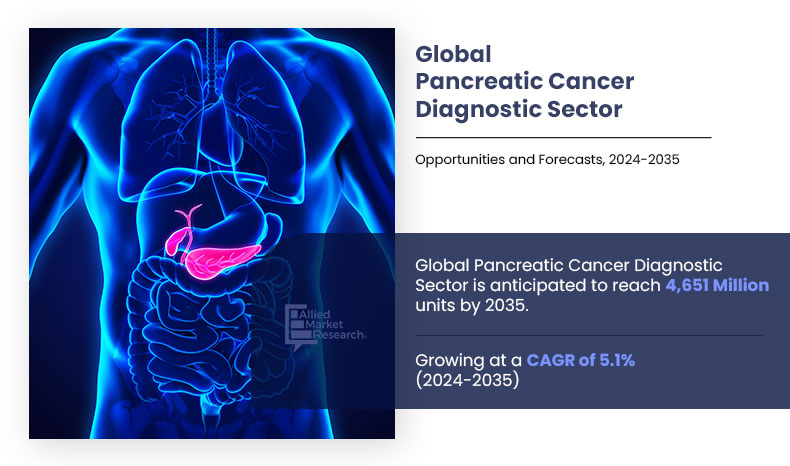

The global pancreatic cancer diagnostic sector volume projection was valued at 2,569 million units in 2023 and is projected to reach 4,651 million units by 2035, registering a CAGR of 5.1% from 2024 to 2035.

Volume Insights - A Strategic Overview

Allied Market Research has released an in-depth report analyzing global installations of pancreatic cancer diagnostic systems, offering valuable insights for stakeholders. Pancreatic cancer diagnostics includes a range of tests and imaging techniques used to detect and confirm pancreatic cancer.

The report highlights pancreatic cancer diagnostic sector volume application and rise in demand for pancreatic cancer diagnostic products, especially across key regions and countries. Product demand has grown significantly, fueled by rise in demand for early disease detection, advancements in diagnostic technologies, and increased healthcare investments.

The moderate growth in the adoption of pancreatic cancer diagnostic products is attributed to rise in prevalence of cancer, increasing demand for early and accurate detection methods, advancements in diagnostic imaging technologies, and government initiatives aimed at improving cancer screening and healthcare accessibility.

The global pancreatic cancer diagnostic sector volume projection is expected to grow from 2,569 million units in 2023 to 4,651 million units by 2035, registering a CAGR of 5.1% during the forecast period. The rapid expansion is supported by rise in prevalence of chronic diseases requiring temperature regulation, increase in surgical procedures, and growing awareness of perioperative hypothermia prevention.

Regional Pancreatic Cancer Diagnostic Sector Volume Growth

Asia-Pacific dominated the pancreatic cancer diagnostic sector sales with 43% share in 2023 with a 6.0% CAGR, while North America, Europe, and LAMEA show strong growth at 3.6%, 4.5%, and 5.1% CAGR respectively, driven by rise in number of pancreatic cancer cases and advancements in technology.

The regional analysis highlights significant variations in adoption trends and field potential across the globe. Asia-Pacific leads the pancreatic cancer diagnostic sector volume, contributing over 43% of the total installations in 2023 and is expected to grow at a CAGR of 6.0%, driven by advancements in early detection techniques, rise in prevalence of pancreatic cancer, and rise in healthcare expenditures. Government initiatives promoting cancer screening programs and collaborations between research institutions and diagnostic companies bolster the growth pancreatic cancer diagnostic sector in the region.

North America, led by the U.S. and Canada, is projected to maintain steady growth at a 3.6% CAGR, fueled by strong adoption rates due to well-established healthcare infrastructure, high awareness levels, and significant investments in research and development. Europe, with key players such as Germany and France, is expected to grow at a 4.5% CAGR, supported by favorable reimbursement policies, increasing incidence rates, and integration of AI-driven diagnostic tools. Meanwhile, LAMEA offers a significant growth opportunity with a 5.1% CAGR, driven by improving healthcare access and a rise in demand for early-stage diagnostics.

Pancreatic Cancer Diagnostic Sector Volume Growth, By Region, 2023-2035 (Million Units)

Region | 2023 | 2028 | 2035 | CAGR (2024–2035) |

North America | 572 | 684 | 875 | 3.6% |

Europe | 644 | 807 | 1,098 | 4.5% |

Asia-Pacific | 1,110 | 1,495 | 2,236 | 6.0% |

LAMEA | 243 | 314 | 442 | 5.1% |

Total | 2,569 | 3,300 | 4,651 | 5.1% |

Source: AMR Analysis

Pancreatic Cancer Diagnostic Country Sector Sales

China and the U.S. lead the pancreatic cancer diagnostic sector volume forecast, projected to reach 1,040 million units and 823 million units by 2035 at 6.7% and 3.6% CAGR, respectively, while India (5.9% CAGR) and Brazil (5.9% CAGR) supported by improvements in healthcare infrastructure, a rise in surgical procedures, and increased adoption of advanced temperature management technologies.

The report identifies China and Japan as the largest contributors to the pancreatic cancer diagnostic in terms of installations. China, with its rapid growth of healthcare infrastructure and increasing focus on early cancer detection, has witnessed significant rise in the adoption of diagnostic equipment, and is projected to reach 1,040 million units by 2035, achieving a CAGR of 6.7%. Japan, on the other hand, remains a critical player in the Asia-Pacific region, growing at a steady 6.2% CAGR and accounting for 229 million units by 2035.

Major countries such as China and India are expected to drive significant growth due to increase in cancer incidence, rise in healthcare expenditure, and growing awareness about early detection. Government initiatives to strengthen diagnostic infrastructure and the expansion of private healthcare facilities are further contributing to rise in demand for pancreatic cancer diagnostic in both countries. China, fueled by rapid healthcare infrastructure development, rise in cancer prevalence, and strong government support, is emerging as a key factor for pancreatic cancer diagnostics is expected to register a CAGR of 6.7%, the highest among major countries. India, representing the Asia-Pacific region, is projected to grow at a CAGR of 5.9%, supported by increasing healthcare access, rise in cancer prevalence, and growing investments in diagnostic imaging.

Pancreatic Cancer Diagnostic Sector Volume Share, By Country, 2023-2035 (Million Units)

Country | 2023 | 2028 | 2035 | CAGR (2024-2035) |

China | 479 | 666 | 1,040 | 6.7% |

U.S. | 538 | 644 | 823 | 3.6% |

India | 268 | 360 | 537 | 5.9% |

Canada | 20 | 24 | 30 | 3.3% |

Brazil | 53 | 71 | 105 | 5.9% |

Mexico | 13 | 16 | 21 | 4.0% |

Germany | 115 | 129 | 146. | 2.0% |

Source: AMR Analysis

Key Highlights by Stakeholders

Highlighting the significance of this report, Anshul Mishra, Vice-President of Allied Market Research, stated, “Rise in pancreatic cancer cases, growing demand for early detection, and advancements in imaging and biomarker-based diagnostic technologies are the key factors driving adoption of diagnostic solutions. Our latest report captures the market's dynamics, providing actionable insights for stakeholders aiming to capitalize on this opportunity.”

He further added, “Asia-Pacific, with its rapid healthcare expansion, remains the most promising region. At the same time, technological advancements in North America and Europe are supporting steady growth in these regions. With this comprehensive analysis, we aim to empower our clients with the knowledge needed to make informed business decisions.”

Pancreatic Cancer Diagnostic Sector Volume Trends

The report also emphasizes the growing role of non-invasive pancreatic cancer diagnostics in addressing the need for patient-friendly and cost-effective solutions. With increasing consumer demand for early and accurate detection methods, along with government initiatives supporting cancer screening programs, the shift toward advanced diagnostic technologies is expected to rise in the coming years. Rise in preference is driving manufacturers to develop solutions that not only enhance diagnostic efficiency but also minimize patient discomfort and healthcare costs.

In addition, technological innovations such as next-generation sequencing (NGS) and biomarker-based assays are shaping the pancreatic cancer diagnostic landscape. The integration of artificial intelligence in imaging techniques enhances diagnostic accuracy, enabling healthcare professionals to detect pancreatic cancer at earlier stages. These developments are expected to fuel demand for highly sensitive and specific diagnostic solutions tailored to various disease stages.

Furthermore, an aging population and lifestyle-related risk factors, including smoking and obesity, have contributed to the growing number of screening procedures. Rise in diagnostic volumes, supported by the implementation of screening programs for high-risk groups and the introduction of more accessible and non-invasive testing methods, is influencing the adoption and utilization of pancreatic cancer diagnostic products.

Moreover, the study explores the impact of healthcare policies and reimbursement frameworks on market dynamics. As healthcare systems globally prioritize cancer diagnostics, increased funding and reimbursement policies are driving accessibility to advanced diagnostic tools. This shift is crucial in improving patient outcomes and facilitating the adoption of novel diagnostic technologies.

Healthcare stakeholders should use the report’s insights to grab new opportunities and plan ahead.

About Allied Market Research

Allied Market Research is a full-service market research and business consulting firm, which provides actionable insights and strategic recommendations to help clients make informed decisions and achieve sustainable growth. For more inquiries, please visit alliedmarketresearch.com