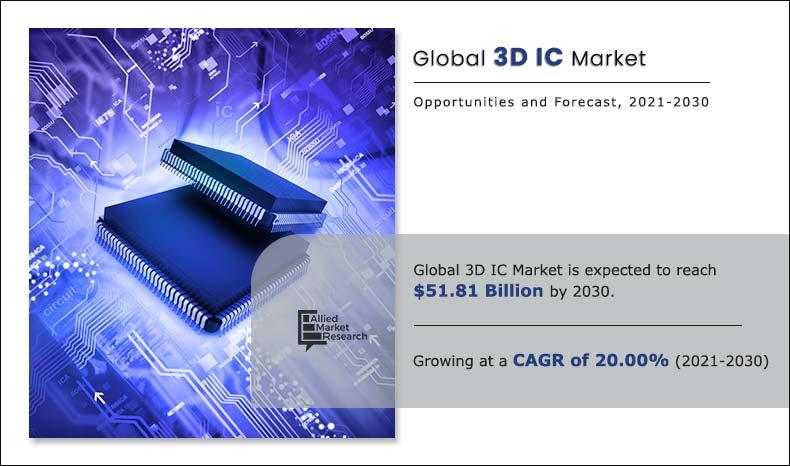

The global 3D IC market size is expected to reach $51.81 billion by 2030 from $9.18 billion in 2020, growing at a CAGR of 20% from 2021 to 2030.

3D ICs are the integrated circuits that incorporate two or more layers of circuitry in a single package. The layers are interconnected vertically as well as horizontally. These multi-layer chips are usually created by manufacturing separate layers and then stacking and thinning them.

In semiconductors, a trend to vertically stack integrated circuits (ICs) or circuitry has emerged as a viable solution for meeting electronic device requirements such as higher performance, increased functionality, lower power consumption, and a smaller footprint. The various methods and processes used to achieve this are called 3D integration technologies.

Semiconductor technology is expected to increase the value of a semiconductor product by adding functionality in its operation, increasing and maintaining the performance while lowering the overall cost of packaging. The adoption of semiconductor packaging is also creating demand for high-performance chips for various consumer electronic products. This augments the demand for 3D IC chips used in smartphones and other mobile devices.

The prominent factors that drive the 3D IC market growth include high adoption of electronics devices, rise in demand for internet of things (IoT) technology, and technological advancement in 3D packaging technology. The high rise in 3D packaging technology has fueled the growth of the 3D IC market revenue. For instance, in 3D TSV technology, the vertical connections are made inside chips as compared to horizontal connections in 2D technology, which reduces the interconnect length and overall size of the chip. The technological advantages of 3D packaging drive its demand in high-end applications such as chips used in computers, DRAMS, NAND, Imaging & optoelectronics, memory, and others. High investment and collaboration by leading outsourced semiconductor assembly & test (OSAT) companies in R&D is anticipated to create growth opportunities for 3D IC market. However, high initial capital investment and high cost of materials is hampering the market growth. Moreover, high adoption of fan-out wafer level packaging technology is expected to provide lucrative opportunities to the market growth.

The global 3D IC market share is segmented on the basis of type, component, application, end user, and region. Based on type, the market is divided into stacked 3D and monolithic 3D. On the basis of component, it is analyzed across through-silicon via (TSV), through glass via (TGV), and silicon interposer. Based on application, the market is categorized into logic, imaging & optoelectronics, memory, MEMS/sensors, LED, and others. By end user, the market is studied across consumer electronics, telecommunication, automotive, military & aerospace, medical device, industrial, and others. By region, the 3D IC market trends are analyzed across the North America, Europe, Asia-Pacific, and LAMEA.

By Type

Stacked 3D segment is projected as one of the most lucrative segments.

Top Impacting Factors

The prominent factors that drive the growth of the 3D IC market include high adoption of electronics devices, rise in demand for internet of things (IoT) technology, and technological advancement in 3D packaging technology. However, high initial capital investment and high cost of materials hampers its adoption, which is expected to pose a major threat to the global market growth. However, high adoption of fan-out wafer level packaging technology are expected to provide lucrative opportunities to the 3D IC market growth.

By End User

Consumer Electronics segment is expected to secure leading position during forecast period.

Competition Analysis

The key players profiled in the 3D IC market report include Amkor Technology (U.S.), ASE Group (Taiwan), United Microelectronics Corp ((Taiwan)), Micron Technology, Inc. (U.S.), Intel Corporation (U.S.), STMicroelectronics (Switzerland), Toshiba Corporation (Japan), Samsung Electronics Co., Ltd. (South Korea), Xilinx Inc. (U.S.), and Taiwan Semiconductor Manufacturing Company (Taiwan). Market players have adopted various strategies, such as product launch, collaboration, agreement, partnership, and expansion, to expand their foothold in the 3D IC industry.

By Region

Asia-Pacific region would exhibit the highest CAGR of 21.15% during 2021-2030

Covid 19 Impact Analysis

- The impact of COVID-19 on the manufacturing industry has significantly affected the global economy. Electronic components, such as LED chips and wafers, ICs, and other semiconductor devices, are mostly imported from China. Attributed to the shutdown of manufacturing units, the prices of semiconductor components have increased, owing to shortage of supplies.

- COVID-19 has a large impact on both consumer and the economy. Electronics manufacturing hubs have been temporarily shut down to limit the COVID-19 spread among individuals. This has majorly affected the supply chain of the 3D IC market by creating shortages of materials, components, and finished goods. Lack of business continuity has ensured significant negative impacts on revenue and shareholder returns, which is expected to create financial disruptions in the 3D IC industry.

- However, slowdown in productions by OEMs and reduction in demand for mobile phones and other consumer electronics has slightly pulled down the 3D IC market growth. In addition, reduction in various capital budgets and delay in planned projects in various end-use industries have hampered the global economy.

Key Benefits For Stakeholders

- This study comprises analytical depiction of the global 3D IC market outlook along with the current trends and future estimations to depict the imminent investment pockets.

- The overall 3D IC market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and 3D IC market opportunities with a detailed impact analysis.

- The current 3D IC market forecast is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and the 3D IC market share of key vendors.

- The report includes the market trends and the revenue share of key vendors.

Key Market Segments

By Type

- Stacked 3D

- Monolithic 3D

By Component

- Through-Silicon Via (TSV)

- Through Glass Via (TGV)

- Silicon Interposer

By Application

- Logic

- Imaging & optoelectronics

- Memory

- MEMS/Sensors

- LED

- Others

By End User

- Consumer Electronics

- Telecommunication

- Automotive

- Military & Aerospace

- Medical Devices

- Industrial

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- Taiwan

- India

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Key Players

- ASE Group

- Amkor Technology

- Samsung Electronics Co., Ltd.

- United Microelectronics Corp

- STMicroelectronics

- Toshiba Corporation

- Intel Corporation

- Micron Technology, Inc.

- Taiwan Semiconductor Manufacturing Company Limited

- Xilinx Inc.

3D IC Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Component |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Samsung Electronics Co. Ltd., STMicroelectronics N.V., Toshiba Corporation, ASE GROUP, United Microelectronics Corporation., TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED, INTEL CORPORATION, AMKOR TECHNOLOGY, Micron Technology, Inc., Xilinx Inc. |

Analyst Review

The 3D IC market is expected to leverage high potential for consumer electronics and automotive verticals. The current business scenario is witnessing an increasing demand for consumer electronics devices, particularly in developing countries such as China, Japan, South Korea, India, and others. Companies in this industry are adopting various innovative techniques, such as merger & acquisition activities, to strengthen their business position in the competitive matrix.

3D IC is steadily gaining traction, owing to rise in demand for enhanced technologies in various industry verticals, such as integration of IoT & AI, and surge in demand for consumer electronics products. Furthermore, technological development by emerging economies in Asia-Pacific boosts the 3D IC market growth. The 3D IC market is competitive, owing to the strong presence of existing vendors.

The key players operating in the global market include Amkor Technology, ASE Group, Intel Corporation, Samsung Electronics Co., Ltd., and Taiwan Semiconductor Manufacturing Company. These players have adopted various revenue and business growth strategies to enhance and develop their product portfolio, strengthen their market share, and help them increase their market penetration.

The 3D IC Market is estimated to grow at a CAGR of 20% from 2021 to 2030.

The 3D IC Market is projected to reach $51.81 Billion by 2030.

To get the latest version of sample report

High adoption of electronics devices, rise in demand for internet of things (IoT) technology, and technological advancement in 3D packaging technology are the prime factors that drive growth of the 3D IC Market.

The key players profiled in the report include Amkor Technology (U.S.), ASE Group (Taiwan), United Microelectronics Corp ((Taiwan)), Micron Technology, Inc. (U.S.), Intel Corporation (U.S.), STMicroelectronics (Switzerland), Toshiba Corporation (Japan), Samsung Electronics Co., Ltd. (South Korea), Xilinx Inc. (U.S.), and Taiwan Semiconductor Manufacturing Company (Taiwan)

On the basis of top growing big corporations, we select top 10 players.

The 3D IC Market is segmented on the basis of type, component, application, end-user, and region

The key growth strategies of 3D IC Market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

The stacked 3D segment accounted for maximum revenue and is projected to grow at a notable CAGR over 2021-2030.

Loading Table Of Content...