5G Enterprise Private Network Market Research, 2032

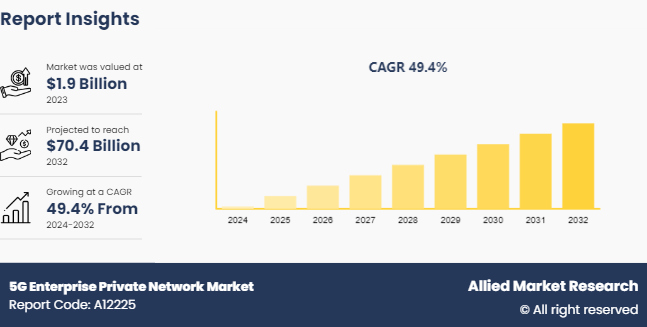

The global 5g enterprise private network market size was valued at $1.9 billion in 2023, and is projected to reach $70.4 billion by 2032, growing at a CAGR of 49.4% from 2024 to 2032. Private 5G networks are nonprofit mobile networks that have the option of using shared, unlicensed, or licensed spectrum. Private 5G networks are meant to augment existing capabilities and introduce new possibilities that other systems are not able to support. There are multiple models for private 5G networks such as wholly owned and operated private 5G networks, hybrid private-public cloud 5G networks and neutral host networks.

Key Takeaways

The 5G enterprise private network industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major 5G enterprise private network industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

The global 5G enterprise private network market growth is significantly rising due to several factors such as the development of wireless networking technologies, the emergence of industry 4.0 are some of the main factors anticipated to propel the growth of the market. However, the privacy and security concerns act as a restraint for the 5G enterprise private network market. In addition, the growing adoption of private 5G networks will provide ample opportunities for the market's development during the forecast period.

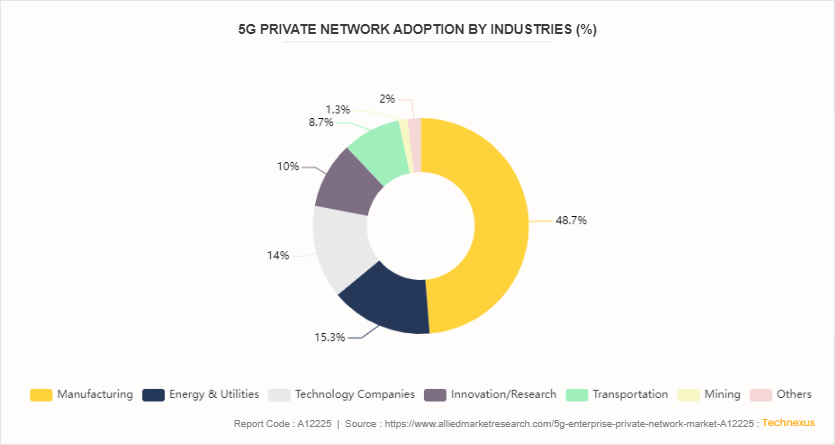

5G Private Network Adoption by Industries

Private 5G networks are increasingly being leveraged by various industry verticals to enhance their operational efficiency, security, and innovation capabilities. According to the article published by Technexus, in 2024, manufacturing is at the forefront, utilizing private 5G to enable real-time monitoring, automation, and predictive maintenance, thereby improving productivity and reducing downtime. Followed by the energy & utilities sector, the energy sector benefits from private 5G by enabling smart grids, real-time monitoring of assets, and improved safety protocols. These factors are further expected to fuel the growth of the global market.

FIGURE 1: 5G Private Network Adoption by Industries (%)

Market Segmentation

The 5G enterprise private network market size is segmented on the basis of component, frequency band, organization size, industry vertical, and region. By component, the market is divided into hardware, software, and services. As per the frequency band, it is fragmented into sub-6 GHz and mmWave. On the basis of organization size, it is bifurcated into large enterprises and small & medium size enterprises (SMEs). By industry vertical, it is categorized into BFSI, manufacturing, energy & utilities, retail, government and public safety, office buildings, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The global 5G enterprise private network market is experiencing substantial growth, with North America playing a pivotal role in this expansion. North America leads the market, propelled by robust technological infrastructure, significant investments in smart technologies, and stringent safety regulations that encourage the integration of advanced 5G enterprise private network solutions. Europe follows closely, with countries like Germany and the UK at the forefront, leveraging 5G enterprise private network solutions. In the Asia-Pacific region, rapid digitalization and increasing awareness of smart solutions are driving the adoption of AI and 5G enterprise private network technology solutions, particularly in China and Japan, where government initiatives support technological advancements.

In June 2024, the General Services Administration (GSA) raised $80 million from the Inflation Reduction Act (IRA) , the largest climate investment in U.S. history, into smart building technologies that help reduce emissions, increase efficiency and reduce costs, and enhance comfort across an estimated 560 federal buildings.

In May 2023, the Canadian government announced to licensing of 80 MHz of mid-band spectrum at 3900-3980 MHz for local shared and private 5G networks. It has also proposed to release portions of the mmWave bands at 26 GHz, 28 GHz, and 38 GHz for local usage by enterprises and other non-traditional users.

Industry Trends

In July 2023, the U.S. Government launched its long-awaited Internet of Things (5G enterprise private network) cybersecurity labeling program that aims to protect Americans against the myriad security risks associated with internet-connected devices.

In May 2021, the Presidential Executive announced the improvement in the Nation’s Cybersecurity and directed NIST to initiate two labeling programs on cybersecurity capabilities of Internet-of-Things (IoT) consumer devices and software development practices.

Competitive Landscape

The major players operating in the 5G enterprise private network market share include Nokia Corporation, Vodafone Ltd., Samsung, ZTE Corp., Huawei Technology Co. Ltd., Verizon Communications, Deutsche Telekom, Jupiter Networks, A&T Inc., and Cisco System Inc.

Recent Key Strategies and Developments

In June 2024, Hewlett Packard Enterprise launched HPE Aruba Networking Enterprise Private 5G to help customers accelerate and simplify the deployment and management of private 5G networks, providing high levels of reliable wireless coverage across large campus and industrial environments and opening up new, untapped use cases for private cellular.

In February 2024, Wipro Limited partnered with Nokia, to help enterprises scale their digital transformation. This joint venture provides enterprises with a more secure 5G private wireless network solution integrated with their operation infrastructure.

In August 2023, VVDN Technologies launched an end-to-end 5G Enterprise solution. The Private 5G solution comprises VVDN's indigenously designed ORAN Radio Units, customized CU/DU, and 5G Core. The solution is completely designed, developed, integrated, and fully tested by VVDN.

Key Sources Referred

Ministry of Electronics & IT

Internet Society

ResearchGate

IEEE

Key Benefits For Stakeholders

This report provides a quantitative analysis of the 5G enterprise private network market forecast segments, current trends, estimations, and dynamics of the 5G enterprise private network market analysis from 2023 to 2032 to identify the prevailing 5G enterprise private network market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the 5G enterprise private network market segmentation assists in determining the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global 5G enterprise private network market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global 5G enterprise private network market trends, key players, market segments, application areas, and market growth strategies.

5G Enterprise Private Network Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 70.4 Billion |

| Growth Rate | CAGR of 49.4% |

| Forecast period | 2024 - 2032 |

| Report Pages | 350 |

| By Component |

|

| By Frequency Band |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Vodafone Ltd., Cisco System Inc., A&T Inc., Deutsche Telekom, Samsung, Jupiter Networks, Huawei Technology Co. Ltd., Nokia Corporation, ZTE Corp., Verizon Communications |

The 5G Enterprise Private Network Market is rapidly evolving, driven by the need for secure, high-performance, and customizable wireless networks for businesses across various industries.

Hardware is the leading component of 5G Enterprise Private Network Market

North America is the largest regional market for 5G Enterprise Private Network in 2023

$70.4 billion is the estimated industry size of 5G Enterprise Private Network in 2032.

Nokia Corporation, Vodafone Ltd., Samsung, ZTE Corp., Huawei Technology Co. Ltd., Verizon Communications, Deutsche Telekom, Jupiter Networks, A&T Inc., and Cisco System Inc. are the top companies to hold the market share in 5G Enterprise Private Network.

Loading Table Of Content...