5G mmWave Technology Market Research, 2032

The Global 5G mmWave Technology Market was valued at $2.6 billion in 2022 and is projected to reach $10.1 billion by 2032, growing at a CAGR of 14.7% from 2023 to 2032. 5G mmWave, which stands for 5th Generation millimeter Wave, refers to a specific portion of the 5G wireless network technology that utilizes the higher frequency bands in the millimeter wave spectrum, typically ranging from 24 GHz to 100 GHz. These higher frequency bands enable mmWave to transmit data at much higher speeds compared to the lower frequency bands used in earlier cellular networks.

This technology is especially suited for high-density areas and applications requiring high data throughput, such as virtual reality, augmented reality, and ultra-high-definition video streaming.

5G mmWave technology, known for its high-frequency millimeter waves, is a vital driver in the 5G market due to its capability to offer exceptionally high data transmission speeds. Unlike 4G networks, 5G mmWave can potentially reach several gigabits per second, significantly enhancing data transfer rates. This remarkable speed is attributed to the higher frequency bands utilized by mmWave technology, which allow for larger bandwidth and thus, faster data throughput. As a result, this technology is not only revolutionizing the way data is transmitted over mobile networks but is also crucial in supporting the burgeoning demands for high-speed internet in various applications like virtual reality, ultra-HD video streaming, and advanced telecommunication services. The adoption of 5G mmWave is therefore seen as a transformative step in the evolution of wireless communication technologies.

Segment Overview

The 5G mmwave technology market is segmented into components, products, frequency bands, applications, and regions.

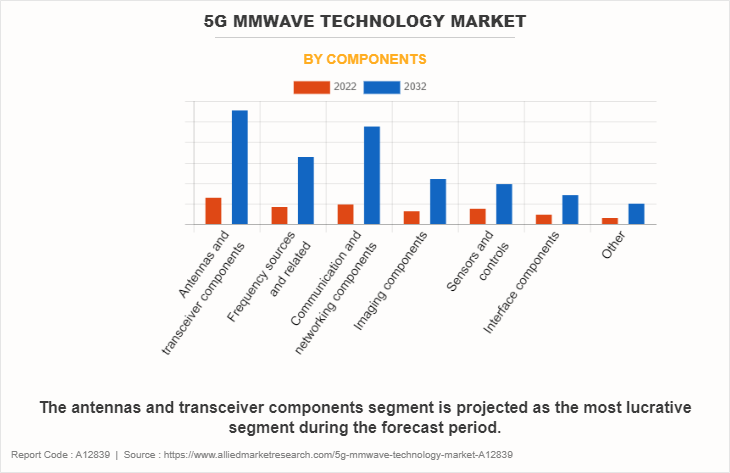

Based on components, the market is broken down into antennas & transceiver components, frequency sources & related, communication & networking components, imaging components, sensors & controls, interface components, and others. The antennas and transceiver components segment dominated the global 5G mmwave technology market in 2022, owing to their critical role in enabling high-speed, high-frequency communications essential for the efficient performance of 5G networks. The communication and networking components segment is expected to experience the fastest CAGR during the forecast period, due to the increasing demand for advanced communication infrastructure to support the exponential growth in data traffic and the deployment of IoT and smart devices.

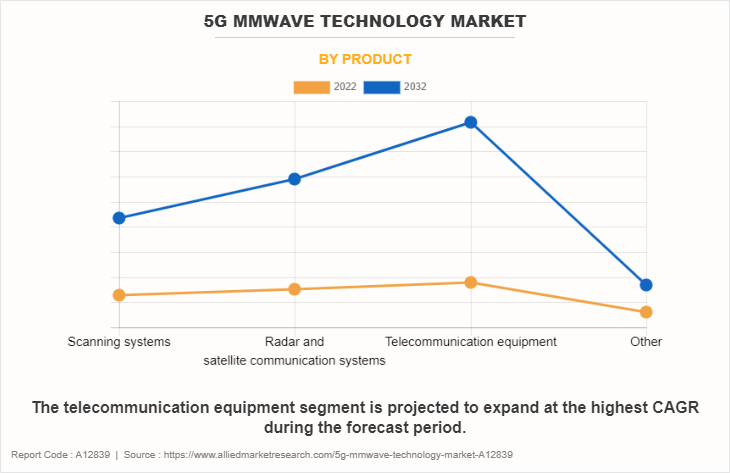

Based on product, the 5G mmwave technology market is classified into scanning systems, radar and satellite communication systems, telecommunication equipment, and others. The telecommunication equipment segment emerged as the market leader in the global 5G mmWave technology market in 2022 and is anticipated to register the fastest CAGR during the forecast period. This dominance can be attributed to the increasing global demand for high-speed internet and the rapid expansion of 5G infrastructure.

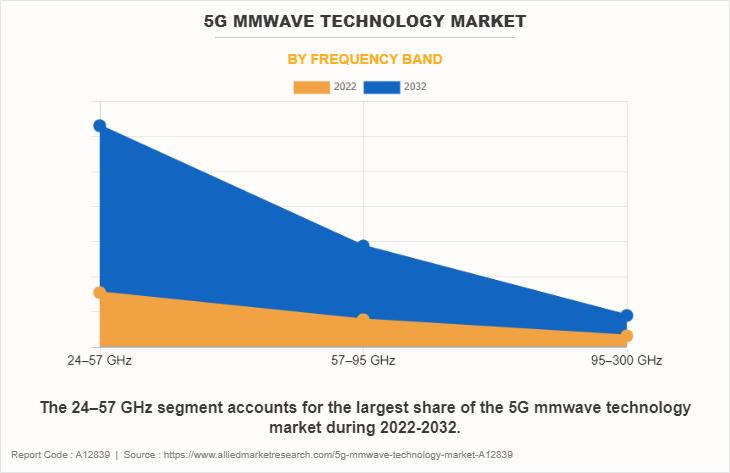

Based on frequency band, the 5G mmwave technology market is divided into 24–57 GHz, 57–95 GHz, and 95–300 GHz. The 24–57 GHz segment emerged as the market leader in the global 5G mmWave technology market in 2022 and is anticipated to register the fastest CAGR during the forecast period. This dominance can be attributed to its optimal balance between coverage, capacity, and speed, making it highly suitable for urban 5G deployments and various commercial applications.

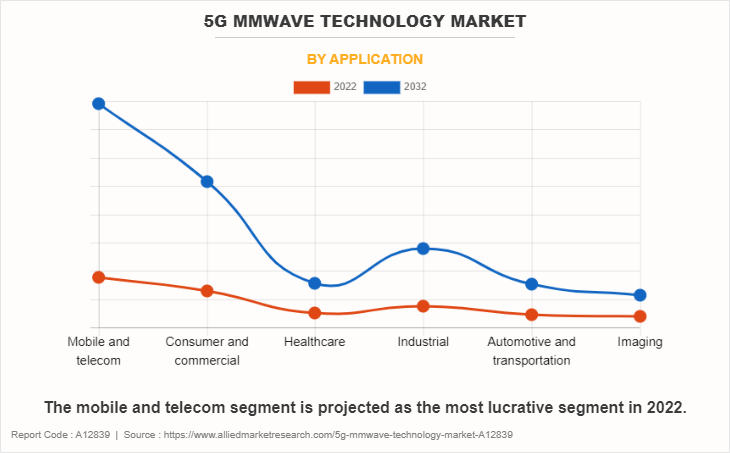

Based on application, the mobile and telecom segment emerged as the 5G mmWave technology market leader in the global 5G mmWave technology industry in 2022 and is anticipated to register the fastest CAGR during the forecast period. This dominance can be attributed to the escalating global demand for higher data speeds and increased network capacity, driven by the widespread adoption of smartphones and the continuous growth of mobile data traffic.

Based on region, the global 5G mmWave technology market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Chile, Argentina), and Middle East & Africa (UAE, Saudi Arabia, Africa). North America dominated the 5G mmWave technology market revenue in 2022. This is primarily due to the region's early adoption of 5G technologies, significant investments in 5G infrastructure, and the presence of major technology companies driving innovation in this field. The Asia-Pacific segment is projected to experience the fastest CAGR from 2023 to 2032, due to rapid technological advancements, increasing investments in 5G infrastructure, and the growing adoption of 5G-enabled devices in densely populated countries like China and India.

Country-wise, the U.S. is a leading revenue generator in the North American 5G mmWave technology market primarily due to its early and aggressive investment in 5G infrastructure and technology. The country has a robust telecommunications industry with major players actively involved in 5G development and deployment. Additionally, there is a high demand for advanced wireless technologies driven by consumer and enterprise markets, especially in urban areas where the need for high-speed internet and connectivity solutions is significant. The U.S. also has a strong ecosystem for innovation, fostering developments in IoT, smart cities, and autonomous vehicles, all of which are reliant on 5G mmWave technology.

In Europe, Germany holds a significant 5G mmWave technology market share, due to its advanced industrial sector and strong emphasis on Industry 4.0, which extensively utilizes IoT and automation technologies dependent on reliable and fast wireless communication. The country's commitment to technological innovation and its position as a leading industrial powerhouse in Europe make it a key player in the adoption and implementation of 5G mmWave technologies. Moreover, Germany's strategic focus on digitizing its manufacturing and automotive industries also contributes significantly to its leadership in the 5G mmwave technology market.

China's leadership in the Asia-Pacific 5G mmwave technology market is driven by its massive investment in 5G infrastructure, coupled with government support and initiatives aimed at promoting 5G deployment. The country has one of the world's largest consumer bases for mobile and internet users, providing a vast market for 5G services. Additionally, Chinese tech giants are heavily involved in 5G technology research and development, contributing to the country's prominent position in the global 5G landscape.

In Latin America, Brazil emerges as a leader in the 5G mmWave market due to its large population and growing demand for advanced telecommunications services. As the largest economy in the region, Brazil has been actively working on improving its digital infrastructure, and the deployment of 5G is seen as a key step towards technological advancement. The country's focus on improving connectivity in both urban and rural areas, along with the growing adoption of smart devices, positions Brazil as a significant market for 5G mmWave technology.

Within the Middle East and Africa region, the African continent is developing in the 5G mmwave technology market. This is largely due to the growing recognition of the potential of wireless technology to overcome traditional infrastructure challenges. With a rapidly expanding young population and increasing urbanization, there is a growing demand for high-speed internet and advanced connectivity solutions. Countries in Africa are increasingly partnering with global telecom players to develop their 5G infrastructure, seeing it as a critical component for economic development and digital inclusion.

However, the limited range and penetration capability of mmWave signals pose a significant restraint on the 5G mmWave technology market growth. Unlike lower frequency signals used in earlier mobile networks, mmWave frequencies have a much shorter range and face challenges in penetrating through common obstacles such as buildings, walls, and trees. This limitation necessitates the deployment of a denser infrastructure of cell sites to ensure adequate coverage and connectivity. The requirement for more cell sites not only increases the complexity and cost of network deployment but also presents logistical challenges, particularly in urban areas where space for new infrastructure is limited. Furthermore, the susceptibility of mmWave signals to environmental factors, such as rain and foliage, can impact the consistency and reliability of the network. These challenges are significant considerations for network providers and could potentially slow the widespread adoption and implementation of 5G millimeter wave technology, particularly in areas where deploying extensive infrastructure is not feasible.

Furthermore, advancements in urban connectivity represent a significant opportunity in the 5G millimeter wave technology market. In densely populated urban areas, where the demand for high-speed internet is continuously growing, 5G mmWave can offer a transformative solution. Its ability to provide incredibly fast data speeds is well-suited to cater to the high density of users and devices typical of urban settings. The deployment of 5G mmWave in these areas can revolutionize the way internet services are delivered, enabling applications that require large bandwidth and low latency, such as high-definition video streaming, real-time gaming, and enhanced virtual and augmented reality experiences. Furthermore, this technology can significantly contribute to the development of smart city infrastructure, supporting various services from traffic management to public safety. By delivering enhanced connectivity and increased network capacity, 5G mmWave stands to not only improve individual user experiences but also drive innovation and growth in urban areas, making it a key opportunity for growth in the 5G market.

Top Impacting Factors

The 5G mmWave technology market is shaped by several key factors. High demand for faster internet and greater bandwidth, fueled by data-heavy applications like HD streaming, AR, VR, and IoT, is a primary driver. This demand is reinforced by the need for digital transformation in sectors such as healthcare, automotive, and manufacturing, requiring advanced wireless technologies for real-time data and machine communications. Supportive regulatory policies and investment in 5G infrastructure, especially in developed regions, further influence market growth. However, challenges like the high cost of deployment, extensive infrastructure needs, and the environmental sensitivity of mmWave signals pose hindrances. Additionally, issues with standardization and compatibility with existing technologies are critical for seamless integration and adoption. These factors together dictate the market's evolution and its influence across various industries.

Competitive Analysis

The 5G mmWave technology market analysis report highlights the highly competitive nature of the 5G mmWave technology market, owing to the strong presence of existing vendors. Vendors with extensive technical and financial resources are expected to gain a competitive advantage over their counterparts by effectively addressing 5G mmWave technology market demands. The competitive environment in this market is expected to increase as product launches and collaboration kind of strategies adopted by key vendors increase. Competitive analysis and profiles of the major 5G mmWave technology market players that have been provided in the report include Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Telefonaktiebolaget LM Ericsson, Nokia Corporation, Qualcomm Incorporated, MediaTek Inc., Keysight Technologies, Inc., NXP Semiconductors N.V., Skyworks Solutions, Inc., and Anritsu Corporation.

Key Developments / Strategies

According to the latest 5G mmWave technology market outlook, Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Telefonaktiebolaget LM Ericsson, Nokia Corporation, and Qualcomm Incorporated are the top 5 players in the 5G mmWave technology market. Top market players have adopted product launches and collaboration strategies to expand their foothold in the 5G mmWave technology market.

June 2022 - Nokia, in collaboration with Elisa and Qualcomm, achieved over 2 Gbps and 5G uplink speeds on mmWave, enhancing the potential for ultra-high-performing, low-latency services.

May 2021 - UScellular, Qualcomm, Ericsson, and Inseego have achieved a groundbreaking 5G milestone over mmWave, establishing the farthest 5G mmWave Fixed Wireless Access (FWA) connection in the U.S. at 7 km, with downlink speeds of ~1 Gbps and peak speeds over 2 Gbps. This achievement, using Ericsson's infrastructure and Inseego's Wavemaker gateway powered by Qualcomm's technology, demonstrates the potential of 5G mmWave to provide high-speed, long-range connectivity, addressing the "last mile" challenge and bridging the digital divide in various communities.

Key Benefits for Stakeholders

To provide an accurate view of future investment pockets, this study provides analytical estimates for the 5G mmWave technology market size along with current trends and estimations.

To be able to achieve a more prominent position, the overall 5G mmWave technology market analysis is based on an understanding of prevailing profitability trends.

The report presents information related to key drivers, restraints, and 5G mmWave technology market opportunities with a detailed impact analysis.

To measure financial competence, 5G mmWave technology market forecasts shall be quantitatively analyzed from 2022 until 2032.

The Porter Five Forces analysis shows that buyers and suppliers are more powerful in the 5G mmWave technology market.

Key vendor shares and 5G mmWave technology market trends are included in the report.

5G mmWave Technology Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.1 billion |

| Growth Rate | CAGR of 14.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Components |

|

| By Product |

|

| By Frequency Band |

|

| By Application |

|

| By Region |

|

| Key Market Players | NEC Corporation, Fujitsu Limited, L3 Technologies, Inc., Mitsubishi Electric Corporation, Farran Technology, Millimeter Wave Products Inc., Sage Millimeter, Inc., Hubei YJT Technology Co., Ltd., DENSO CORPORATION, E-Band Communications, LLC |

Analyst Review

5G mmWave technology, an integral part of the fifth-generation wireless network (5G), represents a groundbreaking advancement in wireless communication. Unlike previous generations that primarily operated in lower-frequency bands, mmWave technology operates in the millimeter wave spectrum, typically between 30 and 300 GHz. This higher frequency enables the transmission of vast amounts of data at incredible speeds, potentially reaching multi-gigabit-per-second rates.

The 5G mmWave technology market is undergoing rapid expansion and is poised for significant growth in the coming years. This market is characterized by its focus on the millimeter-wave spectrum, which offers higher frequencies and faster data transfer rates compared to earlier mobile networks. Key players in this market include Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Telefonaktiebolaget LM Ericsson, Nokia Corporation, Qualcomm Incorporated, MediaTek Inc., Keysight Technologies, Inc., NXP Semiconductors N.V., Skyworks Solutions, Inc., and Anritsu Corporation, who are actively developing and deploying mmWave technology in various regions.

A noteworthy aspect of this market is its segmentation across different frequency bands (24GHz to 300GHz), catering to diverse applications like Enhanced Mobile Broadband (eMBB), Internet of Things (IoT), autonomous vehicles, telemedicine, and more. The telecom sector is projected to be the fastest-growing segment, driven by the integration of mmWave technology in smartphones and infrastructure.

Region-wise, North America holds a dominant market share, attributed to rapid technology deployments and significant investments in 5G by major telecom operators. Asia-Pacific is expected to witness the highest growth rate, driven by increasing smartphone adoption and substantial investments in 5G infrastructure by countries like China, Japan, and South Korea.

Despite its potential, the market faces challenges like the high cost of deployment and technical issues such as limited range and poor building penetration of mmWave signals. However, opportunities abound with the evolving demand for wireless data applications and the proliferation of smart devices.

The industry size of 5G mmWave Technology is estimated to be $2,585.71 million in 2022.

The 5G mmWave Technology Market is expected to grow at a CAGR of 14.69% during the period of 2023 to 2032.

North America is the largest regional market for 5G mmWave Technology.

Mobile and telecom segment is the leading application of the 5G mmWave Technology Market.

The top companies holding significant market share in the 5G mmWave Technology include Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Telefonaktiebolaget LM Ericsson, Nokia Corporation, and Qualcomm Incorporated.

Loading Table Of Content...

Loading Research Methodology...